EV Charging Infrastructure Market Overview

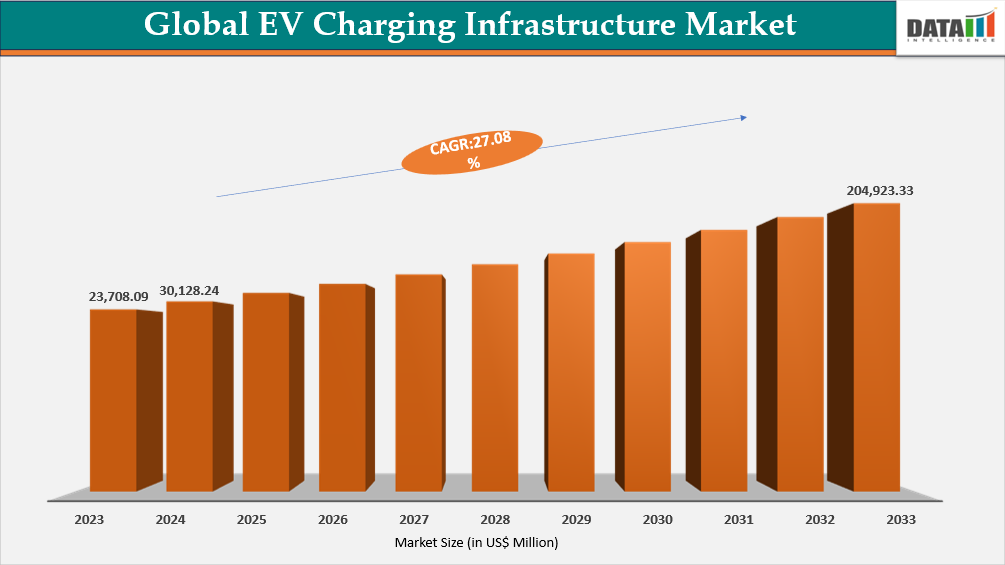

The global EV charging infrastructure market reached US$23,708.09 million in 2023, rising to US$30,128.24 million in 2024 and is expected to reach US$204,923.33 million by 2032, growing at a CAGR of 27.08% from 2025 to 2032.

The global EV charging infrastructure market is entering a high-growth phase driven by accelerating EV adoption, large-scale government funding, and rapid advances in fast-charging and grid-interactive technologies. By 2025, the global stock of electric vehicles had surpassed 30 million units, creating unprecedented demand for both residential and public charging networks. AC charging remains the backbone of global installations, accounting for nearly 68–72% of all chargers in operation, supported by strong penetration of home and workplace charging. In parallel, DC fast-charging capacity is expanding rapidly, growing at an annual rate of nearly 30–35%, as nations prioritize highway electrification and commercial fleets shift to high-power charging solutions to maintain operational uptime.

Massive public-sector investments are reshaping the market’s trajectory. Across Europe, China, and India, cumulative funding for EV charging infrastructure has exceeded US$120 billion between 2022 and 2025, enabling the deployment of high-density charging corridors, interoperability standards, and renewable-powered hubs. Utility participation is also rising, with grid-interactive charging programs projected to reduce local grid reinforcement costs by up to 25%, while unlocking new monetization channels through demand-response and V2G services. With renewable energy now contributing over 28% of global electricity generation, the integration of smart energy management and bidirectional charging positions the EV charging infrastructure market for sustained, long-term expansion.

EV Charging Infrastructure Market Industry Trends and Strategic Insights

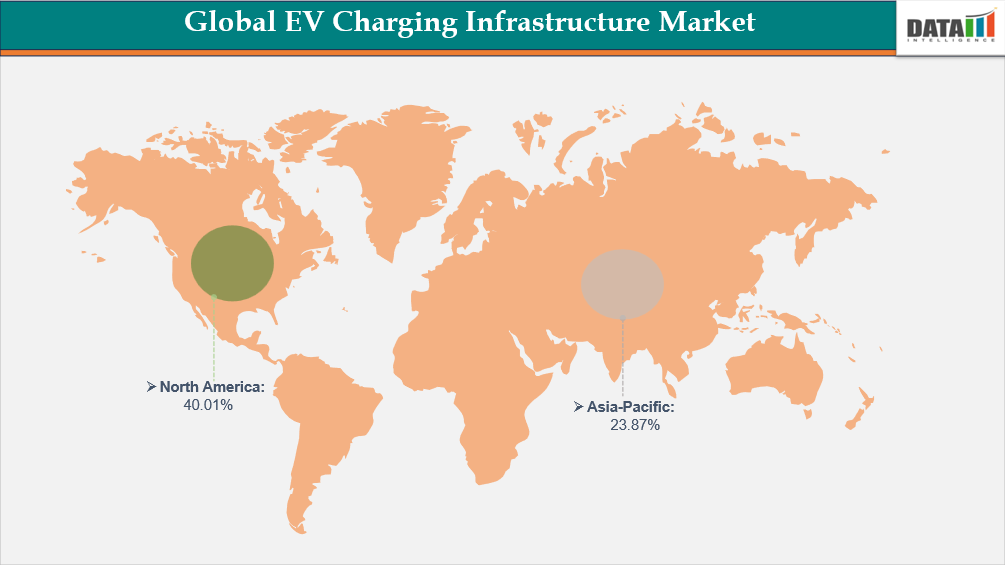

- North America leads the global EV charging infrastructure market, capturing the largest revenue share of 40.01% in 2024.

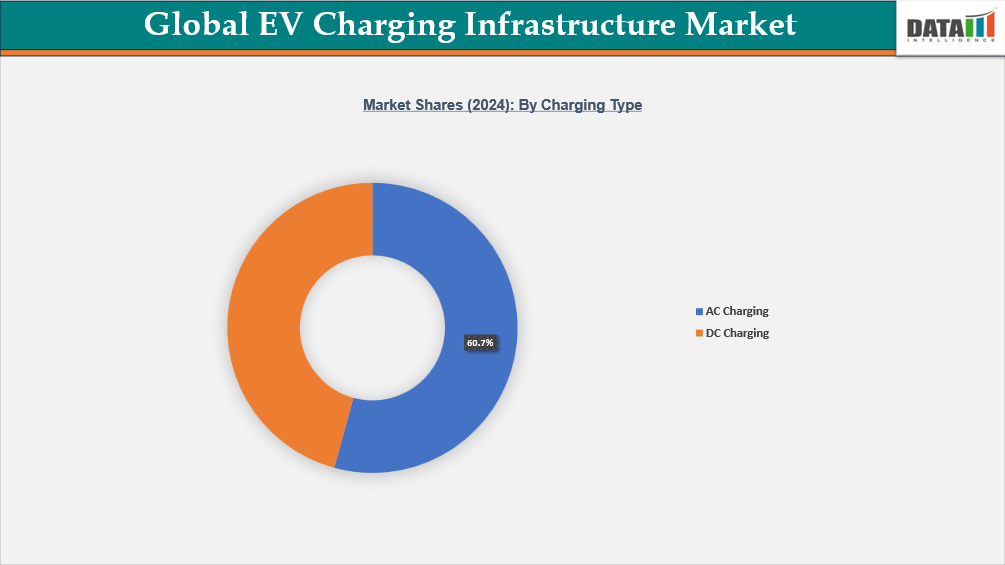

- By charging type segment, AC charging leads the global EV charging infrastructure market, capturing the largest revenue share of 60.7% in 2024.

Global EV Charging Infrastructure Market Size and Future Outlook

- 2024 Market Size: US$30,128.24 million

- 2032 Projected Market Size: US$204,923.33 million

- CAGR (2025–2032): 27.08%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Charger Type | Slow Charger, Fast Charger |

| By Charging Type | ACs, DC |

| By Connector Type | CHAdeMO, CCS, Others |

| By Connectivity | Non-connected Charging Stations, Connected Charging Stations |

| By End-User | Commercial, Residential |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Grid-Interactive Charging & Utility Monetization Opportunities

Grid-interactive charging is rapidly emerging as one of the strongest drivers shaping the EV charging infrastructure market, as utilities and charge point operators increasingly recognize the economic value of bidirectional energy flow, demand-response participation, and dynamic grid balancing. As EV adoption accelerates, surpassing 25 million EVs globally on the road by 2025, the cumulative storage potential of EV batteries represents a massive distributed energy resource. Utilities are leveraging this through vehicle-to-grid (V2G) and vehicle-to-home (V2H) programs, enabling EVs to supply power back to the grid during peak demand. Early pilot programs in Europe and the US show that V2G-enabled EVs can earn US$400–US$1,000 per vehicle annually for providing grid services, creating new revenue streams for both fleet operators and utilities.

At the grid level, the rising penetration of renewable energy, now contributing over 30% of total electricity in several advanced markets, increases the need for flexible storage to stabilize intermittency. Smart, grid-interactive chargers help utilities smooth load curves through time-of-use pricing, automated charging scheduling, and peak shaving. The economic impact is significant: utility-managed smart charging can reduce grid upgrade costs by 20–30%, while optimized charging can lower system-wide peak demand by 5–15%. As charging networks scale, monetization opportunities in energy trading, frequency regulation, and demand-response markets are making grid-interactive charging a critical growth engine for the global EV charging infrastructure market.

Segmentation Analysis

The global EV charging infrastructure market is segmented based on charger type, charging type, connector type, connectivity, end-user, and region.

AC Charging Leads Demand in the Global EV Charging Infrastructure Market

The global EV charging infrastructure market sees AC chargers as the dominant and most widely adopted segment, primarily due to their lower installation cost, compatibility with home charging, and suitability for regular daily commuting patterns. Across major EV-adopting regions, more than 70% of EV owners rely on home or workplace charging, both of which are primarily AC-based. The increasing availability of Level 2 AC chargers in residential complexes, corporate parking facilities, and public destinations has further solidified this segment’s leadership. Rising adoption of personal EVs and the expansion of affordable home-charger incentive programs continue to reinforce AC charging as the backbone of everyday EV charging behaviour. As more consumers prefer overnight charging convenience, the demand for AC infrastructure remains strong and structurally stable worldwide.

DC Fast Charging Emerges as the Fastest-Growing Segment

DC fast charging is experiencing the fastest growth in the market, driven by surging demand for rapid, long-distance, and fleet-based charging solutions. The global number of DC fast chargers has been rising at a significantly higher annual rate as governments prioritize highway electrification and minimum charging standards for intercity travel. Increasing deployment of fast chargers capable of delivering 50 kW to 350 kW is transforming public networks by reducing charging time from hours to minutes, making EV adoption more practical for high-mileage users. Fleet operators, especially logistics, ride-hailing, and last-mile delivery companies, are accelerating investments in DC fast-charging hubs to maintain operational uptime. As EV penetration deepens and consumer expectation shifts toward quicker charging experiences, the DC segment is expanding rapidly and is set to become the primary driver of future charging infrastructure growth.

Geographical Penetration

DOMINATING MARKET:

North America Leads Dominance in the Market

North America remains the largest EV charging infrastructure market, driven by rapid EV adoption, strong government incentives, and large-scale investments from utilities and private charging networks. The region benefits from a mature EV ecosystem, with the US home to over 180,000 public charging points as of 2025, supported by federal programs such as the National Electric Vehicle Infrastructure (NEVI) initiative allocating $5 billion for interstate DC fast-charging corridors. High consumer readiness, robust grid capacity, and strong presence of leading charging operators, ranging from Tesla and ChargePoint to EVgo and Electrify America, reinforce market strength. Extensive support from state governments, rising installation of home chargers, and accelerated deployment of fast and ultra-fast chargers position North America as the global leader in EV charging infrastructure.

US EV Charging Infrastructure Market Trends

The US continues to dominate the regional market, propelled by strong federal and state policies, increasing EV sales, and rising corporate fleet electrification. The country recorded over 1.4 million EV sales in 2024, pushing demand for both public and private charging solutions. Significant investments from utilities and oil & gas companies are expanding nationwide charging networks, while NEVI-funded stations begin rolling out across major highways. Growing emphasis on renewable-powered charging, interoperability mandates, and smart-charging technologies is shaping a highly advanced, scalable infrastructure. The expansion of Tesla’s NACS connector adoption by major automakers is further accelerating network standardization across the US

Canada EV Charging Infrastructure Market Outlook

Canada is emerging as a fast-growing EV charging market, supported by aggressive electrification policies and consumer incentives. With EV penetration crossing 12% of new vehicle sales in 2024, demand for reliable charging networks has surged nationwide. The Canadian government continues to invest through programs such as ZEVIP, which targets more than 85,000 chargers by 2027, including large-scale deployment of DC fast chargers along inter-provincial highways. Cold-climate charging research, renewable-energy-powered stations, and provincial mandates, particularly in British Columbia and Quebec, are accelerating infrastructure growth. Despite periodic fluctuations in vehicle sales due to subsidy adjustments, Canada’s long-term commitment to electrification and clean mobility keeps its EV charging market on a robust upward trajectory.

FASTEST GROWING MARKET:

Asia-Pacific Emerges as the Fastest-Growing Region Driven by EV Expansion and Large-Scale Charging Investments

The global EV charging infrastructure market is witnessing accelerated growth, with Asia-Pacific emerging as the fastest-growing region. This momentum is driven by the rapid electrification of transportation, government-backed incentives for public and private charging deployment, and massive investments in fast and ultra-fast charging networks. Countries across the region are upgrading grid capacity, adopting renewable-energy-based chargers, and implementing smart charging systems integrated with real-time analytics. With rising EV penetration, large-scale funding from both governments and private operators, and the shift toward interoperable charging networks, the Asia-Pacific is solidifying its position as a global hub for charging innovation and infrastructure expansion.

India EV Charging Infrastructure Market Trends

India is experiencing a sharp rise in EV charging deployment, supported by national programs such as FAME-II, state-level EV policies, and growing adoption of electric two-wheelers, three-wheelers, and commercial fleets. The country is seeing rapid installation of public fast chargers along highways and urban centers, driven by partnerships between power utilities, oil marketing companies, and private charging operators. Increasing corporate fleet electrification and e-mobility services are further boosting demand for smart, affordable charging solutions. With ongoing investments in grid modernization and renewable-powered charging stations, India is emerging as one of the most dynamic EV charging markets in Asia-Pacific.

China EV Charging Infrastructure Market Outlook

China remains the dominant force in the regional EV charging landscape, supported by the world’s largest EV market, extensive government incentives, and continuous investment in fast-charging corridors and urban charging hubs. Despite a short-term slowdown, China’s passenger car market recorded a 0.8% decline to 2.27 million units in October 2024 due to reduced subsidies and tax incentives, the country continues to expand its nationwide charging network aggressively. Investments in ultra-fast DC chargers, battery-swapping infrastructure, and renewable-integrated charging stations highlight China’s commitment to large-scale electrification. With strong policy backing, innovation in smart charging technologies, and rapid EV adoption, China reinforces its leadership position in global EV charging infrastructure development.

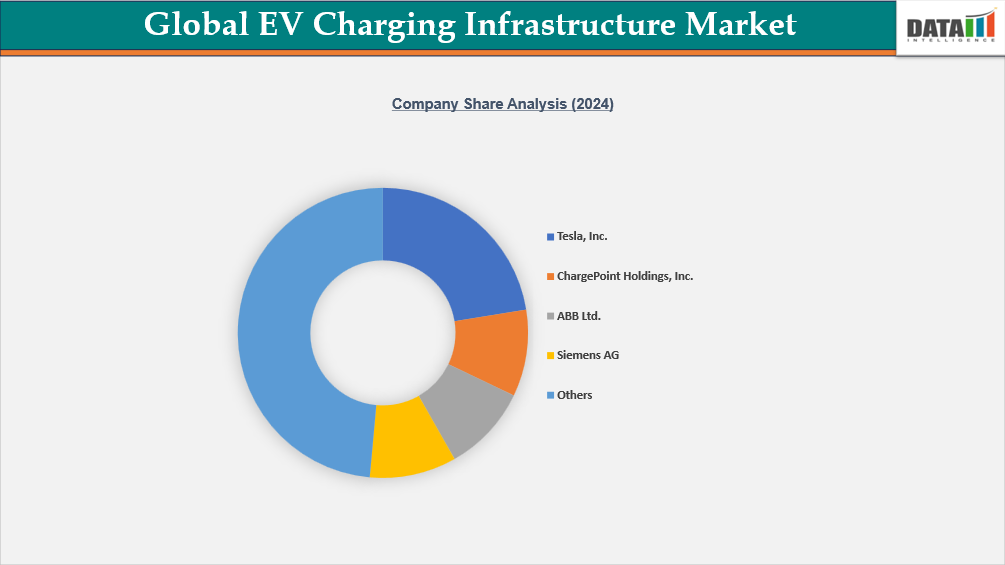

Competitive Landscape

- The global EV charging infrastructure market is highly competitive, characterized by a strong presence of multinational corporations alongside rapidly growing regional operators. Leading companies such as ABB Ltd, ChargePoint Holdings, Inc., Tesla, Inc., Siemens AG, Schneider Electric SE, EVgo Services LLC, Blink Charging Co., IONITY GmbH, and Alfen N.V. maintain market leadership through advanced charging technologies, high-power DC fast-charging solutions, and continuous investments in renewable integration, smart charging software, and R&D.

- Many players are expanding their geographic footprint through strategic partnerships with utilities, automakers, fleet operators, and commercial property developers. These collaborations are enabling large-scale deployment of charging hubs, interoperability across networks, improved payment systems, and seamless integration of energy management and vehicle-to-grid (V2G) capabilities, supporting accelerated global EV adoption.

- Market competition is driven by growing demand for fast-charging infrastructure, the rise of electric fleets, and policy incentives supporting electrification across major economies. Leadership in the EV charging sector increasingly depends on grid-interactive technologies, operational reliability, charging speed differentiation, and cost-efficient infrastructure deployment, all of which shape long-term growth and competitive positioning within the global EV charging infrastructure market.

Investment & Funding Landscape

IONITY GmbH has emerged as one of Europe’s most capital-intensive EV charging networks, backed by strong automotive consortium support. In 2025, the company secured up to €600 million in record financing, marking one of the largest single funding events in the public fast-charging space. This investment is directed toward accelerating the rollout of high-power charging (HPC) sites across Europe, enabling the company to scale its network to thousands of stations through 2030. The financing reflects strategic confidence in IONITY’s cross-border ultra-fast charging model, which is critical for long-distance EV travel across the European Union. The new capital infusion also positions IONITY to compete more aggressively with oil-major-backed networks and state-subsidized charging programs across the region.

Blink Charging has relied on consistent capital injections to expand its charging footprint and strengthen its hardware and software portfolio. Between late 2023 and early 2024, Blink raised approximately $113 million through at-the-market (ATM) equity programs, a cost-efficient route that allowed the company to access public markets without traditional underwriting. In addition to this recent capital raising, Blink also benefits from earlier historical funding rounds, grants, and partnerships that support its global expansion strategy. These financing activities strengthen Blink’s ability to scale its Level 2 and DC fast-charging solutions, enhance manufacturing capacity in the United States, and grow its vertically integrated model, which spans equipment, software, and charging services. The company’s reliance on public-market mechanisms highlights investor confidence as well as the capital-intensive nature of EV charging build-out.

| Company | Investment/Funding | Year | Details | |

| IONITY GmbH | Up to €600 (US$689) million (record financing) | 2025 | IONITY secured financing (up to €600M) to expand its ultra-fast charging network across Europe and scale to thousands of sites through 2030. | |

| Blink Charging Co. | $113 million (ATM equity raises) + historical funding rounds | 2023-2024 | Blink conducted cost-effective ATM equity raises (gross proceeds ~$113M between Nov 2023–Feb 2024) and has raised earlier funding across rounds and grants to support growth. | |

Key Developments

- In November 2025, ChargeZone launched Project E-DHARA, a major initiative aimed at powering its entire EV charging network with 100% renewable energy. The company, which operates more than 13,500 charging points across India and the UAE, will begin the transition by commissioning its first renewable-powered hub in Dahej, Gujarat, in 2025. The project tackles India’s dependence on fossil fuel–based electricity, with nearly 75% of national power generation still coming from coal and other conventional sources. By integrating solar generation, battery storage, and high-speed chargers, Project E-DHARA aims to establish 100 renewable-powered highway hubs by 2026, accelerating the decarbonization of electric mobility.

What Sets This Global EV Charging Infrastructure Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by charger type, charging type, connector, connectivity, end-user, and region segments. Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect vehicle analytics commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.