Digital Banking Solution Market Size

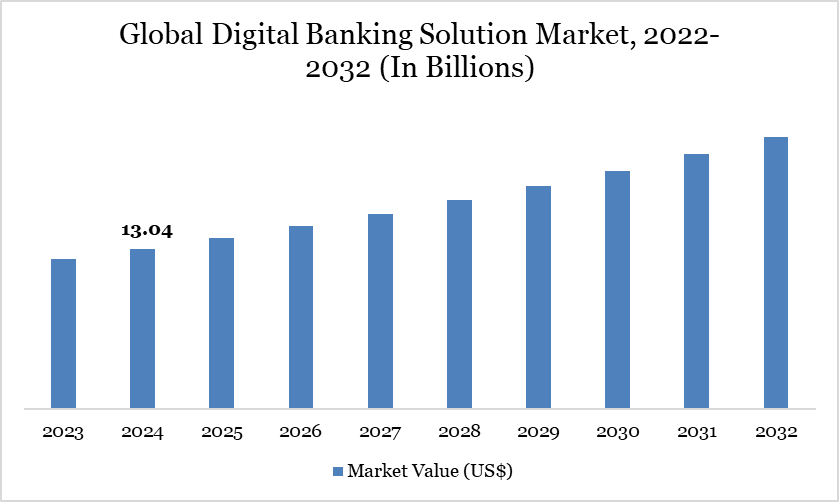

Global Digital banking solution market reached US$ 13.04 billion in 2024 and is expected to reach US$ 24.96 billion by 2032, growing with a CAGR of 8.62% during the forecast period 2025-2032.

The global digital banking solution market is experiencing strong growth, driven by the rapid adoption of online and mobile banking platforms across North America, Europe, and Asia-Pacific. In 2024, the Reserve Bank of India (RBI) reported that over 75% of retail banking transactions in India were conducted digitally, highlighting the accelerated shift away from traditional branch-based banking. Regulatory initiatives such as the European Union’s PSD2 and Open Banking standards, along with data protection mandates like GDPR, are compelling banks to invest in secure, customer-centric digital solutions, including advanced authentication, AI-driven personalization, and cloud-based banking infrastructure.

Digital Banking Solution Market Trend

A notable trend in the market is the growing focus on regulatory-driven digital compliance and cross-border financial data security. The Financial Stability Board (FSB) and the Bank for International Settlements (BIS) have emphasized stricter digital operational resilience requirements, with over 900 cyber incidents in the global banking sector recorded between 2021 and 2024.

Furthermore, the European Union’s Digital Operational Resilience Act (DORA), effective from 2025, mandates standardized risk management for financial institutions and their third-party technology providers. Similarly, the Reserve Bank of India has issued guidelines on cloud adoption and digital payment security. These developments underscore how regulatory oversight and secure digital infrastructure initiatives are shaping the sustainable growth of digital banking solutions.

Market Scope

Metrics | Details |

By Component | Software, Services |

By Type of Banking | Retail Banking, Corporate Banking, Investment Banking |

By Deployment | On-premises, Cloud based, |

By Mode | App-based, Web-based |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Digital Transformation Driving the Expansion of Digital Banking Solutions

The rapid digitalization of the banking industry is a major catalyst for the growth of the global digital banking solutions market. Rising consumer expectations for round-the-clock access, seamless user experiences, and tailored financial services are pushing banks to adopt advanced digital platforms. Retail banks are increasingly turning to mobile app-based solutions to enhance customer convenience, while corporate and investment banks are leveraging AI-powered platforms to improve transaction efficiency, risk management, and decision-making.

Cloud-based deployments are gaining significant traction as financial institutions seek scalable, cost-efficient, and real-time solutions. At the same time, supportive government and regulatory initiatives—such as India’s Digital India Program, the EU’s PSD2 Open Banking Directive, and the U.S. Federal Reserve’s instant payments infrastructure—are accelerating adoption. Together, these developments are fueling strong growth across both mature and emerging banking markets.

High Costs and Legacy System Integration

Despite strong adoption trends, the implementation of digital banking solutions is hindered by high investment requirements and the complexity of integrating with legacy systems. Many financial institutions, particularly in developing economies, still operate on outdated core banking platforms, making the migration to cloud-native or app-based models both costly and time-intensive. Advanced solutions such as AI-driven fraud prevention, blockchain-based transaction systems, and automated compliance tools demand substantial spending on technology upgrades, cybersecurity infrastructure, and workforce training.

Furthermore, strict and varied regulatory requirements ranging from GDPR in Europe and CCPA in the U.S. to global KYC/AML compliance frameworks—increase operational complexity and implementation costs. Smaller banks and regional players often face greater financial strain, slowing adoption and widening the digital gap between large multinational banks and smaller institutions.

Segmentation Analysis

The global Digital Banking Solution Market is segmented based on Component, type of banking, deployment, mode and region.

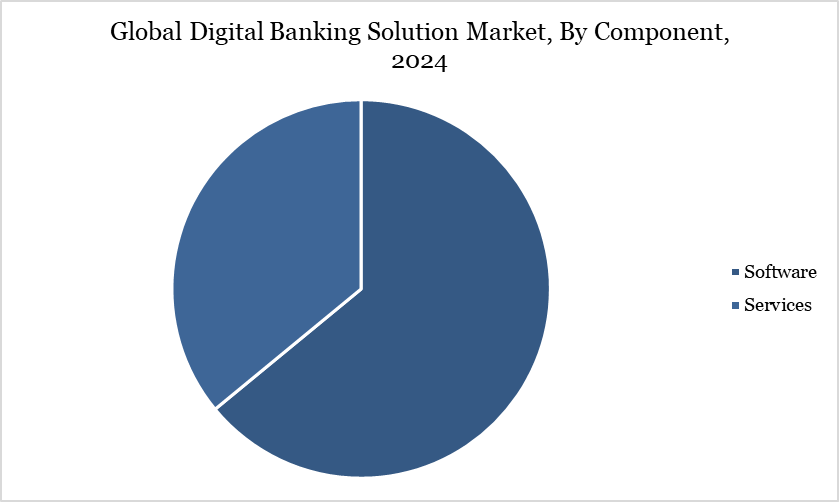

Software Segment Driving Digital Banking Solution Market

The software segment dominates the global digital banking solutions market, accounting for the largest share due to its role in enabling seamless, secure, and real-time financial services. Banks across retail, corporate, and investment banking are increasingly adopting advanced software platforms to support mobile payments, AI-powered fraud detection, digital lending, and blockchain-enabled transactions.

For instance, retail banks are deploying app-based platforms to expand customer access to instant payments and personalized financial planning, while corporate banks rely on digital transaction management and cash flow analytics. Similarly, investment banks are embracing AI-driven platforms for portfolio optimization and risk modeling.

The growing adoption of cloud-native deployments further strengthens the software segment, as financial institutions seek to reduce infrastructure costs while ensuring scalability and compliance. With rapid innovation from global providers such as Temenos, Fiserv, and Finastra, the software segment continues to act as the core growth driver of the digital banking solutions market..

Geographical Penetration

Asia-Pacific Drives the Global Digital Banking Solution Market

The Asia-Pacific region is the fastest-growing hub for digital banking solutions, driven by rapid mobile adoption, government-led digital initiatives, and rising financial inclusion. Countries such as India, China, and Indonesia are witnessing explosive growth in mobile-based banking due to their large unbanked populations and strong smartphone penetration.

For instance, India’s Digital India program and UPI (Unified Payments Interface) have revolutionized mobile transactions, positioning the country as a leader in real-time payments. Similarly, China’s banking ecosystem, dominated by super-apps like Alipay and WeChat Pay, is continuously integrating AI, blockchain, and cloud-based solutions to enhance financial services.

In developed APAC economies such as Japan, Singapore, and South Korea, banks are pioneering advanced cloud-native and AI-driven digital banking platforms to support cashless societies and smart financial ecosystems. These countries are also leading in regulatory innovation, with initiatives around Open Banking and data protection laws supporting long-term adoption.

As a result, APAC is not only driving the highest growth rate in the digital banking solutions market but is also setting new benchmarks for digital-first financial ecosystems globally.

Technology Analysis

The global digital banking solutions market is driven by rapid technological advancements that are reshaping financial services delivery, with key technologies including artificial intelligence (AI) and machine learning for personalized banking, fraud detection, and predictive analytics; blockchain for secure transactions and decentralized finance; cloud computing for scalable, cost-efficient infrastructure application programming interfaces (APIs) enabling open banking ecosystems and seamless third-party integrations; and advanced data analytics for customer insights and risk management.

Additionally, mobile banking applications, biometric authentication, robotic process automation (RPA), and cybersecurity solutions are playing a vital role in enhancing customer experience, improving operational efficiency, and ensuring compliance with evolving regulations. Together, these technologies are enabling banks to transition from traditional models to agile, customer-centric digital ecosystems.

Competitive Landscape

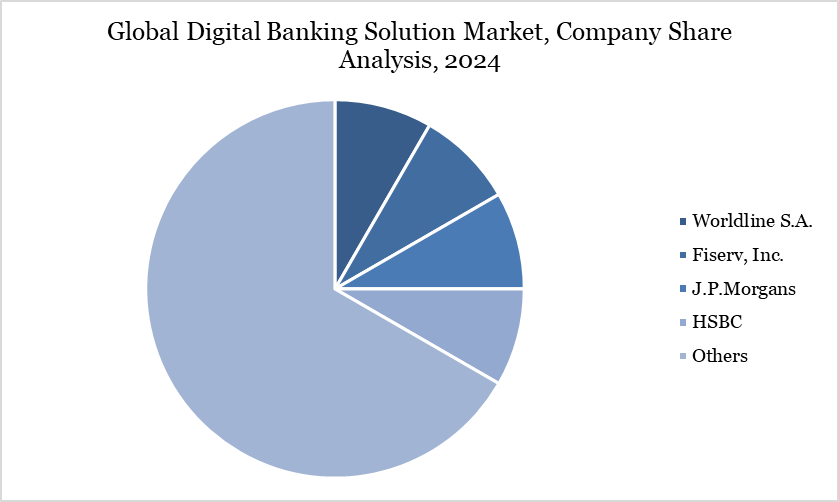

The major global players in the market include Worldline S.A., Fiserv, Inc., J.P.Morgans, HSBC, Digital Banking Solutions, CSI, Finastra, FIS, PwC, and Capgemini.

Key Developments

In 2025, Computer Services, Inc. (CSI), a leading provider of comprehensive financial software and technology, announced that it has signed a definitive agreement to acquire Apiture, a recognized provider of digital banking solutions for U.S. financial institutions.

In 2025, Finastra, a global leader in financial services software, announced that Al Rayan Bank, one of Qatar’s largest Islamic banks with a global presence, has successfully launched Finastra Corporate Channels to enhance and streamline its corporate digital banking services.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies