Overview

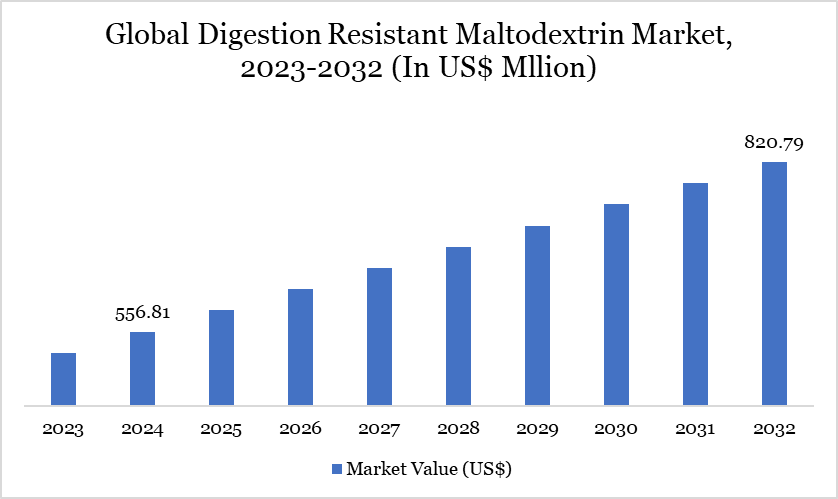

Global digestion-resistant maltodextrin market reached US$ 556.81 million in 2024 and is expected to reach US$ 820.79 million by 2032, growing with a CAGR of 4.97% during the forecast period 2025-2032.

As consumers become more health-conscious, there is a growing demand for products that support gut health. Digestion-resistant maltodextrin, known for its prebiotic properties and ability to improve digestive function, is being increasingly incorporated into functional foods and dietary supplements. It is contributing to the steady expansion of the digestion-resistant maltodextrin market. The growing popularity of functional foods and beverages that offer health benefits beyond basic nutrition is a major driver for the digestion-resistant maltodextrin market.

The ingredient is being used to formulate products with added health benefits, aligning with consumer demand for healthier food options. The shift toward clean-label products, where consumers seek transparent labeling and natural ingredients, is influencing the digestion-resistant maltodextrin market. Manufacturers are responding by utilizing digestion-resistant maltodextrin as a natural fiber source in various food and beverage formulations, supporting the market’s growth.

For instance, in July 2023, Roquette, a prominent manufacturer and supplier renowned for its plant-based ingredients and pharmaceutical excipients, announced an acquisition with Qualicaps. This strategic acquisition was aimed at bolstering Roquette's business operations and expanding its portfolio. By integrating Qualicaps into its structure, Roquette not only strengthened its capabilities in the plant-based and pharmaceutical sectors but also underscored its commitment to growth and innovation in these critical markets.

Digestion Resistant Maltodextrin Market Trend

Consumer emphasis on gut health post-COVID has accelerated demand for digestion-resistant maltodextrin (DRM) as a functional ingredient. With 43% of US consumers prioritizing digestive health, DRM’s prebiotic properties align with growing interest in digestive supplements and fiber-enhanced foods. Its application in performance shakes, probiotics and functional snacks supports consumption-driven growth. Brands incorporating DRM can meet rising expectations for digestive wellness.

As consumers shift toward food-based nutrition over pills, DRM’s tasteless, soluble fiber profile offers strong formulation benefits. The rapid rise of pre- and probiotic sodas and fortified beverages highlights the potential for DRM-enriched innovation. With inflation driving value-conscious health choices, DRM supports product differentiation through functional claims. Manufacturers can capitalize on this by integrating DRM into everyday wellness products.

Market Scope

Metrics | Details |

By Source | Corn-based, Wheat-based, Potato-based, Cassava-based and Others |

By Form | Spray-dried Powder and Instantized/Agglomerated |

By End-User | Foods, Beverages, Nutraceuticals and Others |

By Region | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Consumer Shift Towards Plant-Based Diets

The consumer shift towards plant-based diets is becoming a key driver in the global digestion-resistant maltodextrin market. As more individuals adopt plant-based lifestyles for health, environmental and ethical reasons, the demand for functional ingredients derived from plant sources is rising. Digestion-resistant maltodextrin, typically sourced from corn or wheat, aligns perfectly with this growing consumer preference, helping to fuel market growth.

This trend is especially significant in the food and beverage sector, where manufacturers increasingly incorporate plant-based ingredients into their products to cater to the growing demand for plant-forward foods. Digestion-resistant maltodextrin's role as a soluble dietary fiber makes it an attractive ingredient for plant-based formulations, offering benefits while maintaining a clean label appeal. As a result, the market for digestion-resistant maltodextrin is expected to grow in tandem with the increasing shift towards plant-based diets.

Taste and Texture Challenges

Taste and texture challenges are significant factors restraining the growth of the global digestion-resistant maltodextrin market. Despite its functional benefits as a soluble dietary fiber, digestion-resistant maltodextrin can alter the sensory experience of certain food and beverage products. Consumers are highly sensitive to changes in taste and texture and any negative impact on these factors can result in reduced acceptance of products that include this ingredient.

Similarly, texture modifications can affect the appeal of products containing digestion-resistant maltodextrin. In beverages, for instance, the addition of this fiber might create a thicker or more viscous consistency, which can be off-putting to consumers who prefer a smoother drink. This creates hesitation among manufacturers to widely adopt digestion-resistant maltodextrin in certain product categories, further restraining its market potential.

Segment Analysis

The global digestion-resistant maltodextrin market is segmented based on source, form, end-user and region.

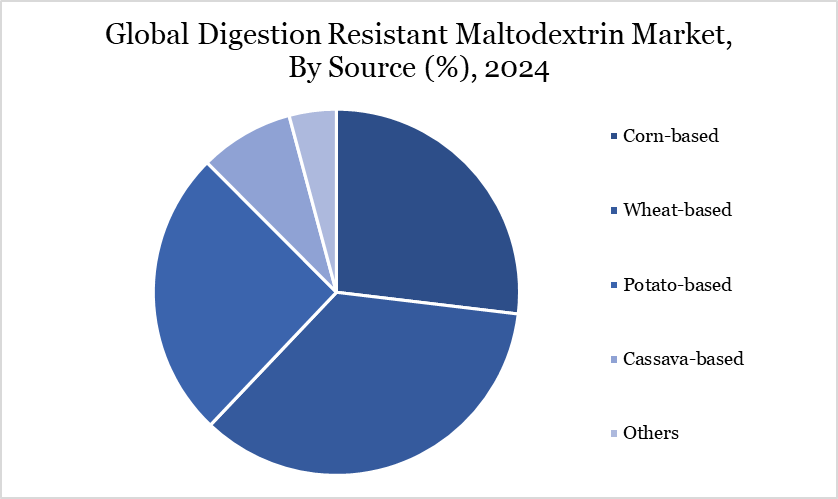

Demand for Cost-Effective Solutions and Production Scalability of Corn

The corn-based segment holds the largest share of the global digestion-resistant maltodextrin market. Corn is a primary source for producing maltodextrin due to its abundant availability and cost-effectiveness. The corn-based segment benefits from the widespread use of corn in starch production, making it the dominant choice in the digestion-resistant maltodextrin market.

Corn-based digestion-resistant maltodextrin is often more affordable compared to alternatives, such as those derived from other sources like tapioca or potatoes. This cost-effectiveness makes it a preferred option for manufacturers looking to optimize production costs while meeting market demands. The production process for corn-based maltodextrins is well-established and scalable, which supports large-scale manufacturing. This efficiency and scalability contribute to the segment's leading position in the global digestion-resistant maltodextrin market.

Geographical Penetration

Demand for Functional Ingredients in North America

North America is expected to hold the largest share of the global digestion-resistant maltodextrin market. The North American market has a high demand for functional ingredients in food and beverages. Digestion-resistant maltodextrin is sought after for its health benefits, including digestive support and blood sugar management, driving its widespread use in the region.

There is a growing consumer focus on health and wellness in North America. This trend supports the demand for digestion-resistant maltodextrin as it aligns with the increasing preference for ingredients that offer functional and health benefits. Many leading manufacturers of digestion-resistant maltodextrin are based in North America or have significant operations in the region. This concentration of key players enhances the supply chain and market presence, further solidifying North America's leading position.

Sustainability Analysis

Digestion Resistant Maltodextrin (DRM) plays a strategic role in advancing sustainable food solutions by supporting sugar reduction and fiber enrichment, meeting the rising demand for clean-label and health-focused products. Derived from renewable plant sources such as corn or wheat starch, DRM offers a more environmentally conscious alternative to synthetic additives, with a lower carbon footprint and efficient resource utilization during production.

DRM contributes to sustainable product development by enhancing formulation stability and extending shelf life, which helps minimize food waste. Its alignment with plant-based and functional food trends positions it as a valuable ingredient in environmentally responsible product innovation. Additionally, DRM supports digestive wellness, reinforcing its role in preventive health strategies and sustainable consumer nutrition.

Competitive Landscape

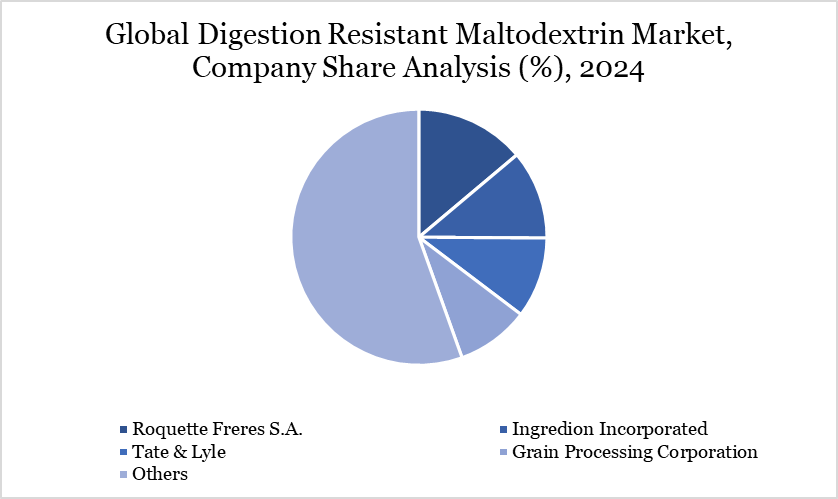

The major global players in the market include Roquette Freres S.A., Ingredion Incorporated, Tate & Lyle, Grain Processing Corporation, Cargill Incorporated, Archer Daniels Midland Company, Satoria Agro, Shandong Saigao Group Corporation, Happy Ratio and AG Nutrition International.

Key Developments

In April 2024, Ingredion Incorporated, a leading provider of high-performance plant-based ingredient solutions, announced that LBB Specialties would serve as its exclusive channel partner for the personal care product portfolio in Canada and the US. This announcement marks a significant step in Ingredion's strategy to enhance its market presence and distribution capabilities in North America, leveraging LBB Specialties' expertise to effectively reach and serve customers in the personal care sector.

In March 2023, Tate & Lyle announced IMCD as its new exclusive distribution partner for ingredients throughout Brazil. This partnership is set to enhance Tate & Lyle's market reach and distribution network in the region, leveraging IMCD's expertise to effectively serve customers and expand the company's presence in the Brazilian market.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies