Global Effervescent Packaging Market is segmented By Material (Plastic Tubes with Desiccant Stoppers, Aluminum Foil, Others), By Type (Blisters, Sachets, Bottles, Tubes, Others), By Application (Powder, Tablets, Granules), By End-User (Nutraceutical, Pharmaceutical, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030.

Effervescent Packaging Market Overview

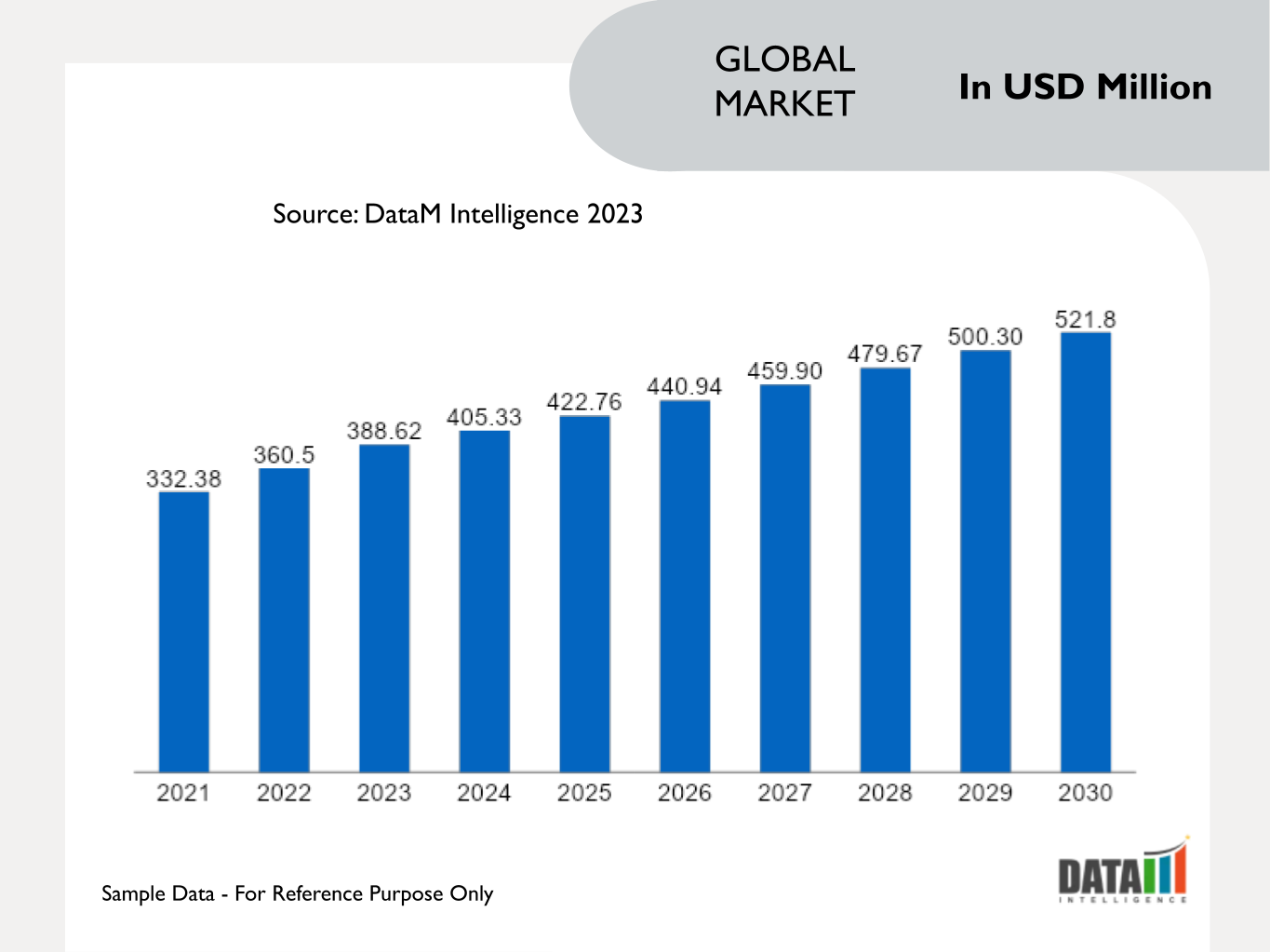

Global Effervescent Packaging Market reached USD 360.5 million in 2022 and is expected to reach USD 521.8 million by 2030, growing with a CAGR of 7.4% during the forecast period 2023-2030.

Health Innovations has introduced EfferShield, a patented technology within the effervescent category. The technology is designed to replace traditional effervescent plastic tubes, offering a more advanced and versatile packaging solution. EfferShield technology enables the use of innovative packaging formats such as sachets, pouch packs and recycled containers. It allows for creative and convenient packaging solutions beyond traditional single-use tubes.

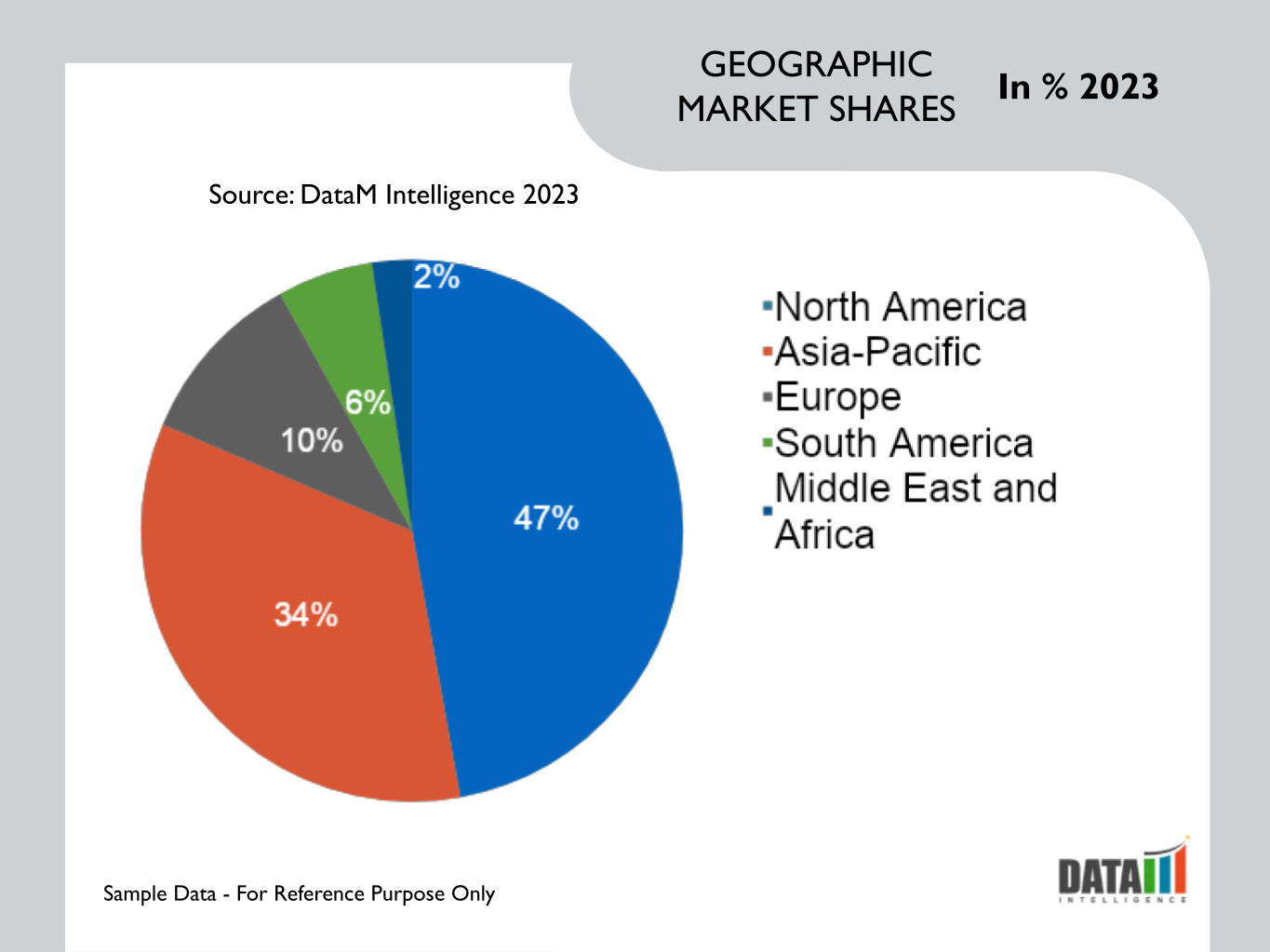

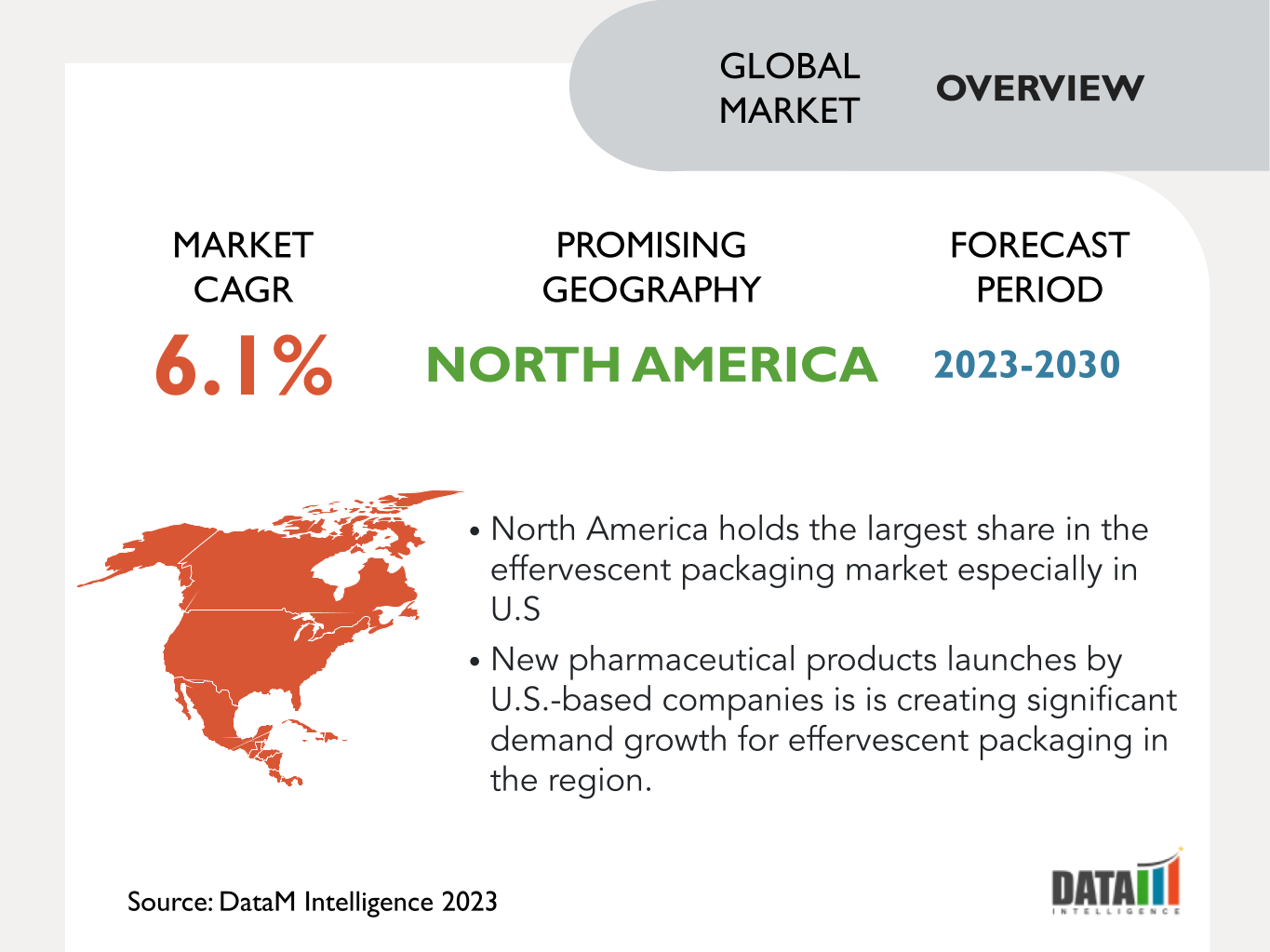

North America holds an extensive share in the effervescent packaging market, According to the EEPIA report, North America accounted for 52.3% of global pharmaceutical sales in 2022 compared to Europe's 22.4%. With more than half of global pharmaceutical sales occurring in North America, the region's extensive pharmaceutical industry creates a substantial demand for various types of pharmaceutical packaging, including effervescent packaging.

Effervescent Packaging Market Scope

|

Metrics |

Details |

|

CAGR |

7.4% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Material, Type, Application, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report Request for Sample

Effervescent Packaging Market Dynamics and Trends

Effervescent Packaging Market: Meeting Pharmaceutical Industry Expansion and Demands

Effervescent packaging is expected to witness increased demand in line with the growth of the global pharmaceutical industry. Innovations in the pharmaceutical industry along with increased sales in emerging regions is driving the demand for effervescent packaging. According to the "World Pharma Today" article, the pharmaceutical sector is rapidly growing and is expected to reach USD 1.5 trillion by 2023.

The demand for individualized medicine drives the need for flexible and responsive production and delivery systems. The adoption of unit dose packaging solutions, including for effervescent products, aims to reduce medication errors and enhance patient care. The pharmaceutical industry places high importance on safety, sterility and compliance. The above factors directly impact packaging processes. Effervescent packaging methods are expected to align with these requirements, focusing on safer and more efficient packaging solutions.

New Advancements in Effervescent Packaging Technology

The effervescent packaging market is experiencing rapid growth driven by new technology advancements and enhancements, particularly in the realm of sustainable and user-friendly packaging solutions. Effervescent packaging advancements also consider safety features, child-resistant mechanisms and anti-tamper devices. Balancing user-friendliness with safety ensures that the packaging meets regulatory standards and protects the integrity of the medication.

Sanner BioBase introduces a portfolio of packaging made from bioplastics for effervescent products. The innovation addresses the increasing demand for sustainable packaging solutions in the pharmaceutical industry. The use of bioplastics, derived from renewable raw materials like corn, sugar cane and cellulose, reflects a shift towards eco-friendly packaging alternatives.

The pharmaceutical industry is witnessing a shift towards alternative oral dosage forms, such as effervescent tablets, that offer enhanced convenience for consumers. Packaging advancements play a crucial role in supporting and complementing these trends, making the products more accessible and attractive to the market. Innovative packaging designs and materials can enhance the overall customer experience and contribute to a positive brand image.

Moisture Contamination Risks and Regulatory Hurdles

Effervescent tablets are highly sensitive to moisture. If the packaging is of low quality and does not provide adequate protection against moisture penetration, it can result in premature dissolution of the tablets. Moisture ingress due to subpar packaging can not only affect the tablet's functionality but also lead to color fading and degradation of the tablet's appearance. Manufacturers may need to allocate resources for re-packaging or product replacements.

The pharmaceutical industry is subject to strict regulatory standards to ensure product safety and efficacy. Inadequate packaging can lead to non-compliance with these standards, resulting in legal and regulatory challenges. Regulatory authorities may impose penalties or recall if packaging does not meet the required standards. Packaging is the first point of contact between consumers and the product. Low-quality packaging can raise doubts about product authenticity and safety.

Effervescent Packaging Market Segmentation

The global effervescent packaging market is segmented based on material, type, application, end-user and region.

Plastic Tube Packaging with Desiccant Stoppers is Most Widely Used in the Global Market

The segment of plastic tubes with desiccant stoppers holds the largest share in the effervescent packaging market due to its numerous advantages and benefits for protecting pharmaceutical products and nutraceuticals, specifically effervescent tablets, chewable and lozenges. The packaging solution is highly effective in safeguarding these products from moisture degradation and breakage, which are critical factors in maintaining their quality and effectiveness. The plastic tubes and desiccant stoppers are compliant with regulations set by U.S. FDA and EU for pharmaceutical applications. It also adheres to U.S. Pharmacopeia 670 standards for desiccant stoppers, ensuring safety and quality.

Sanner, a pioneer in the field of bio-based plastic packaging, has significantly expanded its portfolio with Sanner BioBase. The innovative packaging solution, made from renewable raw materials such as corn, sugar cane, or cellulose, offers a more sustainable alternative for healthcare products and food supplements, particularly effervescent tablets. The composition significantly reduces dependence on fossil raw materials and leads to a substantial reduction in CO2 footprint.

Global Effervescent Packaging Market Geographical Share

North America's Lead in Effervescent Packaging: Pharma Sector Propels Growth

North America holds the largest share of the effervescent packaging market driven by the growth of the regional pharmaceutical industry, especially in U.S. The stringent regulatory environment in North America's pharmaceutical industry mandates the use of high-quality packaging solutions that adhere to safety and quality standards. Effervescent tablets require specialized packaging to prevent moisture and other external factors from affecting their efficacy.

According to an article by Zippia, U.S. pharmaceutical industry's substantial revenue generation of USD 550 billion in 2021 is a testament to its size and importance in the global pharmaceutical market, making it hold 50% of sales revenue globally. The considerable revenue underscores the high demand for pharmaceutical products, including specialty dosage forms like effervescent tablets, which in turn drives the need for specialized packaging solutions.

Effervescent Packaging Market Companies

The major global players in the market include Sanner GmbH, Romaco Group, Airnov, U.D.Pharma Rubber Products, Parekhplast India Limited, Amerilab Technologies, Bilcare Research, Shakoplastic, Xinfuda packaging and Nutra Plast.

COVID-19 Impact Analysis

The effervescent packaging industry has been significantly impacted by the COVID-19 pandemic, reflecting the broader challenges faced by the packaging sector. As the pandemic disrupted supply chains and triggered increased demand for various products, including those utilizing effervescent packaging, the packaging industry had to swiftly adapt to the "new normal." The packaging industry's importance in ensuring goods' safe and efficient movement became even more evident during these times.

However, protective packaging played a critical role in safeguarding products like medical supplies, personal protective equipment and even vaccinations, highlighting the industry's integral place in the global supply chain. the pandemic brought forth a series of challenges for the packaging industry, including those related to supply chain disruptions and shifts in consumer behavior. The surge in online shopping and remote transactions led to a heightened demand for protective packaging to ship goods safely.

Russia-Ukraine War Impact

The ongoing war in Ukraine between Russian and Ukrainian forces has tremendous implications for the effervescent packaging industry. The conflict has resulted in economic sanctions that made a direct impact on the global efficacy of production lines. Also, the lack of an agreed-upon resolution has caused far-reaching economic instability that has caused significant disruption in the global supply chain for packaging machinery, materials and products.

Furthermore, the economic uncertainty created by the prolonged warfare has caused instability in the global market. Companies that had been depending on the Ukraine market for packaging materials and equipment have been forced to look elsewhere, often leading to imbalances in the global distribution network. Moreover, the disruption has caused many companies to lose customers due to higher prices caused by supply chain imbalances.

Key Developments

- In April 2022, Health Innovations, a nutritional supplements formulation and manufacture specialist, has recently launched a new patented manufacturing technology called EfferShield. The technology is designed to replace traditional effervescent plastic tubes and is said to decrease product waste and increase efficiency. EfferShield Pouches utilize a combination of thermal and mechanical processes to produce a precision-filled mixture of ingredients and they can be used for both dry and liquid effervescent formulations.

- In October 2021, GHO Capital Partners announced a strategic investment in Sanner, a global packaging firm with headquarters in Germany and manufacturing facilities across France, Hungary and China. Sanner is a renowned provider of customised solutions in the areas of medical & diagnostics, consumer healthcare and pharma, producing more than 4 billion component parts each year. The new partnership marks a significant milestone for GHO Capital Partners, as the firm looks to increase its reach in the healthcare industry and leverage Sanner's expertise in packaging for medical and consumer healthcare products.

- In August 2022, Sanner BioBase introduced sustainable organic effervescent packaging, Sanner BioBase offers the first sustainable packaging made from over 90% renewable raw materials, specially designed for effervescent products such as tablets.

Why Purchase the Report?

- To visualize the global effervescent packaging market segmentation based on material, type, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of cement market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global effervescent packaging market report would provide approximately 69 tables, 69 figures and 196 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies