Eye Health Supplements Market Overview

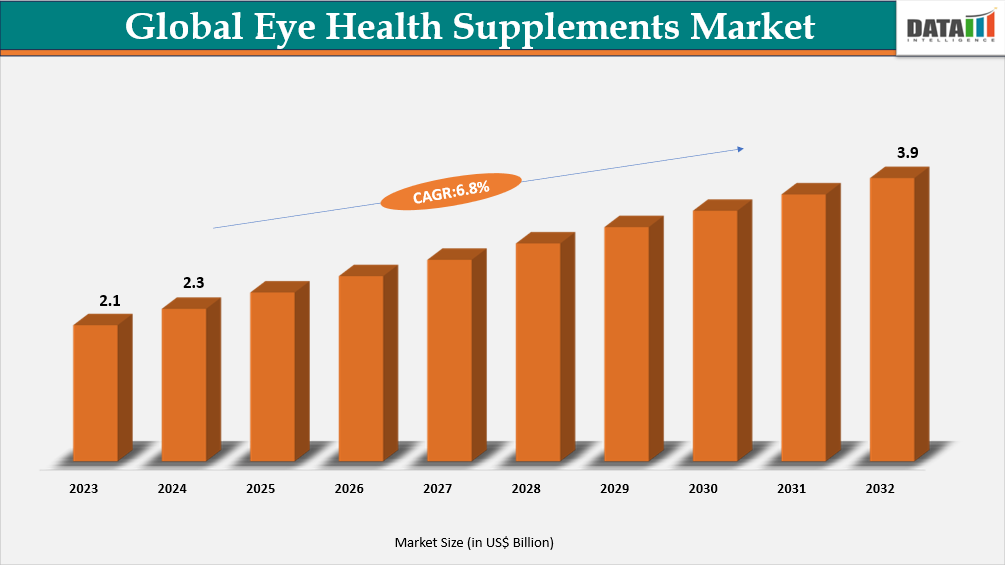

Global Eye Health Supplements Market reached US$ 2.3 billion in 2024 and is expected to reach US$ 3.9 billion by 2032, growing with a CAGR of 6.8% during the forecast period 2025-2032. The global eye health supplements market is experiencing significant growth, driven by increasing awareness of vision health and the rising prevalence of eye disorders. The market’s growth is fueled by factors such as an aging global population, heightened screen time, and a greater emphasis on preventive healthcare.

Key ingredients in these supplements include lutein and zeaxanthin, which accounted for significant market share due to their efficacy in preventing age-related macular degeneration (AMD) and cataracts. The demand for eye health supplements is also influenced by the increasing incidence of vision impairment. For instance, over 2.2 billion individuals globally suffer from visual impairments, a number expected to rise to 3.2 billion by 2050. As consumers seek proactive measures to maintain eye health, the market for eye health supplements continues to expand, offering opportunities for growth and innovation in the sector.

Eye Health Supplements Industry Trends and Strategic Insights

- North America dominates the eye health supplements market, capturing the largest revenue share of 36.2% in 2024.

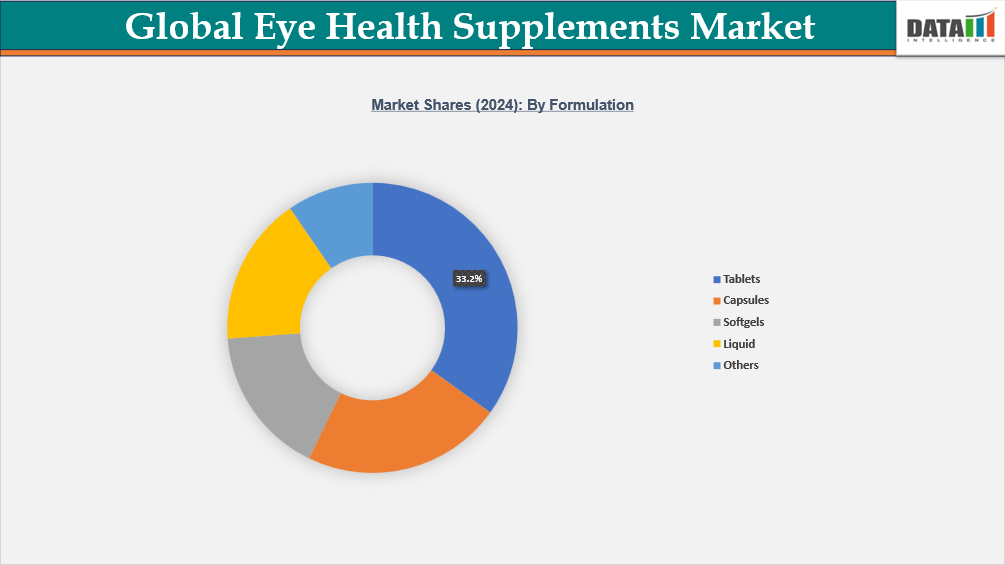

- By formulation, the tablets is projected to be the largest market, holding a significant share of 33.2% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 2.3 Billion

- 2032 Projected Market Size: US$ 3.9 Billion

- CAGR (2025-2032): 6.8%

- Largest Market: North America

- Fastest Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Ingredient Type | Lutein & Zeaxanthin, Antioxidants, Omega-3 Fatty Acids, Coenzyme Q10, Flavonoids, Alpha-Lipoic Acid and Others |

| By Formulation | Tablets, Capsules, Softgels, Liquid and Others |

| By Indication | Age-Related Macular Degeneration (AMD), Cataract, Glaucoma, Eye Fatigue and Others |

| By Distribution Channel | Online and Offline |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Information, Request for Sample

Market Dynamics

Increasing Prevalence of Digital Eye Strain

A significant driver of the global eye health supplements market is the increasing prevalence of digital eye strain, particularly among individuals who spend prolonged periods in front of digital screens. This condition, often referred to as "computer vision syndrome," encompasses symptoms such as eye fatigue, dryness, and blurred vision. With the rise of remote work, online education, and extensive use of smartphones, the incidence of digital eye strain has surged.

This growing concern has led to a heightened demand for supplements containing ingredients like lutein, zeaxanthin, and omega-3 fatty acids, which are believed to support eye health and alleviate symptoms associated with digital eye strain. As awareness of this condition spreads, consumers are increasingly turning to eye health supplements as a preventive measure, thereby propelling market growth.

Limited Scientific Evidence and Regulatory Challenges

A significant restraint on the global eye health supplements market is the limited scientific evidence supporting the efficacy of many ingredient types. While ingredients like lutein and zeaxanthin are widely recognized for their potential benefits, the clinical validation for numerous other compounds remains insufficient. This lack of robust scientific backing can lead to consumer skepticism and hesitancy in adopting these supplements. Furthermore, regulatory challenges and stringent approval processes for health claims can impede the introduction of new ingredient types into the market, slowing overall industry growth.

Segmentation Analysis

The global eye health supplements market is segmented based on ingredient type, formulation, indication, distribution channel and region.

Tablets Segment Overview

Tablets segment is expected to hold about 33.2% of the global market in 2024. The tablets segment continues to dominate the eye health supplement market, primarily due to its unparalleled dose accuracy and potency. Consumers managing age-related conditions like Age-Related Macular Degeneration (AMD) require precise, high-dose formulations of ingredients like AREDS2-based nutrients. Tablets reliably deliver these standardized, therapeutic dosages that are critical for efficacy, a feature where other forms can struggle. This precision builds essential trust and clinical credibility with a health-conscious consumer base, ensuring consistent and measurable health outcomes from each single serving.

Significant demographic tailwinds powerfully fuel this segment's growth, specifically the rapidly expanding global elderly population. Individuals aged 60 and above are the most vulnerable to debilitating eye diseases such as cataracts and AMD. With the global population over 60 projected to reach 2.1 billion by 2050, this creates a vast and expanding addressable market. This demographic prioritizes proven, pharmaceutical-like delivery systems for managing chronic health issues. Tablets perfectly align with this preference, being a familiar and trusted format for long-term preventive care.

Furthermore, the high prevalence of digital eye strain presents a substantial and growing driver across all adult age groups. Over 60% of the global population regularly uses digital devices, leading to a surge in complaints like dry eyes and blurred vision. This has expanded the consumer base beyond the elderly to include younger, tech-savvy adults. For this demographic, the convenience of a single daily tablet fits seamlessly into a busy routine. It offers a simple, proactive solution to counteract the cumulative effects of prolonged screen exposure.

Manufacturing and consumer advantages also solidify the tablet's market-leading position. From a ingredient standpoint, tablets are cost-effective to produce at scale and offer superior stability and a longer shelf life compared to liquids or soft gels. For the consumer, they are highly portable, easy to dose, and lack the taste or texture challenges of powders. This combination of economic and practical benefits ensures the tablet's continued dominance. It remains the most accessible and reliable format for both manufacturers and consumers in the eye health arena.

Softgels Segment Analysis

The softgel segment in the eye health supplements market is experiencing robust growth, primarily due to its superior bioavailability and consumer preference for easy-to-swallow dosage forms. Softgel capsules, with their gelatin-based shell, effectively encapsulate oil-soluble nutrients like omega-3 fatty acids and antioxidants, ensuring better absorption in the body. This enhanced bioavailability makes softgels a preferred choice for delivering essential nutrients that support eye health, such as lutein and zeaxanthin.

Consumer convenience also plays a pivotal role in driving the demand for softgel eye health supplements. The smooth, easy-to-swallow nature of softgel capsules appeals to a broad demographic, including seniors and individuals with pill aversions. This ease of consumption contributes to higher adherence rates among users, thereby boosting the segment's market share.

Furthermore, the softgel segment benefits from advancements in manufacturing technologies that allow for the encapsulation of a wide range of active ingredients. Innovations such as plant-based and vegan-friendly softgel options cater to the growing demand for dietary supplements that align with diverse consumer preferences. These developments not only expand the market reach but also attract health-conscious consumers seeking sustainable and ethical ingredient type choices.

Geographical Penetration

North America Eye Health Supplements Market Insights

North America region held about 36.2% share of the global market in 2024. North America's dominance in the eye health market is fueled by high consumer health literacy and a proactive culture of preventive wellness. The region has one of the world's highest per capita expenditures on dietary supplements, exceeding $150 annually. This is amplified by an aging demographic, with over 20% of the population projected to be 65 or older by 2030, directly increasing the prevalence of Age-Related Macular Degeneration (AMD). Widespread digital device use, averaging over 6.5 hours daily per adult, further expands the consumer base beyond seniors to younger adults seeking relief from digital eye strain.

US Eye Health Supplements Market Insights

The US market is driven by a powerful convergence of high disposable income, strong brand marketing, and clinical precedent. The landmark AREDS2 clinical trials, which established a specific nutrient formula for reducing AMD risk by 25%, created a scientifically-backed ingredient type category that physicians routinely recommend. This clinical validation, combined with the fact that over 50% of US adults regularly use dietary supplements, creates a highly receptive environment. Furthermore, the country's advanced retail and e-commerce infrastructure ensures these ingredient types are easily accessible to a population increasingly concerned with long-term visual health and proactive self-care.

Canada's eye health supplement market is growing steadily, supported by an increasingly health-conscious and aging population, with seniors being the fastest-growing demographic. A key driver is the high prevalence of AMD, the leading cause of vision loss for Canadians over 50. Consumer awareness is bolstered by strong public health messaging and the fact that nearly 80% of the population has internet access, facilitating direct-to-consumer education and sales. While the market is mature, growth is sustained by demand for premium, natural ingredients and targeted formulations for conditions like dry eye, which affects over 5 million Canadians.

Asia-Pacific Eye Health Supplements Market Outlook

The Asia-Pacific region is the epicenter of growth for eye health supplements, driven by a perfect storm of demographic and lifestyle factors. The region is home to over 60% of the world's population aged 60 and above, creating a vast, natural market for age-related conditions like cataracts. Simultaneously, skyrocketing digital device usage, with average screen times now exceeding 6 hours daily in many countries, is causing an epidemic of digital eye strain among the young. This dual pressure from an aging population and a digitally saturated youth, combined with rapidly rising disposable income, fuels unprecedented demand for preventive eye care solutions.

India Eye Health Supplements Market Outlook

India's eye health supplement market is exploding, propelled by a massive, young, and digitally active population facing a myopia crisis. Over 35% of India's 1.4 billion people are now online, with screen time for urban youth surpassing 7 hours a day. This contributes to a myopia rate that has more than doubled in a decade, affecting over 30% of children. As awareness of these issues grows within a burgeoning middle class, demand for supplements containing lutein and zeaxanthin is surging. The market is poised for sustained growth as preventive health becomes a priority for billions of new consumers.

China Eye Health Supplements Market Trends

China dominates the APAC eye health market, fueled by the world's most severe myopia epidemic and a rapidly graying populace. A staggering 80% of Chinese high school students are now myopic, driven by intensive academic pressure and screen use. Concurrently, over 18% of its population is already over 60, a figure set to double by 2050, escalating demand for AMD and cataract support. Government initiatives, like the 2020 "Double Reduction" policy to curb myopia, have further amplified public awareness. This has created a highly receptive consumer base for advanced, scientifically-backed supplements to protect vision across all age groups.

Sustainability Analysis

The global eye health supplements market faces a sustainability challenge centered on ingredient sourcing and environmental impact. The cultivation of key botanicals like marigolds for lutein and bilberries is land- and water-intensive, risking ecosystem strain. Furthermore, the predominant use of plastic packaging for bottles and blister packs generates significant waste, conflicting with consumer demand for eco-friendly ingredient types. A shift towards sustainable agriculture, including regenerative farming for source ingredients, is critical to mitigate this. Long-term viability hinges on transparent supply chains, recyclable or biodegradable packaging innovations, and corporate commitments to reducing the carbon and resource footprint of ingredient typeion, aligning brand growth with planetary health.

Competitive Landscape

- The global eye health supplements market is intensely competitive between established pharmaceutical giants, pure-play supplement leaders, and agile direct-to-consumer (DTC) brands.

- Key players include Pfizer Inc., Bausch & Lomb Incorporated., Amway Corp., Vitabiotics Ltd., Alliance Pharma, Bayer AG, Nature’s Bounty, The Nature's Way Company, ZeaVision LLC., Swanson Health Products.

- Competition is increasingly pivoting to scientific validation, with brands highlighting AREDS2-based formulas.

- A critical battleground is digital marketing, where DTC brands target younger consumers concerned with digital eye strain. Success hinges on transparent labeling, patent-protected formulations, and effective e-commerce strategies to capture a diverse consumer base from aging seniors to screen-saturated millennials.

Key Developments

- In May 2024, Bausch + Lomb, launched a major new initiative for its flagship ingredient type, PreserVision AREDS 2. The development involved the introduction of a new, smaller-sized softgel designed to be easier to swallow, directly addressing a key barrier for its core senior demographic.

- On February 21, 2024, two major ingredient suppliers, ZeaVision LLC and Kemin Industries, announced a strategic partnership. The agreement grants Kemin exclusive global rights to market, sell, and distribute ZeaVision's proprietary Dietary Meso-Zeaxanthin (MZ) for dietary supplements.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies