Equipment as a Service Market Overview

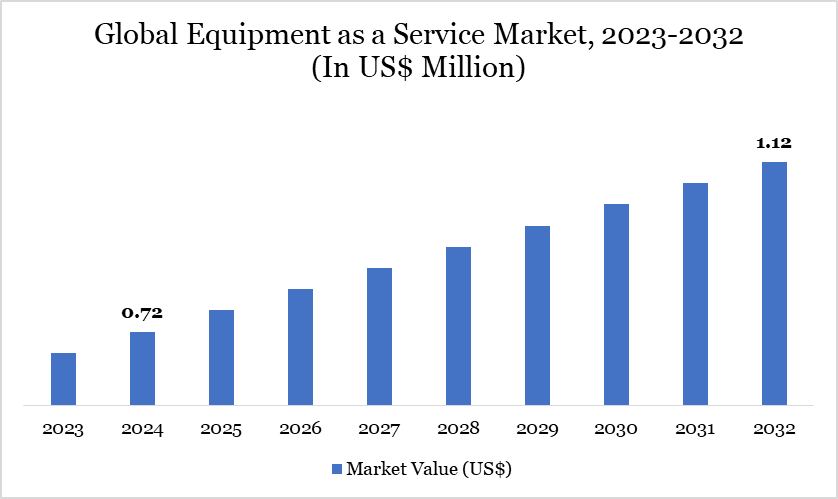

Equipment as a Service Market reached US$ 0.72 billion in 2024 and is expected to reach US$ 1.12 billion by 2032, growing with a CAGR of 5.75% during the forecast period 2025-2032.

The global Equipment as a Service (EaaS) market is now experiencing significant growth as numerous sectors embrace equipment utilization via a subscription model. The demand for cheaper alternatives, smaller capital investments and improved operating skills are the primary driving forces for this transition.

Equipment as a service allows a corporation to use equipment without having to worry about the high expenses involved with original purchase; also, the model assures that maintenance, upgrades and support are all included. The approach is frequently employed in industries such as manufacturing, construction, healthcare, transportation and many others, which have consequences for great and easily accessible equipment.

Equipment as a Service Market Trend

One notable trend in the global Equipment as a Service (EaaS) market is the growing integration of modern technologies such as the Internet of Things (IoT), artificial intelligence (AI) and cloud computing. The technologies enable real-time monitoring, predictive maintenance and equipment performance optimization, which improves operational efficiency and reduces downtime.

For example, in China, the "Made in China 2025" policy aims to improve industries and digitization, making it easier to provide innovative infrastructural services in the manufacturing sector. India, on the other hand, has seen extensive equipment come up due to programs such as "Make in India" and "Industry 4.0" creating a demand for advanced equipment, making the country one of the region's significant players in the equipment as a service market.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Equipment | Air Compressor, Pump, Power Tools, Ground Power Units, Laser Cutting Machines, Printing Machines, CNC machines, Material handling system, Packaging Machine, Excavators, Cranes, Others |

| By Application | Construction & Mining, Manufacturing, Packaging, Material Handling, Others |

| By Financing | Subscription-Based, Outcome-Based |

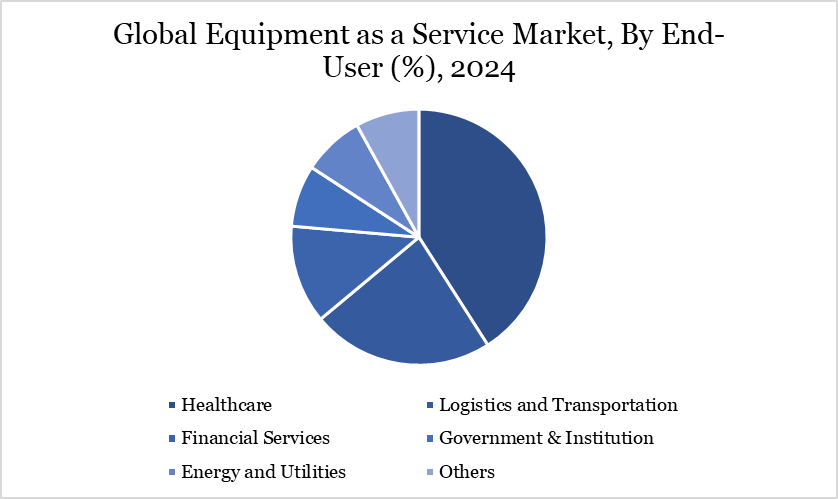

| By End-User | Healthcare, Logistics and Transportation, Financial Services, Government & Institution, Energy and Utilities, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Equipment as a Service Market Dynamics

Growing Government Support and Regulations

Government policy and promotion are also critical to the expansion of the Equipment as a Service sector. In Europe, the European Commission wants to support the green agenda by encouraging the use of clean and energy-efficient machines, hence promoting equipment as a service concept. The European Union has set a target of a 55% reduction in carbon emissions by 2030 compared to 1990, which helps to encourage companies to purchase equipment that meets these aims.

It is particularly visible in countries like the US, where government organizations such as the Environmental Protection Agency EPA and the Department of Energy DOE provided incentives for energy-efficient solutions adopted by enterprises, thus the shift towards equipment-as-a-service models.

Renewable energy sources are expected to reach 11,000 GW by 2030, according to IRENA's 1.5°C Scenario in the World Energy Transitions Outlook and the worldwide renewable power generation capacity will need to triple from its current levels. If the increase predictions for newer energy sources such as solar photovoltaic PV and wind account for over 90% of the planned renewable energy capacity expansions. The programs encourage more enterprises to switch to as-a-service models, where equipment management is done more effectively.

Challenges in Workforce Readiness

As the industry prepares to include remote operations and IoT-driven assets, the labor market continues to see significant disruptions and changes, with manufacturing accounting for the majority of enclosed areas. According to the the Bureau of Labor Statistics overall employment is predicted to expand by 2.8 percent, from 164.5 million in 2022 to 169.1 million in 2032.

Such developments are attributed to the industry's desire and requirements for more complex and advanced systems, resulting in the need for a skilled and efficient workforce capable of operating such equipment, as this demand is fueled by technological advancements and the incorporation of IoT into operational processes. The EaaS market, which encompasses these technologies, is susceptible to legislative restraints that hinder its development.

Equipment as a Service Market Segment Analysis

The global equipment as a service market is segmented based on equipment, application, financing, end-user and region.

Rising Healthcare Expenditure Drive the Segment Growth

Most women and young people consider equipment as a service to be a solution in industries such as healthcare, manufacturing and construction. Medical equipment such as imaging machines and diagnostic tools are leased rather than purchased. The move allows healthcare providers to keep up with technology with minimal capital expenditure. In accordance to the National Institute of Health, the healthcare expenditure in the US for the year 2022 registered 4.1 percent rise to stand at US$ 4.5 trillion, thereby making equipment as a service lucrative in terms of control costs.

In the industry, equipment renting under Equipment as a service is popular for industrial devices such as robotics, CNC machines and 3D printers because it helps businesses to stay competitive in a rapidly changing market. The International Federation of Robotics (IFR) notes in its research that in the year 2023 alone, over 500,000 industrial robots were provided to the market, supporting the argument of the desire for technology-based, more adaptable solutions.

Equipment as a Service Market Geographical Share

Rising Digitalization in Various Industries in North America

North America dominates the Equipment as a Service market due to increased digital technology usage, thriving industries and government support. US has the highest proportion of the Equipment as a Service market, with more enterprises in the manufacturing, healthcare and construction sectors using rented equipment. According to the National Association of Manufacturers (NAM), manufacturing output in US expanded by 3.5% in 2023, confirming the sector's expansion and the rise of equipment as a service to improve operational efficiencies.

The equipment as a service market benefits from higher energy efficiency and sustainability requirements imposed by the region's regulatory authorities. The region is also predicted to rank among the most rapidly rising markets for equipment as a service, owing to the increase in manufacturing infrastructure and faster expansion of technology usage, further boosting the need for more flexible and cheaper ways of using equipment.

Sustainability Analysis

The market has shifted toward more sustainable operational techniques as energy efficiency and environmental friendliness have become increasingly important. This shift in business approach to Equipment as a Service models reduces the need for large-scale manufacturing, lowering the emissions associated with equipment manufacture and disposal. When purchasing equipment is replaced by a leasing policy, enterprises are motivated to select the most efficient model since service providers provide maintenance and replacement of outdated models with new ones.

Enterprises are increasingly looking for ways to incorporate energy-efficient and environmentally friendly equipment into their operations. The transition to as-a-service models reduces the number of mass-scale operations such as manufacturing, hence reducing carbon emissions from factors such as equipment fabrication and waste disposal. On the other hand, because the equipment is available to the companies on a rental basis, the firms are driven to go for the most recent and efficient versions because the equipment is always serviced and updated by the service provider.

Equipment as a Service Market Major Players

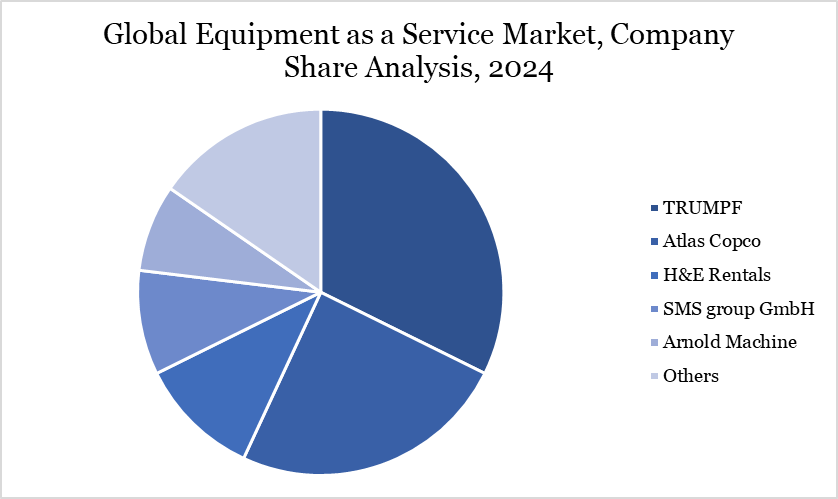

The major global players in the market include TRUMPF, Atlas Copco, H&E Rentals, SMS group GmbH, Arnold Machine, AB Volvo, Heller Maschinenfabrik GmbH, DMG MORI, Metso Outotec and KAESER KOMPRESSOREN.

Key Developments

In October 2024, H&E Rentals inaugurated its Kansas City South location, which specializes on rental services for aerial lifts, earthmoving equipment, forklifts, telehandlers, compaction equipment, generators, light towers and compressors.

In May 2024, TAQA revealed Threlix Drilling Technology's drilling tool to improve these operations by reducing some of the drilling dysfunctions, such as vibrations and torsional oscillation, that limit Rotary Steerable Systems for oil and gas operators.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies