Heart Failure POC and LOC Devices Market Size

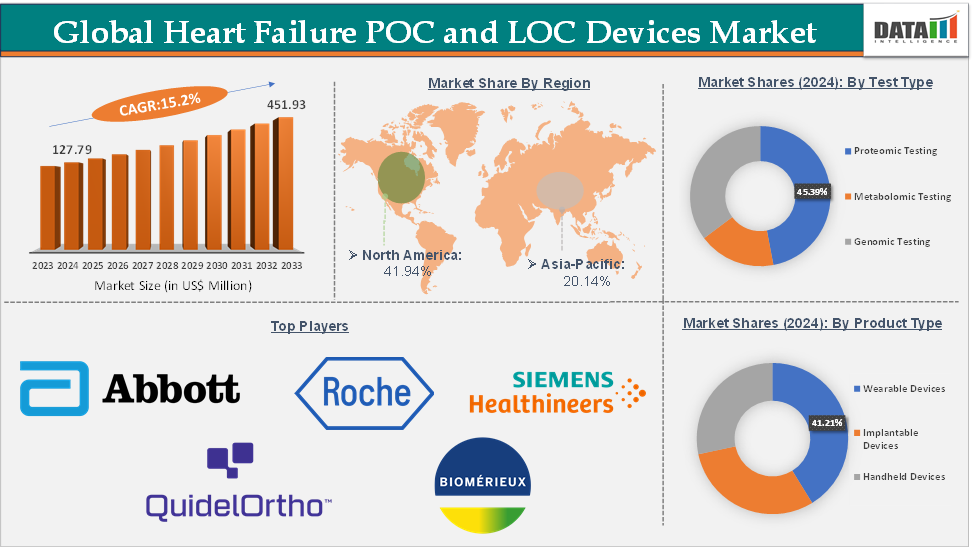

Heart Failure POC and LOC Devices Market Size reached US$ 127.79 Million in 2024 from US$ 112.17 Million in 2023 and is expected to reach US$ 451.93 Million by 2033, growing at a CAGR of 15.2% during the forecast period 2025-2033.

Heart Failure POC and LOC Devices Market Overview

The heart failure Point-of-Care (POC) and Lab-on-Chip (LOC) devices market is on a rapid expansion path. Its growth is underpinned by strong epidemiological trends, breakthrough microfluidic and biosensor technologies, and a fundamental shift toward decentralized, value-based healthcare.

While challenges persist, particularly around reimbursement and multi-analyte validation, the momentum toward personalized, real-time heart failure diagnostics remains powerful, heralding a new era of improved patient outcomes, reduced healthcare costs, and more proactive disease management. This growth reflects expanding demand for rapid, near-patient diagnostic and monitoring solutions that enable early intervention, reduce hospital readmissions, and facilitate personalized therapy adjustments for heart failure patients.

Executive Summary

For more details on this report – Request for Sample

Heart Failure POC and LOC Devices Market Dynamics

Drivers:

Rising technological advancements are significantly driving the heart failure POC and LOC devices market growth

Advances in microfluidics and nanotechnology have enabled the development of highly compact LOC devices that can perform complex biomarker analyses (e.g., BNP, NT-proBNP, ST2) using just a tiny blood sample. This makes testing faster and less invasive, ideal for home or outpatient use. Modern LOC platforms can now detect multiple heart failure-related biomarkers simultaneously, improving diagnostic precision and risk stratification.

For instance, in April 2024, Roche Diagnostics India introduced its point-of-care NT-proBNP test, targeting diabetes patients at risk of cardiovascular diseases like heart failure (HF). This advanced test, available exclusively system, aims to streamline patient care by offering quicker and more accurate diagnosis and management of HF in type 2 diabetes (T2D) patients.

Technological progress in Bluetooth, Wi-Fi, and cloud computing facilitates real-time data transmission from POC devices to healthcare providers. AI algorithms analyze longitudinal biomarker data to predict decompensation episodes earlier, supporting remote patient management. Modern LOC platforms can now detect multiple heart failure-related biomarkers simultaneously, improving diagnostic precision and risk stratification. For example, devices measuring NT-proBNP alongside inflammatory markers provide clinicians with a more comprehensive clinical picture.

The rising prevalence of heart failure is also driving the heart failure POC and LOC devices market growth

According to the Heart Failure Society of America, approximately 6.7 million Americans over 20 years of age have heart failure (HF), and the prevalence is expected to rise to 8.7 million in 2030, 10.3 million in 2040, and 11.4 million by 2050. As heart failure affects more people worldwide, driven by aging populations, rising rates of diabetes and hypertension, and improved survival after acute cardiac events, the demand for rapid, near-patient diagnostics has surged.

In many busy hospitals, acute dyspnea presentations have risen in parallel with heart failure prevalence. To quickly distinguish heart failure from other causes (like pneumonia or COPD exacerbations), emergency physicians now routinely use handheld BNP/NT-proBNP POC tests.

As more patients develop chronic heart failure, outpatient clinics and home-care programs have expanded their use of LOC devices for weekly or biweekly biomarker checks. In a pilot project in Germany, a cardiology practice equipped 150 stable heart failure patients with a home-use NT-proBNP LOC kit linked to a smartphone app. Over six months, those whose rising NT-proBNP levels triggered early nurse follow-up saw a 30 percent reduction in 90-day readmission rates compared to matched controls. This kind of data‐driven intervention boosts the market growth.

Restraints:

Data security and interoperability concerns are hampering the growth of the heart failure POC and LOC devices market

Many POC/LOC systems transmit sensitive biomarker data (e.g., NT-proBNP levels) over Wi-Fi or cellular networks to cloud servers. Hospitals and home-care programs worry about HIPAA (U.S.) or GDPR (EU) violations if data isn’t fully encrypted end-to-end.

For instance, according to the HIPAA Journal, in 2024, the protected health information of 276,775,457 individuals was exposed or stolen. On average, that is 758,288 records per day. In March 2025, 1,754,097 individuals had their protected health information exposed, stolen, or impermissibly disclosed in a healthcare data breach.

Many LOC platforms rely on proprietary apps or dashboards, which don’t speak HL7/FHIR standards that hospital EHRs use. As a result, cardiology practices must maintain separate portals for POC results, fragmenting clinician workflows. Wearable sensors that complement POC/LOC devices, tracking heart rate variability or thoracic impedance, also transmit data continuously. If attackers breach these endpoints, they might gain persistent access to patient networks or launch ransomware attacks on hospital systems.

Opportunities:

Integration of AI and predictive analytics in POC devices creates a market opportunity for the heart failure POC and LOC devices market

The integration of AI and predictive analytics in heart failure POC and LOC devices is creating significant market opportunities by enabling earlier, more accurate detection and personalized management of heart failure, which leads to better patient outcomes and reduced healthcare costs. AI algorithms analyze large datasets from POC devices, including biomarkers, patient history, and vital signs, to predict heart failure exacerbations before symptoms worsen. This allows timely interventions and reduces hospital admissions.

Biofourmis, a digital health company, uses AI-powered wearable sensors combined with LOC biomarker tests to predict heart failure readmissions up to 6 days in advance, reducing readmission rates by 50% in pilot studies. AI and predictive analytics transform heart failure POC and LOC devices from simple diagnostic tools into proactive, personalized management systems. This creates strong market demand by improving patient outcomes, reducing costs, and offering healthcare providers powerful decision-support tools, making AI integration a key opportunity for market growth.

Heart Failure POC and LOC Devices Market Segment Analysis

The global heart failure POC and LOC devices market is segmented based on test type, technology, product type, end-user, and region.

Proteomic testing from the test type segment is expected to hold 45.39% of the market share in 2024 in the heart failure POC and LOC devices market

Two types of biomarkers can be used: heart-specific markers and markers that monitor the cardiovascular and pulmonary systems. Some common peptides assessed to monitor cardiovascular events include N-terminal pro-B-type natriuretic peptide (NTproBNP), troponin, and B-type natriuretic peptide (BNP). Troponin T (TnT) and Troponin I (TnI) are the most specific protein biomarkers linked to myocardial infarction. As a result, most companies have targeted this biomarker as a key revenue-generating segment. The estimated share of proteomic testing is influenced by the presence of many commercial POC devices based on protein marker testing.

BNP and NT-proBNP have decades of large‐scale clinical studies proving their sensitivity and specificity for diagnosing, risk-stratifying, and monitoring HF. Major guidelines (ACC/AHA, ESC) recommend using these markers for acute dyspnea triage and chronic HF management. Payers and hospitals are therefore comfortable reimbursing and implementing proteomic assays in decentralized settings.

Antibody‐based immunoassays for BNP or troponin can be miniaturized onto lateral-flow cartridges or microfluidic chips with well-established capture/detection chemistries. This has led to a proliferation of FDA-cleared/CE-marked products such as Abbott i-STAT BNP, a handheld analyzer that delivers BNP results from a 20 µL finger-stick in ~10 minutes, now standard in many U.S. EDs for rapid dyspnea evaluation, and Roche cobas h 232 NT-proBNP, a compact POC reader used in ambulances and clinics, offering NT-proBNP quantitation in ~12 minutes with a single-use cartridge.

Because BNP/NT-proBNP levels rise before overt symptoms, POC/LOC proteomic tests allow early decompensation detection (often 2–3 days in advance). As proteomic biomarkers are so tightly linked to both acute triage decisions and longitudinal therapy adjustments, and because POC/LOC platforms have proved reliable for these assays, proteomic testing continues to capture the largest share of the heart failure POC/LOC devices market.

Heart Failure POC and LOC Devices Market Geographical Analysis

North America is expected to dominate the global heart failure POC and LOC devices market with a 41.94% share in 2024

Many leading LOC and POC market players, such as Abbott, Thermo Fisher, and Quidel, have U.S. or Canadian headquarters. Their proximity to NIH and NIH-funded clinical trials accelerates validation studies. North American firms frequently leverage the FDA’s Breakthrough Devices program to fast-track multiplex LOC chips. Once cleared, obtaining a CLIA waiver for true point-of-care use (even in small clinics or home settings) is relatively straightforward, driving broader deployment.

Heart Failure Society of America, approximately 6.7 million Americans over 20 years of age have heart failure (HF), and the prevalence is expected to rise to 8.7 million in 2030, 10.3 million in 2040, and 11.4 million by 2050. Approximately one-third of the adult population in the United States (US) is at risk for HF (Stage A), and 24-34% of the US population has pre-HF (Stage B). The lifetime risk of HF has increased to 24%; approximately 1 in 4 persons will develop HF in their lifetime. To manage this burden, North American providers have pioneered home-care models: visiting nurses use handheld POC readers (e.g., Roche’s cobas h 232) on weekly patient visits, feeding data into cloud-based dashboards for cardiologist review.

Asia-Pacific is growing at the fastest pace in the heart failure POC and LOC devices market, holding 20.14% of the market share

Rapid urbanization, changing lifestyles, and aging populations have led to an increase in cardiovascular diseases, including heart failure, in countries like China, India, and Japan. This fuels demand for efficient, accessible diagnostic tools like POC and LOC devices. Many APAC countries are investing heavily in healthcare modernization, including establishing advanced diagnostic facilities and promoting remote healthcare solutions, which boost the adoption of portable and easy-to-use POC devices.

Governments are launching programs to improve early diagnosis and management of chronic diseases. For instance, China’s “Healthy China 2030” plan emphasizes improving cardiovascular health, supporting the market. Due to large rural populations and limited access to hospitals, POC and LOC devices integrated with telehealth are gaining traction for remote patient management.

Heart Failure POC and LOC Devices Market Top Companies

Top companies in the heart failure POC and LOC devices market include Abbott, F. Hoffmann-La Roche Ltd, Siemens Healthineers, QuidelOrtho Corporation, Jant Pharmacal Corporation, Trinity Biotech, bioMérieux, and Beckman Coulter, Inc., among others.

Market Scope

Metrics | Details | |

CAGR | 15.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Test Type | Proteomic Testing, Metabolomic Testing, and Genomic Testing |

Technology | Microfluidics, Array-Based Systems, and Others | |

Product Type | Wearable Devices, Implantable Devices, and Handheld Devices | |

End-User | Hospitals, Specialty Clinics, Homecare Settings, Assisted Living Healthcare Facilities, Laboratories, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global heart failure POC and LOC devices market report delivers a detailed analysis with 64 key tables, more than 63 visually impactful figures, and 165 pages of expert insights, providing a complete view of the market landscape.