Global EPC Consulting Market: Industry Outlook

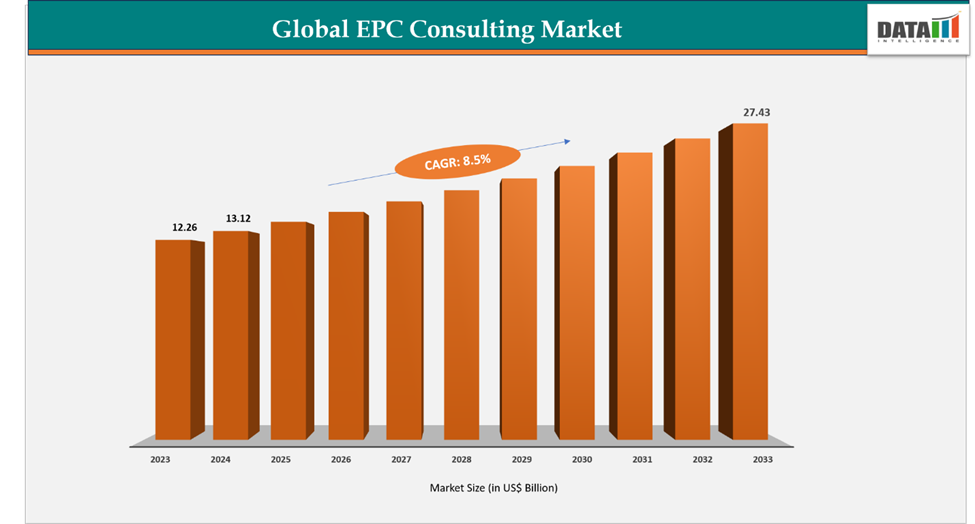

The global EPC consulting market reached US$ 12.26 billion in 2023, with a rise to US$ 13.12 billion in 2024, and is expected to reach US$ 27.43 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033. The global EPC consulting market is expanding steadily, driven by increasing demand across energy, infrastructure, and industrial projects. EPC consulting services are becoming vital for project planning, execution, and management, ensuring efficiency, cost optimization, and compliance with technical standards. Growth is further supported by technological advancements in digital project management, Building Information Modeling (BIM), AI-based process optimization, and sustainable construction practices, alongside rising investments in large-scale industrial and infrastructure projects. Industry dynamics are also being reshaped by strategic collaborations, public-private partnerships, and long-term contracts between governments, EPC contractors, and consulting firms.

US leads the EPC consulting market with strong demand from energy, infrastructure, and industrial projects. Federal and state-level initiatives for energy modernization, highway expansions, and industrial upgrades are driving the adoption of EPC consulting services. For instance, Sempra Infrastructure announced that Port Arthur LNG Phase 2 and Bechtel Energy signed a fixed-price EPC contract for the Port Arthur LNG Phase 2 project in Port Arthur, Texas, highlighting the ongoing large-scale energy infrastructure developments in the country. Supported by robust R&D capabilities, advanced engineering practices, and extensive project budgets, the US remains at the forefront of market growth.

Japan is also emerging as a significant player, strengthening its energy infrastructure and industrial capabilities through procurement of advanced consulting services. In 2024, Toshiba Energy Systems & Solutions partnered with EPC consulting firms to execute a smart energy project integrating renewable power plants and industrial facilities. Japan’s focus on infrastructure modernization and industrial efficiency, coupled with collaborations with global EPC consultants, is expected to accelerate the adoption of EPC consulting services across critical sectors.

Key Market Trends & Insights

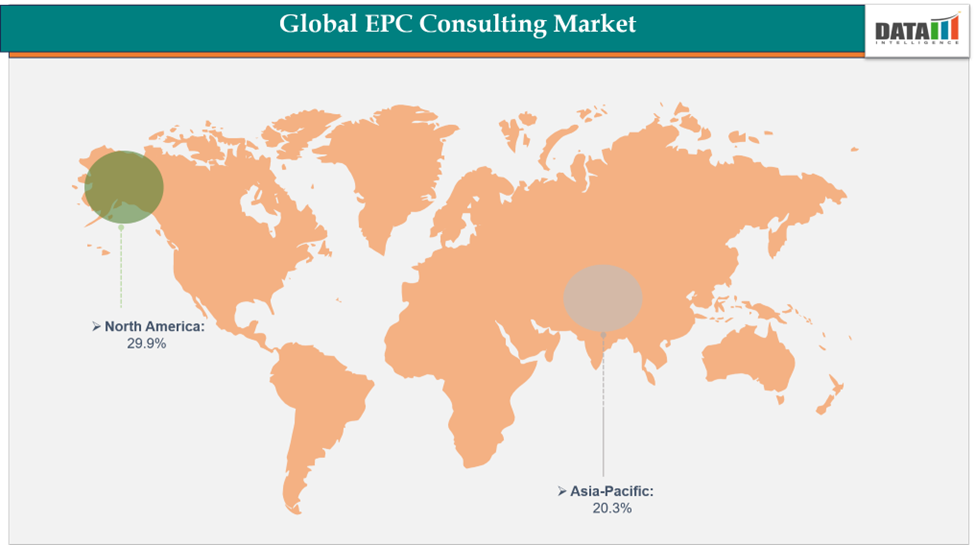

- North America held approximately 29.9% of the global EPC consulting market in 2024 and is expected to maintain its leading position throughout the forecast period. This dominance is driven by substantial investments in energy, infrastructure, and industrial modernization, as well as growing demand for comprehensive project execution and management services. The region’s strong R&D capabilities, advanced engineering expertise, and significant project budgets further strengthen its market leadership.

- Asia-Pacific is expected to be the fastest-growing region, fueled by increasing investments in energy infrastructure, industrial development, and smart construction projects. Rapid economic growth and expanding demand for professional EPC consulting services across emerging markets continue to drive regional adoption.

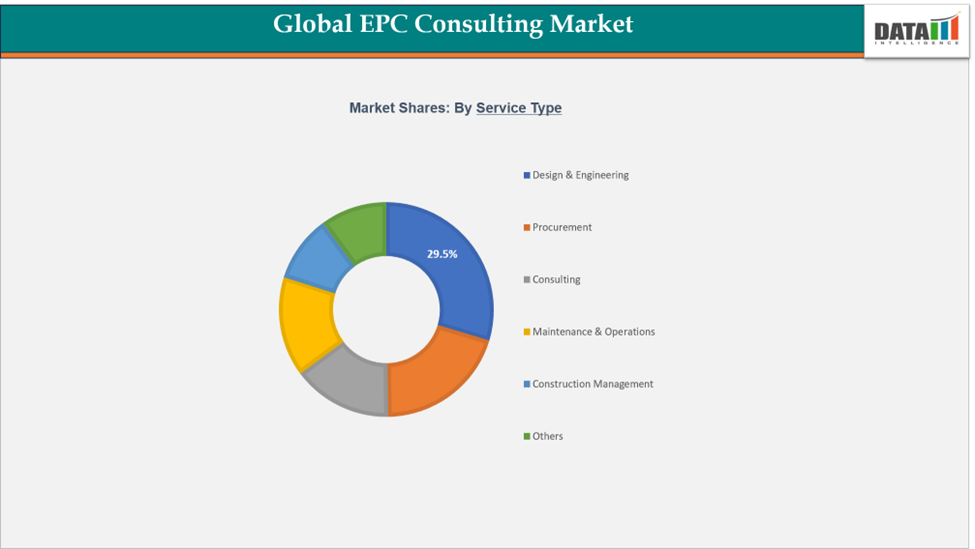

- The design & engineering consulting segment continues to be the largest service category, playing a crucial role in project planning, design, feasibility studies, and optimization of industrial, energy, and infrastructure projects. Its widespread adoption across both public and private sectors highlights its importance in enhancing efficiency, reducing costs, and integrating advanced technologies, ensuring the successful delivery of next-generation EPC projects.

Market Size & Forecast

- 2024 Market Size: US$ 13.12 Billion

- 2033 Projected Market Size: US$ 27.43 Billion

- CAGR (2025–2033): 8.5%

- North America: Largest market in 2024

- Asia-Pacific: Fastest-growing market

Market Dynamics

Driver: Rising Infrastructure Investments

The global EPC consulting market is growing steadily, supported by significant investments in large-scale energy and infrastructure projects. EPC consultants are increasingly relied upon for strategic planning, execution oversight, and risk management in complex developments such as LNG facilities, renewable energy projects, transportation systems, and industrial upgrades. This rising demand reflects the need for expertise that can ensure projects are delivered on time, within budget, and in compliance with regulations.

For instance, NextDecade Corporation (NASDAQ: NEXT) confirmed that its subsidiary, Rio Grande LNG Train 4, LLC, signed a lump-sum turnkey EPC contract with Bechtel Energy Inc. to build Train 4 and supporting infrastructure at the Rio Grande LNG Facility. This project illustrates how infrastructure investments are driving the uptake of EPC consulting services, particularly in the energy and industrial sectors.

Restraint: High Project Complexity

While demand is rising, the EPC consulting market is often challenged by the complexities of executing large-scale projects. Issues such as land acquisition delays, regulatory compliance hurdles, financing difficulties, and the integration of new technologies can extend timelines and raise costs. These challenges impact profitability and create barriers for smaller firms aiming to compete in large projects.

According to Ernst & Young, India’s EPC sector faces persistent obstacles such as delays in land acquisition, regulatory bottlenecks, and difficulties in securing working capital funds. These reflect global issues where scale and complexity continue to test industry resilience. However, the adoption of digital project management platforms, modular construction techniques, and collaborative delivery models is helping to balance these challenges by improving efficiency and reducing risks.

For more details on this report, Request for Sample

Segmentation Analysis

The global EPC consulting market is segmented based on service type, end-user and region.

Service Type

The design & engineering segment represents an estimated 29.5% of the global EPC consulting market and serves as the foundation for successful project execution. This segment covers conceptual design, feasibility analysis, detailed engineering, and optimization, ensuring that infrastructure and energy projects are technically sound and compliant with performance standards. It plays a particularly critical role in renewable energy, oil & gas, and industrial modernization projects.

Recently, Gensol Engineering secured an EPC contract from NTPC Renewable Energy to deliver a solar PV project valued at US$ 10.17 billion . Following this announcement, Gensol Engineering’s shares rose by 9% to US$ 8.83 billion on the BSE, demonstrating the market impact and financial significance of design & engineering services.

Looking forward, the design & engineering segment is expected to maintain its leadership position, supported by growing investments in renewable energy, stricter environmental regulations, and the adoption of advanced digital design tools.

Geographical Analysis

The North America EPC consulting market was valued at 29.9% market share in 2024

The North America EPC consulting market accounted for 29.9% of the global share in 2024 and continues to be the largest regional contributor. Growth in the region is supported by major investments in energy, infrastructure, and industrial projects, alongside the rising need for specialized project management, design, and execution services. The United States dominates the market, driven by strong demand in LNG facilities, renewable energy, advanced manufacturing, and technology-driven infrastructure.

For instance, Bechtel, a global leader in engineering, construction, and project management, announced the formation of its new Manufacturing and Technology business to address growing demand for EPC services in the semiconductor, electric vehicle, synthetic materials, and data center sectors. Such developments highlight North America’s leadership in delivering next-generation EPC consulting solutions.

The Asia-Pacific EPC consulting market was valued at 20.3% market share in 2024

The Asia-Pacific EPC consulting market held 20.3% of the global share in 2024 and is expected to be the fastest-growing region over the forecast period. Regional growth is driven by rapid infrastructure expansion, industrial modernization, renewable energy deployment, and petrochemical development projects. Countries such as China, India, and Japan are at the forefront, with government initiatives and private investments fueling large-scale EPC opportunities.

For example, China Petroleum Engineering, a subsidiary of China National Petroleum Corporation (CNPC), secured a US$ 1 billion EPC contract to construct a petrochemical plant for a Chinese joint venture with Saudi Basic Industries Corporation (SABIC), one of the world’s largest petrochemical companies. This project reflects the growing scale and importance of EPC consulting services across Asia-Pacific.

Competitive Landscape

The major players in the EPC consulting market include Bechtel Corporation, EPC Engineering & Technologies GmbH, Engineers India Limited, TÜV Rheinland, prismecs.com, Jacobs, Fluor Corporation, SAIPEM SpA, LARSEN & TOUBRO LIMITED, John Wood Group PLC

Bechtel Corporation: Bechtel Corporation is a US-based, privately held global leader in engineering, procurement, construction (EPC), and project management services. Headquartered in Reston, Virginia, the company operates across infrastructure, energy, mining, nuclear, manufacturing, and technology sectors. Bechtel is renowned for delivering large-scale, complex projects such as LNG facilities, power plants, rail systems, airports, and data centers. With a strong global footprint, it has executed projects in over 160 countries and is recognized for its focus on safety, sustainability, and innovation.

Market Scope

| Metrics | Details | |

| CAGR | 8.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Service Type | Design & Engineering, Procurement, Consulting, Maintenance & Operations, Construction Management, Others |

| End-User | Oil & Gas, Power & Energy, Chemicals & Pharmaceuticals, Infrastructure & Construction, Metals & Mining, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global EPC consulting market report delivers a detailed analysis with 54 key tables, more than 48 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions For Related Reports

For more EPC consulting-related reports, please click here