Europe Inhalation Therapy Nebulizer Market – Industry Trends & Outlook

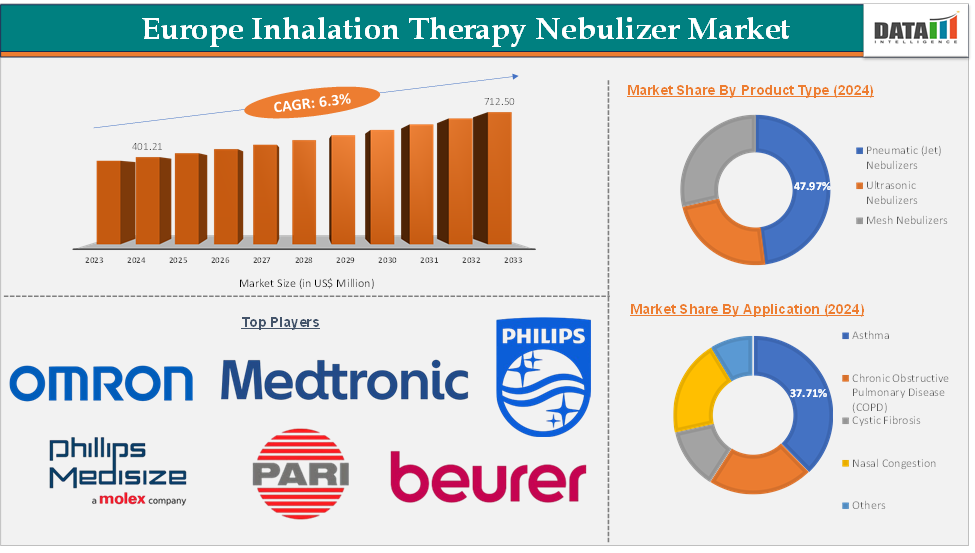

The Europe inhalation therapy nebulizer market was valued at US$ 377.40 Million in 2023 and the market size reached US$ 401.21 Million in 2024 and is expected to reach US$ 712.50 Million by 2033, growing at a CAGR of 6.3% during the forecast period 2025-2033.

The Europe inhalation therapy nebulizer market consists of medical devices, nebulizers that convert liquid medication into a fine mist, allowing patients to inhale drugs directly into the lungs. The most significant driver is the increasing prevalence of respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), cystic fibrosis, and emphysema. Another key driver is the region’s aging population, as longer life expectancy and a rising number of elderly individuals who are more susceptible to chronic respiratory conditions boost demand for nebulizers, particularly those designed for home care use.

Manufacturers are investing in the development of smart and portable nebulizers, including devices compatible with smartphone applications, which enhance patient convenience and adherence to treatment regimens. The trend towards home healthcare is gaining momentum, with patients and caregivers preferring home-based nebulization due to its comfort and the increasing availability of user-friendly, wearable devices.

Europe Inhalation Therapy Nebulizer Market – Executive Summary

Europe Inhalation Therapy Nebulizer Market Dynamics: Drivers

Rising prevalence of chronic respiratory diseases

The rising prevalence of chronic respiratory diseases in Europe is a major growth driver for the inhalation therapy nebulizer market. Conditions like Chronic Obstructive Pulmonary Disease (COPD), asthma, and cystic fibrosis require effective management through inhalation therapies, which nebulizers facilitate by delivering medication directly to the lungs.

The European Respiratory Society projected that by 2050, 49,453,852 people will have COPD (prevalence = 9.3%), which represents a 35.2% relative increase in patients and a 39.6% increase in prevalence. These chronic conditions require daily or frequent administration of bronchodilators and corticosteroid treatments commonly delivered through nebulizers, especially for elderly, pediatric, or severe patients who cannot properly use inhalers.

Severe or uncontrolled asthma and late-stage COPD, where handheld inhalers are less effective. Children under 5 years, for whom nebulizers are often the preferred mode of medication delivery due to ease of use and low inspiratory flow requirements.

Technological advancements and the adoption of smart nebulizers

Technological advancements and the adoption of smart nebulizers are significant drivers of growth in the Europe inhalation therapy nebulizer market. Manufacturers have increasingly focused on developing innovative nebulizer devices that incorporate digital technologies, such as connectivity with smartphones and cloud-based platforms, to enhance both clinical outcomes and user experience.

Smart nebulizers can monitor medication usage, provide reminders, and deliver real-time data to healthcare providers, which helps improve patient adherence and enables more personalized disease management. These advancements are particularly valuable for patients managing chronic respiratory diseases at home, as they support better treatment compliance and allow for remote monitoring by clinicians. Technological innovation is not only enhancing the functionality and convenience of nebulizers but is also expanding their role in integrated digital health ecosystems, positioning smart nebulizers as a key growth segment in the European market.

Europe Inhalation Therapy Nebulizer Market Dynamics: Restraints

Competition from alternative inhalation devices

Patient compliance and usability issues are significant restraints hampering the growth of the Europe inhalation therapy nebulizer market. Nebulizers typically require longer treatment times (often 10-15 minutes per session) compared to inhalers, and patients must perform several steps, including device assembly, medication loading, and cleaning. This complexity leads to lower adherence, especially among busy adults and children.

Proper cleaning is critical to prevent infections and device malfunction, but many patients find the cleaning process cumbersome and time-consuming. Studies indicate up to 50% of nebulizer users in Europe do not follow recommended cleaning protocols, increasing the risk of respiratory infections and reducing therapeutic effectiveness. Together, these usability hurdles, lack of training, complex cleaning routines, and lengthy treatment times erode patient compliance, thereby dampening market growth for inhalation therapy nebulizers in Europe.

Europe Inhalation Therapy Nebulizer Market Dynamics: Opportunities

Integration of artificial intelligence (AI) and IoT technologies

The integration of artificial intelligence (AI) and internet of things (IoT) technologies presents significant opportunities for the Europe inhalation therapy nebulizer market. By embedding AI and IoT capabilities into nebulizer devices, manufacturers can enable real-time monitoring of patient data, medication usage, and device performance.

These smart nebulizers can collect and transmit health metrics to healthcare providers, allowing for continuous remote monitoring, timely interventions, and more personalized treatment adjustments. AI algorithms can analyze large volumes of data generated by IoT-enabled nebulizers, identifying patterns in patient adherence, predicting exacerbations, and providing actionable insights that improve disease management and clinical outcomes.

With European enterprises and healthcare systems increasingly adopting IoT solutions, and with strong growth projected in the AI-in-IoT sector, the market is well-positioned to capitalize on these innovations, driving the next wave of growth and differentiation in inhalation therapy solutions.

For more details on this report, Request for Sample

Europe Inhalation Therapy Nebulizer Market - Segment Analysis

The Europe inhalation therapy nebulizer market is segmented based on product type, application, and end-user.

Product Type:

The pneumatic (jet) nebulizer product type segment is expected to hold 47.9% of the Europe inhalation therapy nebulizer market in 2024

Jet nebulizers have been the standard treatment delivery devices for respiratory diseases like COPD and asthma for decades across Europe. Hospitals and clinics rely on them for their consistent performance in delivering a broad range of medications (bronchodilators, corticosteroids, antibiotics).

Compared to newer technologies like mesh or ultrasonic nebulizers, pneumatic nebulizers are more affordable to produce and purchase. This makes them preferred in both public healthcare settings and by patients who pay out-of-pocket, especially in Eastern and Southern Europe, where healthcare budgets are more constrained.

Many European patients transitioning to home care rely on jet nebulizers due to their reliability and affordability. For instance, in France and Germany, home respiratory therapy programs predominantly provide jet nebulizers for chronic respiratory disease management.

Because of their clinical reliability, cost advantage, drug compatibility, and ease of maintenance, pneumatic (jet) nebulizers continue to dominate the European inhalation therapy nebulizer market, especially in hospital and homecare sectors. Although newer technologies are emerging, jet nebulizers remain the backbone of respiratory treatment across Europe.

Application:

The asthma application segment is expected to hold 37.7% of the Europe inhalation therapy nebulizer market in 2024

The asthma application segment is a major and growing component of the Europe inhalation therapy nebulizer market. Nebulizers are widely used for asthma management because they efficiently deliver liquid medication as a mist, which patients inhale directly into their lungs, providing quick relief during acute attacks and effective control for chronic symptoms.

The high prevalence and significant proportion of moderate-to-severe cases drive demand for nebulizers in both clinical and home care settings. In the UK, where asthma rates are the highest in the 5EU, the need for effective inhalation therapies is especially acute. This creates a substantial and sustained market for nebulizer devices, encouraging manufacturers to innovate and expand their offerings to meet the diverse needs of asthma patients.

According to the National Center for Biotechnology Information (NCBI) research publication in May 2025, the reported prevalence of asthma in the five largest European Union countries (5EU) France, Germany, Italy, Spain, and the United Kingdom was 6.7%, with the UK exhibiting the highest national rate at 10.4%. This means that, on average, nearly 7 out of every 100 people in these countries are living with asthma, and in the UK, the figure is even higher at more than 10 out of every 100. These statistics highlight the significant burden of asthma across Europe and underscore the importance of effective management strategies.

Breaking down the severity of asthma among respondents, about 52% were classified as having mild asthma, 27.9% had moderate asthma, and 20.1% suffered from severe asthma. This distribution is crucial for the inhalation therapy nebulizer market, as patients with moderate and severe asthma are more likely to require advanced and reliable drug delivery systems such as nebulizers for both daily management and acute exacerbations. Severe asthma, in particular, often necessitates frequent and precise medication delivery, which nebulizers are well-equipped to provide, especially for those who struggle with traditional inhalers.

Europe Inhalation Therapy Nebulizer Market – Competitive Landscape

The major players in the Europe inhalation therapy nebulizer market include OMRON Healthcare, Medtronic, Koninklijke Philips N.V., Flexicare (Group) Limited, Beurer GmbH, Phillips Medisize, Medbryt, PARI GmbH, Aerogen Ltd., and Drive DeVilbiss Healthcare, among others.

Europe Inhalation Therapy Nebulizer Market – Scope

Metrics | Details | |

CAGR | 6.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Pneumatic (Jet) Nebulizers, Ultrasonic Nebulizers, Mesh Nebulizers |

Application | Asthma, Chronic Obstructive Pulmonary Disease (COPD), Cystic Fibrosis, Nasal Congestion, Others | |

End-User | Hospitals, Specialty Clinics, Ambulatory Care Centers, Home Healthcare, Others | |

The Europe inhalation therapy nebulizer market report delivers a detailed analysis with 39 key tables, more than 30 visually impactful figures, and 156 pages of expert insights, providing a complete view of the market landscape.