Global Carbon Removal Technology Market Size & Overview

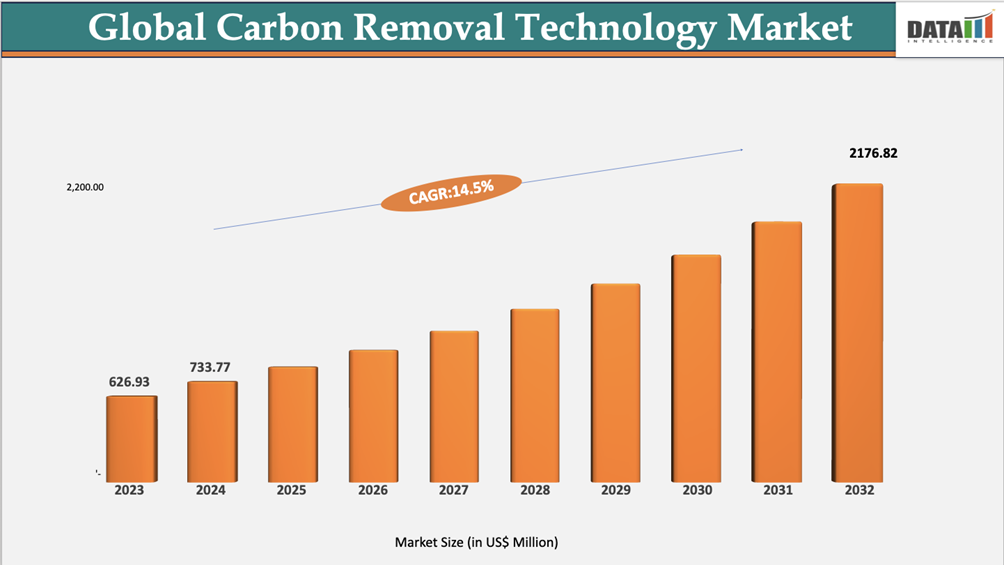

The global carbon removal technology market was valued at US$733.77 million in 2024 and is projected to reach US$2,176.82 million by 2034, growing at a compound annual growth rate CAGR of 14.59% during the forecast period from 2025 to 2034.

This growth is driven by rising environmental concerns, supportive regulations on carbon capture, waste-to-energy, and decarbonization initiatives, and industries adopting carbon removal solutions as sustainable alternatives to conventional emissions mitigation methods. For instance, Japan, South Korea, and several EU countries are investing heavily in advanced carbon removal technologies, including Direct Air Capture (DAC), Bioenergy with Carbon Capture and Storage (BECCS), biochar, and enhanced mineralization, to capture and store CO₂ from industrial and atmospheric sources. In 2024, Japan partnered with industry leaders to scale up carbon removal-based circular economy projects, showcasing its early adoption and leadership in the global energy transition.

Global Carbon Removal Technology Industry Trends and Strategic Insights

The Asia-Pacific region dominates the market, capturing the largest revenue share of xx% in 2024.

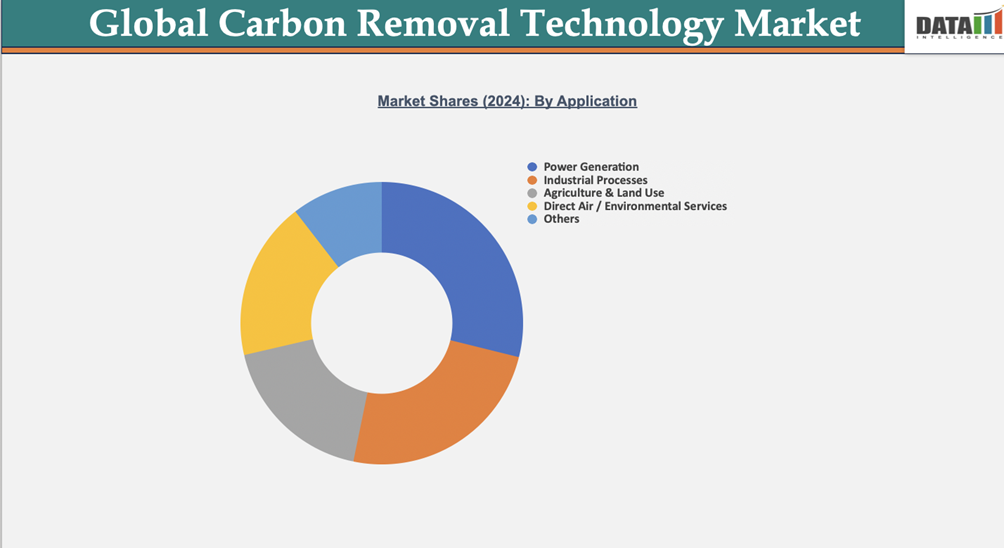

By Application, the industrial segment is projected to experience the largest market, registering a significant xx% in 2024.

Market Size and Future Outlook

2024 Market Size: US$733.77 Million

2032 Projected Market Size: US$2176.82 Million

CAGR (2025-2032): 14.56%

Largest Market: Asia-Pacific

Fastest Market: North America

Market Scope

Metrics | Details |

By Technology | Direct Air Capture (DAC), Bioenergy with Carbon Capture & Storage (BECCS), Biochar Enhanced Mineralisation / Carbon Mineralisation, Ocean-based Removal, Afforestation & Reforestation, Others |

By Application | Industrial Processes, Agriculture & Land Use, Direct Air / Environmental Services, Carbon Credit & Trading Markets, Robotic Process Automation (RPA) |

By Storage | Geological Storage, Terrestrial Storage, Ocean Storage, Mineral Storage, Others |

By Project Scale | Technical Removal Projects Nature-Based and Hybrid Projects |

By Region | North America, South America, Europe, Asia-Pacific, the Middle East, and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More details Insights: Request for Sample

Market Dynamics

Rising Demand from the Power Generation & Transportation Sector

The Power Generation and transportation sector is a major driver for the Carbon Removal Technology market, as manufacturers focus on reducing emissions to improve efficiency and meet stringent global climate targets. According to ACEA, around 93.9 million motor vehicles are produced globally every year, creating a substantial demand for advanced carbon reduction solutions. The rapid adoption of electric vehicles further accelerates the need for innovative technologies that minimize lifecycle emissions and support clean mobility.

To cater to this growing demand, companies are introducing cutting-edge carbon removal technologies specifically designed for Power Generation applications. For example, in June 2025, NALCO launched a next-generation carbon capture system—CCS-90—crafted for critical Power Generation facilities, offering enhanced efficiency, durability, and scalability. This development underlines the strategic focus on high-performance carbon reduction technologies, aligning with the booming Power Generation sector in India and globally. As automakers and energy producers continue to prioritize sustainability, such innovations are expected to accelerate the adoption of carbon removal technologies worldwide.

Segmentation Analysis

The global Carbon Removal Technology market is segmented based on technology, application, storage, project scale, and region.

Power Generation Sector Dominates Carbon Removal Technology Market Through Rising Demand for Lightweight Vehicles

The Power Generation industry holds a significant share in the Carbon Removal Technology market due to its rising need for lightweight materials that improve fuel efficiency and reduce emissions. Carbon Removal Technology is essential for manufacturing engine blocks, cylinder heads, wheels, and structural components, offering a superior strength-to-weight ratio and corrosion resistance.

According to the Government of India, the global Power Generation components market was valued at US$D 2 trillion, with exports contributing nearly US$700 billion, further driving demand for Carbon Removal Technology. India has emerged as the fourth-largest global producer after China, the USA, and Japan, with an annual production of nearly 6 million vehicles. These factors collectively strengthen the Power Generation sector’s role as a major consumer of Carbon Removal Technology, ensuring sustained growth in this market.

The Industrial Processes Sector Commands a Significant Share in the Carbon Removal Technology Market Due to Growing Urban Development

The Industrial Processes sector is driving significant demand for Carbon Removal Technology, as the material’s lightweight, corrosion-resistant, and durable properties make it ideal for modern buildings, bridges, and urban infrastructure projects. Rapid urbanisation and the expansion of smart cities worldwide are further boosting the adoption of aluminium in structural and architectural applications. In India, the government has announced a massive US$1.4 trillion investment in infrastructure by 2025, signalling a surge in mega projects such as expressways, metro networks, and airports, all of which rely heavily on aluminium components for safety and performance.

The government initiatives, such as the Bureau’s US$54.2 million no-match grant program launched on August 7, 2025, aim to advance infrastructure projects in rural and tribal communities, reflecting a broader commitment to modernise both urban and rural areas. Aluminium’s recyclability and low maintenance requirements also align with sustainable construction practices, further strengthening its demand in the sector globally.

Geographical Penetration

Asia-Pacific Dominates Carbon Removal Technology Market Driven by Industrial Growth and Infrastructure Development

Asia-Pacific holds a dominant position in the global Carbon Removal Technology market, driven by rapid industrialisation and urbanisation across major economies like China, India, and Japan. The region benefits from strong government support, large-scale infrastructure projects, and expanding energy demand, which collectively boost the adoption of carbon capture, utilization, and storage (CCUS) technologies. Growing investments in renewable energy and industrial decarbonisation are further positioning Asia-Pacific as the global hub for carbon removal solutions.

Government-led initiatives promoting clean energy transitions such as renewable integration, carbon neutrality pledges, and sustainable infrastructure projects are accelerating deployment across industries. In addition, local players and international companies are forming strategic partnerships to expand regional capacity and bring advanced technologies to market. With competitive manufacturing costs and abundant resources, Asia-Pacific is set to maintain its leadership role in the Carbon Removal Technology market.

India Carbon Removal Technology Market Outlook

India’s Carbon Removal Technology market is experiencing robust growth, supported by rapid infrastructure development, strong energy demand, and rising industrial emissions. Government backed initiatives such as the Smart Cities Mission and National Hydrogen Mission are creating a favorable policy environment for carbon capture and utilization technologies. As of May 9, 2025, the Smart Cities Mission has completed 7,555 out of 8,067 projects worth US$151.0 billion, with 512 projects worth US$1,479.4 million (₹13,043 crore) in advanced stages.

The industrial sector, particularly power generation and cement, is investing in emission-reduction technologies to align with national net-zero targets. Emerging startups, along with global leaders, are collaborating to deploy scalable carbon removal solutions across energy, construction, and manufacturing industries. With its growing commitment to climate action and industrial decarbonisation, India’s carbon removal technology market outlook remains highly promising.

China Carbon Removal Technology Market Trends

China continues to lead the global Carbon Removal Technology market, supported by its position as the largest emitter of carbon dioxide and its aggressive policy push toward carbon neutrality by 2060. In 2024, the country deployed large-scale CCUS pilot projects across power generation and industrial clusters, making it one of the most active markets for carbon removal globally.

Strong domestic demand from heavy industries such as steel, cement, and power generation is driving rapid adoption. At the same time, government-led mega projects and partnerships with international players are fostering advancements in direct air capture (DAC) and geological storage solutions. With consistent policy support, technological innovation, and expanding infrastructure, China’s market is expected to sustain strong growth in the coming years.

North America Leads Carbon Removal Technology Market Growth Fueled by Power Generation

North America dominates the global carbon removal technology market, driven primarily by its power generation sector’s rapid transition toward decarbonization. With fossil fuels still accounting for a significant portion of the region’s energy mix, utilities are increasingly adopting carbon capture, utilization, and storage (CCUS) technologies to offset emissions from coal and natural gas plants. The U.S. Inflation Reduction Act (IRA) provides tax credits of up to $85 per ton for carbon captured from industrial and power generation sources, making large-scale deployment financially attractive. Similarly, Canada’s Clean Fuel Regulations are accelerating the integration of carbon removal solutions into energy infrastructure projects.

Carbon Removal Technology Market Insights

The US Carbon Removal Technology market is growing steadily, supported by strong demand from the Power Generation, aerospace, and construction sectors. Lightweight and high-strength aluminium alloys are increasingly preferred in manufacturing. Domestic production capacity remains robust, ensuring a consistent supply. Technological improvements in ingot quality are enhancing product efficiency and versatility. Overall, the market outlook remains positive with continued industrial and infrastructure demand.

Canada Carbon Removal Technology Industry Growth

Canada is rapidly advancing in the carbon removal technology industry, supported by strong federal policies, abundant renewable resources, and increasing industrial adoption. The country’s Clean Fuel Regulations and carbon pricing framework are driving investment in technologies such as bioenergy with carbon capture and storage (BECCS), direct air capture (DAC), and biochar. With vast forestry and agricultural resources, Canada is uniquely positioned to scale nature-based carbon removal alongside engineered solutions. The government has committed over CAD 9 billion toward clean energy and carbon capture projects, strengthening momentum for deployment. Key sectors such as oil & gas, cement, and transportation are integrating carbon removal to align with national net-zero targets by 2050. Supported by innovation hubs in Alberta and British Columbia, Canada is emerging as a North American leader in scaling commercially viable carbon removal technologies.

Sustainability Analysis

Firms are investing in carbon-neutral operations, sustainable feedstocks, and eco-friendly capture methods to ensure long-term viability. Regulatory compliance and global net-zero targets are pushing companies to adopt transparent reporting frameworks and robust monitoring, reporting, and verification (MRV) systems. Circular economy models are also emerging, where captured CO₂ is reused in fuels, building materials, and industrial processes, creating value-added pathways.

The market is shifting toward holistic sustainability by aligning environmental responsibility with scalability, ensuring carbon removal solutions contribute meaningfully to global decarbonization while fostering economic and social co-benefits.

Competitive Landscape

The global carbon removal technology market is moderately concentrated, led by innovators in DAC, BECCS, biochar, and mineralization.

Climeworks, CarbonCure, and Carbon Clean command 35–40% market share; Climeworks opened the world’s largest DAC plant in Iceland (2023).

Global Thermostat, Blue Planet, and Charm Industrial form a strong second tier; Charm Industrial removed over 5,000 tons of CO₂ in 2024 via bio-oil injection.

Niche innovators like Solidia Technologies developed low-carbon cement products, while Graphyte launched a novel biomass carbon removal pilot in 2024.

Competition is strengthened by joint ventures and pilots: e.g., CarbonCure partnered with Amazon and Microsoft to supply carbon removal credits (2023–2024).

Government support plays a key role: U.S. DOE funded $1.2 billion DAC hubs in Texas and Louisiana (2023).

High entry barriers—capital intensity, compliance, and technology validation—sustain leadership among top players.

Future competition will hinge on scalability, cost reduction, and integration within global decarbonization ecosystems.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares, and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of yearly updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies