Overview

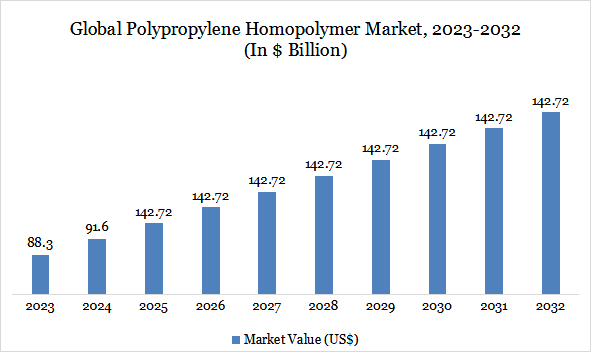

Global polypropylene homopolymer market reached US$ 91.6 billion in 2024 and is expected to reach US$ 142.72 billion by 2032, growing with a CAGR of 5.7% during the forecast period 2025-2032.

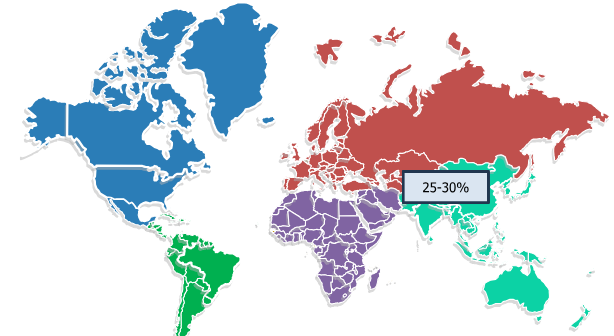

PPH segment remains particularly important in the automotive industry, where lightweight and durable materials are essential. PPH’s low density and high strength-to-weight ratio make it a preferred choice for vehicle interior panels, trim, and non-structural exterior components, contributing to improved fuel efficiency and reduced emissions. North America and Europe together hold the leading share of the PPH market, while Asia‑Pacific is experiencing the fastest growth, driven by industrialization and rising automotive and packaging demand in China and India.

Polypropylene Homopolymer Market Trend

A key trend shaping the polypropylene homopolymer (PPH) market is the growing integration of smart manufacturing technologies and material innovation across the production landscape. Since 2022, leading manufacturers such as LyondellBasell and ExxonMobil have adopted advanced technologies like AI-driven process control, IoT-enabled monitoring, and predictive maintenance to optimize polymer production. By 2024, these digital advancements had become standard practice, enabling the development of specialty-grade PPH with enhanced heat resistance, impact strength, and recyclability, particularly suited for demanding applications in the automotive and medical industries.

Market Scope

Metrics | Details |

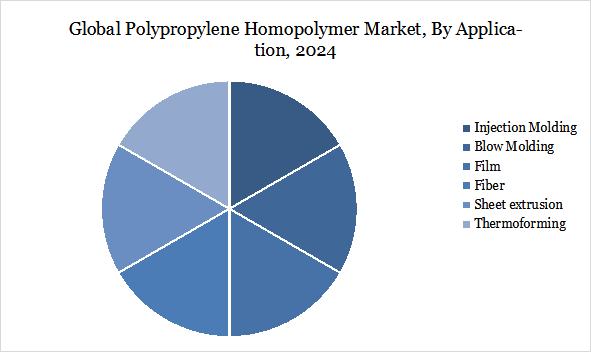

By Application | Injection Molding, Blow Molding, Film, Fiber, Sheet extrusion, Thermoforming |

By End User | Packaging, Textiles, Pipes, Automotive Components, Electrical Applications, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand in the Packaging Industry

Rising demand in the packaging industry is a major factor driving the growth of the Polypropylene Homopolymer (PPH) market. Known for its lightweight, rigidity, and excellent moisture resistance, PPH is widely used in the production of rigid containers, food packaging, caps, and closures.

Companies like Berry Global expanded their high-performance PPH packaging lines in early 2023 to meet growing demand in e-commerce and consumer goods. Additionally, LyondellBasell’s involvement in the NEXTLOOPP project reflects the industry’s push toward developing food-grade recycled PPH, highlighting how sustainability and innovation are shaping the future of polypropylene packaging.

Environmental Concerns and Regulatory Pressures

Environmental concerns and regulatory pressures are key restraints on the Polypropylene Homopolymer (PPH) market. Since PPH is non-biodegradable and derived from fossil fuels, it faces growing scrutiny due to its contribution to plastic waste and carbon emissions. Regulations like the EU’s Single-Use Plastics Directive and rising global demand for sustainable alternatives are pushing manufacturers to reduce reliance on virgin PPH, potentially limiting its use in packaging and consumer goods.

Segment Analysis

The global polypropylene homopolymer market is segmented based on application and end user, and region.

Injection Molding Segment Driving Polypropylene Homopolymer Market

Injection molding is expected to dominate the polypropylene homopolymer market due to its efficiency, cost-effectiveness, and versatility in producing complex, high-volume plastic parts with excellent dimensional accuracy. PPH’s favorable characteristics—such as low melt viscosity, good flow properties, and high stiffness—make it especially well-suited for injection molding processes across industries like automotive, consumer goods, packaging, and electronics.

A significant example is the automotive sector, where injection-molded PPH is widely used to manufacture components such as interior trims, dashboards, door panels, and battery casings. For instance, Toyota and Hyundai utilize PPH through injection molding to produce lightweight interior panels that contribute to overall vehicle weight reduction and improved fuel efficiency. This method not only ensures fast production cycles but also enables the reuse of recycled PPH, aligning with sustainability goals in manufacturing.

TABLE 1 - Global Polypropylene Homopolymer Market value (US$ Billion), Application, 2023-2032

Application | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | CAGR (%) 2025-2032 | |

Injection Molding | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Blow Molding | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Film extrusion | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Fiber | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Sheet | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Thermoforming | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Geographical Penetration

Asia-Pacific Drives the Global Polypropylene Homopolymer Market

Asia-Pacific dominates the global polypropylene homopolymer market, accounting for approximately 40% to 50% of total market share, driven by rapid industrial growth, urbanization, and expanding automotive and packaging industries in countries like China, India, Japan, and South Korea. In the automotive sector alone, PPH represents around 30–35% of the total plastic used in vehicle manufacturing.

China, as the world’s largest automotive producer, with over 30 million vehicles manufactured in 2024, significantly contributes to this demand. Additionally, increasing investments in infrastructure and rising adoption of electric vehicles are further accelerating PPH consumption in the region, solidifying Asia-Pacific’s leadership in both production and end-use applications.

Sustainability Analysis

Polypropylene Homopolymer (PPH), though non-biodegradable, contributes to sustainable manufacturing through its high recyclability, lightweight nature, and energy-efficient processing. It is widely used in sectors like packaging and automotive, where reducing material usage and improving fuel efficiency are key priorities. Leading producers such as LyondellBasell and Braskem are developing recycled and bio-attributed PPH grades to support circular economy goals and reduce the carbon footprint of plastic production. These innovations position PPH as a practical material choice in efforts to balance performance with environmental responsibility.

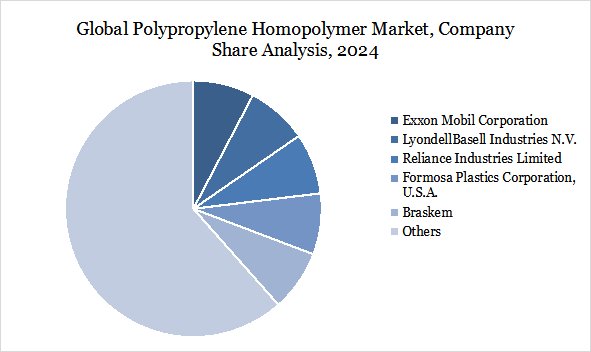

Competitive Landscape

The major global players in the market include Exxon Mobil Corporation, LyondellBasell Industries N.V., Reliance Industries Limited, Formosa Plastics Corporation, U.S.A., Braskem, INEOS Group, LG Chem, Mitsubishi Chemical Group of companies, TotalEnergies, and LOTTE Chemical.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies