Digital Health Trackers Market Size

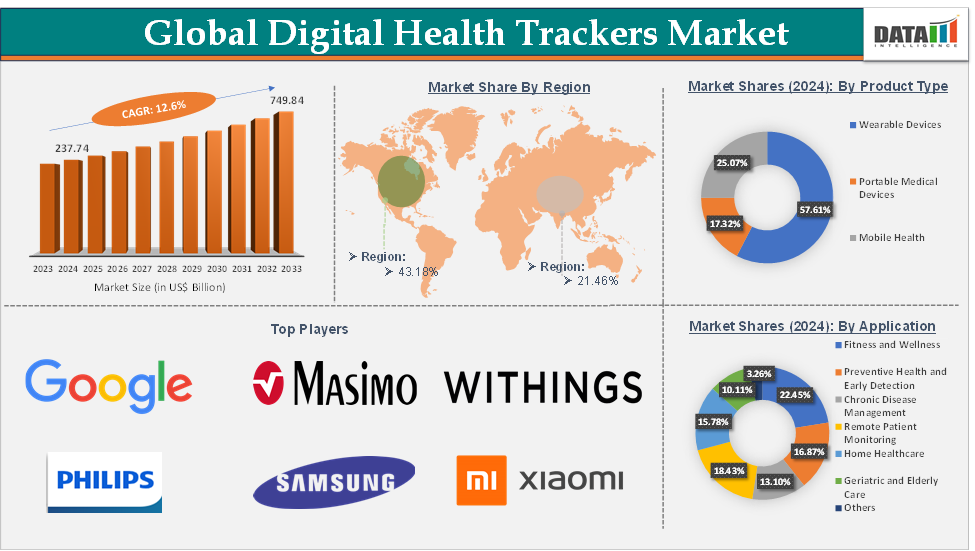

Digital Health Trackers Market Size reached US$ 237.74 Billion in 2024 and is expected to reach US$ 749.84 Billion by 2033, growing at a CAGR of 12.6% during the forecast period 2025-2033.

Digital Health Trackers Market Overview

The digital health trackers market encompasses wearable devices and mobile applications designed to monitor and manage various health metrics, including physical activity, heart rate, sleep patterns, and chronic disease indicators. These tools empower individuals to take proactive control of their health and wellness, offering real-time data and insights. The market is experiencing rapid growth, fueled by technological advancements, increased health consciousness, and the integration of artificial intelligence (AI) and machine learning into health tracking solutions.

Key trends influencing this growth include advancements in wearable technology, integration with healthcare systems, and increasing consumer demand for personalized health insights. However, addressing challenges related to data privacy, regulatory compliance, and technological accessibility will be crucial for sustained market expansion.

Executive Summary

For more details on this report, Request for Sample

Digital Health Trackers Market Dynamics: Drivers & Restraints

Rising aging population and elderly care needs are significantly driving the digital health trackers market growth

Aging brings higher risks of chronic diseases, such as cardiovascular issues, diabetes, arthritis, and cognitive decline, which require prior health care for elders. This rising aging population with age-related issues and elderly care needs creates an urgent need for continuous health monitoring, which digital health trackers can provide.

For instance, according to the World Health Organization, one in six individuals will be 60 years of age or older by 2030 worldwide. There will be 1.4 billion people over 60 by 2030, up from 1 billion in 2020. The number of individuals in the world who are 60 or older is expected to increase to 2.1 billion by 2050. By 2050, the population of people 80 years of age or older is predicted to triple, reaching 426 million. This rising aging population creates an urgent need for digital health trackers for continuous health monitoring, which further drives the market growth.

Aging is highly linked with an increased prevalence of chronic diseases, where there is high use of digital health trackers. For instance, according to the National Council on Aging, nearly 95% of adults 60 and older have at least one chronic condition, while nearly 80% have two or more. Managing these requires consistent monitoring, making digital health trackers essential. Many older adults prefer to live independently rather than in assisted living facilities. Digital health trackers support this independence by offering fall detection, emergency alerts, and continuous monitoring.

Privacy and data security concerns are hampering the market growth

Digital health trackers collect a variety of sensitive data points, such as heart rate, activity level, sleep patterns, and, in certain cases, more specific health information like blood pressure, glucose levels, and ECG readings. Concerns about how companies could use consumers' private health information are common, particularly because some of it may reveal lifestyle choices or health conditions.

Additionally, hackers may get access to real-time health data or personal identifiers, which might lead to identity theft, fraud, or the unauthorized selling of health data. Inadequate security measures might make devices and the mobile apps that are connected to them vulnerable to attacks. For instance, a Colorado-based pathology laboratory is notifying more than 1.8 million patients that their sensitive information was compromised in one of the largest breaches reported by a medical testing lab to US federal regulators, making the healthcare industry especially vulnerable to hackers.

Additionally, according to the HIPAA Journal, in March 2025, 1,754,097 individuals had their protected health information exposed, stolen, or impermissibly disclosed in a healthcare data breach, 2,277,555 individuals were affected in February 2025, and 3,121,358 individuals in January 2025. These rising data breaches may hesitate patients about their personal data, which hinders the market growth.

Digital Health Trackers Market Segment Analysis

The global digital health trackers market is segmented based on product type, technology, age group, application, and region.

The wearable devices from the product type segment are expected to hold 57.61% of the market share in 2024 in the digital health trackers market

The wearable devices segment holds a major portion of the digital health trackers market share and is expected to continue to hold a significant portion of the market share over the forecast period due to their convenience, advanced technology integration, and unique ability to offer real-time health data. These devices play a pivotal role in personal health management, offering users a hands-free, accessible way to monitor vital signs, fitness levels, and other health metrics.

Top and emerging market players are developing various wearable devices for health monitoring. For instance, in February 2025, OPPO unveiled its latest flagship smartwatch, the OPPO Watch X2. Built to redefine wearable tech, the OPPO Watch X2 combines comprehensive health and fitness monitoring capabilities, premium design, and exceptional battery life. Equipped with cutting-edge sensors, the Watch X2 enables ECG Analysis, blood oxygen tracking, and a revolutionary 60-second health checkup for a comprehensive wellness experience. It also offers up to 5 days of use in Smart Mode and 16 days in Power Saver Mode with the use of next-gen silicon-carbon battery technology. These novel product launches are expanding the segment growth.

Digital Health Trackers Market Geographical Analysis

North America is expected to dominate the global digital health trackers market with a 43.18% share in 2024

The North America region is expected to hold the largest market share over the forecast period owing to owing to technological innovations and availability of advanced digital health solutions, and strong consumer adoption. North America, particularly the United States, is a global leader in technological advancements. The region’s focus on innovation has led to the development of advanced digital health solutions, including highly sophisticated wearable devices that leverage cutting-edge technologies.

For instance, in May 2025, Whoop unveiled two new wearable devices, Whoop 5.0 and Whoop MG, marking a significant leap in personal health and fitness tracking. Accompanied by a redesigned digital interface and a flexible membership model, the new launch is designed to help users better understand their long-term health and performance. Both devices are 7% smaller, boast a 14-day battery life, and come equipped with powerful new tools through the Whoop app. This development of advanced digital health wearables is accelerating the market growth in North America.

Digital Health Trackers Market Top Companies

Top companies in the digital health trackers market include Apple Inc., Google, Samsung Electronics Co., Ltd., Garmin Ltd., Xiaomi Corporation, Huawei Device Co., Ltd., Withings, OMRON Healthcare, Inc., Koninklijke Philips N.V., Masimo Corporation, and among others. The emerging players include WHOOP, Oura Health Oy, Zepp INC., Biofourmis, Movano Health, and others.

Market Scope

| Metrics | Details | |

| CAGR | 12.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Wearable Devices, Portable Medical Devices, and Mobile Health |

| Technology | Bluetooth Enabled Devices, Wi-Fi Enabled Devices, GPS Enabled Devices, Artificial Intelligence, and Wearable Sensors | |

| Age Group | Geriatric/Elderly, Adults and Infants, and Children | |

| Application | Fitness and Wellness, Preventive Health and Early Detection, Chronic Disease Management, Remote Patient Monitoring, Home Healthcare, Geriatric and Elderly Care, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global digital health trackers market report delivers a detailed analysis with 70 key tables, more than 68 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.