Global Edge AI Chip Market Overview

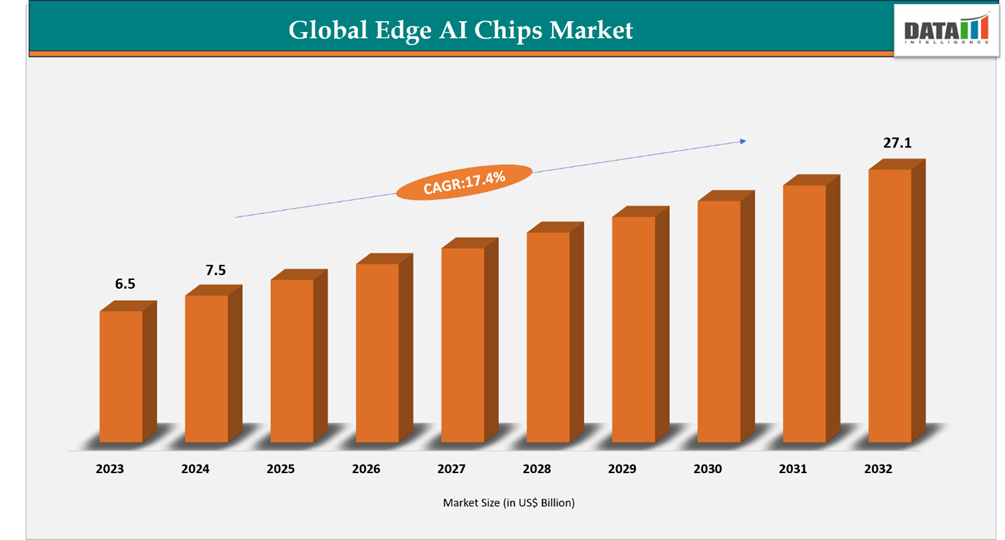

Global edge AI chip market reached US$ 7.5 billion in 2024 and is expected to reach US$ 27.1 billion by 2032, growing with a CAGR of 17.4% during the forecast period 2025-2032. The global Edge AI chips market is rapidly expanding, driven by the rising need for on-device AI processing in sectors such as autonomous vehicles, IoT, industrial automation, and smart healthcare. By enabling real-time computation, these chips reduce latency, enhance data privacy, and improve energy efficiency. Technological advancements, coupled with supportive government policies particularly in the Asia-Pacific region are further accelerating adoption, positioning edge AI chips as a key component of next-generation intelligent systems.

Edge AI Chip Industry Trends and Strategic Insights

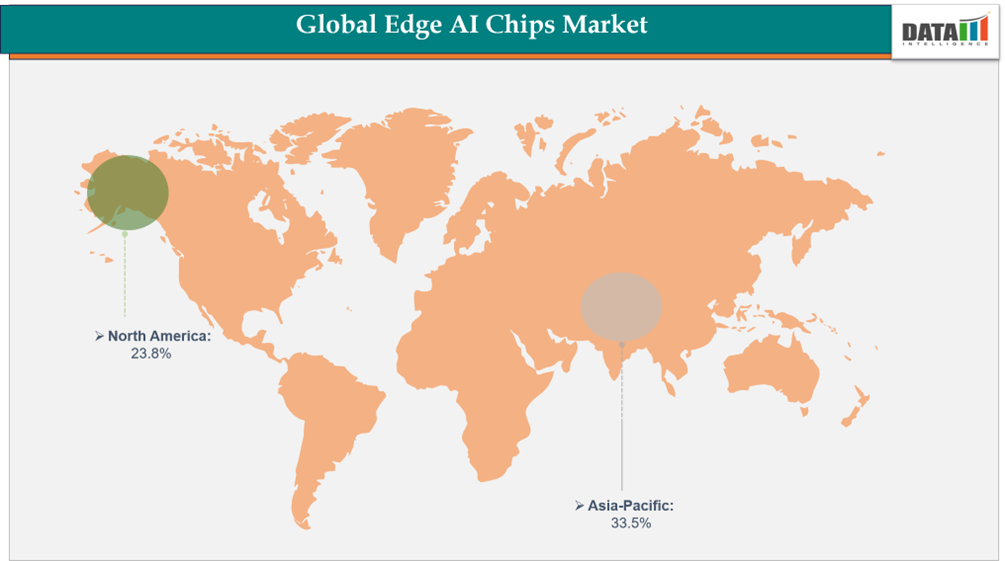

- Asia-Pacific dominates the edge AI chip market, capturing the largest revenue share of 33.5% in 2024.

- By end-user, the consumer electronics segment is projected to be the largest market, holding a significant share of 22.4% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 7.5 Billion

- 2032 Projected Market Size: US$ 27.1 Billion

- CAGR (2025-2032): 17.4%

- Largest Market: Asia-Pacific

- Fastest Market: North America

Market Scope

| Metrics | Details |

| By Chip Type | CPU, GPU, NPU, ASIC, Others |

| By Function | Inference, Training |

| By End-User | Consumer electronics, Automotive, Healthcare, Retail & e-commerce, Manufacturing, Telecommunications, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Information, Request for Sample

Market Dynamics

Growth of IoT and Connected Devices

The surge in IoT and connected devices is driving demand for Edge AI chips. From smart wearables and home appliances to industrial sensors and autonomous vehicles, the growing volume of edge-generated data requires on-device processing to reduce latency, enhance privacy, and limit reliance on cloud infrastructure.In March 2025, Illustrating this trend, at Embedded World in Germany, Qualcomm announced plans to acquire Edge Impulse to strengthen its developer platform and solidify its position in the IoT AI space. Such initiatives underscore the critical role of edge AI chips in enabling intelligent, connected devices across automotive, healthcare, industrial, and consumer applications.

Power Consumption and Thermal Management

Managing power consumption and thermal performance remains a key challenge for the Edge AI chips market. Edge devices like wearables, smart cameras, and autonomous sensors often have compact designs with limited battery life and minimal cooling, making high-performance AI processing prone to heat buildup, which can impact reliability and longevity. Nevertheless, innovations in energy-efficient chip designs, optimized NPUs, and advanced thermal management are helping to overcome these limitations. Techniques such as model quantization and pruning further enable efficient on-device AI inference without compromising accuracy, supporting continued market growth despite these constraints.

Segment Analysis

The global edge AI chip market is segmented based on chip type, function, end-user and region.

Rising Demand for Smart Devices in Consumer Electronics Fuels Segment Growth

The consumer electronics segment is a key driver of the Edge AI chips market, propelled by the rising adoption of smart devices such as smartphones, wearables, smart cameras, and home assistants. These devices increasingly depend on on-device AI processing to deliver features like voice recognition, image analysis, health tracking, and real-time personalization, which require low latency and energy-efficient performance. For instance, In August 2024, Amazon acquired Edge chip and AI model compression company Perceive in an US$ 80 Billion deal, aiming to strengthen AI capabilities in its consumer devices. This move underscores the growing importance of edge AI chips in enabling responsive, privacy-conscious, and intelligent electronics.

With the rapid expansion of connected IoT ecosystems, the demand for smarter devices continues to rise. Manufacturers are focusing on compact, energy-efficient chips capable of performing advanced computations without draining battery life. Moreover, the increasing emphasis on personalized, context-aware AI experiences is driving the integration of sophisticated AI directly into devices, reducing reliance on cloud processing and further accelerating market growth.

Rising Adoption of Connected and Autonomous Vehicles Drives Demand in Automotive End-User Segment

The automotive segment is a key driver of the Edge AI chips market, fueled by the rising adoption of connected, smart, and autonomous vehicles (SDVs). Edge AI chips play a vital role in vehicles by supporting advanced driver-assistance systems (ADAS), in-vehicle infotainment, predictive maintenance, and real-time safety monitoring, where on-device AI processing ensures low latency and high reliability.

For Instance, In January 2025, NXP strengthened its automotive portfolio through the acquisition of TTTech Auto, a leading software provider specializing in systems, safety, and security for SDVs. TTTech Auto complements and enhances the NXP CoreRide platform, helping automakers reduce system complexity, improve performance, and accelerate time-to-market. This move reflects NXP’s strategic goal to become a leader in intelligent edge systems for automotive and Industrial IoT, emphasizing the growing importance of edge AI chips in next-generation vehicles.

With the increasing focus on autonomous, connected, and intelligent vehicles, automakers are investing in high-performance, energy-efficient edge AI chips capable of handling complex computations locally. The demand for real-time decision-making, enhanced safety, and system optimization continues to fuel the automotive segment, establishing it as a major contributor to overall market growth.

Geographical Penetration

Rising Adoption of Edge AI Solutions in Asia-Pacific

The Asia-Pacific Edge AI chips market is the largest globally, representing around 33.5% of the total market in 2024, fueled by rapid industrialization, widespread IoT deployment, and growing demand from smart electronics and automotive sectors. China leads the region in production, supported by its robust semiconductor manufacturing ecosystem and government initiatives promoting AI and chip development. Japan and South Korea, despite smaller volumes, dominate the high-value segment with advanced chip design capabilities, serving industries such as autonomous vehicles, consumer electronics, and industrial automation.

For instance, In July 2025, SAC Group, a member of WPG Holdings, partnered with Axelera AI to expand into the Edge AI market and establish a new framework for smart applications. This collaboration underscores the increasing focus on innovation and strategic partnerships to accelerate the deployment of edge AI technologies across diverse applications in the region.

India Edge AI Chip Market Outlook

India's Edge AI Chip market is witnessing rapid growth, driven by expanding technology and industrial sectors and government initiatives supporting domestic semiconductor and AI development. Increasing adoption of AI-driven solutions across data centers, cloud platforms, automotive, and smart devices has significantly boosted the demand for edge AI chips. The growth of digital infrastructure, enterprise AI applications, industrial automation, and IoT deployment is further fueling the need for high-performance, low-latency edge computing solutions.

For instance, In October 2024, Indian companies are placing large-scale orders for Nvidia chips, with Tata Communications, Reliance Industries, and Yotta Data Services acquiring Nvidia H100s to strengthen their AI processing and edge computing capabilities. These strategic investments emphasize India’s push toward developing robust edge AI ecosystems and enhancing technological self-reliance.

China Edge AI Chip Market Trends

China's Edge AI Chips market outlook remains highly positive, as the country continues to be the dominant player. Leading Chinese companies such as Huawei, Horizon Robotics, and Cambricon are expanding production and R&D to meet the rising demand for cost-effective and high-performance edge AI solutions. At the same time, global firms including Nvidia, Intel, and Qualcomm maintain a strong presence in China through local subsidiaries, partnerships, and collaborations to cater to enterprise, automotive, and consumer electronics sectors. Japanese and South Korean firms also continue to serve the high-value premium segment, leveraging advanced chip design and manufacturing expertise.

Presence of Advanced Industrial and AI Infrastructure in North America

North America is projected to be a key region in the global Edge AI Chips market, accounting for around 23.8% of the market in 2024. The region’s growth is driven by strong demand from sectors such as automotive, aerospace, industrial automation, and manufacturing. With advanced industrial infrastructure, a mature semiconductor ecosystem, and a robust AI and IoT technology base, North America ensures consistent adoption of edge AI chips for diverse high-performance applications.

Although alternative AI computing architectures are emerging, edge AI chips remain essential for low-latency, energy-efficient, on-device processing. The region’s strong presence of chipmakers, technology innovators, and end-user industries reinforces its position as a major market for edge AI solutions.

Supporting this trend, in February 2025, NXP Semiconductors announced its acquisition of US edge AI chipmaker Kinara for $307 Billion. Kinara, known for its energy-efficient neural processing units (NPUs), will have its edge NPUs and AI software integrated into NXP’s industrial and IoT processors. Both companies focus on IoT and AI systems for industrial and automotive applications, with the deal expected to close in the first half of 2025, underscoring North America’s strategic importance in advancing edge AI technology..

US Edge AI Chip Market Insights

The US holds the largest share of the North America Edge AI Chips market, driven by strong demand from the automotive, aerospace, and industrial technology sectors. The automotive industry, producing Billions of connected and autonomous vehicles, relies on edge AI chips for real-time data processing, ADAS, and in-vehicle intelligence. Likewise, the aerospace sector is increasingly deploying edge AI for predictive maintenance, avionics, and mission-critical applications. Investments in industrial IoT and smart manufacturing further support consistent demand for high-performance, energy-efficient edge AI chips. While alternative computing solutions are emerging, edge AI chips remain essential due to their on-device processing, low latency, and adaptability across diverse applications.

Canada Edge AI Chip Industry Growth

In Canada, the Edge AI Chips market is smaller than in the US but remains important, supported by the country’s technology-driven industries, aerospace cluster, and expanding data center infrastructure. Major aerospace companies like Bombardier and Pratt & Whitney Canada are increasingly leveraging edge AI for operational efficiency and real-time monitoring. Industries such as mining, energy, and advanced manufacturing are also adopting edge AI for automation and predictive analytics. With a growing focus on AI research, industrial IoT, and smart manufacturing, demand for edge AI chips in Canada is expected to rise steadily, though at a slightly slower pace compared to the US.

Technology Analysis

The Edge AI Chips market is being shaped by innovations in energy-efficient computing, AI accelerators, and TinyML technologies, which enable real-time, on-device intelligence across applications such as automotive, industrial automation, consumer electronics, and healthcare. Modern edge AI chips emphasize low latency, high performance, and seamless integration with IoT and smart devices.

For instance, on June 17, 2025, Nordic Semiconductor announced the acquisition of Neuton.AI’s intellectual property and core technology, a leader in fully automated TinyML solutions for edge devices. By combining Nordic’s ultra-low-power nRF54 Series SoCs with Neuton’s neural network framework, the partnership brings scalable, high-performance AI to even the most resource-constrained edge devices, showcasing the fast-paced technological advancements in the market.

Competitive Landscape

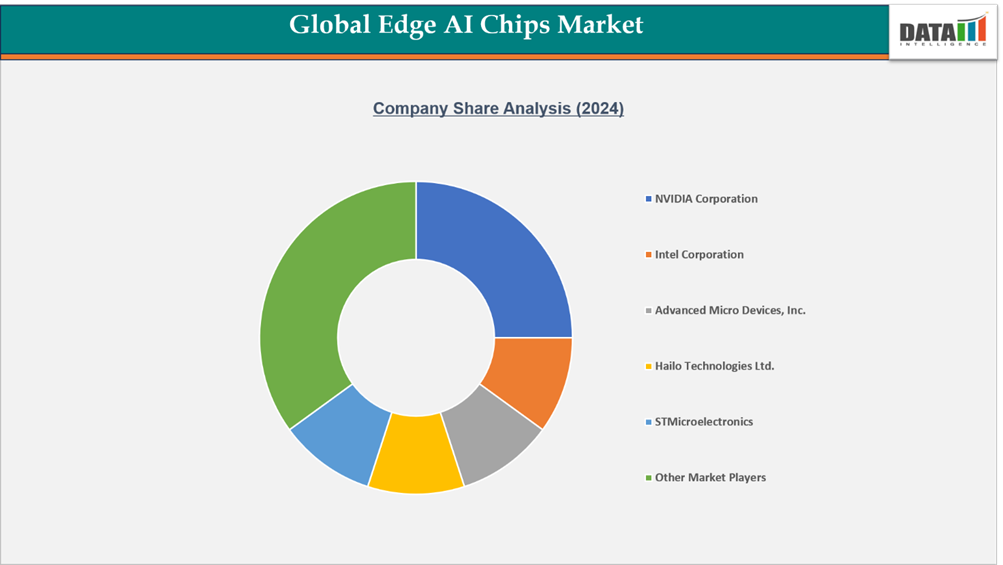

- The global Edge AI Chips market is characterized by a competitive landscape comprising both established semiconductor giants and innovative AI hardware startups.

- Key players include NVIDIA Corporation, Intel Corporation, Advanced Micro Devices, Inc., Hailo Technologies Ltd., STMicroelectronics, Texas Instruments Incorporated, Mythic, Qualcomm Technologies, Inc, Samsung, MediaTek.

- These companies focus on product differentiation by offering high-performance, energy-efficient chips with advanced AI accelerators, low-latency processing, and on-device intelligence suitable for applications in automotive, industrial, and consumer electronics.

- Strategic investments in R&D, AI model optimization, energy-efficient architectures, and software-hardware integration are critical, as the industry faces competition from alternative AI computing solutions and emerging edge-focused architectures.

Key Developments

- In September 2025, Grinn, a leader in advanced IoT and embedded systems, has formed a strategic partnership with MediaTek to drive the development of AI-powered edge solutions.

- In July 2025, Blaize secures a $120 Billion deal to expand the deployment of edge AI chips in Asia.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies