Drug Discovery Services Market Size & Industry Outlook

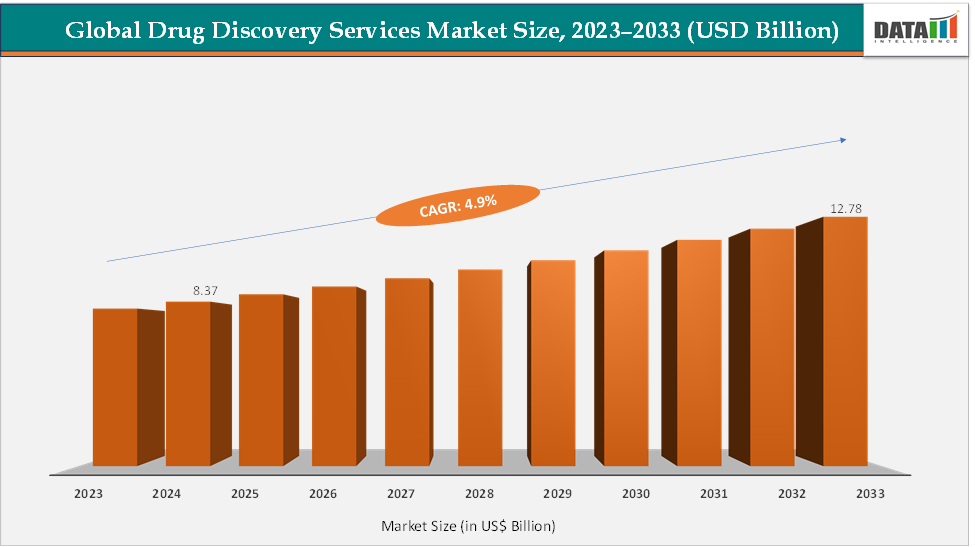

The global drug discovery services market size reached US$ 8.37 Billion in 2024 from US$ 8.01 Billion in 2023 and is expected to reach US$ 12.78 Billion by 2033, growing at a CAGR of 4.9% during the forecast period 2025-2033. The increasing prevalence of chronic diseases, growing R&D expenditure, and technological advancements are key drivers of drug discovery services market growth. However, high costs and long timelines, complex regulatory environments, and high failure rates in clinical trials pose significant challenges.

Pharmaceutical companies are increasingly outsourcing drug discovery processes to specialized service providers to streamline research timelines, reduce costs, and enhance the success rate of drug development. The market is poised for continued growth, supported by technological innovations, increasing demand for personalized medicine, and strategic collaborations between pharmaceutical companies and service providers. The integration of advanced technologies and the expansion into emerging markets are expected to further propel the market forward.

Key Market Highlights

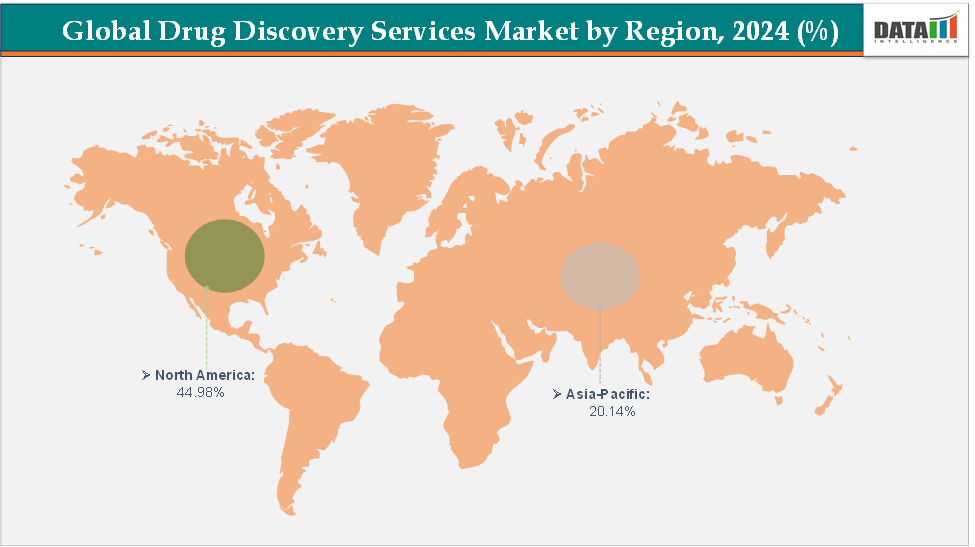

- North America dominates the drug discovery services market with the largest revenue share of 44.98% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.7% over the forecast period.

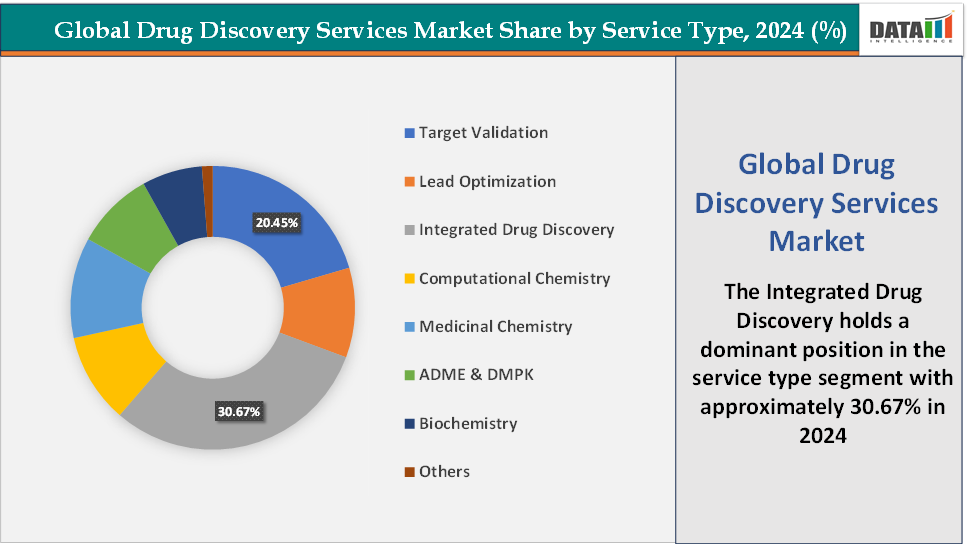

- Based on service type, the integrated drug discovery segment led the market with the largest revenue share of 30.67% in 2024.

- The major market players in the drug discovery services market are Charles River Laboratories, Thermo Fisher Scientific Inc., Labcorp, WuXi AppTec, Evotec, Domainex, GenScript, and Pharmaron, among others

Market Dynamics

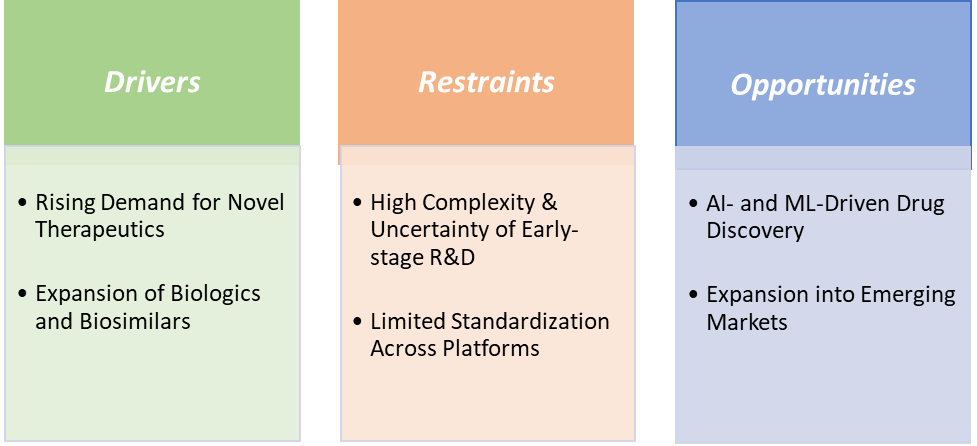

Drivers: Rising demand for novel therapeutics is significantly driving the drug discovery services market growth

Globally, many people are facing a surge in chronic illnesses like cancer, diabetes, and neurological disorders due to aging populations and urban lifestyles. This has created an urgent need for innovative, targeted treatments, pushing pharmaceutical companies to invest in drug discovery. Biopharmaceutical companies are rapidly expanding their focus from traditional small molecules to biologics, biosimilars, and gene therapies. These therapies require specialized drug discovery services, including molecular modeling, target validation, and biologic assay development.

Demand for novel therapies has spurred the use of AI, big data, and high-throughput screening platforms. AI-driven platforms are shortening drug development timelines and reducing failure rates. For instance, in April 2024, Aurigene Pharmaceutical Services, an arm of Dr. Reddy’s Laboratories, launched Aurigene.AI, an AI and ML-assisted platform for accelerating drug discovery projects from hit identification to candidate nomination. These further accelerate the demand for drug discovery services globally. The rise in demand for novel therapies has led to a boom in clinical trials, especially in oncology, rare diseases, and immunotherapy. This has created a robust need for upstream drug discovery services to feed the clinical pipeline.

Restraints: High complexity & uncertainty of early-stage R&D are hampering the growth of the market

The intrinsic complexity and uncertainty of early-stage R&D create several drag factors for the drug discovery services market. Less than 5% of preclinical candidates ever reach human trials, so CROs must constantly absorb costs for projects that never yield a viable lead. Developing and validating novel target assays (e.g., complex phenotypic screens for neurodegenerative targets) can take 9–18 months alone, delaying downstream workflows and contract awards.

A failure in target validation or a sudden shift in disease biology (e.g., new insights into tumor microenvironment) forces service providers to restart key experiments, and clients often hesitate to commit budget until “proof-of-concept” is robust. RNA-targeting and gene-editing platforms require specialized equipment and expertise. Variation in biological materials (cell lines, primary tissues) and complex multi-omics data integration leads to frequent irreproducibility of lead-finding experiments, undermining confidence in outsourced results.

In essence, the very attributes that make early drug discovery so valuable, novel targets, cutting-edge modalities, and complex biology, also generate high technical risk and cost, slowing decision-making, inflating project timelines, and ultimately hampering the steady growth of the drug discovery services market.

For more details on this report – Request for Sample

Drug Discovery Services Market, Segment Analysis

The global drug discovery services market is segmented based on service type, application, and region.

Service Type: The integrated drug discovery segment is dominating the drug discovery services market with a 30.67% share in 2024

The integrated drug discovery services segment, where a single provider manages everything from target identification through lead optimization and preclinical candidate nomination, has emerged as the dominant model in the market. Clients prefer one-stop solutions to avoid multi-vendor coordination. End-to-end data integration and shared informatics accelerate decision-making. Many companies are developing drug discovery platforms with advancements, which further driving the segment growth.

For instance, in May 2025, Viva Biotech, a company that provides one-stop services ranging from early-stage structure-based drug R&D to commercial manufacturing to global biopharmaceutical innovators, successfully held the AIDD platform launch event "Enchantment of Drug Discovery", unveiling the advanced and comprehensive AI-Driven Drug Discovery (AIDD) platform to the industry. Through a series of case studies, Dr. Qian showcased how Viva's AIDD platform acts as a transformative "enchantment" for drug R&D, offering an intelligent, efficient, and integrated approach to accelerate the discovery of novel therapeutics.

Additionally, in May 2024, Enzene launched a Discovery Division at its Pune facility to meet increasing industry demands. This division will offer integrated discovery services, including antibody services, reagent production, and multi-platform assays. The state-of-the-art laboratories are expected to be operational by July, with further expansions planned.

The target validation is the fastest-growing segment in the drug discovery services market, with a 20.45% share in 2024

Target validation is a critical early step in drug discovery where researchers confirm that a biological target is directly involved in a disease process and is “druggable.” This step is essential to ensure that efforts to design or identify a drug will be effective, making it a cornerstone of the drug discovery process. Accurate target validation reduces costly failures in later development stages. Since many drug candidates fail due to poor target selection, pharma companies prioritize robust validation to improve success rates, driving demand for these services.

Techniques like CRISPR gene editing, RNA interference (RNAi), proteomics, and high-throughput screening have advanced target validation, making it a highly specialized and resource-intensive segment. Providers with expertise in these technologies dominate the market. Due to complexity and cost, many pharma companies outsource target validation to Contract Research Organizations (CROs) with advanced capabilities. Global growing CRO sector, especially in emerging regions, benefits from this trend.

Drug Discovery Services Market, Geographical Analysis

North America is dominating the global drug discovery services market with a 44.98% in 2024

North America dominates the global drug discovery services market due to its strong presence of leading pharmaceutical and biotechnology companies, advanced research infrastructure, and high R&D spending. The U.S. alone contributes the largest market share, supported by extensive funding, robust clinical trial activity, and rapid adoption of technologies like AI-driven discovery and high-throughput screening. Additionally, a favorable regulatory environment and strong intellectual-property protection continue to attract innovation, keeping North America at the forefront of global drug discovery efforts.

US Drug Discovery Services Market Trends

The United States is home to some of the world’s largest pharmaceutical companies, such as Pfizer, Merck, Johnson & Johnson, and Bristol Myers Squibb. It also has strong biotech clusters such as Boston-Cambridge, San Diego, and the San Francisco Bay Area, which heavily invest in early-stage R&D and outsource to CROs, further fueling demand for drug discovery partnerships. These centers are also developing drug discovery platforms, which are further boosting the market growth.

For instance, in April 2025, the Icahn School of Medicine at Mount Sinai launched the AI Small Molecule Drug Discovery Center, a bold endeavor that harnesses artificial intelligence (AI) to revolutionize drug development. The new Center will integrate AI with traditional drug discovery methods to identify and design new small-molecule therapeutics with unprecedented speed and precision.

The US has cutting-edge research institutions, academic partnerships, and a robust clinical trial network. The country leads in the adoption of AI, machine learning, and high-throughput screening technologies in drug discovery. For instance, Charles River Laboratories and Labcorp Drug Development are U.S.-based CROs offering fully integrated drug discovery platforms and dominate global service contracts.

The Asia Pacific region is the fastest-growing region in the global drug discovery services market, with a CAGR of 5.7% in 2024

The Asia-Pacific region is the fastest-growing market in global drug discovery services due to its unique combination of expanding healthcare needs, large scientific talent pool, and cost-efficient R&D ecosystem. Countries like China, India, Japan, and South Korea are heavily investing in biotechnology infrastructure, enabling rapid growth in early-stage research capabilities and attracting global outsourcing from major pharmaceutical companies. The rising prevalence of chronic diseases, especially cancer, diabetes, and cardiovascular disorders, is further increasing demand for innovative therapeutics and accelerating discovery activity across the region.

APAC also offers significantly lower operational and labour costs, allowing CROs and biotech companies to deliver high-quality services at competitive prices. Moreover, the region is witnessing a surge in AI-driven drug discovery, supported by strong government funding and rapid digitalization. China and India, in particular, are emerging as global hubs for preclinical research, high-throughput screening, and computational biology. With expanding biotech clusters, favorable regulatory reforms, and a growing pipeline of domestic pharma companies, the Asia-Pacific region is expected to maintain its strong growth momentum and continue outpacing all other regions in the drug discovery services market.

Europe Drug Discovery Services Market Trends

Europe is a major growth engine for the global drug discovery services market and is steadily expanding due to its strong scientific ecosystem and coordinated regional initiatives. The region benefits from substantial public and private funding, including large-scale programs such as Horizon Europe and the Innovative Medicines Initiative (IMI), which inject billions into early-stage drug research, supporting collaboration among universities, biotech firms, and CROs.

Europe also hosts several world-leading discovery service providers such as Evotec, Sygnature Discovery, Eurofins Scientific, and NovAliX alongside major biotech hubs in the UK, Germany, France, Switzerland, and the Netherlands, which specialize in medicinal chemistry, biologics development, and integrated discovery platforms. The market further benefits from strong regulatory alignment under the European Medicines Agency (EMA), enabling smoother cross-border clinical and preclinical research.

Additionally, the rising prevalence of chronic diseases, growing investments in AI-enabled discovery, and the expansion of cost-efficient R&D centers in Eastern Europe are broadening the region’s capabilities and appeal. These combined strengths, rich talent pools, advanced infrastructure, regulatory support, and strategic funding are accelerating Europe’s role as a key contributor to global drug discovery services growth.

Drug Discovery Services Market Competitive Landscape

Top companies in the drug discovery services market include Charles River Laboratories, Thermo Fisher Scientific Inc., Labcorp, WuXi AppTec, Evotec, Domainex, GenScript, and Pharmaron, among others.

Drug Discovery Services Market Scope

| Metrics | Details | |

| CAGR | 4.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Service Type | Integrated Drug Discovery, Target Validation, Lead Optimization, Computational Chemistry, Medicinal Chemistry, ADME & DMPK, Biochemistry, and Others |

| Application | Oncology, Neurology, Metabolic Disorders, Inflammatory Diseases, Immunology, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global drug discovery services market report delivers a detailed analysis with 48 key tables, more than 48 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here