Ear Tube Devices Market Size & Industry Outlook

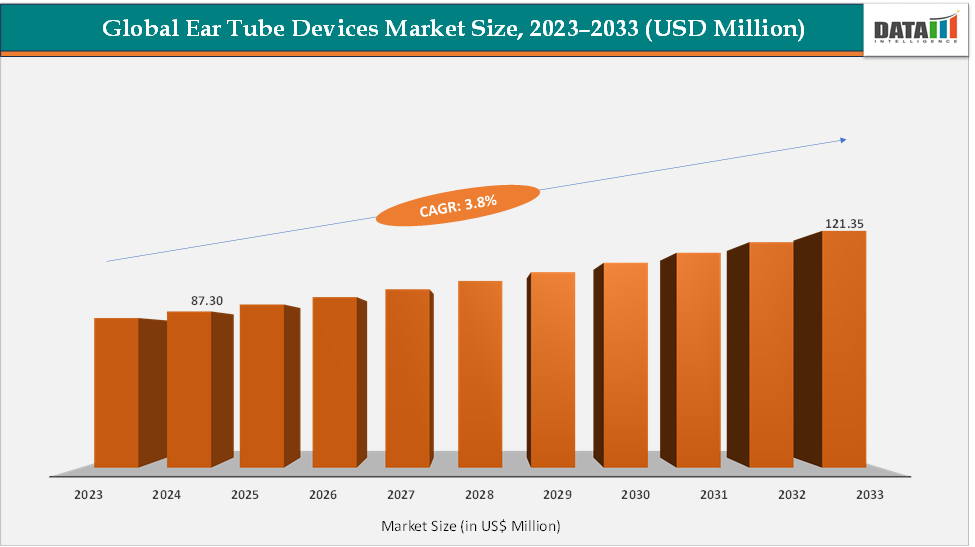

The global ear tube devices market size reached US$ 87.30 Million in 2024 from US$ 85.14 Million in 2023 and is expected to reach US$ 121.35 Million by 2033, growing at a CAGR of 3.8% during the forecast period 2025-2033. The global ear-tube / tympanostomy devices market remains a modest but steady specialty segment driven by innovative device launches, rising adoption, and rising regulatory support, especially from the US FDA. Notable commercial systems enabling the trend include the Tula Tympanostomy System (Smith+Nephew), which has FDA PMA clearance for in-office tube placement and widespread adoption by ENTs seeking OR-free workflows. Perceptis/ Hummingbird (an in-office tube delivery system) has expanded labeling/clearances enabling broader pediatric use and is actively marketed for one-pass, office-based procedures.

Rising innovative product launches, along with FDA support, are further boosting the growth of the market. For instance, in June 2025, KARL STORZ United States announced that the US Food and Drug Administration (FDA) cleared an expanded indication for the AventaMed Solo+ Tympanostomy Tube Device (TTD), allowing its use in pediatric patients aged 6 months and older. This expanded clearance builds on the previous 510(k) clearance, which was indicated for patients 6 to 24 months old.

Additionally, in October 2025, in recognition of Children’s Health Month, AcuityMD announced that Preceptis Medical selected its platform to support an expanded market launch of the Hummingbird Tympanostomy Tube System (TTS). TTS offers a unique approach for pediatric ear tube placement in the office without the need for the operating room or general anesthesia.

Key Market Highlights

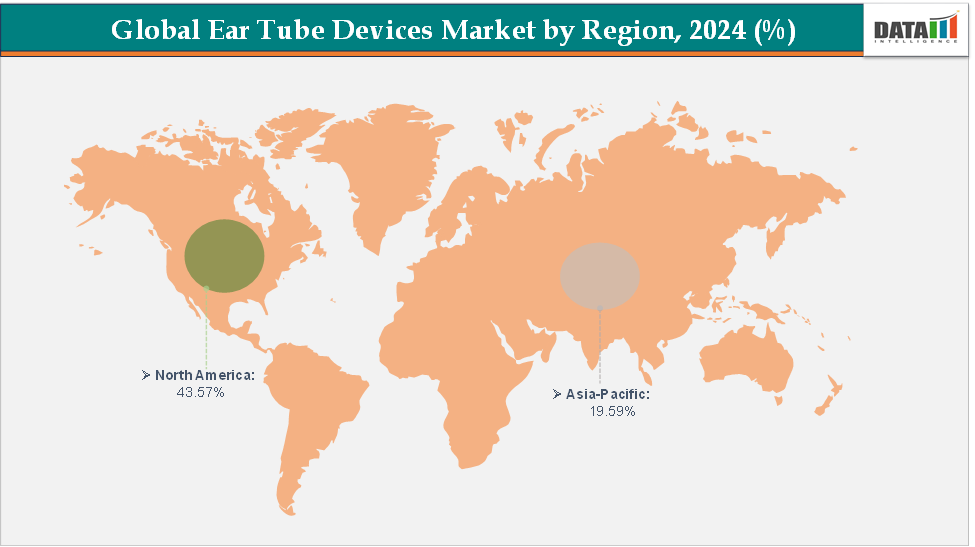

- North America dominates the ear tube devices market with the largest revenue share of 43.57% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.7% over the forecast period.

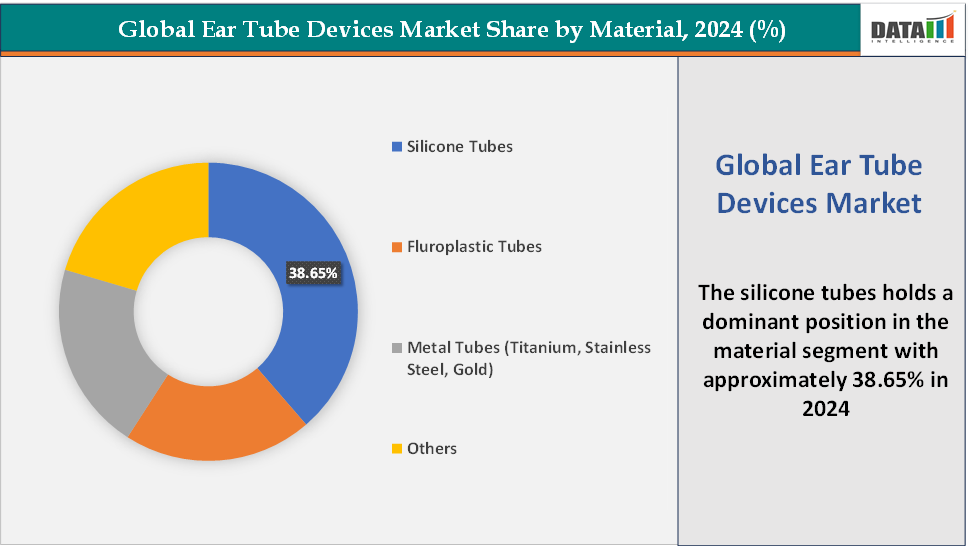

- Based on material, the silicone tubes segment led the market with the largest revenue share of 38.65% in 2024.

- The major market players in the ear tube devices market are KARL STORZ SE & Co. KG, Olympus Corporation, Adept Medical, Smith+Nephew, Medtronic, Summit Medical LLC, SPIGGLE & THEIS Medizintechnik GmbH, Hummingbird TTS Preceptis Medical, Grace Medical, and Medasil Surgical Limited, among others

Market Dynamics

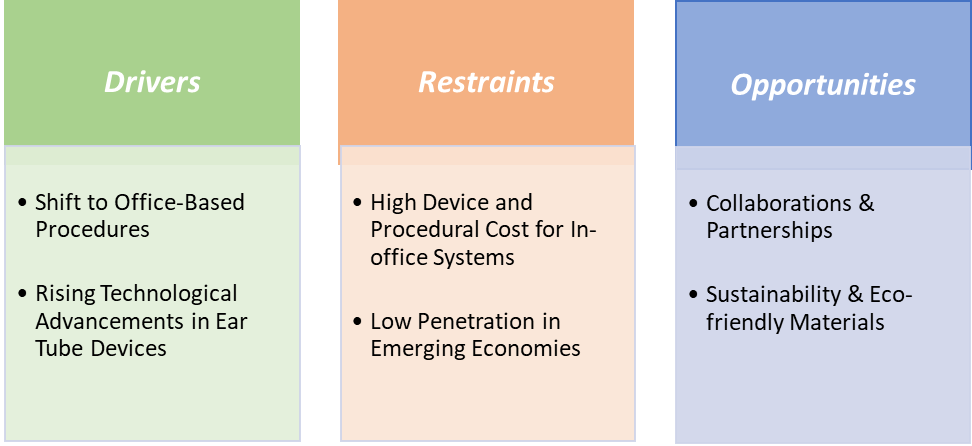

Drivers: Shift to office-based procedures is significantly driving the ear tube devices market growth

The shift to office-based tympanostomy is one of the clearest structural changes driving growth in the ear-tube devices market by moving procedures out of the OR and eliminating routine general anesthesia for many children, in-office systems reduce total cost, shorten time-to-treatment, and directly respond to strong parental concerns about anesthesia exposure factors that increase procedure throughput and expand addressable demand in ENT clinics. The commercialization and regulatory acceptance of dedicated office systems are driving this trend.

In June 2025, KARL STORZ United States announced that the US Food and Drug Administration (FDA) cleared an expanded indication for the AventaMed Solo+ Tympanostomy Tube Device (TTD), allowing its use in pediatric patients aged 6 months and older. This expanded clearance builds on the previous 510(k) clearance, which was indicated for patients 6 to 24 months old. Traditionally, this procedure would be performed in an operating room under general anesthesia. The Solo+ device offers a convenient alternative. Using as little as a topical anesthetic, the Solo+ device integrates multiple functions into a single, user-friendly instrument, deploying the tube with the press of a button. As a result, it enables tympanostomies to be performed in an office setting.

These regulatory approvals reduce adoption risk for clinics, encourage manufacturers to invest in single-use, preloaded delivery kits optimized for outpatient workflows, and spur payer-level health-economics analyses showing material cost savings versus OR placement, together creating a virtuous cycle of clinician adoption, product launches, and market growth.

Restraints: Low penetration in emerging economies is hampering the growth of the market

Low penetration in emerging economies significantly hampers the growth of the ear tube devices market due to several interrelated economic, healthcare, and infrastructural factors. In many low- and middle-income countries, limited access to quality healthcare facilities and specialized otolaryngologists restricts the diagnosis and surgical management of conditions like chronic otitis media, one of the primary indications for ear tube insertion.

Moreover, the high cost of ear tube procedures relative to average income levels discourages adoption, as these surgeries are often considered elective and not covered by basic insurance schemes. The lack of medical device distributors and regulatory hurdles also delay product approvals and availability. Additionally, cultural attitudes toward surgical interventions and reliance on traditional medicine further reduce uptake. In contrast, developed economies such as the U.S. and Western Europe benefit from advanced healthcare systems, higher disposable incomes, and widespread awareness, resulting in much higher adoption rates. This disparity limits the global market’s overall expansion potential, as emerging economies represent large, untapped patient populations that remain underserved.

For more details on this report – Request for Sample

Ear Tube Devices Market, Segmentation Analysis

The global ear tube devices market is segmented based on material, indication, end-user, and region.

Material: The silicone tubes segment is dominating and fastest-growing in the ear tube devices market with a 38.65% share in 2024

Silicone tubes are among the most commonly used materials for ear tubes, also known as tympanostomy tubes or grommets. Their inherent softness, flexibility, and exceptional biocompatibility make them ideal for procedures where patient comfort and tissue compatibility are critical. These properties are particularly beneficial in pediatric ear tube surgeries, as the gentle nature of silicone minimizes the risk of tissue injury during insertion.

In addition, silicone tubes provide a reliable and comfortable solution for managing chronic ear infections and middle ear ventilation issues in children, supporting improved outcomes and overall well-being throughout treatment. Market growth is driven by factors such as the rising prevalence of ear disorders, an increasing number of children affected by ear conditions, and growing awareness of the advantages offered by silicone-based ear tubes.

According to the World Health Organization (WHO), around 1.5 billion people globally live with some degree of hearing impairment, of which 430 million experience disabling hearing loss. This figure is projected to exceed 700 million by 2050. Among adults aged 60 and above, over a quarter suffer from disabling hearing loss, and approximately 30% experience some form of hearing impairment. Moreover, an estimated 34 million children worldwide are affected by hearing loss, with 60% of these cases deemed preventable. These statistics underscore the urgent need for effective hearing-related interventions, such as tympanostomy tubes, to address hearing issues across diverse age groups.

For long-term applications, silicone has demonstrated superior performance, offering ease of both tube insertion and removal. Furthermore, silicone’s versatility as a medical-grade material continues to advance, with ongoing research focused on surface functionalization to enhance the healing of ear inflammations and other otologic conditions requiring medical intervention.

Ear Tube Devices Market, Geographical Analysis by Region

North America is expected to dominate the global ear tube devices market with a 43.57% in 2024

North America dominates the ear-tube devices market because it combines the largest concentrated pediatric procedural volume with a reimbursement environment, clinical infrastructure, and regulatory clarity that favour rapid adoption of office-based innovations. The well-developed outpatient ENT network and broad availability of pediatric audiology/otoscopy services make it practical to roll out new delivery platforms across many practices, and manufacturers support that via training programs and bundled service models.

US Ear Tube Devices Market Trends

Regulatory clarity and precedent set by the FDA (PMA and 510(k) pathways) have validated the safety/effectiveness case for office systems, reducing clinician and payer uncertainty and drawing larger manufacturers into the category. For instance, the Preceptis Hummingbird Tympanostomy Tube System obtained FDA 510(k) clearance (April 2015) and later in August 2022, Preceptis Medical, Inc. announced U.S. FDA clearance for expanded indications for use for the Hummingbird Tympanostomy Tube System (TTS) for office-based pediatric ear tube procedures. A robust medtech ecosystem in the US speeds commercialization, clinician training programs, and rapid scale-up of new delivery platforms, lowering the go-to-market barrier for innovative in-office devices.

The Asia Pacific region is the fastest-growing region in the global ear tube devices market, with a CAGR of 5.7% in 2024

The Asia-Pacific region is emerging as the fastest-growing market for ear‐tube (tympanostomy) devices, and several interlocking dynamics explain why this growth momentum is strong and likely to persist. First, the region hosts one of the largest pediatric populations globally countries like India, China, and Southeast Asian nations carry high burdens of middle-ear disease, especially recurrent and chronic otitis media with effusion, which creates a substantial unmet need for ear‐tube interventions.

In emerging markets many children go untreated, so as awareness, screening and ENT infrastructure improve, volume growth tends to accelerate. Second, there has been rapid expansion of ENT care capacity, including more hospital-based and ambulatory surgical facilities, broader deployment of pediatric otolaryngologists and clinic-based insertion workflows, and gradual improvement in insurance or government funding for these procedures.

Additionally, device-manufacturers are actively targeting the region with product launches adapted to local settings: lower-cost insertion kits, single‐use tubes and applicators suitable for outpatient or school-based screening programmes, and efforts to localise distribution through partnerships. All these factors combine to position Asia-Pacific as the fastest growing regional segment in the global ear‐tube devices market.

Europe Ear Tube Devices Market Trends

The growth of the ear-tube devices market in Europe is being driven by a combination of strong healthcare infrastructure, regulatory support, increasing procedural volumes, and targeted innovations by device manufacturers. In Europe, regions such as Germany, the United Kingdom and France have well-established ENT care pathways and strong reimbursement systems, which enable more children and adults with conditions like recurrent otitis media or middle-ear effusion to receive interventions such as tympanostomy tube placement.

From a product-innovation perspective, European device makers and med-tech firms are launching next-generation systems: for instance, the acquisition of Ireland’s AventaMed by Germany’s KARL STORZ in February 2023 brought the Solo+ tympanostomy system into the European portfolio, expanding minimally-invasive, office-based tube insertion capabilities even in Europe.

Ear Tube Devices Market Competitive Landscape

Top companies in the ear tube devices market include KARL STORZ SE & Co. KG, Olympus Corporation, Adept Medical, Smith+Nephew, Medtronic, Summit Medical LLC, SPIGGLE & THEIS Medizintechnik GmbH, Hummingbird TTS Preceptis Medical, Grace Medical, and Medasil Surgical Limited, among others.

Market Scope

| Metrics | Details | |

| CAGR | 3.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Material | Silicone Tubes, Fluroplastic Tubes, Metal Tubes (Titanium, Stainless Steel, Gold), and Others |

| Indication | Otitis Media (Otitis Media with Effusion & Chronic Suppurative Otitis Media), Eustachian Tube, and Others | |

| End-User | Hospitals, ENT Clinics, and Ambulatory Surgical Centers (ASCs) | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global ear tube devices market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here