Overview

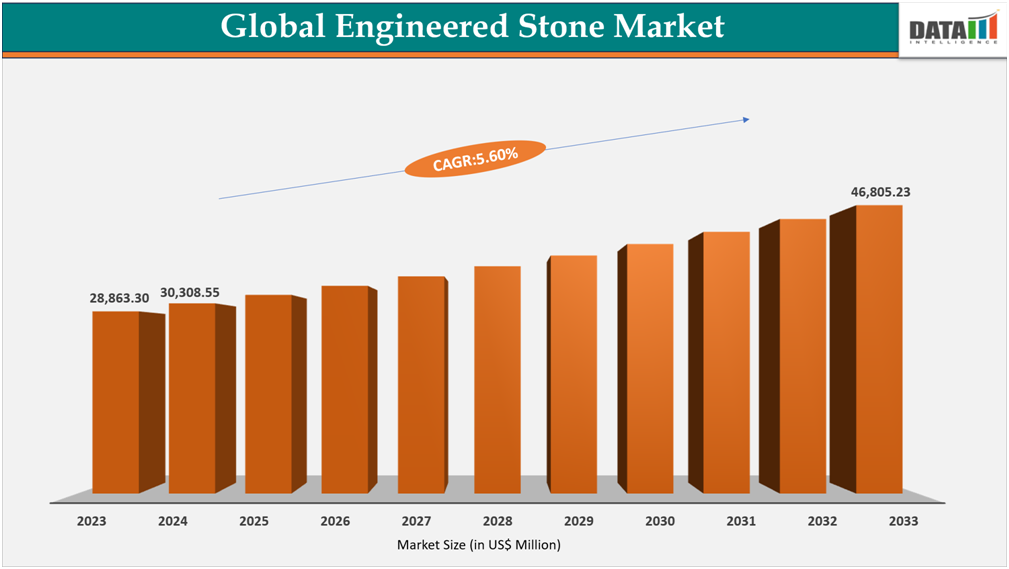

The global engineered stone market reached US$28,863.30million in 2023, rising to US$30,308.55million in 2024 and is expected to reach US$46,805.23million by 2032, growing at a CAGR of 5.6% from 2025 to 2032.

The engineered stone market is expanding rapidly, driven by growing demand in the global construction and interior design industries. According to the National Acts on Human Rights, the construction market is projected to grow by US$4.5 trillion to US$15.2 trillion in the next decade, led by China, India, the US, and Indonesia. This surge, along with global efforts to achieve UN Sustainable Development Goals 9 and 11, is fueling the adoption of sustainable, innovative, and ethically produced materials like engineered stone.

The market is also witnessing rising consumer preference for durable, low-maintenance, and eco-friendly surfaces in residential and commercial spaces. Engineered stones are valued for their resistance to stains, heat, and scratches, making them superior to natural stones. Supporting this sustainability push, Brachot launched UnistoneUniQ in February 2025, using Breton’s BioQuartz technology to create a crystalline silica-free material that reduces health risks and is produced with recycled content through a zero-waste approach.

Simultaneously, the demand for aesthetic excellence and premium interior finishes is driving manufacturers to introduce advanced product lines. Hyundai L&C’s launch of the Opimo Collection in October 2025 exemplifies this trend, offering layered quartzite-inspired patterns and 28% larger slabs that mirror the texture of natural stone while enhancing design flexibility. After debuting at the North American Kitchen & Bath Industry Show, Opimo received strong global demand, underlining the growing appetite for luxury, design-driven materials in modern interiors.

Urbanization and infrastructure development are key accelerators of market growth, with urban populations expected to increase by two billion by 2050. As sustainable construction gains momentum, engineered stone plays a vital role in achieving resilience and longevity in building design. Overall, the engineered stone market is thriving on the synergy of sustainability, innovation, and urban growth.

Engineered Stone Market Industry Trends and Strategic Insights

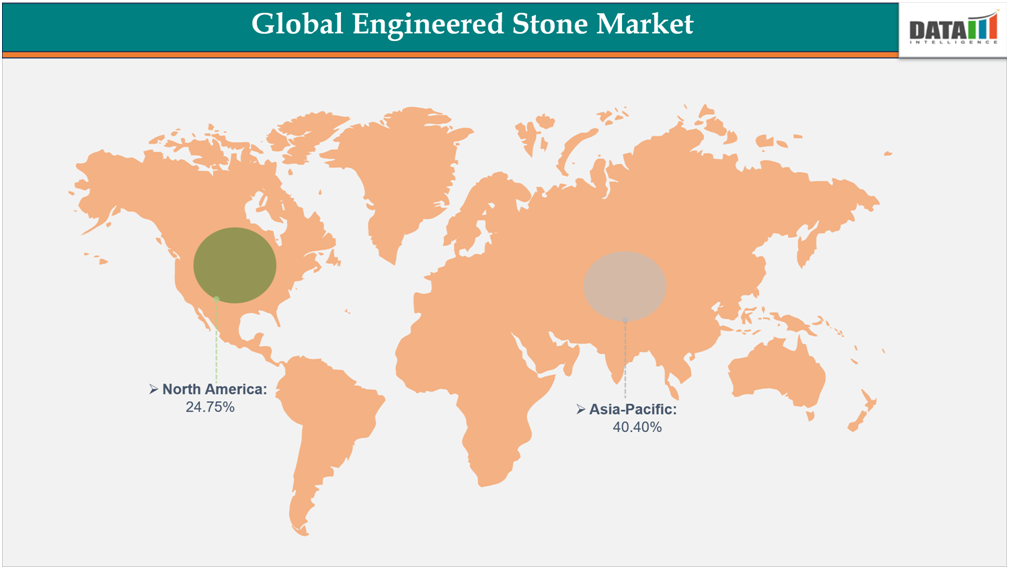

- Asia-Pacific leads the global engineered stone market, capturing the largest revenue share of 40.40% in 2024.

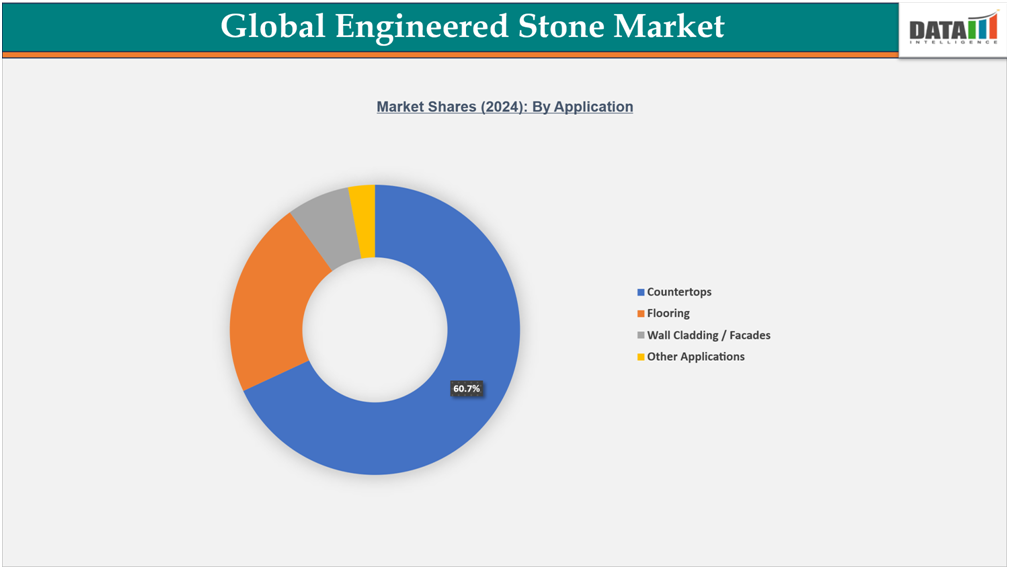

- By application segment, countertops lead the global engineered stone market, capturing the largest revenue share of 60.7% in 2024.

Global Engineered Stone Market Size and Future Outlook

- 2024 Market Size:US$30,308.55 million

- 2032 Projected Market Size:US$46,805.23million

- CAGR (2025–2032):5.6%

- Dominating Market: Asia-Pacific

Fastest Growing Market: North America

source : datam intelligence Email: [email protected]

Market Scope

| Metrics | Details |

| By Type | Engineered Quartz, Polymer Concrete, Engineered Marble Stone |

| By Application | Countertops, Flooring, Wall Cladding / Facades, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Surging Residential and Commercial Construction

The surge in residential and commercial construction activity continues to be a major growth driver for the engineered stone market, as developers and homeowners increasingly seek high-quality, durable, and aesthetic surfacing materials. Engineered stones, known for their superior strength, stain resistance, and design versatility, are becoming integral to modern infrastructure and interior projects across housing and commercial sectors.

In the residential sector, steady growth in new housing projects and remodelling activities is accelerating the use of engineered stone in kitchens, bathrooms, and flooring applications. Consumers are increasingly investing in home upgrades despite macroeconomic uncertainties. According to FMI, a banking firm, home improvement spending grew by 1% in 2023, reflecting homeowners’ willingness to enhance property value and aesthetics through premium materials like quartz surfaces.

At the same time, the commercial construction segment is providing a strong boost to market growth. Rising investments in offices, hospitality, and retail infrastructure are creating steady demand for durable and visually refined surfaces. As per FMI, commercial construction spending surged 11% year-over-year to US$128 billion as of July 2023, highlighting robust nonresidential activity. This growing commercial pipeline continues to strengthen the adoption of engineered stone for high-traffic, design-focused environments.

Supporting this rising demand, manufacturers are expanding their production capacity to meet both domestic and global needs. In November 2024, in India, Pokarna Engineered Stone Limited (PESL) announced a ₹440 crore (~US$49.7 million) investment to expand its quartz surface plant in Telangana by 8.1 lakh sq. mt. The project, which includes the installation of a third Bretonstone production line, will be operational by March 2026, strengthening supply to meet increasing construction-led consumption worldwide.

Segmentation Analysis

The global engineered stone market is segmented based on type, application, and region.

The global engineered stone market for countertops is leading the market

The global engineered stone market for countertops was US$20,635.11 million in 2024 and is expected to reach US$31,176.00 million by 2032, growing with a CAGR of 5.4% between 2025 and 2032.

The global demand for engineered stone in countertop applications has witnessed substantial growth, driven by the rise in residential remodeling, hospitality expansion, and technological innovation in surface materials. Engineered stone, primarily composed of quartz, resins, and pigments, has increasingly replaced natural marble and granite due to its superior durability, design consistency, and environmental performance. The market’s trajectory reflects broader construction and renovation trends, particularly in North America, Europe, and Asia-Pacific, as well as evolving consumer preferences for sustainable and high-performance interior materials.

In the United States, the home improvement sector has been a key demand driver for engineered stone countertops. According to the US Census Bureau’s 2023 Home Improvements report, renovation activity has remained resilient despite economic headwinds. In 2022, home improvement spending hit a record US$567 billion, fueled by pandemic-era housing investments and remote work trends. However, as inflation and interest rates rose, spending moderated to US$463 billion in 2023, with projections indicating a slight decline to US$451 billion in 2024, before stabilizing in early 2025. Data from Angi’s State of Home Spending Report (2023) further supports this pattern, showing US homeowners spent an average of US$9,542 per household on home improvement, completing roughly 2.8 projects each year. Within these expenditures, kitchen and bath remodels remained top priorities, where engineered quartz countertops are among the most commonly installed materials, preferred for their low maintenance and customizable aesthetic.

Rising Demand in Flooring Application

The global engineered stone market for flooring was US$6,651.99 million in 2024 and is expected to reach US$10,728.58 million by 2032, growing with a CAGR of 6.2% between 2025 and 2032. The global demand for engineered stone in flooring applications is experiencing notable growth, supported by trends in sustainability, hygiene, and design innovation across residential, commercial, and institutional sectors. Engineered stone, composed primarily of quartz and resins, offers a durable, non-porous, and low-maintenance alternative to natural materials such as marble and granite. Its resistance to stains, scratches, and microbial growth has made it increasingly popular for high-traffic environments.

In North America, the market is evolving through innovations that combine aesthetics with functionality. A major milestone in this space is American Biltrite’s launch of UltraCeramic Contract, a 4 mm grouted engineered stone flooring solution designed for commercial use. The product features a rigid-core structure protected by a 20-mil wear layer and a polyurethane coating, ensuring long-term resistance to moisture, abrasion, and frequent cleaning. According to Catherine del Vecchio, Vice-President of Marketing at American Biltrite, the aim was to design a resilient flooring that delivers the authentic look and texture of natural stone while eliminating the maintenance drawbacks of ceramic or marble. The unique patent-pending rounded edges on all sides require full grouting, enhancing visual appeal while providing the comfort and acoustic benefits of resilient flooring. UltraCeramic Contract’s design and performance respond to the demand for hygienic, long-lasting surfaces in post-pandemic commercial interiors.

This innovation aligns with a wider North American trend toward advanced, durable flooring. The US Census Bureau’s 2023 construction report recorded over US$560 billion in nonresidential construction spending, underscoring steady investment in commercial, healthcare, and retail infrastructure, all key applications for engineered flooring.

Geographical Penetration

DOMINATING MARKET:

Asia-Pacific Leads Dominancein the Market

Asia-Pacific’s engineered stone market was valued at US$12,244.65 million in 2024 and is estimated to reach US$20,182.96 million by 2032, growing at a CAGR of 6.5% during the forecast period from 2025-2032.

The Asia-Pacific engineered stone market is benefiting from large-scale construction and renovation dynamics in the region. For instance, in China, the gross output value of construction work by state-owned and holding enterprises was recorded at about RMB 28,968,340 million in 2024 (equivalent to roughly US$4.0 trillion), up compared with 2023, pointing to the sheer scale of building activity which drives surfacing material demand. At the same time, investment in real-estate development in China in 2024 stood at RMB 10,028.0 billion (≈ US$1.4 trillion), with residential building investment alone at RMB 7,604.0 billion. These numbers reflect the pipeline of homes, apartments and mixed-use buildings that specify kitchen, bath, flooring and façade surfaces, all prime applications for engineered stone systems.

Across the region, residential kitchen and luxury interior upgrades are driving engineered quartz and composite stone uptake. Homeowners in urban centres increasingly favor low-maintenance, non-porous surfaces that resist stains, provide hygiene benefits and deliver premium aesthetics. Products responding to this demand include launches by regional manufacturers: In March 2022, Häfele introduced its Terra Quartz Surfaces collection across Asia-Pacific, aimed at kitchen counters, bathroom surfaces and reception walls. In October 2024, Greenlam Laminates – Asia’s largest laminate brand – released its Stratus kitchen surface line in the region, emphasizing durability, easy-clean surfaces and anti-virus/anti-bacterial features, signaling how engineered-stone-style surfacing increasingly integrates hygiene and design.

FASTEST GROWING MARKET:

North America is the Fastest-Growing Market

North America’s engineered stone market was valued at US$7,502.12 million in 2024 and is estimated to reach US$11,451.21 million by 2032, growing at a CAGR of 5.5% during the forecast period from 2025-2032.

Engineered stone demand in North America continues to grow steadily, supported by sustained construction spending, expanding renovation activity, and material innovations that extend its applications beyond traditional countertops. The foundation of this demand lies in a strong construction sector. In 2024, the total value of construction put in place in the US was about US$2.154 trillion, representing a 6.5% increase from the previous year. Both residential and non-residential projects contributed to this growth, creating a large base of installations where engineered stone products, such as quartz surfaces, manufactured stone veneers, and rigid-core flooring, are commonly specified. Housing starts in the US remained high at around 1.36 million units in 2024, while Canada also maintained strong activity in major provinces like Ontario, Quebec, and British Columbia. Each new housing unit, along with ongoing remodeling projects, generates recurring demand for kitchen and bathroom surfaces, façades, and flooring that favor engineered stone for its durability and appearance.

Renovation spending further fuels consumption across the region. Homeowners continue to invest heavily in kitchen and bath remodels, where engineered quartz and thin stone veneers dominate due to their stain resistance, low maintenance, and modern designs. Even when new home construction fluctuates, remodeling and replacement cycles sustain demand for engineered surfaces. Commercial renovations also contribute, especially in hospitality, healthcare, and office interiors, where hygiene and resilience are priorities.

Regulatory Analysis

In North America, regulatory pressure is intensifying as the US Department of Labor’s OSHA launched an enforcement and compliance initiative on September 25, 2023, to combat silica exposure in engineered stone fabrication and installation. The initiative mandates stricter safety measures such as engineering controls, wet-cutting systems, and respiratory protection, addressing the alarming rise in silicosis cases. Canada also enforces strict exposure limits under its provincial occupational health and safety acts, particularly in Ontario and British Columbia, where inspections are frequent. Mexico is aligning its workplace safety regulations with North American standards to protect workers from silica-related diseases.

In South America, the regulatory environment remains inconsistent, with Brazil recording some of the world’s highest silicosis cases, up to 38% in mining sectors, due to weak enforcement of NR22 standards. Chile and Argentina have begun adopting stronger industrial hygiene measures, requiring companies to implement dust suppression systems and regular worker health screenings. However, compliance remains limited among small and medium enterprises (SMEs). These disparities in safety governance threaten export competitiveness, prompting trade partners to demand proof of compliance before accepting South American-engineered stone products.

The Asia-Pacific region presents a mixed picture, with Australia leading the charge through its nationwide ban on engineered stone effective 1 July 2024, prohibiting products with 1% or more crystalline silica. New Zealand is reviewing similar legislation, while countries like China and India, major engineered stone exporters, are tightening occupational exposure limits but still face enforcement challenges due to fragmented oversight. Japan and South Korea, on the other hand, follow stringent industrial safety laws emphasizing dust monitoring and ventilation. The region’s overall shift toward stricter compliance reflects growing awareness of silica-related health risks and sustainable manufacturing standards.

Competitive Landscape

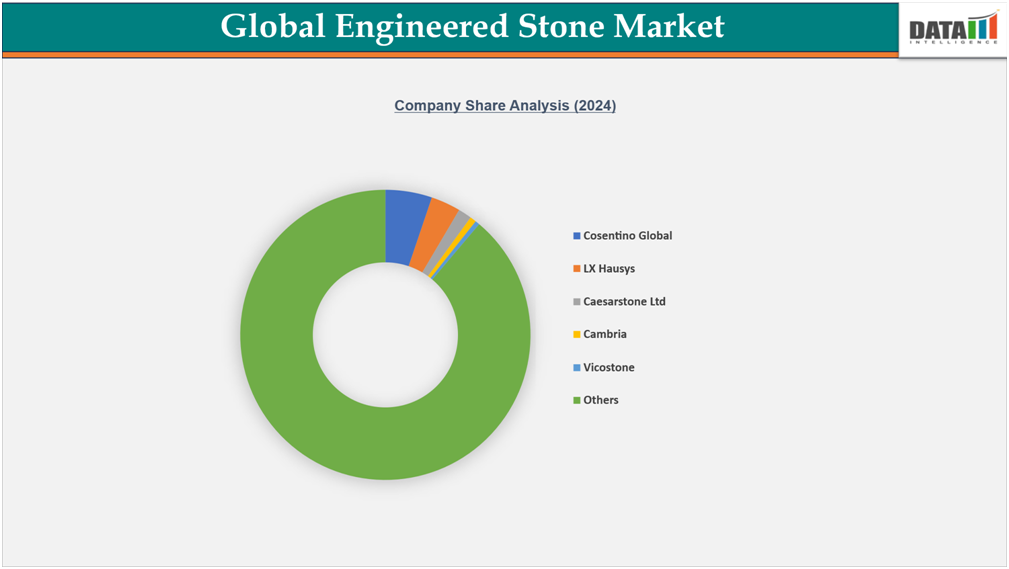

The global engineered stones market is characterized by a diverse and competitive landscape, with a few leading companies holding significant yet moderate market shares.

Cosentino Global leads the segment with a 5.2% share, driven by its innovative Silestone and Dekton product lines and strong global presence. LX Hausys follows with 3.3%, leveraging advanced quartz and solid surface technologies under its Viatera and HIMACS brands. Caesarstone Ltd accounts for 1.5%, recognized for its design leadership and sustainability-focused engineered quartz surfaces. Cambria contributes 0.7%, emphasizing premium US-made quartz products with distinctive finishes and textures. Vicostone, known for its high-quality quartz surfaces, holds 0.5% of the global market.

Despite the presence of these major players, the engineered stones industry remains highly fragmented, with 88.9% of the market comprised of numerous regional and emerging manufacturers worldwide.

Key Developments

- In October 2025, Cosentino Global, S.L.U. has launched a new flagship material brand, Eclos, marking the debut of a new category of “in-layered mineral surfaces. Inlayr technology enables Eclos to be manufactured using a layered design system. With advanced robotics engineering processes and innovative decoration techniques, it gives the entire surface a 3D design with unique veins and patterns.

What Sets This Global Engineered Stone Market Intelligence Report Apart

- Granular Market Intelligence: Comprehensive assessment of the global engineered stone market, including detailed evaluation of market size, material composition, and growth trajectories through 2032. The analysis captures the shifting demand from natural stone to engineered quartz, sintered stone, and other composite materials, driven by design flexibility, performance, and sustainability. Segment-level intelligence covers product types (quartz, marble, granite-based, and solid surfaces), applications (countertops, flooring, wall cladding, and others), and end-use industries (residential, commercial, and institutional construction).

- Regulatory Intelligence: In-depth and actionable review of regulatory frameworks influencing engineered stone production, trade, and occupational safety. This includes evolving silica dust exposure regulations (OSHA, Safe Work Australia, EU REACH), green building standards (LEED, BREEAM, WELL), and trade policies affecting stone slab imports and exports. Also covered are environmental and health regulations driving the shift toward low-silica formulations, recycled content, and eco-certified resins.

- Competitive Benchmarking: Detailed benchmarking of global and regional manufacturers, encompassing capacity distribution, product differentiation strategies, technology integration (e.g., Bretonstone process, sintering technology), and recent mergers and expansions. Comparative insights highlight leading players’ approaches to brand positioning, raw material integration, and downstream fabrication partnerships, offering a clear view of competitive intensity in both developed and emerging markets.

- Investment and Opportunity Mapping: Identification of high-growth applications and emerging profit pools across key segments such as premium kitchen and bathroom countertops, large-format architectural panels, modular furniture, and outdoor surfaces. Region-specific opportunities are mapped across Asia-Pacific (China, India, Vietnam), North America, and Europe, emphasizing the interplay between urbanization trends, remodeling activities, and the penetration of engineered stone in new construction and retrofit projects.

- Supply Chain Strategy: Critical evaluation of the engineered stone value chain, from quartz sourcing and resin formulation to surface finishing, distribution, and fabrication networks. The analysis covers raw material cost dynamics (quartz, pigments, polymer resins), energy-intensive production challenges, and logistics bottlenecks, alongside strategic insights into regional manufacturing clusters, recycling initiatives, and the adoption of digital fabrication technologies (CNC and waterjet cutting) to enhance operational efficiency.

- Expert, Forward-Looking Insights: Strategic recommendations from industry and materials experts with deep understanding of surface material innovations, building and construction market cycles, and sustainable design trends. Forward-looking perspectives highlight next-generation product developments (bio-based resins, ultra-compact surfaces), automation in slab processing, and circular design models, enabling stakeholders to make informed investment, capacity expansion, partnership, and M&A decisions in a rapidly evolving engineered stone ecosystem.