Flavors Market Overview

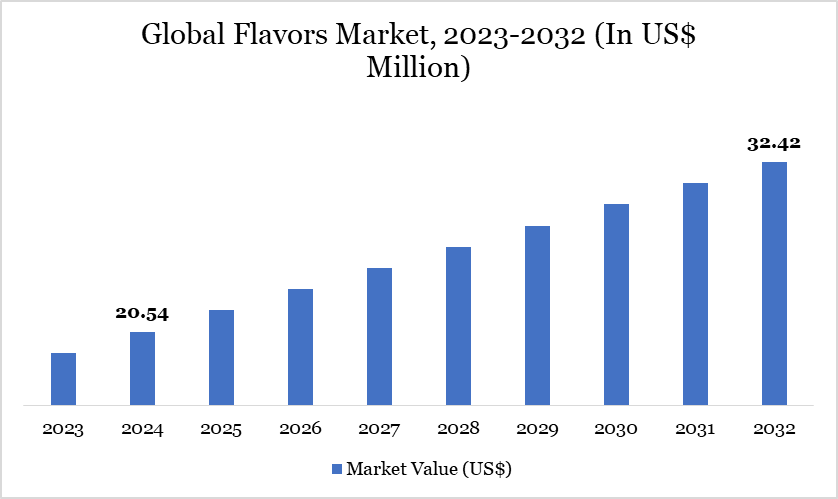

Flavors Market reached US$20.54 million in 2024 and is expected to reach US$32.42 million by 2032, growing at a CAGR of 5.87% during the forecast period 2025-2032.

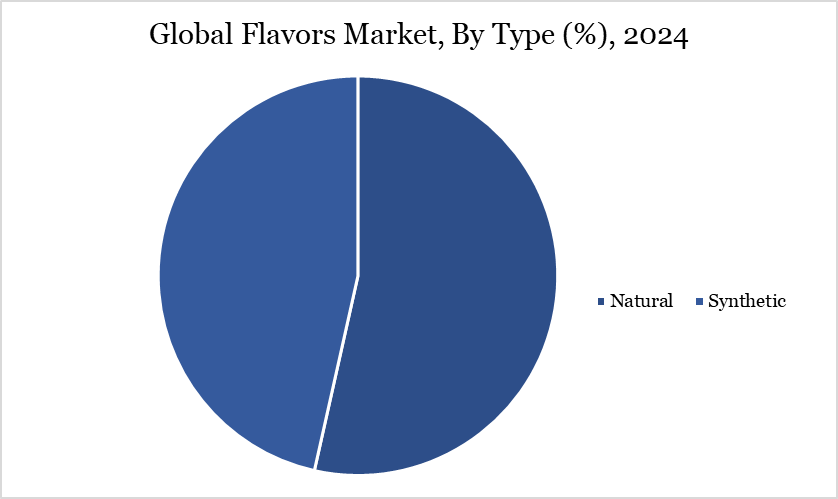

The global flavor market is expanding as demand for natural, organic, and innovative flavoring solutions rises, driven by changes in consumer tastes and a push toward healthier and more sustainable food options. The flavor industry includes both natural and synthetic flavoring agents used across the food and beverage, pharmaceutical, and cosmetic sectors. The market's growth is fueled by consumer trends that prioritize clean-label ingredients and transparency in sourcing and production processes.

Moreover, the increase in processed food consumption, coupled with innovations in flavor technology, supports the steady expansion of this industry. Furthermore, Regulatory bodies, such as the Food and Agriculture Organization (FAO) and European Food Safety Authority (EFSA), play significant roles in setting quality standards for flavors, ensuring that products meet health and safety guidelines while supporting innovation in the industry.

Flavors Market Trend

The rising popularity of plant-based diets has driven demand for flavors that deliver rich umami and smoky profiles, helping replicate the savory depth of meat and grilled foods. This trend addresses consumer desire for satisfying, authentic taste experiences without animal products. Flavor companies are responding by developing advanced technologies o create natural, complex flavor systems that enhance plant-based proteins.

For instance, in May 2025, T. Hasegawa USA launched PLANTREACT, a new flavor technology that replicates the complex, savory taste of animal proteins in vegan products using advanced natural processes like Maillard reactions and fermentation. Designed to improve the taste of plant-based proteins, PLANTREACT addresses a key consumer concern that has hindered market growth. The innovation comes as the US plant-based protein market,

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

By Type | Natural, Synthetic |

By Source | Plant-Based Flavors, Animal-Based Flavors, Microbial-Derived Flavors |

By Form | Powder, Liquid/Gel |

By Application | Food, Beverages, Personal Care, Pharmaceuticals, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Flavors Market Dynamics

Growing Demand for Natural and Clean-Label Flavors

The flavor market is significantly influenced by a shift in consumer preferences toward natural flavors. This trend is reflected in regulatory changes, such as the European Union's Food Information to Consumers (FIC) regulation, which enforces strict labeling requirements for artificial flavors. As a result, many companies are investing in natural alternatives to cater to health-conscious consumers.

Similarly, US Food and Drug Administration (FDA) has implemented stringent guidelines on flavor labeling, promoting transparency in the sourcing and production processes of flavor ingredients. These regulations require manufacturers to clearly label natural flavors and disclose any major allergens present, thereby enhancing consumer trust in food products. As consumers become increasingly skeptical about the authenticity of flavoring agents, the importance of accurate labeling cannot be overstated.

Supply Chain Disruptions

Supply chain disruptions significantly restrain the global flavors market by causing inconsistent availability of essential raw materials such as spices, fruits, and herbs. These disruptions, often driven by climate change, natural disasters, geopolitical tensions, and pandemics, lead to delays and increased costs in sourcing ingredients. As a result, manufacturers face challenges in maintaining consistent flavor quality and production schedules. The volatility in raw material supply also drives price fluctuations, affecting profit margins. Additionally, reliance on limited geographic regions for certain natural ingredients increases vulnerability to localized disruptions. This unpredictability hampers innovation and slows down new product development.

Flavors Market Segment Analysis

The global flavors market is segmented based on type, source, form, application and region.

High Demand for Natural and Organic Flavors in the Beverage Industry

The demand for natural and organic flavors is rapidly increasing as consumer preferences shift away from synthetic options. A survey conducted by the International Food Information Council revealed that 62% of consumers prefer foods with clean-label ingredients. This trend has prompted flavor companies to invest significantly in the development of natural and organic flavors, which are now widely used in various product categories such as beverages, snacks and dairy.

Consumers are particularly interested in achieving authentic taste profiles without the presence of artificial additives, leading to a notable rise in the popularity of botanical flavors like citrus, mint and floral essences. This shift towards clean-label products reflects a broader movement towards transparency and health consciousness among consumers.

Research indicates that consumers are more vigilant about ingredient lists, often opting for products that feature recognizable and minimally processed components. The clean-label trend is not only about eliminating artificial ingredients but also about fostering trust through transparency regarding sourcing and production methods. As consumers become more health-aware, they are willing to pay a premium for products that align with their values, further driving the market for natural and organic flavors. Top of Form

Flavors Market Geographical Share

Rapid Consumption of Processed Food Drives the Market in North America

North America is at the forefront of the global flavor market, driven by a high consumption rate of processed and convenience foods. According to research from Northeastern University’s Network Science Institute, approximately 73% of the food supply in the US is classified as ultra-processed. The region's robust demand for processed food is supported by an advanced food and beverage sector that continuously innovates to meet evolving consumer preferences, particularly for natural and organic flavoring solutions that align with the growing trend toward clean-label ingredients.

The market in US benefits significantly from government support, including tax incentives and subsidies for research and development in food innovation. This backing fosters the creation of unique flavors while ensuring safety and transparency in flavor additive usage, as emphasized by the Canadian Food Inspection Agency (CFIA).

Consequently, North America maintains a well-regulated and competitive market environment that not only promotes health-conscious choices among consumers but also encourages manufacturers to shift away from synthetic flavors towards more natural options. As companies like Archer-Daniels-Midland Co. and International Flavors & Fragrances Inc. commit to reducing artificial additives, the future of clean-label flavors looks promising, reflecting a broader shift towards healthier food options across the continent.

Sustainability Analysis

Sustainability has become a pivotal focus in the flavor industry, with companies actively adopting measures to reduce their environmental footprint. According to the Global Flavors & Fragrances Sustainability Council, 91% of innovations in 2023 featured a sustainability value proposition, as assessed by IFF's Innovation for Sustainability (I4S) Scoring Methodology. It is largely driven by advances in biotechnology and in the use of fermenting microbes to produce flavor compounds. Such methods diminish dependence on traditional agricultural raw materials and lower resource consumption, thereby promoting a more sustainable production model.

The integration of digital technologies further enhances sustainability efforts within the flavor production process. For instance, blockchain technology is being utilized to improve supply chain transparency, ensuring that sustainable practices are consistently followed. This combination of biotechnological innovations and digital tracking systems positions the flavor industry at the forefront of sustainable practices, aligning with consumer demand for environmentally friendly products.

Flavors Market Major Players

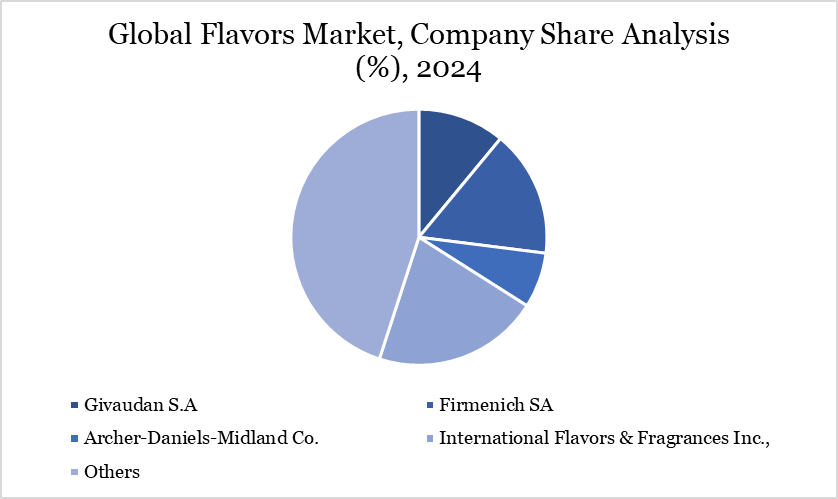

The major global players in the market include Givaudan S.A., Firmenich SA, Symrise AG, Archer-Daniels-Midland Co., Kerry Group, MANE S.A., Takasago International Corporation, International Flavors & Fragrances Inc., Sensient Technologies and BASF SE.

Key Development

In May 2024, FlavorSum, a leading North American flavor producer, launched its innovative “Choose Your Flavor Adventure” platform aimed at accelerating flavor innovation in the food and beverage industry. This interactive online tool serves as a comprehensive flavor lexicon, helping formulators precisely articulate their flavor goals. With unique educational features, the platform streamlines communication and speeds up the product development process.

In March 2024, BASF Aroma Ingredients expanded its Isobionics portfolio with the launch of Isobionics Natural beta-Caryophyllene 80, a new natural flavor ingredient. Unlike traditional sources such as clove oil, this product is free from phenolic and eugenol notes and is produced from renewable resources using advanced biotechnology.

In January 2023, International Flavors & Fragrances (IFF) introduced CHOOZIT VINTAGE in the US and Canadian markets, specifically catering to cheddar cheese producers. This product helps cheesemakers oversee and improve flavor evolution during aging, ultimately boosting both flavor consistency and texture, which are essential for ensuring consumer satisfaction.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies