Generic Drugs Market Size

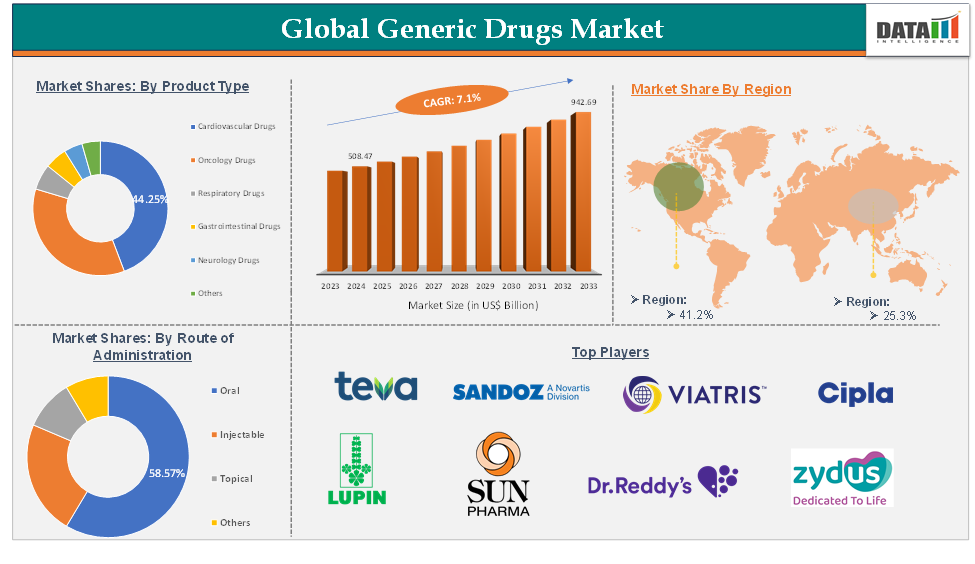

Generic Drugs Market Size reached US$ 508.47 billion in 2024 and is expected to reach US$ 942.69 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025-2033.

The global generic drugs market is experiencing growth due to rising healthcare costs, patent expirations, and an aging population. These drugs offer cost-effective alternatives with therapeutic value, making them crucial in developing economies. North America dominates the market due to key manufacturers, favorable regulatory frameworks, and high adoption rates. Government initiatives and the demand for affordable treatment options further support the region's market leadership.

Executive Summary

For more details on this report, Request for Sample

Generic Drugs Market- Market Dynamics: Drivers & Restraints

Rise in the Prevalence of Chronic Diseases is Driving the Market Growth

The global generic drugs market is growing due to the increasing prevalence of chronic diseases like diabetes, hypertension, cardiovascular diseases, cancer, and respiratory disorders. These conditions are often costly and require long-term treatment, putting a strain on patients and healthcare systems.

For instance, according to the Centers for Disease Control and Prevention, the US has 129 million people with at least one major chronic disease, with five of the top 10 leading causes of death being preventable and treatable. Prevalence has increased over the past two decades, and 42% have multiple conditions. Chronic diseases also significantly impact the US healthcare system, accounting for 90% of the annual $4.1 trillion expenditure.

Hence, the rising prevalence of chronic diseases in the U.S. drives demand for long-term medications, boosting the need for affordable treatment options. This supports the global generic drugs market, as generics offer cost-effective alternatives to branded drugs. The dominance of chronic conditions in healthcare spending encourages healthcare systems and insurers to promote generics.

Stringent Regulatory and Approval Requirements

The global generic drugs market faces significant challenges due to stringent regulatory and approval requirements imposed by health authorities. These requirements involve extensive testing to demonstrate bioequivalence to the original branded drug, which can be time-consuming and costly. Regulatory bodies like the FDA and EMA update their compliance standards, requiring manufacturers to adapt their practices.

Inconsistent or underdeveloped regulatory frameworks can lead to delays and market access issues in emerging economies. Maintaining high-quality control standards and consistency across production batches is crucial for gaining and retaining regulatory approval. Meeting these requirements poses a significant financial and operational challenge for small and mid-sized pharmaceutical companies.

Generic Drugs Market Segment Analysis

The global generic drugs market is segmented based on product, route of administration, distribution channel, and region.

Product Type:

The cardiovascular drugs segment holds 44.25% of segment share in the global generic drugs market

Cardiovascular drugs are pharmaceutical agents used to treat heart and circulatory conditions like hypertension, coronary artery disease, heart failure, arrhythmias, and hyperlipidemia. They are essential in managing the long-term effects of cardiovascular diseases and are a high-demand category for cost-effective generic alternatives.

The global generic drugs market is experiencing a surge in the cardiovascular drugs segment due to the product launches, increasing prevalence of cardiovascular diseases, primarily due to aging populations, sedentary lifestyles, unhealthy diets, and rising obesity rates.

For instance, in March 2025, Glenmark Pharmaceuticals launched Empagliflozin, an SGLT2 inhibitor, in India under the brand name Glempa. The drug, a globally recognized treatment for heart failure and diabetes, is available in fixed-dose combinations, Glempa-L and Glempa-M. It offers cardiovascular and renal safety benefits.

Moreover, over 7.6 million people in the UK are affected by heart and circulatory diseases, with over 4 million males and 3.6 million females affected. The number is expected to rise further due to an aging population and improved survival rates. By 2030, there could be 1 million more people with heart and circulatory diseases in the UK, and 2 million more by 2040.

Hence, increasing heart and circulatory diseases in the UK, fueled by an aging population and improved survival rates, present significant growth opportunities for the cardiovascular drugs segment in the global generic drugs market, offering cost-effective treatment options.

Furthermore, government policies and health insurance programs also encourage generic prescriptions, while increasing awareness among healthcare professionals and patients contributes to market expansion.

Generic Drugs Market Geographical Share

North America is expected to hold 41.2% in the generic drugs market

North America, particularly the US, dominates the global generic drugs market due to its focus on reducing healthcare costs, product launches, streamlined approval processes by the FDA, and the high prevalence of chronic diseases like diabetes, cardiovascular disorders, and cancer.

For instance, in June 2024, Teva Pharmaceuticals, a US affiliate of Teva Pharmaceutical Industries Ltd., launched an authorized generic of Victoza1 (liraglutide injection 1.8mg) in the US. This move provides patients with type 2 diabetes with another option for treatment and strengthens Teva's diverse complex generics portfolio.

Hence, Teva Pharmaceuticals' launch of an authorized generic of Victoza® in the U. S. improves access to affordable treatment for type 2 diabetes patients, supporting the North American generic drugs market. This step addresses rising healthcare costs and strengthens Teva's position in the complex generics segment, aiding the growth of the global generic drugs market.

Moreover, the expiration of patents on blockbuster branded drugs has created opportunities for generic manufacturers to expand their portfolios. The presence of established generic drug players, rising consumer awareness, and supportive reimbursement policies further strengthen North America's position as a dominant force in the global generic drugs market. Overall, the US's role in the global generic drugs market is significant.

Asia-Pacific is expected to hold a significant revenue of 132.20 million in 2024 in the generic drugs market

The Asia-Pacific region is a significant growth driver in the global generic drugs market due to its aging population, novel generic drug launches, chronic diseases, and rising healthcare costs. Countries like India and China, as major producers and exporters of generic medicines, are playing a significant role. Government policies, expanding healthcare infrastructure, and increasing acceptance of generics in public health programs are also driving market growth. The cost-sensitive nature of healthcare in the region further fuels the demand for affordable generic alternatives.

Around 80% of prescribed drugs in Japan are generic, offering lower prices, the same effect, and availability. These generics not only reduce the cost burden on patients but also help mitigate rising medical costs in Japanese society. They also provide the same efficacy as brand-name products, making them appealing for their lower prices.

Generic Drugs Market Key Players

The major global players in the generic drugs market include Teva Pharmaceutical Industries Ltd., Sandoz (a Novartis Division), Viatris Inc., Sun Pharmaceutical Industries Ltd, Lupin Limited, Dr. Reddy’s Laboratories Ltd, Cipla Ltd, Zydus Lifesciences Ltd, Fresenius Kabi AG, and Amneal Pharmaceuticals Inc., among others.

Key Developments

- In February 2025, Glenmark Pharmaceuticals launched Latanoprost ophthalmic solution, a 0.005% (0.05mg/mL) generic medication to treat glaucoma in the US market, which is therapeutically equivalent to Upjohn US LLC’s reference-listed drug, Xalatan Ophthalmic Solution. The Mumbai-based drug maker announced the launch.

- In November 2024, Sunshine Biopharma, a Canadian pharmaceutical company, launched a new generic prescription drug through its subsidiary, Nora Pharma Inc., which specializes in life-saving medicines in oncology and antivirals.

Scope

| Metrics | Details | |

| CAGR | 7.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product | Cardiovascular Drugs, Oncology Drugs, Respiratory Drugs Gastrointestinal Drugs, Neurology Drugs, Others |

| Route of Administration | Oral, Injectable, Topical, Others | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global generic drugs market report delivers a detailed analysis with 62 key tables, more than 56 visually impactful figures, and 200 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Distribution Channel & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.