Global Electronic Shelf Label Market is segmented By Product Type (LCD ESL, Segmented E-Paper ESL, Full-Graphic E-Paper ESL), By Component (Displays, Batteries, Transceivers, Microprocessors, Others), By Store Type (Hypermarkets, Supermarkets, Non-Food Retail Stores, Specialty Stores, Others), By Communication Technology (Radio Frequency, Infrared, Near Field Communication, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Electronic Shelf Label Market Overview

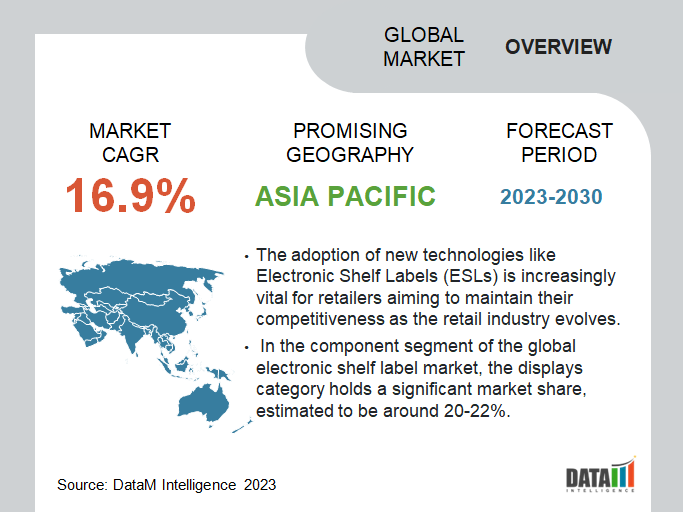

Global Electronic Shelf Label market to grow at a CAGR Of 16.9% during the forecast period 2024-2031

Product launches and government initiatives aimed at promoting the adoption of new technologies in the retail sector are contributing to the market growth of the ESL market. As the retail industry continues to evolve, the adoption of ESLs is likely to continue to grow, creating new market opportunities for retailers and technology providers alike.

As the retail industry continues to evolve, the adoption of new technologies such as ESLs is becoming increasingly important for retailers looking to remain competitive. The displays segment occupies almost 20-22% of the market share in the component segment of the global electronic shelf label market. Similarly, Asia-Pacific is the largest region in the market with over 30% of the market share in the regional segment.

Electronic Shelf Label Market Scope

|

Metrics |

Details |

|

CAGR |

16.9% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Component, Product, Store, Communication Technology and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To know more insights Download Sample

Electronic Shelf Label Market Dynamics

The Need for Retailers to Improve Their Operations and Remain Competitive in an Increasingly Crowded Market

The global electronic shelf label (ESL) market has been growing at a significant pace in recent years and the main driver behind the market growth has been the increasing adoption of ESLs by retailers around the world. ESLs offer several benefits to retailers, including reduced labor costs, improved pricing accuracy and enhanced customer experience.

According to government statistics, the retail industry is a major contributor to the global economy, and it is expected to continue to grow in the coming years. In 2020, the global retail market was valued at over US$ 20 trillion and it is projected to reach US$ 31 trillion by 2025. Thus, the increasing demand for ESLs in the retail sector and the market opportunies are driven by the need for retailers to improve their operations and remain competitive in an increasingly crowded market.

The Regulatory Compliance Requirements

Regulatory compliance requirements vary from country to country and can include product labeling standards, data privacy regulations and environmental regulations. For example, in U.S., the Food and Drug Administration (FDA) has specific labeling requirements for food and drug products and failure to comply with these requirements can result in fines and other penalties.

Similarly, in the European Union, the General Data Protection Regulation (GDPR) has strict rules around data privacy and security, which can make it challenging for retailers to collect and use customer data for marketing purposes.

These regulatory compliance requirements can be particularly challenging for smaller players in the market, as they may not have the resources to navigate complex regulatory frameworks or invest in the technology and infrastructure needed to meet regulatory requirements. Therefore, the regulatory compliance requirements hamper the global electronic shelf label market opportunities and growth.

Electronic Shelf Label Market Segmentation Analysis

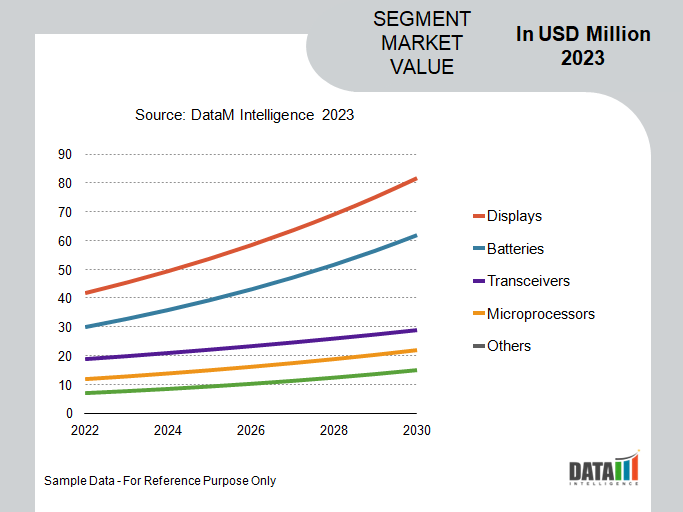

The global electronic shelf label market is segmented based on product, component, store, communication technology and region.

Improved Store Operations, Enhanced Customer Experience and Increased Sales

ESLs with high-quality displays are becoming increasingly popular among retailers as they offer a range of benefits such as improved store operations, enhanced customer experience, and increased sales.

In the Asia Pacific region, the ESL market is expected to witness significant growth in the coming years, driven by the increasing adoption of ESLs by retailers in the region. For instance, in 2020, Samsung SDS launched its Nexshop ESL solution, which includes ESLs with e-paper displays, a cloud-based management platform and an AI-based recommendation engine.

The solution is aimed at helping retailers in the Asia Pacific region enhance the in-store customer experience and increase sales. Overall, the growth of the displays segment in the global ESL market is expected to be driven by several factors, including the increasing adoption of ESLs by retailers, the demand for high-quality displays that can enhance the in-store customer experience and the need for ESLs that can improve store operations and increase sales.

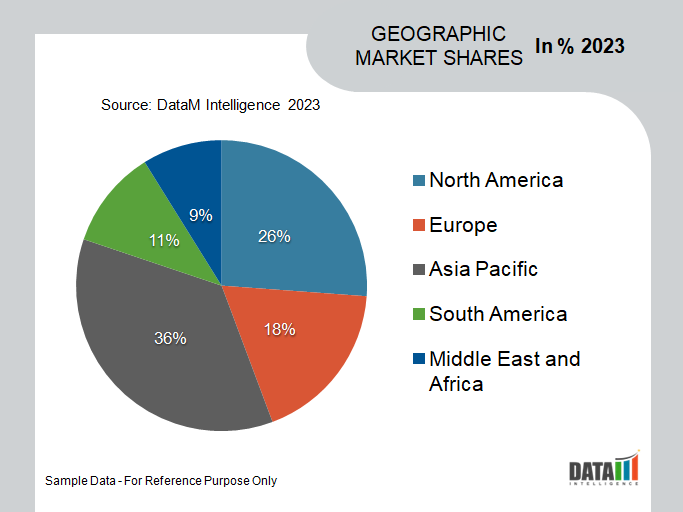

Electronic Shelf Label Market Geographical Share

The Large and Growing Population, Rising Disposable Incomes and Increasing Adoption of Digital Technologies in Asia-Pacific

The Asia-Pacific region has emerged as a key growth market for electronic shelf labels (ESLs) in recent years. The region's large and growing population, rising disposable incomes, and increasing adoption of digital technologies have all contributed to the growth of the ESL market in Asia-Pacific.

According to data from the Asia-Pacific Economic Cooperation (APEC), the region's retail industry has been growing at an average rate of 5.6% per year, with China and India being the fastest-growing markets.

The respective growth has been driven by increasing consumer spending, rising urbanization, and the expansion of e-commerce platforms. In response to these trends, many retailers in Asia-Pacific are adopting ESLs to improve their store operations and enhance the customer experience. As a result, the demand for electronic shelf labels (ESLs) in Asia-Pacific is witnessing a significant rise thus boosting the market share of the region.

Electronic Shelf Label Companies

The major global players include Ses-Imagotag, Pricer, Samsung Electro-Mechanics, E Ink Holdings, Display data, M2 Communication, Diebold Nixdorf, Opticon Sensors Europe, Teraoka Seiko and NZ Electronic Shelf Labelling.

The Global Electronic Self Label Market Report Would Provide Approximately 69 Tables, 72 Figures and 178 Pages.