Overview

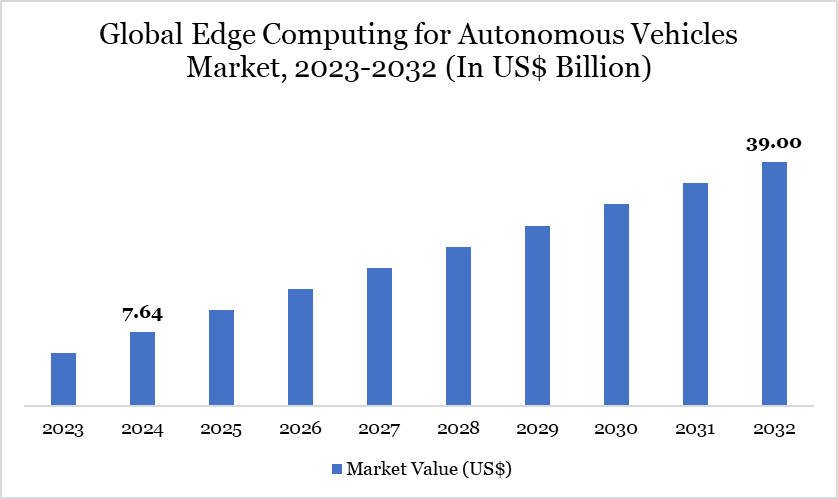

Global edge computing for autonomous vehicles Market reached US$ 7.64 billion in 2024 and is expected to reach US$ 39.00 billion by 2032, growing with a CAGR of 22.60% during the forecast period 2025-2032.

Edge computing is an emerging computing paradigm that includes a variety of networks and devices located at or near the user's location. This strategy focuses on processing data closer to its source, allowing for faster and larger-volume data handling, resulting in more meaningful, real-time insights. The future of autonomous vehicles linked with edge computing has enormous potential to change the transportation industry.

The integration of self-driving cars and edge computing anticipates a future of safer, more accessible and sustainable transportation. In this context, edge computing is poised to play a major role in transforming travel, cementing its place as a critical technology for the advancement of self-driving vehicles. In November 2022, NVIDIA announced DRIVE Thor, a centralized automotive computer that combines tasks including clustering, infotainment, automated driving and parking into a single, cost-effective system.

Edge Computing for Autonomous Vehicles Market Trend

The integration of 5G networks to provide ultra-low latency communication is a key trend driving the edge computing market for autonomous vehicles. Autonomous vehicles rely on real-time data streams from onboard sensors like LIDAR, radar and high-definition cameras to make speedy decisions. Edge computing allows data to be processed closer to the source, in or near the vehicle, considerably lowering latency.

The increasing deployment of 5G infrastructure in major automotive manufacturing regions such as North America, Europe and East Asia is hastening this trend. For example, telecom providers in Germany, South Korea and the US are collaborating with automobile OEMs to develop roadside edge nodes and vehicle-to-everything (V2X) communication frameworks. It increases the safety and reliability of autonomous driving systems and allows for more efficient fleet management and predictive maintenance.

Market Scope

Metrics | Details |

By Component | Hardware, Software, Services |

By Deployment | On-Premises, Cloud-based, Hybrid |

By Connectivity | 5G, 4G/LTE, Wi-Fi, DSRC |

By Vehicle | Passenger Vehicles, Commercial Vehicles |

By Application | Autonomous Driving, Predictive Maintenance, Vehicle Telematics, Traffic Management, Fleet Management, Infotainment and Digital Cockpits, Others |

By End-User | OEMs, Tier 1 Suppliers, Fleet Operators, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

MEC-Enabled Applications

The integration of Mobile Edge Computing (MEC) into self-driving vehicles is advancing quickly, boosting vehicle efficiency and enabling new applications. Organizations like the Automotive Edge Computing Consortium (AECC) play an important role in promoting these technologies by lobbying for the use of MEC in intelligent driving solutions. Researchers believe that MEC will enable real-time data-driven applications like as dynamic mapping and driving assistance systems, which will be enabled by cloud computing.

For these technologies to thrive, vehicles must be connected to high-capacity networks capable of transmitting large amounts of data while maintaining uninterrupted performance. MEC also supports the transition to mobility-as-a-service by transforming each vehicle into a data repository. It opens up opportunities for external services like navigation aid, ride-sharing and traffic management systems.

High Implementation Cost

Establishing and implementing edge computing systems necessitates sophisticated gear, including high-performance CPUs, sensors and data storage solutions, which can be costly. Furthermore, the necessity for a resilient connectivity infrastructure, encompassing 5G networks, to facilitate real-time data processing contributes to the total expenditure. Significant initial investments might pose a challenge, especially for smaller automakers and technology providers who can find it difficult to validate the financial commitment necessary for extensive implementation.

The continuous maintenance and enhancements to edge computing systems escalate operational expenses. As technology advances swiftly, the necessity for ongoing enhancements and the incorporation of novel functionalities may escalate the long-term expenses of edge computing. This financial encumbrance is an obstacle for wider adoption, as companies must evaluate the expense of installation relative to the prospective advantages of enhanced vehicle autonomy and performance. Thus, the elevated expenses continue to be a significant impediment to the expansion of edge computing within the autonomous car industry.

Segment Analysis

The global edge computing for autonomous vehicles market is segmented based on component, deployment, connectivity, vehicle, application, end-user and region.

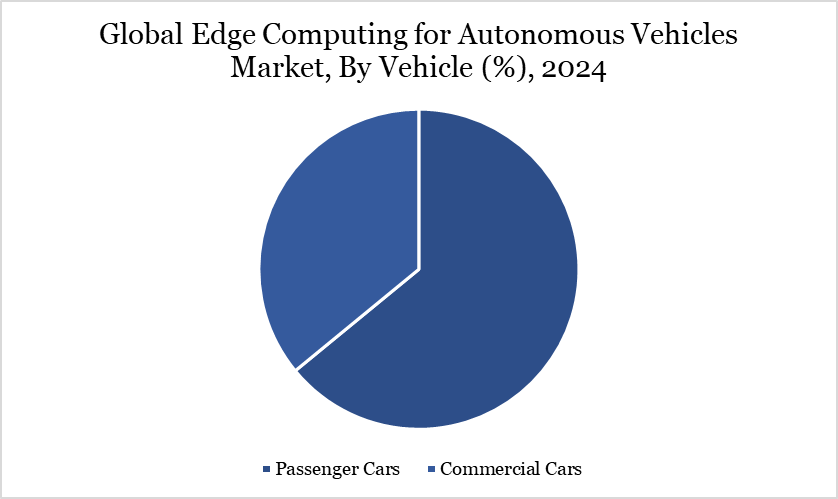

Rising Demand for Real-Time Decision-Making in Passenger Cars Drives the Segment Growth

The growing demand for real-time decision-making skills to assure safety, comfort and dependability is propelling the passenger automobile industry. Modern passenger vehicles, particularly those with SAE Levels 2 to 4 autonomy, generate and handle vast volumes of sensor data per second, including data from cameras, LIDAR, radar and ultrasonic sensors. Relying on cloud data centers for every decision creates latency, which is undesirable in key driving scenarios like as lane changes, unexpected braking or object detection.

Edge computing allows these decisions to be made directly within the vehicle or at the network's edge, resulting in significantly reduced latency and bandwidth. Edge AI modules, for example, incorporated in advanced driver-assistance systems (ADAS), enable vehicles to instantaneously recognize and respond to people, road signs and traffic conditions. With increasing consumer expectations for seamless autonomous experiences in passenger vehicles, automakers such as Tesla, Mercedes-Benz and BMW are integrating edge-based technologies to enable everything from navigation and driver monitoring to infotainment and predictive diagnostics.

Geographical Penetration

Rising Edge Computing In North America

The growing use of IoT devices, the increased need for low-latency processing and the development of 5G technology are all contributing to the notable rise of the edge computing industry in autonomous vehicles in North America. To enable autonomous vehicle applications that need real-time data processing for navigation, safety and operational efficiency, major industry participants are making significant investments in edge computing infrastructure.

North America's dominance in this market is further supported by the region's well-established technology hubs and robust edge computing ecosystem. North America is in a strong position to maintain its leadership in the global edge computing market for autonomous vehicles because to ongoing investments in edge infrastructure and collaborations to support creative use cases.

Sustainability Analysis

Edge computing in autonomous vehicles promotes sustainability by improving operating efficiency and enabling predictive maintenance. These capabilities can help to extend the life of vehicle components, decrease waste and promote circular economy concepts. Furthermore, the trend toward electrified autonomous vehicles, which frequently use edge computing, is consistent with global efforts to minimize carbon emissions and reliance on fossil fuels.

North America and Europe are investing in sustainable infrastructure to support the adoption of edge computing in self-driving vehicles. The initiatives include building energy-efficient edge data centers and encouraging the use of renewable energy sources to power vehicles and computer infrastructure. Such projects try to lessen the environmental impact of growing computational demands while supporting the greater goal of sustainable urban mobility.

Competitive Landscape

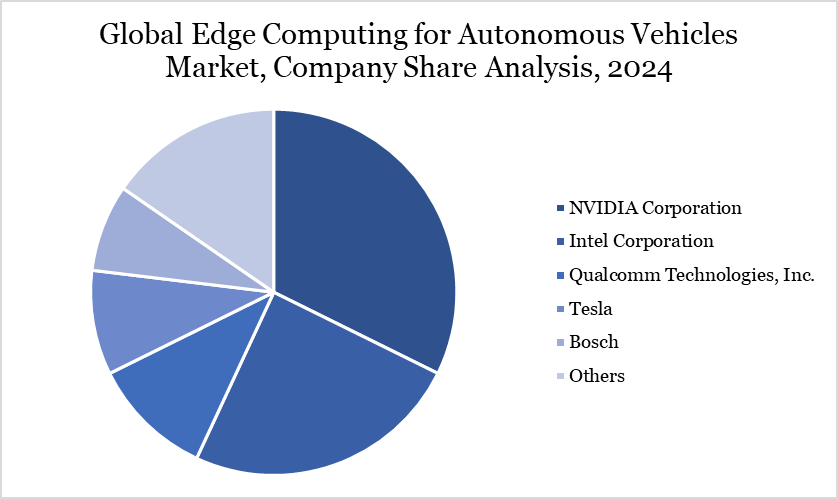

The major global players in the market include NVIDIA Corporation, Intel Corporation (Mobileye), Qualcomm Technologies, Inc., Tesla, Baidu Apollo, Bosch, Huawei, Waymo (Alphabet Inc.), Amazon Web Services (AWS) and Microsoft (Azure).

Key Developments

In January 2023, Belden introduced the Single Pair Ethernet (SPE) series of connectivity solutions, which are designed to improve Ethernet connectivity in difficult environments such as the industrial and transportation sectors. The SPE product line includes IP20-rated PCB jacks, patch cords and cord set for clean-area connections, as well as IP65/IP67-rated circular M8/M12 patch cables, cord sets and receptacles for reliable industrial Ethernet connections to field equipment.

In February 2023, Digi International made an announcement. The Digi IX10 cellular router, debuting at DistribuTECH 2023, enhances its portfolio of private cellular network (PCN) solutions, providing essential connectivity for smart grid devices via the CBRS shared spectrum and Anterix Band 8 900 MHz licensed spectrum.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies