External Defibrillators Market Size & Industry Outlook

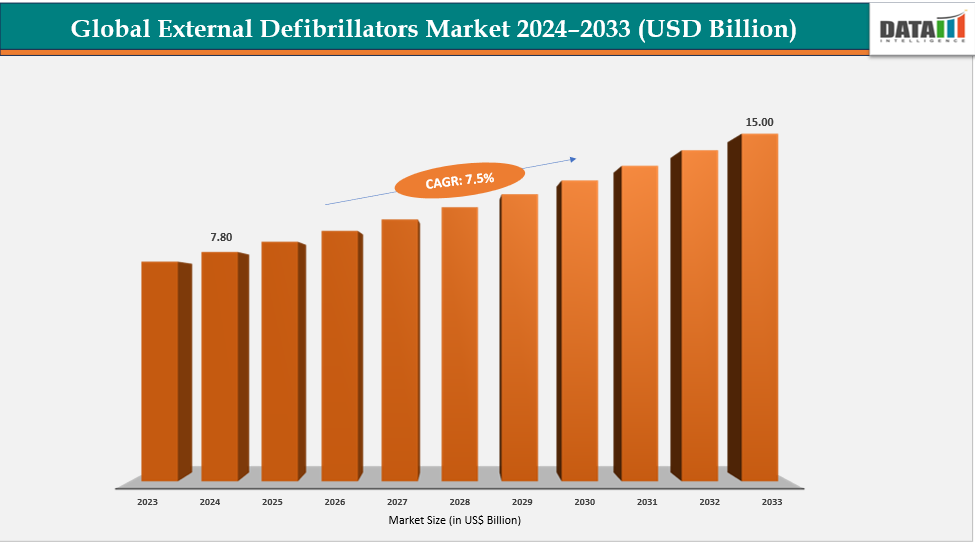

The global external defibrillators market size reached US$ 7.29 Billion in 2023 with a rise of US$ 7.80 Billion in 2024 and is expected to reach US$ 15.00 Billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

Market expansion for external defibrillators (AEDs) is being driven by technological advancements. Compact AEDs facilitate emergency deployment and transportation. Biphasic waveforms increase patient survival and defibrillation effectiveness. Longer battery life guarantees that devices stay functional for extended periods of time. Real-time remote status monitoring is made possible by IoT and connectivity. Healthcare providers are able to monitor the maintenance requirements and device readiness. Improved usability promotes uptake in hospitals and public areas. Data collection for improved patient outcomes is supported by integration with digital platforms. Constant innovation boosts safety and dependability, which fosters user trust.

Key Highlights

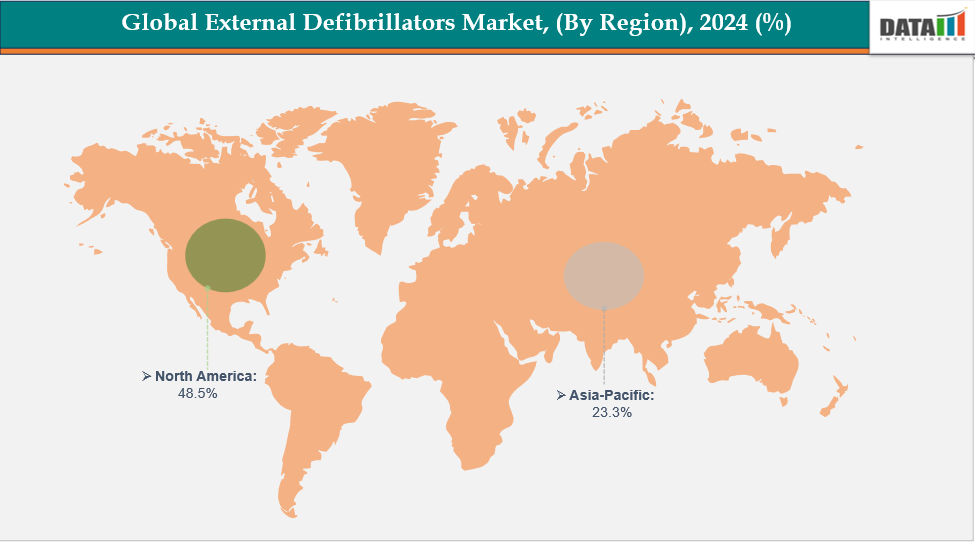

- North America is dominating the global external defibrillators market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global external defibrillators market, with a CAGR of 7.7% in 2024

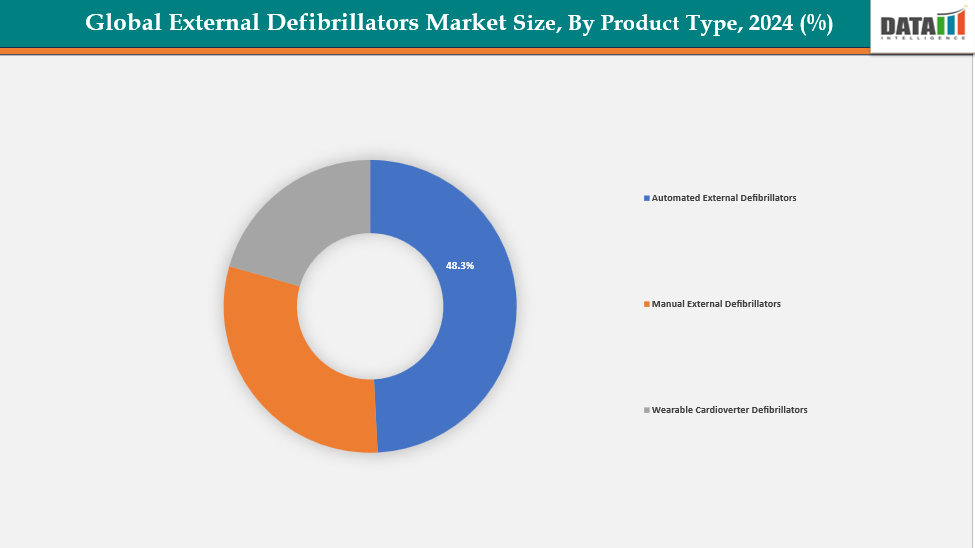

- The automated external defibrillators from product type are dominating the external defibrillators market with a 48.3% share in 2024

- The biphasic defibrillation segment form technology is dominating the external defibrillators market with a 59.3% share in 2024

- Top companies in the external defibrillators market include Koninklijke Philips N.V., ZOLL Medical Corporation, Defibtech LLC, Stryker, Avive Solutions, Inc., iPAD, SCHILLER, MEDIANA Co., Ltd., Afrimedics, and ViVest Medical Technology Co., Ltd., among others.

Market Dynamics

Drivers: Rising incidence of cardiovascular disease and sudden cardiac arrest are accelerating the growth of the external defibrillators market

The market for external defibrillators is expanding due to the increased prevalence of cardiovascular disorders and sudden cardiac arrest. Heart-related emergencies have increased as a result of aging populations, obesity, and more sedentary lifestyles because sudden cardiac arrest necessitates an instant response, there is a great need for user-friendly automated external defibrillators (AEDs).

According to recent WHO and CDC data, cardiovascular diseases (CVDs) remained the leading global cause of mortality in 2022, with 85% due to heart attacks and strokes. In the U.S., approximately 805,000 people suffered heart attacks, highlighting the critical need for prevention and treatment.

Restraints: High upfront device costs and recurring costs limit adoption in low-resource settings are hampering the growth of the external defibrillators market

External defibrillators are more expensive up front, which limits their availability for hospitals and clinics in areas with little resources. Modern AEDs and monitor-defibrillators can be too expensive for smaller medical facilities. Recurring costs like batteries, pads, and routine maintenance increase the financial strain. Moreover, networking features and software upgrades raise operating expenses.

Consequently, emergency response capabilities continue to be limited. By lowering demand, this pricing barrier impedes market expansion, particularly in areas where cardiac crises are on the rise but financial resources are scarce.

For more details on this report, see Request for Sample

External Defibrillators Market, Segment Analysis

The global external defibrillators market is segmented based on product type, technology, end user and region

By Product Type: The automated external defibrillators from product type are dominating the external defibrillators market with a 48.3% share in 2024

The market for external defibrillators is dominated by Automated External Defibrillators (AEDs). In an emergency, laypeople may easily use them thanks to their design. Users can safely administer shocks with the aid of voice cues and visual instructions. AEDs are frequently seen in public settings like businesses, schools, sports arenas, and airports. AED adoption rises as a result of governments and groups supporting public-access defibrillation initiatives. Unlike manual defibrillators, they do not need medical professionals with training. The market share of wearable defibrillators is limited since they cater to a restricted group of high-risk patients.

Additionally, this area is dominant due to firm collaborations, mergers, and acquisitions. For instance, in August 2025, Cardio Partners, a Sarnova division, acquired RescueStat, a healthcare technology firm specializing in Automated External Defibrillator (AED) program management and remote monitoring. The acquisition strengthened Cardio Partners’ ability to improve survival rates from sudden cardiac arrest nationwide.

By Technology: The biphasic defibrillation segment from technology is dominating the external defibrillators market with a 59.3% share in 2024

The market for external defibrillators is dominated by the biphasic defibrillation segment. It increases the efficacy of shocks by delivering current in two phases. Higher success rates in reestablishing a normal cardiac rhythm are guaranteed by this method. By using less energy, biphasic defibrillators lessen patient discomfort and myocardial damage. Compared to monophasic devices, they are safer and more effective. The sophisticated algorithms and small size improve usefulness in emergency situations.

Additionally, manufacturers' ongoing advancements and new product introductions are enhancing accuracy and portability. For instance, in May 2025, Element Science received FDA approval for its Jewel Patch Wearable Cardioverter Defibrillator, featuring advanced biphasic defibrillation technology. The device marked a major milestone in cardiac care, offering effective, patient-friendly protection. It had also obtained the CE mark and UKCA certification for broader global access.

External Defibrillators Market, Geographical Analysis

North America is dominating the global external defibrillators market with a 48.5% in 2024

North America's robust healthcare system, high rate of cardiac arrests, and growing use of cutting-edge biphasic technologies all contributed to the market for external defibrillators. The region's market grew as a result of regular product introductions, knowledgeable emergency responders, encouraging reimbursement practices, and strict regulatory requirements.

In the USA, advanced healthcare systems, frequent product launches, innovative biphasic technologies, and favorable FDA approvals enhancing emergency response are propelling the external defibrillator market growth. For instance, in October 2023, Medtronic received FDA approval for its Aurora EV-ICD MRI SureScan and Epsila EV defibrillation lead, marking the first extravascular defibrillator system designed to deliver life-saving therapy without placing leads inside the heart or veins.

Europe is the second region after North America which is expected to dominate the global external defibrillators market with a 34.5% in 2024

Europe's market for external defibrillators is growing as a result of an aging population, an increase in the prevalence of cardiovascular disease, and improved healthcare facilities. Innovation is being fueled and regional market growth is being accelerated by frequent product releases, advantageous reimbursement policies, and ongoing EU and CE mark approvals. Owing to factors like continuous EU and CE mark approvals. For instance, in February 2024, ZOLL announced that its AED Plus and AED 3 defibrillators received CE mark approval, becoming fully compliant with the EU Medical Device Regulation 2017/745 (MDR), ensuring adherence to stringent European safety and quality standards.

The market for external defibrillators in Germany is fueled by a sophisticated healthcare system, strict laws, and a high level of clinical skill. Technological innovation, government initiatives, broad hospital access, and training programs all assist rapid adoption, which improves patient outcomes and speeds up market expansion.

The Asia Pacific region is the fastest-growing region in the global external defibrillators market, with a CAGR of 7.7% in 2024

The Asia-Pacific market for external defibrillators, which includes China, India, South Korea, and Japan, is growing quickly as a result of rising rates of cardiovascular diseases, sophisticated hospital infrastructure, technological advancements, rising healthcare costs, and growing awareness of the importance of prompt emergency interventions. Wearable defibrillators and AED use are major factors propelling market expansion.

India’s External Defibrillator (AED) market is experiencing robust growth, driven by rising cardiovascular disease prevalence, government initiatives for public access to AEDs, and advanced hospital infrastructure. Moreover, company expansion for the medical devices segment makes it more dominant. For instance, in September 2025, Stryker expanded its R&D presence in India by opening a 140,000-square-foot facility in Whitefield, Bengaluru. The center, complementing its Gurgaon campus, showcased medical technologies, including ICU beds, stretchers, ambulance cots, and automated external defibrillators, enhancing collaboration with healthcare professionals.

External Defibrillators Competitive Landscape

Top companies in the external defibrillators market include Koninklijke Philips N.V., ZOLL Medical Corporation, Defibtech LLC, Stryker, Avive Solutions, Inc., iPAD, SCHILLER, MEDIANA Co., Ltd., Afrimedics, and ViVest Medical Technology Co., Ltd., among others.

Koninklijke Philips N.V.: Koninklijke Philips N.V., a global leader in health technology, offers advanced external defibrillators (AEDs) designed for both public and clinical use. Its HeartStart portfolio includes user-friendly, reliable devices with real-time guidance, data connectivity, and integrated monitoring. Philips focuses on improving cardiac emergency response, enhancing patient survival rates, and supporting healthcare providers with innovative resuscitation solutions worldwide.

Key Developments:

- In April 2025, Medtronic received FDA approval for the OmniaSecure defibrillation lead, the smallest-diameter, lumenless lead, designed for precise right-ventricle placement. Building on the SelectSecure Model 3830, it treated VT/VF and brady-arrhythmias, and investigational study results were simultaneously announced, enhancing Medtronic’s lead solution portfolio.

- In July 2025, Safe Life expanded into Asia by acquiring HTM Medico, Singapore’s leading AED distributor. The acquisition strengthened Safe Life’s market presence and marked a significant milestone, establishing the Group’s first operational footprint in Asia and enhancing its global portfolio of life-saving solutions.

Market Scope

| Metrics | Details | |

| CAGR | 7.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product Type | Automated External Defibrillators, Manual External Defibrillators, Wearable Cardioverter Defibrillators |

| By Technology | Biphasic Defibrillation, Monophasic Defibrillation | |

| By End User | Hospitals, Clinics, Home Care Services, Ambulatory Surgical Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global external defibrillators market report delivers a detailed analysis with 62 key tables, more than 52 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here