Food Ingredients Market Size

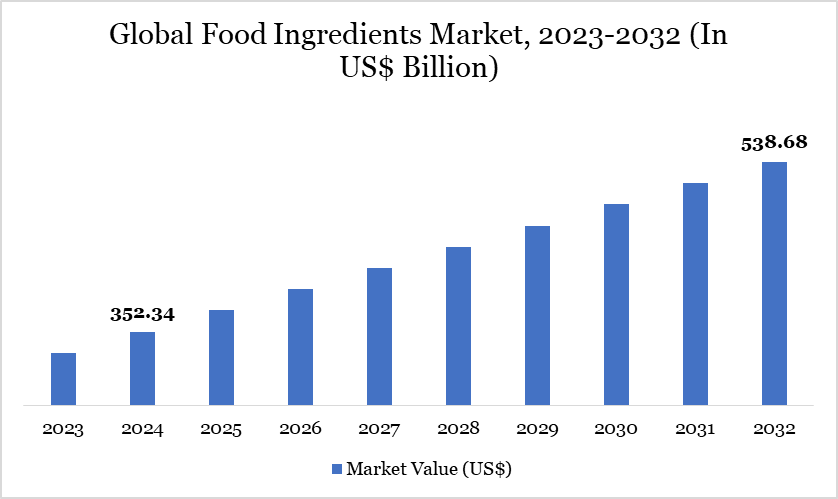

Food Ingredients Market Size reached US$ 352.34 billion in 2024 and is expected to reach US$ 538.68 billion by 2032, growing with a CAGR of 5.45% during the forecast period 2025-2032.

The global food ingredients market continues to witness robust growth, driven by rising consumer demand for natural, functional and clean-label products. Key sectors such as plant-based proteins, natural sweeteners, probiotics and specialty oils are experiencing significant expansion. Technological advancements in food processing and ingredient formulation are enabling greater innovation and product differentiation. Additionally, heightened awareness of health and wellness is reshaping consumer preferences and influencing purchasing behavior.

Food Ingredients Market Trend

The food ingredients market is being shaped by several key trends aligned with evolving consumer preferences and industry innovation. Clean-label demand is accelerating, with consumers seeking transparency, minimal processing and recognizable ingredients. Functional and fortified ingredients such as vitamins, probiotics, adaptogens and plant-based proteins are gaining traction due to growing health and wellness awareness. For instance, in March 2025, Louis Dreyfus Company launched a plant-based vitamin E product line at Food Ingredients China 2025, catering to the growing demand for natural and sustainable nutritional supplements.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

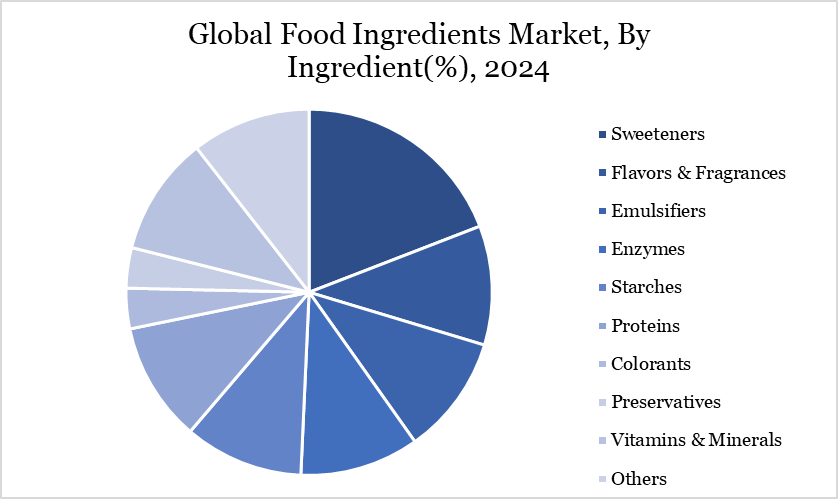

| By Ingredient | Sweeteners, Flavors & Fragrances, Emulsifiers, Enzymes, Starches, Proteins, Colorants, Preservatives, Vitamins & Minerals, Others. | |

| By Type | Natural, Synthetic. | |

| By Function | Texturants, Nutritional Ingredients, Flavoring & Seasoning, Processing Aids, Others. | |

| By Application | Fortified Food Products, Beverages, Bakery and Confectionery, Dairy and Dairy Products, Meat and Fish Products, Others. | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Food Ingredients Market Dynamics

Demand for Clean Label & Natural Products

The growing demand for clean-label and natural products is significantly driving the global food ingredients market. Consumers are increasingly prioritizing transparency, seeking foods made with simple, recognizable and minimally processed ingredients. This shift has led manufacturers to reformulate products, eliminating artificial additives, preservatives and synthetic colors. Natural alternatives such as plant-based sweeteners, fruit and vegetable extracts and functional botanicals are gaining traction.

According to a recent survey by the International Food Information Council (IFIC), consumer awareness around food ingredients is rising significantly. About 62% of individuals are paying more attention to ingredient lists compared to five years ago. Additionally, 63% of adults report that the ingredients in food or beverages moderately to strongly influence their purchasing decisions. This highlights a growing demand for transparency and clean-label products in the market.

Stringent Regulatory Compliance

Stringent regulatory compliance is a significant restraint on the global food ingredients market. In the US, the Department of Health and Human Services (HHS) directed the Food and Drug Administration (FDA) to reevaluate the "Generally Recognized as Safe" (GRAS) pathway, which currently allows companies to self-certify the safety of food ingredients without FDA approval.

Frequent changes in standards, such as those related to allergens, GMO content or organic certification, require constant reformulation and revalidation of ingredients. This can hinder innovation and discourage smaller companies from entering or expanding into regulated markets. Regulatory barriers also limit the global scalability of novel ingredients, even those backed by scientific data. Additionally, delayed approvals for functional or bioactive compounds can slow down product launches.

Food Ingredients Market Segment Analysis

The global food ingredients market is segmented based on the ingredient, type, function, application and region.

Sweeteners Hold a Significant Share Due to Widespread Use in Diverse Food and Beverage Applications

Sweeteners hold a significant share in the global food ingredients market due to the growing demand for sugar alternatives driven by health-conscious consumers. The versatility of sweeteners in a wide range of food and beverage applications, including baked goods, beverages, dairy and snacks, contributes to their dominant role. With innovations improving their taste and functionality, sweeteners continue to play a crucial role in shaping the future of the food ingredients market.

As concerns over obesity, diabetes and sugar-related health issues rise, the market for low-calorie, natural and plant-based sweeteners such as stevia, monk fruit and erythritol is expanding. These alternatives offer manufacturers the opportunity to cater to both the health-conscious and those following specific dietary plans, such as keto or diabetic-friendly diets. For instance, in January 2025, SteviaX introduced a new line of zero-calorie sweeteners targeting health-conscious consumers, anticipating a 20% increase in market share within the next quarter.

Food Ingredients Market Geographical Share

Asia-Pacific's Product Innovation and Rapid Urbanization

Asia-Pacific holds a significant share in the global food ingredients market due to its large population, growing middle class and increasing demand for processed and convenience foods. The region's diverse culinary traditions also drive the use of a wide range of ingredients, from spices to functional additives. Additionally, rapid urbanization and rising health consciousness have led to a surge in demand for healthier food options, such as plant-based ingredients and natural additives. The presence of major food manufacturers and suppliers in countries like China, India and Japan further strengthens the market's position.

With advancements in food technology and innovations in flavors, textures and preservatives, Asia-Pacific is poised for continued growth in this sector. In March 2022, Symega Food Ingredients launched its premium Cuisinary range at the AAHAR-International Food & Hospitality Fair in New Delhi, India, offering seasonings, breaders, coatings, spice blends and sauces designed for professional kitchens. The products cater to hotels, restaurants, caterers and quick service establishments, addressing the growing demand for convenient, high-quality cooking solutions in India's food service sector.

Sustainability Analysis

The global food ingredients market is increasingly focused on sustainability, driven by consumer demand for cleaner labels and environmentally friendly products. Companies are prioritizing the use of natural organic and locally sourced ingredients to reduce carbon footprints and support local economies. Innovations such as plant-based ingredients, biodegradable packaging and sustainable sourcing practices are reshaping the industry.

As consumers demand healthier and more sustainable options, companies across the industry are investing in innovative, functional ingredients that offer both health benefits and minimal environmental impact. For instance, in March 2025, NotCo launched a botanical GLP-1 booster that can be added to any food to help with appetite control and weight loss, offering a natural alternative to synthetic drugs.

Food Ingredients Market Major Players

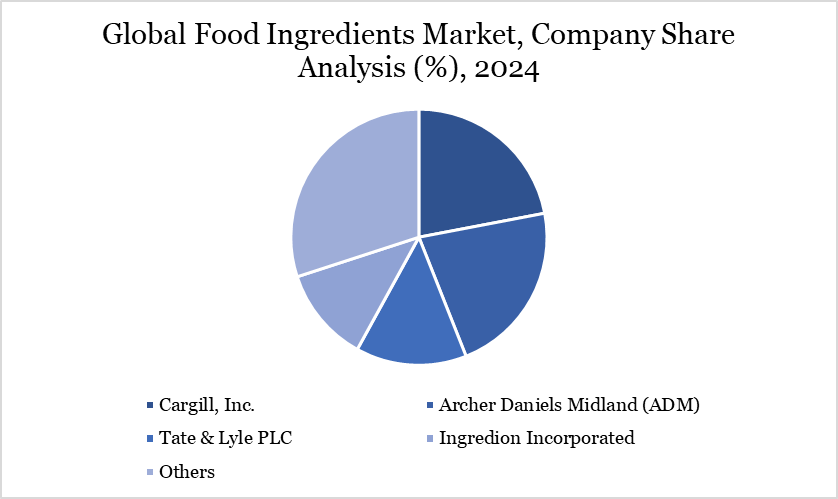

The major global players in the market include Cargill, Inc., Archer Daniels Midland (ADM), Tate & Lyle PLC, Ingredion Incorporated, Kerry Group, Symrise AG, International Flavors & Fragrances (IFF), DSM-Firmenich, Glanbia Nutritionals, BASF SE and others.

Key Developments

- In May 2025, Compound Foods, a US-based company, introduced a beanless ingredient platform offering cocoa- and coffee-free alternatives made from upcycled materials like date seeds, chicory and carob. This initiative aims to mitigate supply chain risks and reduce environmental impact.

- In February 2024, Ingredion, a US-based company, launched the NOVATION Indulge 2940, a functional native starch designed for clean-label products. This non-GMO starch offers a unique texture for gelling and co-texturizing, ideal for dairy and plant-based desserts. It meets the demand for healthier, indulgent options with a consumer-friendly "corn starch" label, supporting the growing preference for clean labels and better-for-you foods.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies