Dyslipidemia Market Size

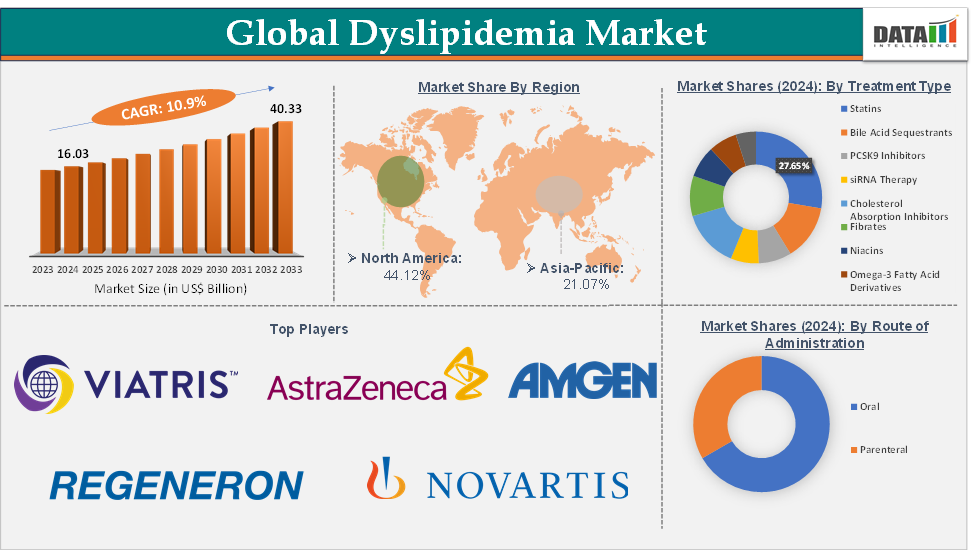

Dyslipidemia Market Size reached US$16.03 Billion in 2024 and is expected to reach US$40.33 Billion by 2033, growing at a CAGR of 10.9% during the forecast period 2025-2033, according to DataM Intelligence report.

Dyslipidemia Market Overview

Dyslipidemia refers to an abnormal concentration of lipids in the blood, such as elevated low-density lipoprotein cholesterol (LDL-C), elevated triglycerides, or low high-density lipoprotein cholesterol (HDL-C). As a major risk factor for cardiovascular diseases, including coronary artery disease and stroke, managing dyslipidemia is critical to reducing morbidity and mortality worldwide. The global dyslipidemia therapeutics market has demonstrated robust growth driven by rising obesity rates, sedentary lifestyles, and aging populations, which collectively contribute to increased prevalence of lipid disorders.

However, the market will also face ongoing challenges such as pricing pressures, payer scrutiny on high-cost biologics, and competition from generics. Manufacturers will need to demonstrate value through cardiovascular outcome trials and real-world evidence to justify premium pricing. Enhancing patient adherence via digital health tools and patient support programs will also be critical to maximize therapeutic outcomes and market uptake.

Executive Summary

For more details on this report – Request for Sample

Dyslipidemia Market Dynamics: Drivers & Restraints

Rising product developments and regulatory approvals are significantly driving the dyslipidemia market growth

New drug classes are entering the market, addressing unmet needs such as statin intolerance, residual cardiovascular risk, and poor patient adherence. These innovations are reshaping treatment paradigms and capturing new patient segments. For instance, in March 2024, Praluent (alirocumab) received FDA approval for pediatric patients (age ≥8) with heterozygous familial hypercholesterolemia. By enabling earlier intervention in high-risk children, this approval not only extended market reach but also encouraged clinicians to adopt PCSK9 inhibitors more broadly.

similarly, in February 2025, Celltrion Pharm Inc. launched domestic sales of its triple-combination drug for hypertension and hyperlipidemia, Amrozet Tablet. Amrozet combines the calcium channel blocker (CCB) amlodipine for hypertension with rosuvastatin and ezetimibe for hyperlipidemia treatment. It is available in four dosage combinations: 5/5/10 mg, 5/10/10 mg, 10/5/10 mg, and 10/10/10 mg. The insurance prices are set at 1,372 won ($0.93), 1,428 won, 1,638 won, and 1,694 won, respectively.

Rising regulatory approvals, especially FDA approvals, are significantly driving growth in the dyslipidemia market by introducing innovative and effective treatment options for lipid management, particularly for patients who do not respond well to traditional therapies like statins. This regulatory support accelerates the availability of novel drugs for dyslipidemia treatment, expanding the dyslipidemia market by addressing diverse patient needs and improving cardiovascular outcomes.

For instance, in February 2025, LIB Therapeutics Inc. announced the U.S. Food and Drug Administration (FDA) accepted for review the Biologics License Application (BLA) of Lerodalcibep to reduce low-density lipoprotein cholesterol (LDL-C) for the treatment of patients with atherosclerotic cardiovascular disease (ASCVD), or very high or high risk of ASCVD, and primary hyperlipidemia, including heterozygous, and those 10 years or older with homozygous familial hypercholesterolemia (HeFH / HoFH).

The high cost associated with the dyslipidemia treatment is hampering the growth of the dyslipidemia market

The high cost of advanced dyslipidemia treatments, particularly newer therapies like PCSK9 inhibitors and RNA-based drugs, is a barrier to the dyslipidemia market growth. For instance, according to the NIH, PCSK9 inhibitors were initially priced at around $14,000 per year, making them less accessible despite their effectiveness in lowering LDL cholesterol in high-risk patients. Although prices have since been reduced to around $5,850 annually in some markets, they remain costly compared to generic statins, which can be as low as $10 per month.

This price disparity limits access, especially among uninsured patients or those in low- and middle-income countries, and contributes to lower patient adherence for dyslipidemia. Additionally, high costs put pressure on healthcare systems and insurance providers, often resulting in restrictive reimbursement policies. Consequently, fewer prescriptions for these advanced drugs are written, slowing market adoption and hampering growth despite rising demand for innovative treatments for dyslipidemia.

Dyslipidemia Market Segment Analysis

The global dyslipidemia market is segmented based on treatment type, route of administration, and region.

The statins from the treatment type segment are expected to hold 27.65% of the market share in 2024 in the dyslipidemia market

Ever since lovastatin launched in the late 1980s, statins have been shown to lower LDL-C by 30–60% on average and to reduce cardiovascular events and mortality in both primary and secondary prevention. As a result, major guidelines (ACC/AHA, ESC/EAS) uniformly recommend statins as first-line therapy for virtually all patients with elevated LDL-C or established atherosclerotic cardiovascular disease (ASCVD). This “default” positioning means that virtually every newly diagnosed dyslipidemic patient begins on a statin unless there is documented intolerance or a very specific contraindication.

When atorvastatin (Lipitor) lost exclusivity in 2011 and rosuvastatin (Crestor) began facing generics in the mid-2010s, many markets saw prices drop by more than 90%. A typical generic statin prescription can cost under $10–$15 per month, making it accessible even in resource-limited settings. By contrast, newer non-statin treatments (PCSK9 inhibitors, bempedoic acid, inclisiran) often carry out-of-pocket co-pays in the hundreds of dollars or more. This vast price differential ensures that statins account for roughly 60–70% of overall dyslipidemia prescriptions and revenue in most regions, even though their share of total spend is lower than their share of patient volume.

Moreover, these drugs for dyslipidemia are among the top-selling lipid-lowering drugs worldwide. For instance, Atorvastatin, sold under the brand name Lipitor, manufactured by Viatris Inc., has generated approximately US$ 1,468.8 million in 2024. In addition, Rosuvastatin, sold under the brand name Crestor, manufactured by AstraZeneca, generated approximately US$ 1,153 million in the same year.

Dyslipidemia Market Geographical Analysis

North America is expected to dominate the global dyslipidemia market with a 44.12% share in 2024

Many leading dyslipidemia manufacturers (Amgen, Regeneron, AstraZeneca, Merck, and Esperion) and other emerging market players are headquartered or maintain large R&D centers in North America, giving the region a first‐mover advantage on clinical trials and regulatory filings. U.S. trial sites often enroll faster than those in other regions, accelerating NDA/BLA submissions.

For instance, in July 2024, NewAmsterdam Pharma completed the enrollment of 407 patients in the pivotal Phase III TANDEM clinical trial evaluating obicetrapib in combination with ezetimibe in patients with heterozygous familial hypercholesterolemia (HeFH) and/or atherosclerotic cardiovascular disease (ASCVD). Obicetrapib has demonstrated strong tolerability in more than 800 patients with elevated lipid levels in NewAmsterdam’s clinical trials to date. NewAmsterdam’s obicetrapib is expected to be the most promising agent to launch in the dyslipidemia market by 2032.

Broad insurance coverage (Medicare, Medicaid, and private payers) in the U.S. generally reimburses first‐line statins with minimal out‐of‐pocket cost, encouraging near‐universal adoption. When high‐cost therapies like PCSK9 inhibitors (e.g., evolocumab/Repatha and alirocumab/Praluent) were introduced, early payers carved out prior‐authorization pathways that allowed patients at highest cardiovascular risk (e.g., familial hypercholesterolemia, recent myocardial infarction) to access them.

Asia-Pacific is growing at the fastest pace in the dyslipidemia market, holding 21.07% of the market share

The Asia Pacific region is experiencing the fastest growth in the dyslipidemia market due to the rising prevalence of lipid disorders and increasing healthcare investments. Countries like China, India, and Japan are witnessing significant lifestyle shifts, including increased consumption of high-fat diets and sedentary behaviors, contributing to an escalating burden of dyslipidemia and associated cardiovascular diseases.

For instance, according to the National Institute of Health, 2024, the metabolic non-communicable disease health report of India: the ICMR-INDIAB nationwide cross-sectional epidemiological study (ICMR-INDIAB-17), 12 on 1,13,043 individuals (79,506 from rural and 33,537 from urban areas) showed the overall prevalence of dyslipidemia to be 81.2%. Low HDL cholesterol accounted for most, with a prevalence of 66.9%.

Governments in the Asia-Pacific region are increasing healthcare spending, with an emphasis on preventive care and managing chronic diseases. For instance, Japan’s "Healthy Life Expectancy" initiative includes aggressive screening programs for cardiovascular risk factors, fostering early detection and treatment of dyslipidemia. Moreover, multinational pharmaceutical companies are increasingly entering the Asia-Pacific market, forming partnerships with local firms to expand drug access and support new product launches.

Dyslipidemia Market Top Companies

Top companies in the dyslipidemia market include Viatris Inc., AstraZeneca, Organon group of companies, Regeneron Pharmaceuticals, Inc., Amgen Inc., Novartis AG, Esperion Therapeutics, Inc., Pfizer Inc., Teva Pharmaceuticals USA, Inc., and Lupin Pharmaceuticals, Inc., among others.

Emerging Players

The emerging players in the dyslipidemia market include Arrowhead Pharmaceuticals, Inc., Alnylam Pharmaceuticals, Inc.,Kowa Pharmaceuticals America, Inc., Gemphire Therapeutics Inc., and Ionis Pharmaceuticals, Inc., among others.

Dyslipidemia Market Key Developments

In February 2025, LIB Therapeutics Inc. announced the U.S. Food and Drug Administration (FDA) accepted for review the Biologics License Application (BLA) of Lerodalcibep to reduce low-density lipoprotein cholesterol (LDL-C) for the treatment of patients with atherosclerotic cardiovascular disease (ASCVD), or very high or high risk of ASCVD, and primary hyperlipidemia, including heterozygous, and those 10 years or older with homozygous familial hypercholesterolemia (HeFH / HoFH).

In June 2024, Daewoong Bio launched a new product that combines the hyperlipidemia drug rosuvastatin with the dietary supplement Omega-3. It offers improvements in lipids and instability, and tolerability compared to rosuvastatin alone.

In March 2024, Esperion cleared that the United States Food and Drug Administration (FDA) has approved broad new label expansions for NEXLETOL (bempedoic acid) Tablets and NEXLIZET (bempedoic acid and ezetimibe) Tablets based on positive CLEAR Outcomes data that include indications for cardiovascular risk reduction and expanded LDL-C lowering in both primary and secondary prevention patients. In addition, the enhanced labels support the use of NEXLETOL and NEXLIZET either alone or in combination with statins.

In March 2024, the U.S. Food and Drug Administration (FDA) approved Praluent (alirocumab) developed by Regeneron Pharmaceuticals Inc. for extended application to pediatric patients aged 8 and older with heterozygous familial hypercholesterolemia (HeFH). This drug can be used in adjunct with diet and other lipid-lowering drugs.

Market Scope

Metrics | Details | |

CAGR | 10.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Treatment Type | Statins, Bile Acid Sequestrants, PCSK9 Inhibitors, siRNA Therapy, Cholesterol Absorption Inhibitors, Fibrates, Niacins, Omega-3 Fatty Acid Derivatives and Others |

Route of Administration | Oral and Parenteral | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global dyslipidemia market report delivers a detailed analysis with 60+ key tables, more than 55+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.