Expanded Polystyrene (EPS) Market Size

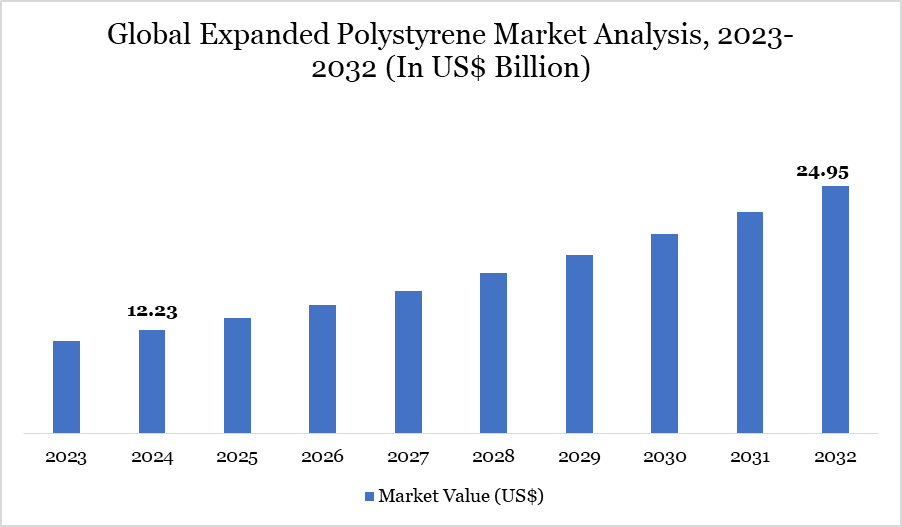

Expanded Polystyrene (EPS) Market size reached US$ 12.23 billion in 2024 and is expected to reach US$ 24.95 billion by 2032, growing with a CAGR of 9.32% during the forecast period 2025-2032.

Expanded polystyrene (EPS) is a crucial material across various industries owing to its advantageous physical and functional properties. EPS is widely utilized in packaging, construction, and electronics due to its lightweight, moisture-resistant, thermally insulating, and shock-absorbing properties.

The application is advancing because to increasing demand from e-commerce and food retail chains, where product integrity during transportation is essential. In the US, the construction and packaging industries are significant users of EPS, particularly as projects such as the SoFi Stadium and high-speed rail programs enhance EPS utilization in insulation and structural design.

Globally, the demand for EPS is intricately linked to changes in consumer behavior and urbanization trends, which are propelling the need for packaged food, healthcare infrastructure, and sustainable construction. The worldwide packaging industry's worth attained US$ 42.2 billion in 2021, highlighting the significant potential for EPS-based packaging. These dynamics collectively establish EPS as a fundamental material across various industries.

Expanded Polystyrene Market Trend

The EPS market is seeing a significant upheaval, propelled by advancements in sustainable construction technologies and smart packaging. A significant trend is the rising utilization of EPS in prefabricated housing. China's January 2022 Five-Year Plan anticipated that prefabricated components might constitute over 30% of new building, with EPS panels being integral due to their lightweight and thermal insulation characteristics.

The increase in intelligent and sustainable packaging solutions is enhancing the popularity of EPS. Its closed cellular composition, consisting of 98% air, offers unparalleled stress absorption, rendering it optimal for safeguarding delicate electronics and medical devices. Moreover, the food industry's dependence on EPS, particularly for seafood and perishable items, is increasing due to its exceptional moisture resistance and insulating properties. The seafood market is anticipated to attain US$ 336 billion by 2025, hence amplifying the significance of EPS packaging. These tendencies indicate a market progressively influenced by sustainability and functional efficacy.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Product | White, Grey, Others |

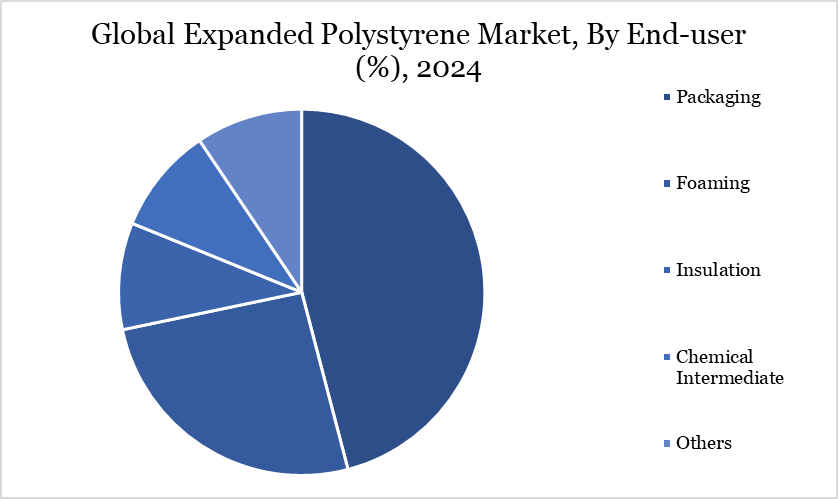

| By Application | Packaging, Foaming, Insulation, Chemical Intermediate, Others |

| By End-user | Electronics, Automotive, Construction, Food & Beverages, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Expanded Polystyrene Market Dynamics

Digital Economy and Processed Food Accelerate EPS to Maximum Efficiency

A convergence of industry factors is driving the global EPS market, particularly in the food, construction, and electronics sectors. The expansion of the digital economy, especially in India, where the electronics manufacturing sector is anticipated to attain US$ 520 billion by 2025, is propelling the demand for shock-resistant EPS packaging.

Similarly, the global food industry's revenue, projected at US$ 276.10 billion in 2022, underscores the increasing dependence on EPS for secure, protected food transportation. In the US, urbanization and e-commerce have accelerated the demand for packaged and processed food, a trend further intensified by the COVID-19.

EPS is essential in various sectors due to its protective properties and adherence to pharmaceutical and food-grade standards. Moreover, the utilization of EPS panels in prefabricated building is increasingly popular due to its efficiency and ecological advantages. These advancements are establishing EPS as a favored material in contemporary industrial systems that demand thermal insulation, impact resistance, and transport durability.

Regulatory Restrictions Impede EPS in Food Packaging

The EPS market is contending with heightened regulatory oversight, particularly over environmental sustainability. As of 2023, many regions worldwide have implemented rigorous regulations on single-use plastics and expanded polystyrene in food packaging. The European Union's Single-Use Plastic Directive exemplifies a mandate that necessitates producers to develop recyclable and biodegradable alternatives to EPS.

The rising requirements, although fostering environmental stewardship, pose compliance and cost issues for current product lines. Furthermore, the transition in consumer preferences towards sustainable materials is intensifying the pressure on conventional EPS utilization in retail and food service sectors.

This legislative landscape requires a reassessment of manufacturing and supply chain strategies, especially for firms dependent on non-recyclable EPS formats. While activities in bio-based and recyclable EPS are advancing, the changeover time presents operational and financial challenges. This regulatory pressure is a substantial limiting factor in an otherwise expanding EPS sector, necessitating players to emphasize sustainable innovation.

Expanded Polystyrene Market Segment Analysis

The global expanded polystyrene market is segmented based on product, application, end-user and region.

The Versatility of EPS in Enhancing Industry-Specific Packaging Solutions

EPS has demonstrated its efficacy as a cost-efficient, high-performance packaging material appropriate for various industrial applications. In food packaging, it bolsters the worldwide seafood market—valued at US$ 253 billion in 2021 and projected to reach US$ 336 billion by 2025—by maintaining freshness through its heat and moisture-resistant attributes. In pharmaceuticals, EPS guarantees adherence to rigorous regulatory standards by safeguarding temperature-sensitive drugs throughout storage and transportation.

In recent years, the electronics sector in Germany generated EUR 199.5 billion in sales and extensively used EPS for its shock-absorbing properties, protecting fragile components. Moreover, consumer items and home appliances leverage EPS's lightweight properties and rigidity, enabling stackable, damage-resistant packaging. The rising demand for e-commerce and retail-ready formats is driving the development of EPS for last-mile delivery protection. The adaptability of EPS in the food, pharmaceutical, electronics, and consumer products sectors establishes it as the preferred material in the global packaging industry.

Expanded Polystyrene Market Geographical Share

Sectoral Expansion Establishes APAC as EPS Market Dominance

The Asia-Pacific region holds the greatest share of the global EPS market, supported by strong industrial expansion in the construction, electronics, and automotive sectors. The construction industry's critical significance in China was underscored during the 13th Five-Year Plan (2016–2020), achieving an annual rise of 5.1% in added value and accounting for 6.9% of GDP. The government's initiative for prefabricated housing, anticipated to exceed 30% of new constructions, is intensifying the need for EPS.

India is rising as a significant economic engine, with its electronics manufacturing sector anticipated to attain US$ 520 billion by 2025, hence driving demand for effective EPS packaging solutions. Notwithstanding a 3% reduction in vehicle production in 2021, Japan continues to be a significant consumer of EPS owing to its robust automotive manufacturing sector. These changes highlight the strategic significance of the Asia-Pacific region in propelling EPS consumption, bolstered by infrastructural improvements, manufacturing growth, and the evolution of consumer markets in major economies.

Expanded Polystyrene Market Major Players

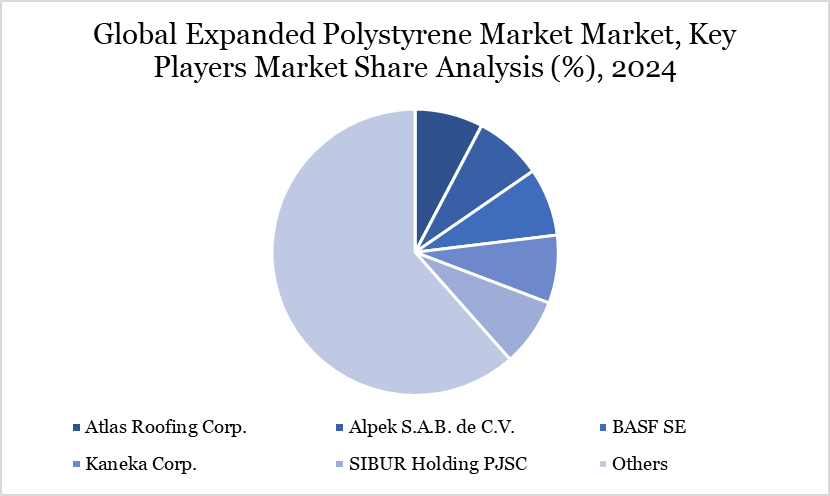

The major global players in the market include Atlas Roofing Corp., Alpek S.A.B. de C.V., BASF SE, Kaneka Corp., SIBUR Holding PJSC, BEWI, SUNPOR, Synthos, TotalEnergies, Flint Hills Resources, NOVA Chemicals Corporate.

Sustainability Analysis

Sustainability has arisen as both a challenge and a catalyst for innovation in the EPS market. In light of increasing regulatory pressure and evolving customer values, manufacturers are hastening the creation of bio-based and recyclable EPS substitutes. Companies such as Plastilite are leading research and development into eco-friendly EPS materials that maintain the practical advantages of traditional goods. Synthos SA has created specialized EPS recycling facilities to tackle waste management issues. These initiatives correspond with overarching packaging trends, as the global packaging sector attained a valuation of US$ 42.2 billion in 2021, with a growing focus on sustainable materials.

Furthermore, the utilization of EPS in prefabricated building systems promoted by China's Five-Year Plan reduces CO2 emissions during transit and on-site construction, thereby facilitating sustainable infrastructure. The industry's shift towards circularity, eco-efficiency, and adherence to environmental regulations signifies a proactive change to ensure EPS's sustainability in the face of increasing ecological responsibility.

Key Developments

In 2024, BASF introduced Neopor Mcycled, a significant development in the global Expanded Polystyrene (EPS) market, featuring 10% recycled EPS waste. This innovation highlights the industry's increasing shift towards sustainability, with a growing emphasis on incorporating recycled materials into EPS production.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies