Dunche Muscular Dystrophy Therapeutics Market Size & Industry Outlook

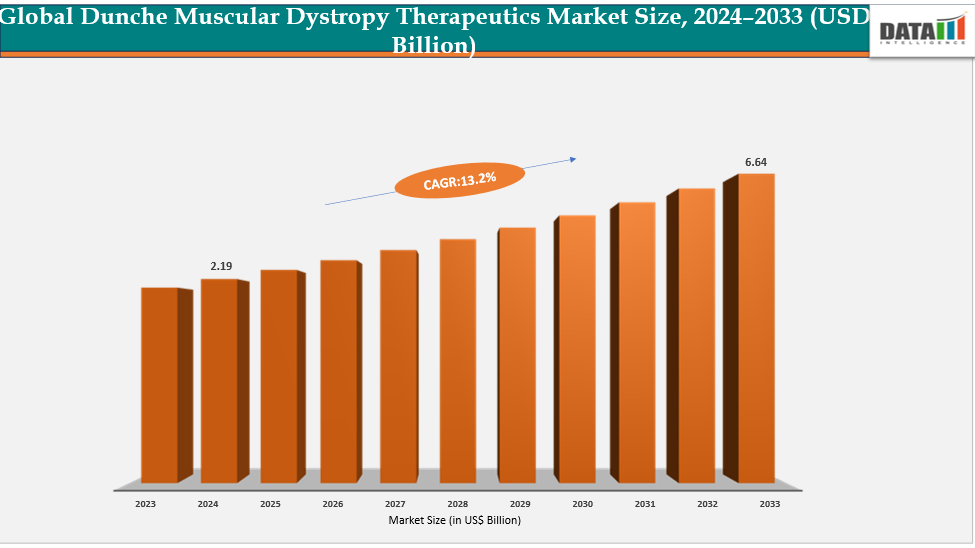

The global dunche muscular dystrophy therapeutics market size reached US$ 2.19 billion in 2024 is expected to reach US$ 6.64 billion by 2033, growing at a CAGR of 13.2% during the forecast period 2025-2033. The global duchenne muscular dystrophy therapeutics market is also driven by the surge in research funding and collaborative initiatives among biotechnology companies, pharmaceutical firms, and research institutions. Increasing investments from both public and private sectors are accelerating the development of advanced therapies such as gene editing, RNA-based treatments, and cell therapies. Strategic partnerships—such as licensing agreements between large pharma and emerging biotech firms—are helping to share expertise, reduce R&D costs, and speed up clinical development timelines. These collaborations not only strengthen innovation pipelines but also enhance global market penetration once products reach commercialization, thereby supporting sustained market growth in the DMD therapeutics segment.

Key Highlights

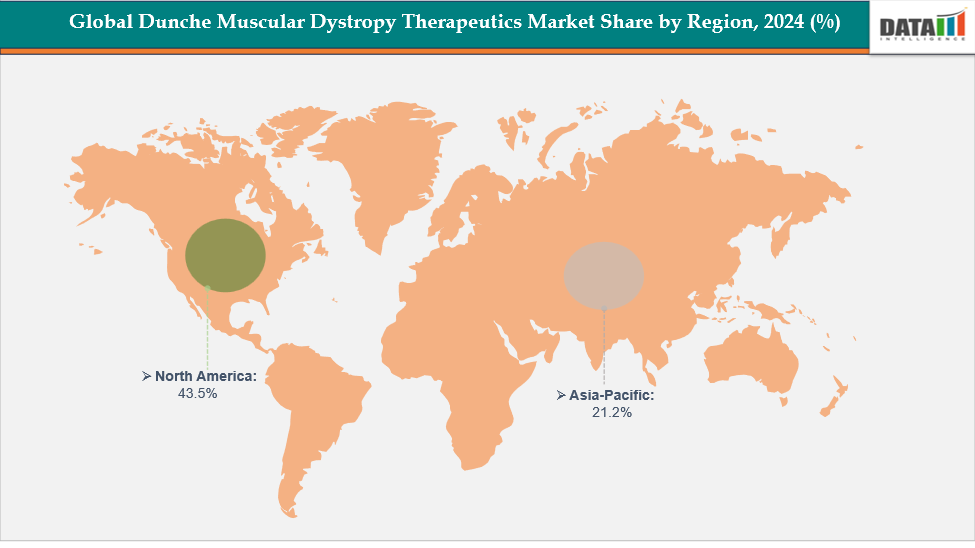

- North America dominates the Dunche Muscular Dystrophy Therapeutics market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

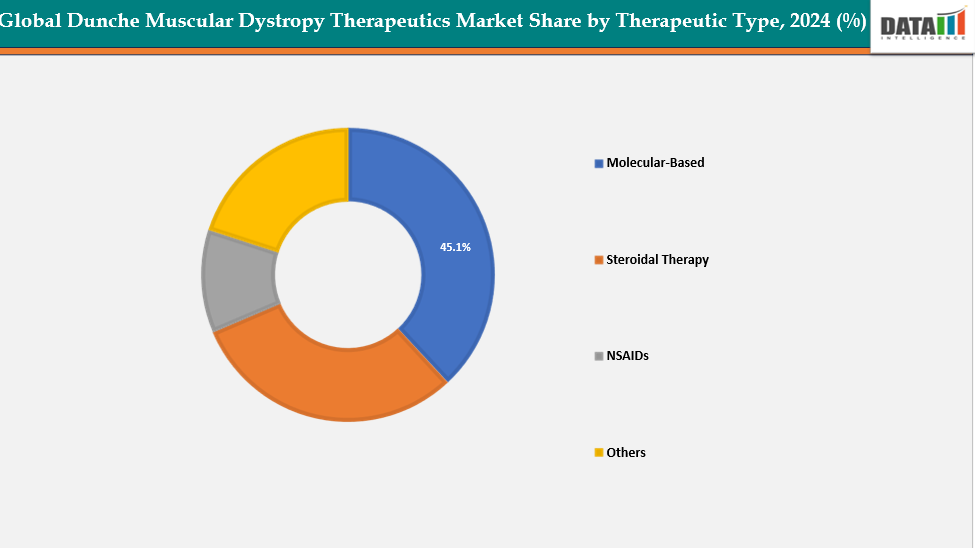

- Based on therapeutic type, molecular-based segment led the market with the largest revenue share of 45.1% in 2024.

- The major market players in the Dunche Muscular Dystrophy Therapeutics market includes Sarepta Therapeutics, PTC Therapeutics, Nippon Shinyaku (NS Pharma), ITF THERAPEUTICS, Catalyst Pharmaceuticals and among others.

Market Dynamics

Drivers: Rising approvals of novel therapies significantly driving the Dunche Muscular Dystrophy Therapeutics market growth

The increasing approval of novel therapies plays a pivotal role in shaping the growth and maturity of the global Duchenne Muscular Dystrophy (DMD) therapeutics market. As traditional corticosteroid treatments provide only symptomatic relief, the introduction of advanced modalities such as exon-skipping drugs, gene therapies, and mutation-agnostic agents has revolutionized disease management.

Regulatory approvals of products like Elevidys, Duvyzat, and Viltepso have not only expanded therapeutic options but also validated innovative scientific approaches in DMD treatment. These approvals encourage more biotech and pharma companies to invest in R&D, leading to a more competitive and innovation-driven market.

For instance, in September 2025, Capricor Therapeutics, a biotechnology company focused on developing advanced cell and exosome-based therapies for rare diseases, announced a regulatory update regarding its Biologics License Application (BLA) for Deramiocel, an investigational cell therapy for Duchenne Muscular Dystrophy (DMD). The update follows a recent Type A meeting with the U.S. Food and Drug Administration (FDA), conducted in response to the Complete Response Letter (CRL) the company received in July 2025.

Restraints: High cost and limited accessibility of therapies are hampering the growth of the dunche muscular dystrophy therapeutics market

One of the major challenges restraining the growth of the Duchenne Muscular Dystrophy (DMD) therapeutics market is the extremely high cost of treatment, which limits accessibility for most patients worldwide. Recently approved gene therapies and exon-skipping drugs are priced at levels far beyond conventional medicines.

For instance, Sarepta’s Elevidys gene therapy is estimated at around USD 3.2 million per patient, making it one of the most expensive treatments globally. Similarly, exon-skipping therapies such as Exondys 51 and Viltepso cost between USD 300,000 and USD 600,000 annually. Such steep prices place a significant financial burden on healthcare systems and families, particularly in regions with limited insurance coverage or reimbursement frameworks. As a result, despite notable scientific progress, the high treatment cost continues to pose a serious barrier to equitable access and widespread adoption of DMD therapies.

For more details on this report – Request for Sample

Segmentation Analysis

The global dunche muscular dystrophy therapeutics market is segmented based on therapeutic type, mutation type, route of administration, distribution channel, and region.

Therapeutic Type: The molecular-based from therapeutic type segment to dominate the dunche muscular dystrophy therapeutics market with a 45.1% share in 2024

The molecular-based segment of the Duchenne Muscular Dystrophy (DMD) therapeutics market is witnessing strong growth, primarily driven by advancements in gene and RNA-based technologies. Exon-skipping therapies, antisense oligonucleotides (ASOs), and readthrough compounds have transformed the treatment landscape by directly targeting the underlying genetic mutations responsible for DMD. The growing clinical success and regulatory approvals of drugs have validated the potential of molecular approaches to deliver disease-modifying benefits.

Additionally, continuous innovation in mRNA modulation, RNA editing, and targeted delivery systems is enhancing therapeutic precision and safety profiles. Increasing R&D funding, expanding patient awareness of genetic testing, and supportive orphan drug designations from regulatory agencies are further propelling the molecular-based segment, making it one of the most dynamic areas in the global DMD therapeutics market.

Route of Administration: The intravenous segment is estimated to have a 46.1% of the dunche muscular dystrophy therapeutics market share in 2024

The intravenous (IV) route plays a crucial role in the Duchenne Muscular Dystrophy (DMD) therapeutics market, primarily for delivering advanced biologics and gene therapies. Most approved DMD treatments, including Elevidys, Viltepso, and Exondys 51, utilize IV infusion for effective delivery to muscle tissues. This method ensures controlled dosing and enhanced bioavailability of large molecules, such as antisense oligonucleotides and viral vector based therapies, which are not suitable for oral administration. The growth of hospital infrastructure and infusion-based therapy adoption in rare diseases supports this segment's expansion, with increasing demand expected as new cell and gene therapies emerge in the market.

Geographical Analysis

North America dominates the global dunche muscular dystrophy therapeutics market with a 43.5% in 2024

North America dominates the global DMD therapeutics market, driven by strong regulatory support, high healthcare expenditure, and the early adoption of advanced therapies. The region benefits from the presence of leading companies such as Sarepta Therapeutics, PTC Therapeutics, and Capricor Therapeutics, which actively drive innovation in gene and molecular-based treatments. Favorable reimbursement frameworks, expanding access to genetic testing, and continuous FDA approvals for novel therapies like Elevidys and Duvyzat further reinforce market growth.

The United States represents the largest single market within North America due to its advanced biopharmaceutical ecosystem and robust orphan drug policies. Strong FDA regulatory pathways, including accelerated and breakthrough designations, have significantly shortened approval timelines for DMD therapies.

For instance, in August 2025, The U.S. Food and Drug Administration (FDA) has awarded Breakthrough Therapy designation to delpacibart zotadirsen (del-zota), an investigational therapy for Duchenne Muscular Dystrophy (DMD) in patients with mutations amenable to exon 44 skipping (DMD44). Developed by Avidity Biosciences, del-zota belongs to a novel class of RNA therapeutics called Antibody Oligonucleotide Conjugates (AOCs), representing a promising approach to advance treatment options for rare genetic disorders.

Europe is the second region after North America which is expected to dominate the global dunche muscular dystrophy therapeutics market with a 34.5% in 2024

The European market for DMD therapeutics is primarily driven by increased approval of orphan drugs, supportive healthcare policies, and expanding clinical research infrastructure. Countries across the region are focusing on improving early genetic diagnosis through national screening programs, boosting treatment uptake.

Germany serves as one of the leading markets for DMD therapeutics in Europe, supported by strong government funding for rare disease research and high awareness among healthcare professionals. The country’s advanced healthcare infrastructure and reimbursement systems encourage the adoption of costly therapies, including exon-skipping and gene-based treatments.

For instance, in January 2024, Santhera Pharmaceuticals (SIX: SANN) has announced the launch of AGAMREE (vamorolone) in Germany for the treatment of Duchenne Muscular Dystrophy (DMD). The therapy is indicated for patients aged 4 years and older, regardless of their underlying mutation or ambulatory status.

The Asia Pacific region is the fastest-growing region in the global dunche muscular dystrophy therapeutics market, with a CAGR of 8.1% in 2024

The Asia-Pacific DMD therapeutics market is expanding rapidly, driven by growing healthcare investments, improving diagnosis rates, and increasing collaborations with global biotech firms. Countries such as Japan, South Korea, China, and India are witnessing greater awareness of muscular dystrophy and enhanced access to novel treatments.

Japan represents one of the most advanced DMD markets in the Asia-Pacific region, driven by early adoption of exon-skipping therapies and strong government support for rare disease management. The approval of Viltepso (viltolarsen) developed by Nippon Shinyaku (NS Pharma) has positioned Japan as a leader in DMD innovation. The country’s efficient regulatory framework, coupled with investment in genomic research and personalized medicine, supports ongoing advancements in RNA and gene-based therapies.

For instance, in September 2025, Dyne Therapeutics, Inc, a clinical-stage biotechnology company, announced that the Ministry of Health, Labour and Welfare (MHLW) in Japan has granted Orphan Drug designation for DYNE-251. The therapy is intended for individuals with Duchenne Muscular Dystrophy (DMD) who carry mutations in the DMD gene amenable to exon 51 skipping. DYNE-251 is currently being evaluated in the Phase 1/2 DELIVER global clinical trial.

Competitive Landscape

Top companies in the Dunche Muscular Dystrophy Therapeutics market include Sarepta Therapeutics, PTC Therapeutics, Nippon Shinyaku (NS Pharma), ITF THERAPEUTICS, Catalyst Pharmaceuticals and among others.

Sarepta Therapeutics:- Sarepta Therapeutics plays a pivotal role in the global Duchenne Muscular Dystrophy (DMD) therapeutics market as a leader in gene and molecular-based therapies. The company has pioneered the development of exon-skipping antisense oligonucleotides such as Exondys 51 (eteplirsen), Vyondys 53 (golodirsen), and Amondys 45 (casimersen), providing targeted treatment options for patients with specific DMD mutations. Additionally, Sarepta’s gene therapy program (Elevidys) represents a first-in-class approach aimed at delivering micro-dystrophin to restore muscle function.

Market Scope

| Metrics | Details | |

| CAGR | 13.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Therapeutic Type | Molecular-Based, Steroidal Therapy, NSAIDs, Others |

| Mutation Type | Exon 51 Skipping, Exon 53 Skipping, Exon 45 Skipping, Others | |

| Route of Administration | Intravenous, Subcutaneous, Others | |

| Distribution Channel | Hospital Pharmacies, Specialty Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Dunche Muscular Dystrophy Therapeutics market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.