Fintech as a Service (Faas) Market Overview

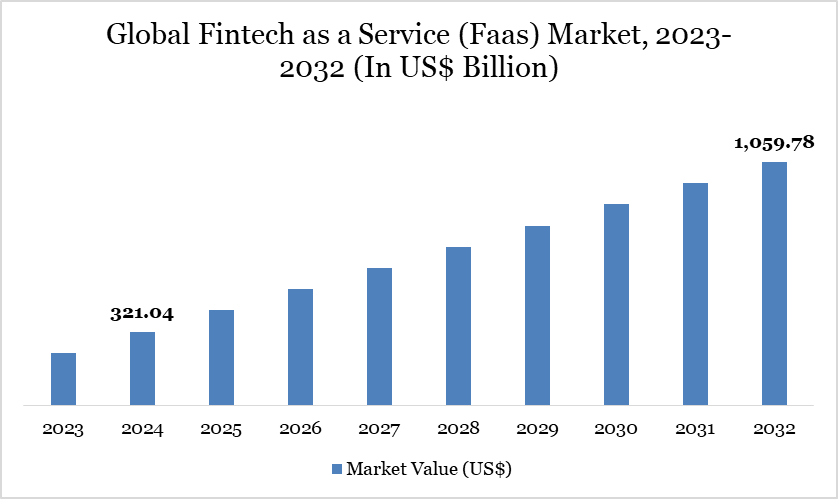

Global Fintech as a Service (Faas) Market reached US$ 321.04 billion in 2024 and is expected to reach US$ 1,059.78 billion by 2032, growing with a CAGR of 16.10% during the forecast period 2025-2032.

The Fintech as a Service (FaaS) market is witnessing rapid growth as businesses across industries seek to embed financial services into their digital ecosystems without building them from scratch. FaaS enables companies to offer services like digital payments, lending, wealth management, and KYC verification through cloud-based APIs and modular platforms. The global surge in digital transformation, coupled with the rise of open banking regulations, is driving this adoption.

For instance, Stripe, a leading FaaS provider, powers embedded payment infrastructure for platforms like Shopify and Amazon, enabling seamless transactions across geographies. The market is expanding across regions, with fintech-friendly regulations in the EU, India, and the US fostering innovation. As both startups and large enterprises increasingly look for cost-effective, scalable, and secure fintech solutions, the FaaS model is becoming a foundational pillar in the evolving digital finance ecosystem.

Fintech as a Service (Faas) Market Trend

Businesses across e-commerce, travel, and retail are embedding financial services like “buy now, pay later” (BNPL), insurance, and lending directly into their platforms. For instance, Uber offers its drivers debit cards and instant payments powered by FaaS providers like Green Dot. Fintech providers are focusing on API-first architectures to enable faster, more seamless integrations.

Companies like Plaid and Yodlee are leading this trend by offering robust API libraries for payments, account aggregation, and identity verification. More non-financial players such as retailers, SaaS companies, and marketplaces are launching their own financial services using FaaS. For example, Shopify offers Shopify Capital (lending) and Shopify Balance (banking), enabled by third-party FaaS infrastructure.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Type | Payments as a Service, Banking as a Service (BaaS), Lending as a Service, Insurance as a Service (InsurTech), Others |

| By Deployment | Cloud-Based, On-Premises, Hybrid |

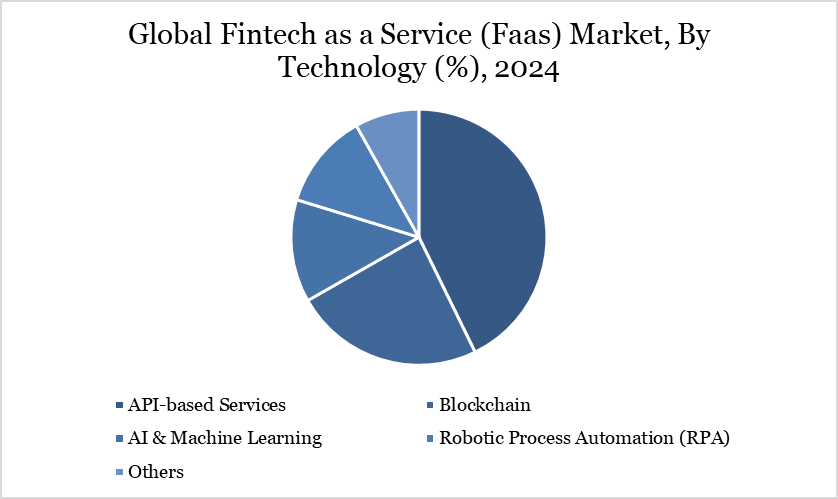

| By Technology | API-based Services, Blockchain, AI & Machine Learning, Robotic Process Automation (RPA), Others |

| By Application | Banks & Financial Institutions, Insurance Companies, Fintech Startups, eCommerce & Retail Businesses, Telecom Companies, Government Agencies, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Fintech as a Service Market Dynamics

Growing Fintech Startups and Non-Banking Players

The growing number of fintech startups and non-banking players is a major driver of the FaaS market, as these entities seek to quickly and cost-effectively launch financial products without obtaining full banking licenses. Startups, digital platforms, and tech companies increasingly rely on FaaS providers to embed services like payments, credit, insurance, and digital banking into their applications.

For instance, in 2024, Global financial technology leader FIS had launch of its 2024 FIS Fintech Hangout Series, an initiative that fosters and connects fintech startups, investors, financial institutions, FIS experts, and participants from the FIS Fintech Accelerator Program. This series will spark meaningful conversations, share best practices, and showcase the amazing work of the participating fintechs. As more tech-forward businesses enter the financial services space, the demand for modular, scalable, and compliant fintech infrastructure continues to surge solidifying FaaS as the backbone of modern financial innovation.

Regulatory and Compliance Challenges

Regulatory and compliance challenges significantly restrain the growth of the Fintech as a Service (FaaS) market by creating operational, legal, and financial uncertainties for both providers and adopters. Financial services are heavily regulated across jurisdictions, and FaaS providers must ensure that their offerings comply with varying standards related to KYC (Know Your Customer), AML (Anti-Money Laundering), data protection (like GDPR or India's DPDP Act), and licensing laws.

For instance, a fintech startup using a FaaS platform to offer digital lending in the European Union must comply with the region’s PSD2 directive, while the same model in the U.S. may need to adhere to different state-wise regulations, causing compliance overhead. These challenges not only increase the cost of compliance but also slow down market entry and innovation, making it harder for new players to scale their financial offerings quickly.

Fintech as a Service Market Segment Analysis

The global Faas market is segmented based on offering, deployment, technology, application and region.

Blockchain-Driven Innovation in FaaS: Enhancing Transparency, Speed, and Trust

The blockchain technology segment is playing a pivotal role in driving the Fintech as a Service (FaaS) market by offering decentralized, secure, and transparent financial solutions that enhance trust and efficiency. Blockchain enables real-time settlement, reduces transaction costs, and eliminates the need for intermediaries—making it highly attractive for fintech applications like cross-border payments, smart contracts, identity verification, and decentralized finance (DeFi).

For instance, Ripple’s blockchain-based payment infrastructure is used by financial institutions like Santander and SBI Holdings to process cross-border transactions faster and at lower costs. As blockchain becomes more integrated into mainstream finance, its ability to offer transparent, tamper-proof, and programmable financial services continues to accelerate the adoption of FaaS solutions across both traditional and emerging markets.

Fintech as a Service Market Geographical Share

North America’s Leadership in the FaaS Market: A Hub for Innovation, Investment, and Scalable Fintech Solutions

North America dominates the FaaS market due to its advanced digital infrastructure, strong presence of leading fintech players, and favorable regulatory frameworks that encourage innovation. The United States, in particular, is home to major FaaS providers like Stripe, Plaid, Marqeta, and Square, which offer a wide range of API-based financial services such as payments, digital banking, card issuing, and data aggregation.

These platforms are widely adopted by tech startups, neobanks, and even legacy financial institutions aiming to modernize their offerings. Furthermore, North America has a relatively mature regulatory environment such as clear guidelines from the Office of the Comptroller of the Currency (OCC) and Consumer Financial Protection Bureau (CFPB)—that supports fintech development while ensuring consumer protection. This combination of technological leadership, financial investment, and regulatory clarity solidifies North America’s position as the global hub for FaaS innovation and deployment.

Technology Analysis

The technology landscape in the FaaS market is rapidly evolving, driven by innovations in cloud computing, API integration, artificial intelligence (AI), and blockchain. Cloud-native infrastructure forms the backbone of most FaaS platforms, enabling scalable, secure, and cost-efficient deployment of financial services across geographies. API-first architectures are central to FaaS, allowing seamless integration of modular services like digital payments, lending, identity verification, and compliance into client applications. AI and machine learning are increasingly being used to enhance fraud detection, personalize user experiences, and automate underwriting in real-time.

For instance, FaaS providers like Unit and Synapse offer AI-enhanced decision engines for credit and risk analysis. Together, these technologies are transforming the financial services landscape by enabling faster, more secure, and more accessible fintech solutions that can be embedded directly into non-financial platforms.

Fintech as a Service Market Major Players

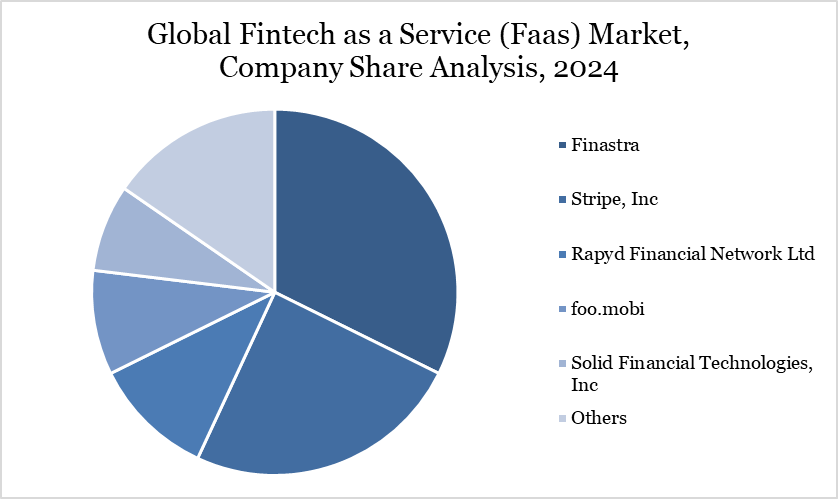

The major global players in the market include Finastra, Stripe, Inc, Rapyd Financial Network Ltd, foo.mobi, Solid Financial Technologies, Inc, Synctera Inc, SAP Fioneer, TCS BaNCS, PayMate, Backbase and among others.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies