Overview

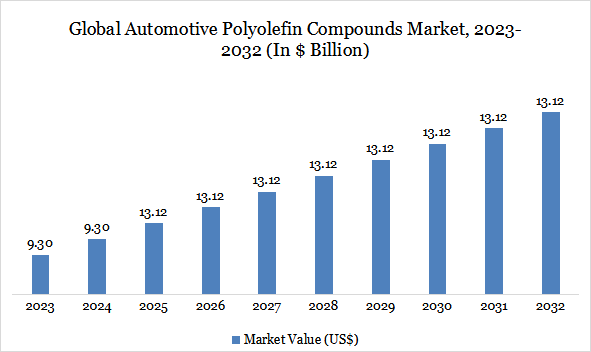

Global automotive polyolefin compounds market reached US$ 9.30 billion in 2024 and is expected to reach US$ 13.12 billion by 2032, growing with a CAGR of 4.4% during the forecast period 2025-2032.

The global automotive polyolefin compounds market is growing due to the automotive industry's focus on weight reduction, cost optimization, and sustainability. Polyolefins, such as polypropylene (PP), thermoplastic polyolefins (TPO), and thermoplastic elastomers (TPE), are widely used in automotive interiors, exteriors, and engine bay components due to their lightweight nature, excellent processability, impact resistance, and cost-effectiveness. They help automakers meet fuel economy and emissions regulations by replacing heavier plastics without compromising performance or aesthetics. Major automotive OEMs are incorporating polyolefins into dashboards, bumper systems, trims, door panels, and battery casings, especially in electric vehicles (EVs).

Automotive polyolefin compounds Market Trend

The automotive polyolefin compounds market is undergoing a significant transformation due to the integration of recycled and bio-based polyolefins into mainstream vehicle production. Companies like Borealis, LyondellBasell, and SABIC are introducing recycled-content PP and TPO compounds that meet mechanical and aesthetic standards for interior and exterior automotive parts. These sustainable materials are being incorporated into components like door trims, center consoles, and cargo liners, especially in electric and hybrid vehicles. Bio-based polyolefins derived from renewable feedstocks are also gaining traction, offering a reduced carbon footprint without compromising performance.

Market Scope

Metrics | Details |

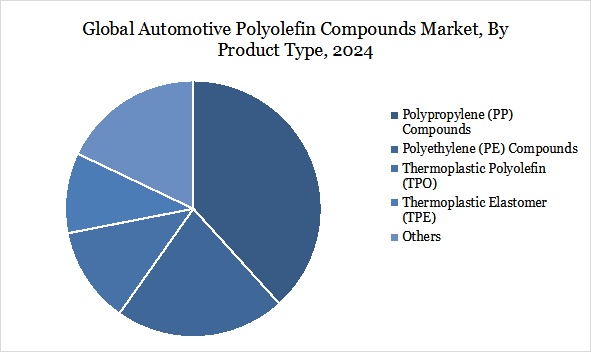

By Product type | Polypropylene (PP) Compounds, Polyethylene (PE) Compounds, Thermoplastic Polyolefin (TPO), Thermoplastic Elastomer (TPE), Others |

By Vehicle type | Passenger Vehicles, Commercial Vehicles, Electric Vehicles |

By Application | Interior, Exterior, Under-the-hood Components, Electrical Components, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand for Lightweight Vehicles to Meet Fuel Efficiency Norms

One of the major global growth drivers for the automotive polyolefin compounds market is the surging demand for lightweight materials with an aim to improve fuel efficiency and reduce vehicular emissions. Automotive OEMs are pursuing approaches for light weighting because of the strict fuel economy and CO2 emission standards enforced by various global automotive regulatory bodies such as the U.S. Environmental Protection Agency (EPA), the European Commission, and the China VI Emission Standards Authority. Polyolefin compounds are coming into greater use with lighter density vis-à-vis metals, and some engineering plastics, with the particular rating on PP and TPO. Thus, an excellent mix of rigidity, impact strength, and processability is afforded by these materials for use in automotive interiors (instrument panels, consoles, door trims), automotive exteriors (bumpers, fenders, spoilers), and, in some cases, even structural applications.

Limited High-Temperature Resistance Restricts Under-the-Hood Applications

Polyolefin compounds, despite many advantages, face the challenge of decreased high-temperature resistance. For applications under the hood-the engine cover and turbocharger duct-this property is of utmost importance. Polyolefins are not the materials of choice in an environment requiring exposure to +150°C for longer durations, give the advantage to polyamides or PPS-based materials. Therefore, the limitation posed by high temperature is of utmost consideration in the progressive move of smaller and efficient engines generating higher temperatures.

Segmentation Analysis

The global automotive polyolefin compounds market is segmented based on product type, vehicle type, application, and region.

Polypropylene (PP) Compounds Segment Driving Automotive Polyolefin Compounds Market

The automotive industry is gaining momentum in the polypropylene (PP) compounds segment due to its lightweight properties, cost efficiency, and moldability, making it ideal for interior trims, exterior panels, and under-the-hood applications. OEMs are replacing heavier materials with PP-based alternatives, supported by recent product innovations. For instance, in July 2024, Borealis introduced Borcycle GD3600SY, a glass-fiber reinforced polypropylene compound with 65% post-consumer recycled polymer content, for use in automotive interiors in a partnership with Plastivaloire and Stellantis, a thermoplastic injection specialist and OEM owner of 14 automotive brands.

Geographical Penetration

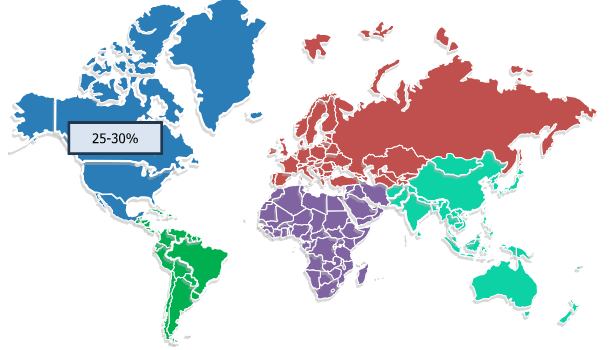

25-30%

North America Drives the Global Automotive Polyolefin Compounds Market

North America's automotive industry is experiencing a surge in demand for automotive polyolefin compounds due to its robust production base, increasing adoption of electric vehicles, and emphasis on lightweighting. Major OEMs like Ford, General Motors, and Stellantis are incorporating polypropylene and TPO compounds into vehicle interiors to improve fuel efficiency. Government incentives and the use of sustainable polyolefin compounds are also driving this demand.

Sustainability Analysis

The global automotive polyolefin compounds market is undergoing rapid transformation due to regulatory mandates and industry-led environmental commitments. Traditionally, polyolefins like polypropylene and thermoplastic olefins are derived from fossil-based feedstocks, raising concerns about their environmental footprint. However, recent developments are directing the industry towards circular and low-emission alternatives.

Major producers like Borealis, LyondellBasell, and SABIC have launched closed-loop recycling and bio-based compound portfolios for automotive applications, reducing reliance on virgin polymers and lowering greenhouse gas emissions. Polyolefin compounds also contribute indirectly to sustainability by enabling vehicle lightweighting, reducing fuel consumption and tailpipe emissions, and enhancing energy efficiency in electric vehicles.

Competitive Landscape

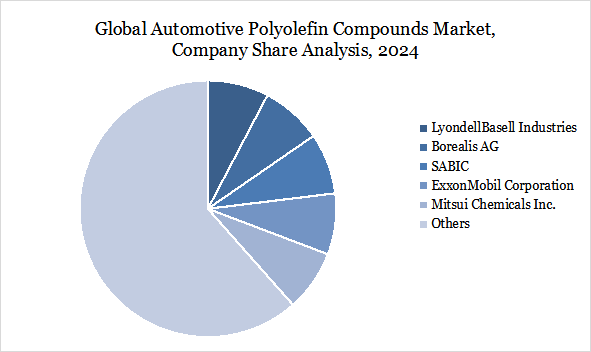

The major global players in the market include LyondellBasell Industries, Borealis AG, SABIC, ExxonMobil Corporation, Mitsui Chemicals Inc, Sumitomo Chemical Co., Ltd., Dow Inc, INEOS Group, Washington Penn Plastic Co., Inc, and RTP Company.

Key Developments

In April 2024, Dow developed a POE-based artificial leather solution for the automotive industry, aiming to transition towards animal-free alternatives. HIUV Materials Technology, a China-based partner, has commercialized this innovative option, which has been certified by an electric car manufacturer for its auto seatings application.

In July 2024, LyondellBasell launched its Schulamid ET100 product line, a polyamide-based compound product designed for automotive interior structural solutions like door window frames. This innovative technology showcases LYB's engineering capabilities in Engineered Polymers.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies