DNA Forensics Market Size and Trends

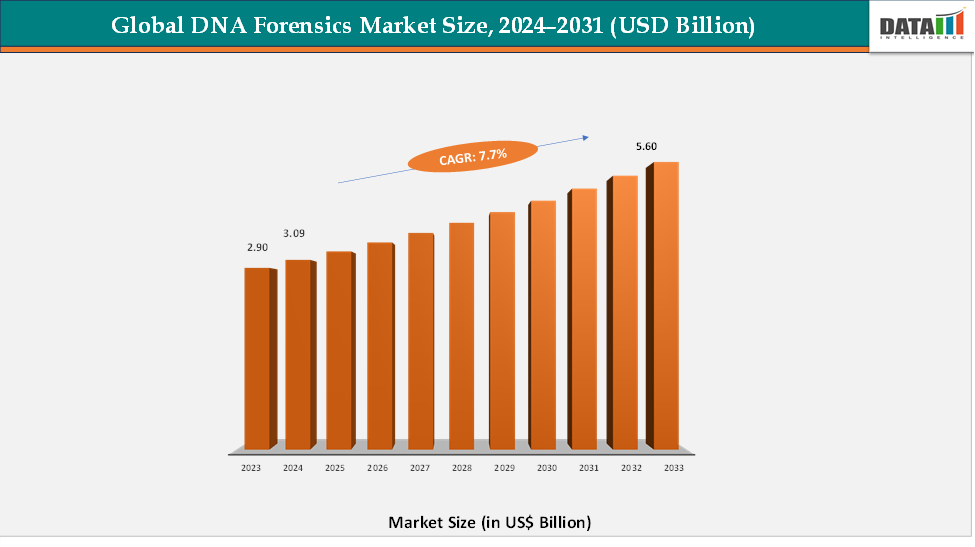

The global DNA forensics market reached US$ 2.90 billion in 2023, with a rise to US$ 3.09 billion in 2024, and is expected to reach US$ 5.60 billion by 2033, growing at a CAGR of 7.7% during the forecast period 2025–2033. The rapid advancement of DNA forensics is revolutionizing criminal investigations and legal proceedings by enabling faster and more precise identification through genetic profiling and advanced sequencing methods. With its ability to analyze even highly degraded samples, DNA forensics is helping law enforcement agencies solve cold cases, reduce investigation timelines, and improve conviction accuracy. This growing reliance on DNA-based evidence is strengthening judicial outcomes and enhancing public safety, establishing DNA forensics as a critical pillar of modern criminal justice systems worldwide.

Key Market highlights

North America dominates the DNA forensics market with over 42.5% revenue share, driven by the presence of advanced forensic infrastructure, strong government funding, and widespread adoption of technologies for criminal investigations and cold-case resolutions.

Asia-Pacific is emerging as the fastest-growing region with an 18.9% share, supported by expanding forensic laboratories, rising investments in national DNA databases, and increasing use of genetic technologies in law enforcement across countries like China and India.

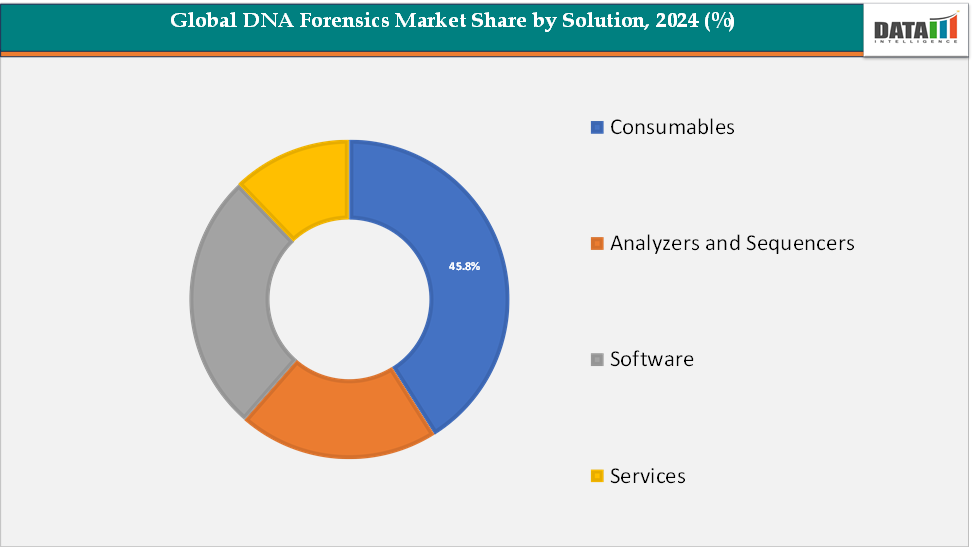

The consumables segment dominates the market, accounting for 65.8% of the overall share, owing to the recurring demand for reagents, extraction kits, and other lab essentials required for every forensic DNA test, making it the backbone of revenue generation in this sector.

Market Size & Forecast

2024 Market Size: US$ 3.09 Billion

2033 Projected Market Size: US$ 5.60 Billion

CAGR (2025–2033): 7.7%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Rising Criminal Investigations and Forensic Cases

Rising criminal investigations and forensic casework are significantly driving growth in the DNA forensics market, as law enforcement agencies increasingly rely on advanced genetic technologies to solve complex and cold cases. Several governments and companies are working together to cater to the needs of rising demand for forensic labs with the growing investigations. For instance, Australia launched its first independent forensic laboratory in 2025, dedicated to solving cold cases and unidentified human remains.

Complementing these developments, in November 2024, the European Union Drugs Agency (EUDA) convened the inaugural meeting of its newly established network of forensic and toxicological laboratories, a key initiative under its updated mandate to enhance EU preparedness on drugs. These initiatives collectively highlight how the surge in criminal and cold-case investigations, combined with expanding forensic infrastructure and international collaboration, is driving investments in advanced DNA technologies and investigative genetic genealogy worldwide.

Restraint: Privacy and ethical concerns

One of the key challenges for the DNA forensics market lies in rising privacy and ethical concerns. Although DNA profiling is a powerful tool for solving crimes, it raises sensitive issues around how genetic data is stored, shared, and protected. Fears of misuse can reduce public trust and cooperation with law enforcement. Ethical debates over informed consent, particularly when using relatives’ DNA in forensic genetic genealogy, further complicate adoption. Without clear policies, strong data protection, and transparent ethical frameworks, these concerns could restrict the growth of DNA forensics despite its proven value in modern criminal justice.

For more details on this report, Request for Sample

Segmentation Analysis

The global DNA forensics market is segmented by product type, application, end-user, and region.

Product Type:The consumables segment is estimated to have 65.8% of the DNA forensics market share.

The consumables segment currently dominates the DNA forensics market, holding the largest revenue share. This is primarily because every forensic analysis, whether STR profiling, mitochondrial DNA testing, or next-generation sequencing, requires a steady and repeated purchase of reagents, extraction kits, columns, and other lab-grade disposables. Unlike analyzers or sequencers that involve one-time capital investments, consumables represent recurring expenditures, making them indispensable and consistently in demand. The consumables segment holds approximately 45.8% of the total market share, driven by the surge in criminal casework, cold-case re-examinations, and the growing need for validated, high-sensitivity reagents for degraded samples. A key development reinforcing this trend is the rising adoption of advanced NGS library prep kits by forensic labs in the U.S. and Europe to accelerate backlog reduction, underscoring why consumables remain the revenue backbone of the market.

The software segment is estimated to have 15.8% of the DNA forensics market share.

The software segment is the fastest-growing in the DNA forensics market, fueled by the integration of AI, machine learning, and big data analytics into forensic workflows. Unlike consumables, which scale linearly with sample volume, software dramatically increases efficiency by automating data interpretation, enabling genetic genealogy searches, and supporting database integrations across jurisdictions. Recent years have witnessed strong momentum. For instance, in June 2025, Othram recently announced a major expansion of its business model to offer deployable workflow solutions. Originally developed for its own genomic services, these solutions enable other laboratories, agencies, and partners to access the same advanced capabilities that underpin Othram’s forensic successes.

With crime labs under pressure to resolve cases faster and with greater accuracy, the demand for forensic-grade analytical software is expected to outpace all other segments, cementing it as the fastest-expanding category.

Geographical Analysis

The North America DNA forensics market was valued at 42.5% market share in 2024

North America is expected to maintain its dominant position in the global DNA forensics market, primarily due to its advanced forensic infrastructure, high crime rates requiring sophisticated investigations, and strong government investments in forensic science. The U.S., in particular, has one of the largest DNA databases in the world, the Combined DNA Index System (CODIS), which drives continuous demand for DNA profiling technologies and consumables.

Federal and state-level funding programs are consistently strengthening crime lab capacities, while partnerships with private forensic genomics companies are accelerating the resolution of cold cases through advanced methods like whole-genome sequencing and investigative genetic genealogy. For instance, in September 2024, the NIJ announced $1.1 million in funding for three new projects under its Public Labs Research & Evaluation (R&E) program. This initiative aims to enhance forensic science by advancing efficient, accurate, reliable, and cost-effective methods for testing and interpreting physical evidence in publicly funded laboratories.

Together with the strong presence of leading players such as Thermo Fisher Scientific, Illumina, and Othram, North America’s well-established forensic ecosystem ensures its continued market leadership.

The Europe DNA Forensics market was valued at 21.8% market share in 2024

Europe represents a steadily growing DNA forensics market, characterized by its strong regulatory environment, cross-border cooperation, and emphasis on ethical use of genetic data. The region benefits from well-established forensic networks such as the European Network of Forensic Science Institutes (ENFSI), which ensures high standards across member states. In recent years, European countries have focused on strengthening privacy-compliant forensic workflows, particularly under the EU’s General Data Protection Regulation (GDPR), which governs the use and sharing of genetic data. While this regulatory focus can sometimes slow down rapid adoption compared to North America or APAC, it also builds trust in the system, supporting long-term sustainable growth.

Several European nations, including the UK, Germany, and France, have been investing in next-generation sequencing platforms and expanding their forensic DNA databases to tackle rising criminal complexity and terrorism-related threats. The growing use of forensic genomics in both law enforcement and humanitarian applications, such as identifying missing persons from migration crises, is also expanding the scope of DNA forensics in Europe. This positions the region as a stable and innovation-driven contributor to the global market, though its growth pace is more measured compared to APAC.

The Asia-Pacific DNA Forensics market was valued at 18.9% market share in 2024

The Asia-Pacific region is projected to be the fastest-growing market for DNA forensics, fueled by a surge in government-backed initiatives, expanding forensic infrastructure, and rising crime complexity across emerging economies. Countries like China, India, and Japan are significantly increasing investments in forensic laboratories and national DNA databases, recognizing the role of forensic science in modern policing and judicial efficiency. Additionally, the region’s large population, increasing crime rates, and emphasis on modernizing criminal justice systems are expected to contribute to a double-digit CAGR, making APAC the fastest-growing hub for DNA forensics.

China has been rapidly expanding its DNA database, which is already among the largest globally, while India has been strengthening its DNA testing infrastructure under the Criminal Procedure (Identification) Act, passed in 2022, which began full-scale implementation in subsequent years. Growing collaborations between APAC governments and technology providers have led to the deployment of advanced sequencing systems and forensic kits in regional crime labs, accelerating adoption.

Competitive Landscape

The major players in the DNA forensics market include Abbott, Promega Corporation, Thermo Fisher Scientific Inc., QIAGEN, Illumina, Inc., InVita Healthcare Technologies, Omega Bio-tek, Inc., Takara Bio Inc., SCIEX, Bio-Rad Laboratories, Inc., among others.

Abbott:

Abbott plays a significant role in the DNA forensics market through its expertise in molecular diagnostics, advanced laboratory technologies, and high-quality consumables. The company’s real-time PCR instruments, extraction kits, and reagents are widely used in forensic laboratories for DNA profiling, human identification, and genetic analysis in criminal investigations.

Key Developments:

In April 2024, QIAGEN launched its Investigator Quantiplex Pro FLX Kit, designed to deliver exceptional sensitivity for forensic laboratories handling casework samples. The new kit enables precise DNA quantification, giving researchers greater confidence in evaluating sample quality and making informed decisions for downstream forensic workflows.

Market Scope

Metrics | Details | |

CAGR | 7.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Solution | Consumables, Analyzers and Sequencers, Software, Services |

Method | PCR Amplification, Capillary Electrophoresis, Next Generation Sequencing, Others | |

Application | Criminal Testing, Paternity and Familial Testing, Others | |

End-User | Medical and Research Institutions, Law Enforcement Agencies, Legal and Judicial Systems, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global DNA forensics market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostics-related reports, please click here