Food Colors Market Size

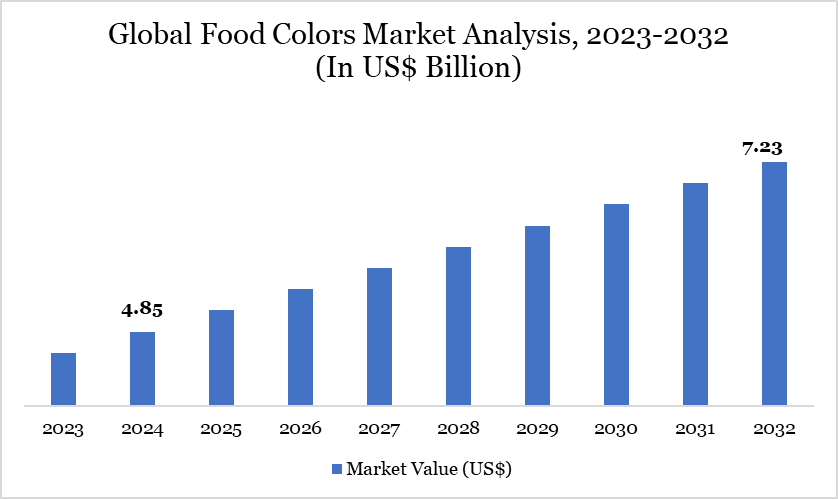

Food Colors Market size reached US$ 4.85 billion in 2024 and is expected to reach US$ 7.23 billion by 2032, growing with a CAGR of 5.12% during the forecast period 2025-2032.

The global food colors market is experiencing robust growth, fueled by evolving consumer preferences, regulatory changes, and innovation in food processing. According to the US Department of Agriculture (USDA), food and beverage companies in the US spent over US$ 4.6 billion on food additives including colorants in 2023, reflecting a 6.2% increase over 2022.

For more details on this report – Request for Sample

The European Commission’s 2023 Food Improvement Agents report also confirms a gradual but clear shift toward approved natural colors, with synthetic color usage declining by nearly 9% across EU member states over five years. Large corporations like Nestlé and Unilever have committed to removing artificial dyes from their global product portfolios, citing internal ESG goals and consumer health concerns.

Food Colors Market Trend

A major emerging trend in the food colors market is the rise of fermented and algae-based colorants. According to Givaudan, 18% of their new color innovation pipeline in 2023 focused on fermentation-derived blues and purples. The USDA's National Institute of Food and Agriculture (NIFA) has funded over US$ 2.3 million in algae research for natural dye development since 2021. The EFSA has also approved new microalgae species as food colorants in 2022, expanding legal options for manufacturers. This trend reflects a blend of sustainability, innovation, and scalability.

Market Scope

Metrics | Details |

By Source | Plants & Animals, Minerals & Chemicals, Microorganisms |

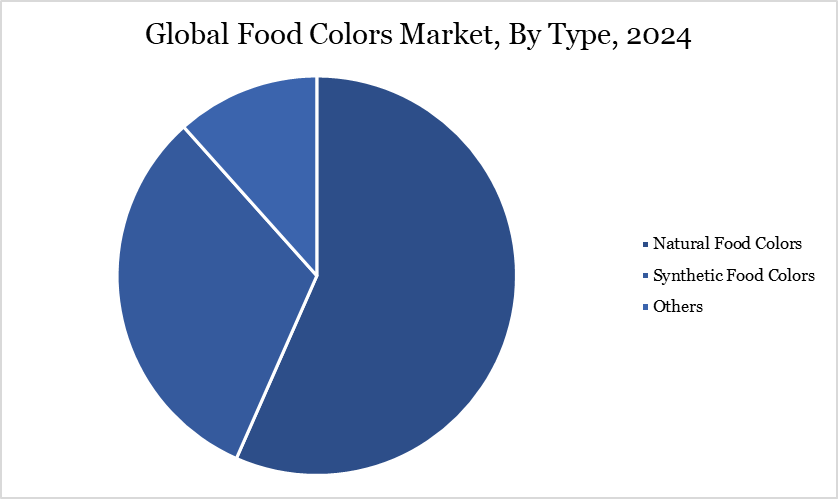

By Type | Natural Food Colors, Synthetic Food Colors, Others |

By Form | Liquid, Powder, Gel |

By Application | Food and Beverage, Pet Food, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Food Colors Market Dynamics

Technological Advancements in Extraction Methods

Technological advancements in extraction methods enhance the market by improving the efficiency and quality of natural colorants. Innovative techniques, such as supercritical fluid extraction and ultrasound-assisted extraction, facilitate the sustainable production of colors derived from fruits and vegetables. This aligns with the increasing consumer demand for clean-label products that prioritize health and transparency.

Additionally, these methods make natural alternatives more cost-effective and customizable, while ensuring compliance with safety regulations. New processes are delivering promising future market growth. For instance, in November 2023, researchers at The Novo Nordisk Foundation Center for Biosustainability introduced a groundbreaking fermentation process that transforms the production of natural betalain-type food colors.

Traditionally, betanin, the primary pigment in red beets, is extracted with a low yield of approximately 0.2% of the wet weight, rendering conventional extraction methods wasteful and resource-intensive. This inefficiency raises sustainability concerns due to the substantial agricultural inputs. The new fermentation technology offers a more efficient alternative by allowing betalains to be produced in controlled environments, minimizing waste and resource consumption.

Health Concerns Related to Some Food Colors

The market is constrained by rising health concerns and regulatory scrutiny surrounding artificial food colorings such as Blue 1, Red 40, Yellow 5 and Yellow 6. Research has linked these synthetic dyes to allergic reactions, particularly in sensitive individuals, with conditions like chronic hives showing a notable correlation. Moreover, while studies have largely found no evidence of carcinogenic effects for most artificial colors, there are significant concerns regarding Blue 2 and Red 3.

These safety concerns have heightened consumer awareness and shifted preferences toward healthier, more natural options. Additionally, growing evidence of a connection between artificial food colors and hyperactivity in children has further fueled demand for alternatives. In response, governments are implementing stricter food safety regulations. This combined pressure from health-conscious consumers and regulatory bodies is likely to hinder market growth.

Food Colors Market Segment Analysis

The global food colors market is segmented based on source, type, form, application and region.

Natural Food Colors Segment Driving Food Colors Market

Demand for natural food colors is a key driver of growth in the overall food colors market, spurred by rising health awareness, regulatory support, and consumer preference for clean-label ingredients. According to the US Food and Drug Administration (FDA), the number of color additives certified annually has declined for synthetic dyes while natural alternatives have gained ground, with more than 60 plant- and mineral-based colorants now permitted under the Code of Federal Regulations (CFR).

A 2023 report by the European Commission highlighted that over 63% of food manufacturers in the EU had reformulated their products to include natural colorants, in compliance with the EFSA’s push to phase out certain synthetic dyes due to health concerns. In India, data from the Ministry of Commerce & Industry shows exports of natural color sources like paprika and marigold extract rose by 13.2% in 2022–23, pointing to both rising domestic production and international demand. This global regulatory alignment, coupled with increasing consumer scrutiny of artificial additives, is catalyzing a steady shift toward natural food colorants, making them the fastest-growing segment in the food colors market.

Food Colors Market Geographical Share

Demand for Food Colors in Europe

Europe's dominance in the global food colors market is primarily driven by its stringent regulatory framework and commitment to safety. The EU has established comprehensive regulations, such as the EU Food Color Directive (94/36/EC), which ensures high safety standards for food additives. This rigorous approval process, overseen by scientific committees like the SCF, enhances consumer confidence in European products, making them highly regarded in international markets.

Moreover, Europe's influence extends globally, as its regulatory framework often sets standards that other regions adopt. Many countries look to EU guidelines when developing their regulations, which can lead to a preference for European products in international markets. The EU's extensive trade agreements further facilitate the export of food colors, solidifying Europe’s position as a leader in the food colors sector while shaping global standards and market dynamics.

Sustainability Analysis

The sustainability landscape of the food colors market is increasingly shaped by regulatory and environmental pressures, with government and corporate data indicating a decisive shift toward natural alternatives. According to the USDA’s Economic Research Service (2024), US organic food sales, which heavily rely on natural colorants like beet juice and turmeric, surpassed $60 billion in 2023, reflecting a 4.4% increase year-over-year, driven largely by consumer demand for clean-label products.

Concurrently, the European Food Safety Authority (EFSA) has tightened evaluations of synthetic food dyes, encouraging manufacturers to pivot toward plant-based sources. Firmenich, a major flavor and color house, reports that over 75% of its new product innovations in 2023 incorporated naturally derived colorants, aligning with its goal to achieve 100% sustainable sourcing by 2030.

Moreover, the Indian Ministry of Food Processing Industries noted that exports of turmeric—commonly used as a natural yellow dye—increased by 11% in FY 2022–23, driven by global demand for sustainable ingredients. These trends underscore a critical transition within the food colors market toward environmentally conscious and health-driven formulations.

Food Colors Market Major Players

The major global players in the market include Archer Daniels Midland, Döhler Group, EQT AB, DSM-Firmenich, Givaudan, Sensient Technologies Corporation, Kalsec, Inc, Roquette Frères, Aromata Group and Ajanta Colours.

Key Developments

In April 2025, Phytolon, a biotech-foodtech startup that offers natural food colors via fermentation of baker's yeast, and Ginkgo Bioworks, which is building the leading platform for cell programming and biosecurity, announced the successful completion of the second development milestone of their multi-product collaboration to produce natural food colors and the resulting distribution of an equity milestone to Ginkgo.

In January 2024, Israeli precision fermentation startup Phytolon aims to launch a broad range of vibrant natural colors produced by genetically engineered baker’s yeast in the US this year, pending regulatory approvals. The move follows technical breakthroughs with partner Ginkgo Bioworks enabling it to optimize its strains to achieve titers it claims can make it cost competitive with natural colors extracted from plants, but with higher levels of purity, no off tastes, and a more sustainable, reliable supply chain.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies