Overview

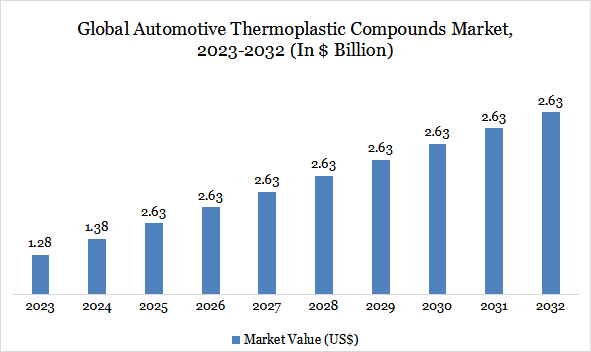

Global automotive thermoplastic compounds market reached US$ 1.38 billion in 2024 and is expected to reach US$ 2.63 billion by 2032, growing with a CAGR of 8.4% during the forecast period 2025-2032.

The global automotive thermoplastic compounds market is expanding due to the automotive industry's shift towards electrification, lightweighting, and sustainability. Thermoplastic compounds, including polypropylene, polyamide, and high-performance materials like polyphenylene sulfide and thermoplastic elastomers, are replacing metals and thermosets in critical automotive components due to their superior processability, recyclability, and ability to meet modern vehicle design requirements. Automakers are using these materials to produce lightweight interior trims, exterior panels, powertrain components, and battery housings that comply with global fuel economy and emission regulations.

Automotive Thermoplastic Compounds Market Trend

The global automotive thermoplastic compounds market is experiencing a shift towards metal replacement in structural and semi-structural vehicle components. Advanced thermoplastics like reinforced polyamide, polyphthalamide, and polyphenylene sulfide are being used for applications traditionally dominated by metals, such as front-end modules and engine brackets. These high-performance thermoplastics offer weight savings, mechanical strength, thermal resistance, and corrosion protection. Companies like LANXESS are developing glass-fiber and carbon-fiber reinforced thermoplastic grades for load-bearing structures in both internal combustion and electric vehicles. This trend enables carmakers to meet emission targets and improve vehicle efficiency.

Market Scope

Metrics | Details |

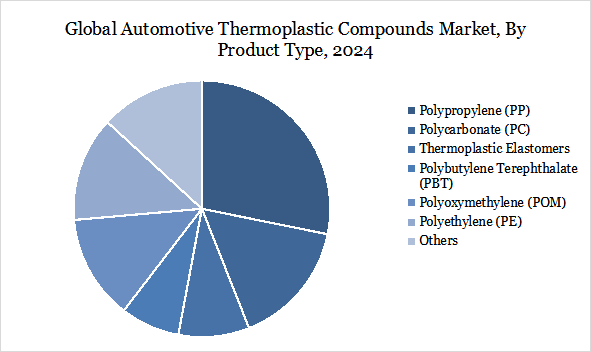

By Product type | Polypropylene (PP), Polycarbonate (PC), Thermoplastic Elastomers, Polybutylene Terephthalate (PBT), Polyoxymethylene (POM), Polyethylene (PE), Others |

By Vehicle type | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles (EVs) |

By Application | Seat Frames, Battery Trays, Bumper Beams, Load Floors, Front Ends, Under Engine Covers, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Increasing Use of Thermoplastic Compounds in EV Battery Enclosures and Thermal Management Systems

The increased uptake of electric vehicles is reported to be functioning as a key driver warmer for the global automotive thermoplastic compounds market; EVs require superior materials for lightweight battery enclosures, thermal management, and electrical insulation. Thermoplastics such as polyamide (PA), polycarbonate (PC), and polybutylene terephthalate (PBT) are flame-retardant, have high thermal stability and high dimensional accuracy, which are essential for components found in EV battery systems.

Major OEMs are now shifting from aluminum to glass-fiber-reinforced thermoplastics, which provide a reduction in weight without compromising performance, for high-voltage connectors, battery cooling modules, and enclosures. Battery modules are employing materials such as BASF's Ultramid and Celanese's Fortron PPS compounds to meet stringent thermal and safety requirement standards.

Dimensional Instability and Degradation of Thermoplastics Under Long-Term Heat Exposure

The widespread use of thermoplastic compounds in the automotive sector is hindered by their vulnerability to degradation and warping in high-temperature environments. These compounds, like PP, ABS, and POM, can deform, lose strength, or discolor, leading to reduced part lifespan and performance failures. High-performance thermosets or metals are preferred in critical under-the-hood and powertrain applications. The additional cost and limited recyclability of high-heat thermoplastic variants also pose economic barriers, particularly in cost-sensitive automotive segments.

Segment Analysis

The global automotive thermoplastic compounds market is segmented based on product type, vehicle type, application, and region.

Polypropylene (PP) Compounds Segment Driving Automotive Thermoplastic Compounds Market

The automotive thermoplastic compounds market is experiencing significant growth due to the ideal balance of lightweight properties, mechanical strength, and cost-effectiveness. PP compounds are being increasingly used in electric vehicles (EVs) for weight reduction, enhancing battery efficiency and driving range. They are also being used in parts like instrument panels, center consoles, door trims, and bumpers due to their dimensional stability, recyclability, and ease of processing. OEMs are also adopting specialty PP grades with enhanced scratch resistance, thermal stability, and matte finishes to meet consumer expectations for aesthetics and durability. Innovations like LyondellBasell's Hostacom and Borealis' Daplen PP series are accelerating their adoption, particularly in Europe and Asia.

TABLE 1 - Global Automotive Thermoplastic Compounds Market value (US$ Billion), Product Type, 2023-2032

Product type | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | CAGR (%) 2025-2032 | |

Polypropylene (PP) | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Polycarbonate (PC) | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Thermoplastic Elastomers | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Polybutylene Terephthalate (PBT) | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Polyoxymethylene (POM) | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Polyethylene (PE) |

| xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Others |

| xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Geographical Penetration

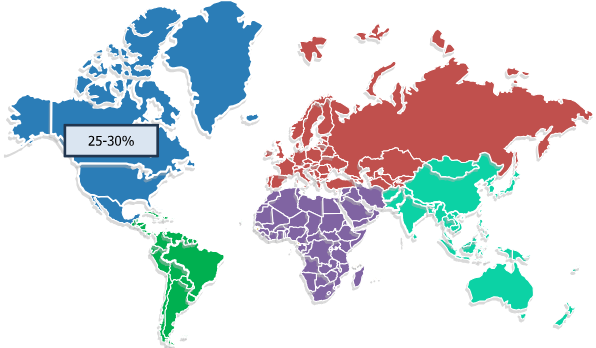

North America Drives the Global Automotive Thermoplastic Compounds Market

The automotive thermoplastic compounds market in North America is driven by strong OEM presence, regulatory pressure for lightweighting, and a shift towards electric vehicle manufacturing. Major automakers like Ford, General Motors, and Tesla are using advanced thermoplastics to reduce vehicle weight and improve fuel efficiency. The region's robust R&D infrastructure and material innovation ecosystem, supported by companies like Celanese, DuPont, and SABIC, have accelerated the development of high-performance thermoplastic formulations for critical automotive applications. U.S. federal and state-level incentives are also driving investment in EV production facilities, driving demand for thermoplastics in battery enclosures, lightweight housings, and thermal management systems.

TABLE 2 – North America Automotive Thermoplastic Compounds Market Value (US$ Billion), Product Type, 2023-2032

Product type | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | CAGR (%) 2025-2032 | |

Polypropylene (PP) | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Polycarbonate (PC) | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Thermoplastic Elastomers | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Polybutylene Terephthalate (PBT) | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Polyoxymethylene (POM) | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Polyethylene (PE) |

| xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | |

Others |

| xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | |

TABLE 3 – North America Automotive Thermoplastic Compounds Market Value (US$ Billion), Country, 2023-2032

Country | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | CAGR (%) 2025-2032 | |

US | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Mexico | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Canada | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx | xx% | |

Sustainability Analysis

The automotive thermoplastic compounds market is focusing on sustainability, with leading compounders like Covestro, BASF, and SABIC introducing recycled-content and bio-based thermoplastic compounds that meet automotive performance standards. These compounds are used in interior trims and structural parts. Partnerships between OEMs and recyclers are expanding to facilitate the collection and reuse of end-of-life vehicle plastics. Thermoplastics' inherent recyclability makes them well-suited for circularity in vehicle manufacturing. The integration of life cycle assessment and carbon footprint tracking into material selection is reinforcing the market's shift towards eco-efficient thermoplastic solutions.

Competitive Landscape

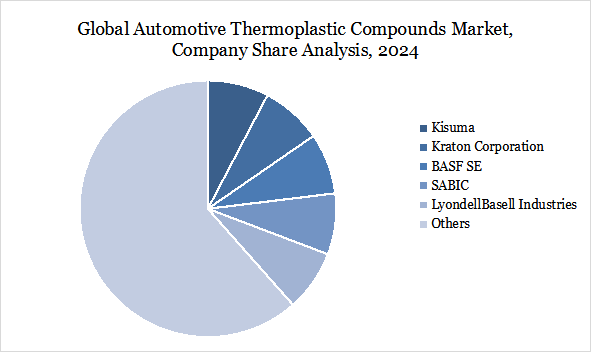

The major global players in the market include Kisuma, Kraton Corporation, BASF SE, SABIC, LyondellBasell Industries, Celanese Corporation, Dow Inc., DuPont de Nemours, Inc, Covestro AG, and Lanxess AG

Key Developments

In July 2024, Borealis introduced Borcycle GD3600SY, a glass-fiber reinforced polypropylene compound with 65% post-consumer recycled polymer content, for use in automotive interiors in a groundbreaking project partnered with Plastivaloire and Stellantis, a thermoplastic injection specialist and OEM owner of 14 automotive brands.

In February 2024, KRAIBURG TPE introduced a new range of thermoplastic elastomer (TPE) products with at least 73% recycled content, specifically designed for automotive applications. The Recycling Content TPE for Automotive series is partnering with Tessi Supply to produce inlay cases and floor mats using these grades.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies