Overview

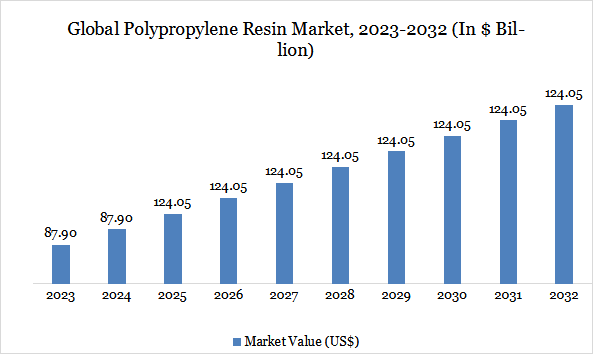

Global polypropylene resin market reached US$ 87.90 billion in 2024 and is expected to reach US$ 124.05 billion by 2032, growing with a CAGR of 4.4% during the forecast period 2025-2032.

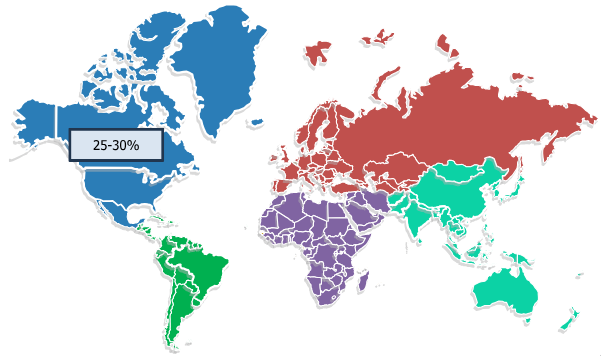

The polypropylene resin market is experiencing a shift due to structural demand from core industries and material innovation. Demand remains strong in packaging, automotive, and healthcare sectors, with rigid and thin-wall food containers dominating consumption. Players are focusing on value-added polypropylene grades, including impact-modified and specialty copolymers, to cater to niche performance needs. North America and Asia-Pacific lead in consumption and production, with the U.S., China, and India being key growth engines. Supply volatility and environmental scrutiny are prompting resin manufacturers to accelerate sustainability strategies, including recycled and bio-based PP offerings. This makes the market increasingly competitive and innovation-centric.

Polypropylene resin Market Trend

The polypropylene resin market is undergoing significant changes due to the rapid advancement of chemical recycling technologies. Companies like PureCycle Technologies and ExxonMobil are investing in purification and depolymerization processes to convert post-consumer waste into virgin-like resin, preserving its original performance properties. This trend is driven by regulatory pressure and brand owners' demands for high recycled content in packaging and consumer products. Chemical recycling offers a closed-loop system for polypropylene, opening new applications in food-grade packaging and medical supplies. The scalability of these technologies and growing partnerships between resin producers and waste management firms signal a shift towards circular polypropylene production.

Market Scope

Metrics | Details |

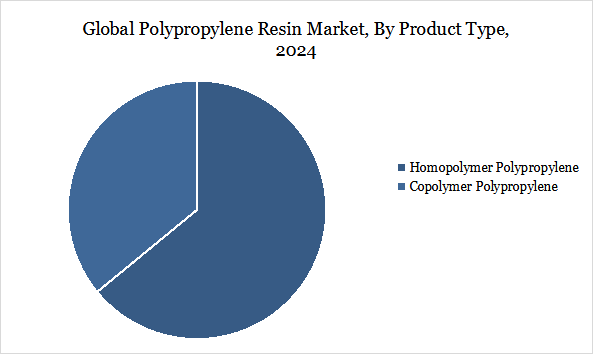

By Product type | Homopolymer Polypropylene, Copolymer Polypropylene |

By Processing Method | Injection Molding, Extrusion, Blow-Molding, Thermoforming, Others |

By Application | Automotive, Building & Construction, Electrical & Electronics, Textile, Healthcare, Consumer Goods, Agriculture, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand for Rigid Food Packaging

The homopolymer polypropylene (PP) segment is experiencing growth due to the increasing demand for rigid food packaging, especially in developed markets like North America and Europe. PP offers stiffness, clarity, and moisture resistance, making it ideal for yogurt containers, takeaway meal trays, and microwaveable food tubs. It can withstand higher temperatures, allowing hot-fill processes and microwave reheating. Major food brands and packaging converters are choosing PP due to its compatibility with high-speed thermoforming and injection molding lines, enhancing production efficiency and cost savings. Its recyclability aligns with circular economy goals, driving sustained growth in the segment.

Limited Impact Resistance at Low Temperatures

A key limitation of homopolymer polypropylene is its poor impact strength at sub-zero temperatures, which restricts its application in cold-chain logistics and outdoor uses in colder climates. This has led some end-users to prefer copolymer polypropylene or alternate materials that offer better toughness in extreme conditions, especially in packaging and automotive segments.

Segment Analysis

The global polypropylene resin market is segmented based on product type, processing method, application, and region.

Homopolymer Polypropylene (PP) Segment Driving Polypropylene Resin Market

The homopolymer polypropylene (PP) segment is popular due to its strength, stiffness, and cost-effectiveness, making it suitable for various applications. Its high crystallinity offers excellent mechanical properties, making it ideal for rigid packaging, textiles, automotive components, and consumer goods. PP is used in injection molding, thermoforming, automotive interior parts, medical syringes, laboratory wares, and pharmaceutical packaging due to its chemical resistance and sterilizability. The growing demand for high-performance, recyclable materials strengthens the market, as manufacturers seek materials that balance performance with environmental compliance.

TABLE 1 - Global Polypropylene Resin Market value (US$ Billion), Product type, 2023-2032

Product type | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | CAGR (%) 2025-2032 | |

Homopolymer Polypropylene | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Copolymer Polypropylene | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Geographical Penetration

North America Drives the Global Polypropylene Resin Market

North America's polypropylene resin market is thriving due to strong demand in packaging, automotive, and healthcare industries. The region's manufacturing base, particularly in the U.S. and Canada, supports large-scale production and innovation in lightweight plastic solutions. Regulatory pressure to reduce plastic waste is driving investment in recycling infrastructure and sustainable alternatives. The automotive sector's push for fuel efficiency is boosting the adoption of lightweight polypropylene components. The expanding healthcare sector relies on PP for medical-grade packaging and equipment. Strategic collaborations between resin producers and recyclers are enhancing supply chain resilience and sustainability.

TABLE 2 – North America Polypropylene Resin Market value (US$ Billion), Product type, 2023-2032

Product type | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | CAGR (%) 2025-2032 | |

Homopolymer Polypropylene | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Copolymer Polypropylene | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

TABLE 3 – North America Polypropylene Resin Market value (US$ Billion), Country, 2023-2032

Country | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | CAGR (%) 2025-2032 | |

US | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Mexico | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Canada | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Sustainability Analysis

The polypropylene (PP) resin market is undergoing a significant transformation due to environmental regulations, corporate ESG goals, and consumer demand for greener materials. Key market players are investing in bio-based and recycled polypropylene to reduce the industry's carbon footprint. Advanced mechanical and chemical recycling initiatives are gaining traction in Europe and North America. Brands are also focusing on lightweighting and closed-loop systems in automotive and packaging sectors. However, challenges remain in scaling sustainable production methods and ensuring consistent quality of recycled PP. Sustainability is now a competitive necessity in the market.

Competitive Landscape

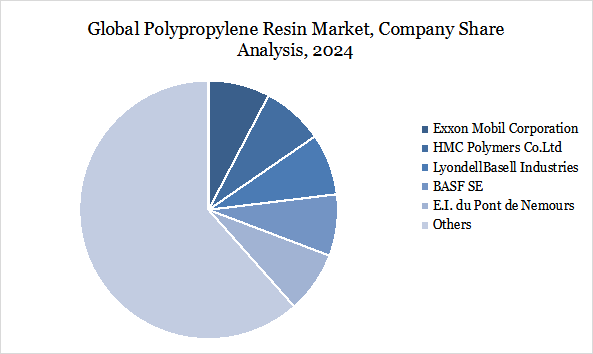

The major global players in the market include Exxon Mobil Corporation, HMC Polymers Co.Ltd, LyondellBasell Industries, BASF SE, E.I. du Pont de Nemours, Dynachem, Chevron Phillips Chemical Company LLC, K Polymers Inc, Scott Bader Company Limited.

Key Developments

In February 2025, Polyplastics introduced Plastron LFT RA627P, an environmentally friendly composite material made from polypropylene resin and long cellulose fibers. This material offers low density, high specific stiffness, high impact strength, and excellent damping properties for various applications, including audio components and industrial component housings.

In July 2024, Southeast Asia petrochemical company IRPC and global materials science expert Milliken & Company have launched new grades of polypropylene (PP) resin with a UL Environmental Claim Validation label. The Polimaxx clarified PP resin grades use 10% less energy during molding, resulting in verified savings across the plastics value chain.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.