Overview

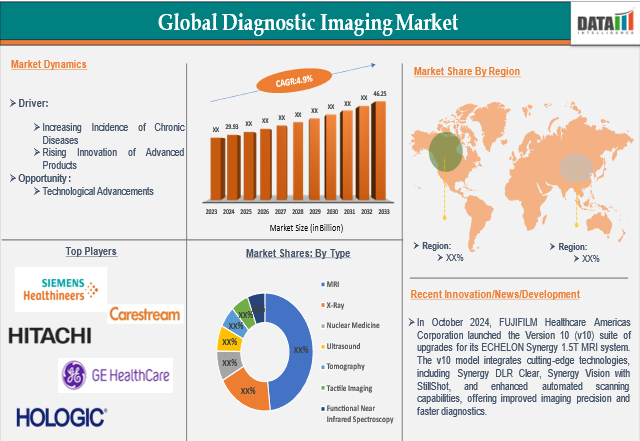

The global diagnostic imaging market reached US$ 29.93 billion in 2024 and is expected to reach US$ 46.25 billion by 2033, growing at a CAGR of 4.9% during the forecast period of 2025-2033.

Diagnostic imaging encompasses a variety of medical techniques used to create visual representations of the interior of the body, enabling healthcare professionals to diagnose, monitor, and treat various conditions. These imaging methods, which include X-rays, CT scans, MRIs, ultrasounds, and nuclear medicine, provide detailed images that help doctors identify the underlying causes of symptoms, such as pain, swelling, or unusual findings in physical exams.

Beyond diagnosis, diagnostic imaging also plays a key role in monitoring the progress of treatments for conditions like fractures, tumors, infections, or chronic diseases. By offering a non-invasive way to examine the body's internal structures, diagnostic imaging is essential for accurate, timely medical intervention and ongoing patient care.

Executive Summary

Market Dynamics: Drivers & Restraints

Increasing Incidence of Chronic Diseases

The growing prevalence of chronic and pathological conditions has created a significant demand for advanced diagnostic imaging technologies. As the need for early detection of complications increases, the market for diagnostic imaging equipment has expanded rapidly. These imaging procedures, which utilize techniques such as radiography, ultrasonography, fluoroscopy, and nuclear medicine, provide detailed internal visuals of the body and are essential for diagnosing a variety of chronic disorders. Among the most common conditions diagnosed through these methods are cardiovascular disease, cancer, chronic respiratory disorders, and diabetes.

For example, according to the National Osteoporosis Foundation, 10.2 million people in the U.S. are affected by osteoporosis, with women experiencing a higher prevalence (16.5%) than men (5.1%). Additionally, 43.4 million people have low bone mass. It’s projected that by 2030, 71 million adults will have osteoporosis or poor bone mass. Similarly, the American Cancer Society’s 2024 Global Cancer Statistics report highlighted that approximately 20 million new cancer cases were diagnosed worldwide in 2022, with 9.7 million deaths attributed to the disease. By 2050, the global number of cancer cases is expected to rise to 35 million. As these chronic diseases continue to increase, the demand for diagnostic imaging continues to grow, driving the expansion of the market.

High Costs of Diagnostic Imaging Systems

The high costs associated with diagnostic imaging systems are expected to pose a significant challenge to the growth of the diagnostic imaging market. These advanced technologies, such as MRI machines, CT scanners, and PET scanners, require substantial upfront investment for purchasing and installation, as well as ongoing expenses for maintenance and operation.

For many healthcare facilities, the financial burden of acquiring and maintaining these sophisticated systems can be prohibitive. As a result, the high costs associated with diagnostic imaging systems are likely to slow down the market's growth, especially in regions where healthcare budgets are already stretched.

For more details on this report – Request for Sample

Segment Analysis

The global diagnostic imaging market is segmented based on type, application, end-user, and region.

MRI in the type segment is expected to dominate the diagnostic imaging market

The MRI segment is expected to hold a significant portion of the market share. This is because of their ability to produce detailed images of organs, as well as technological advances in product innovation. Magnetic resonance imaging (MRI) is a diagnostic tool that can generate detailed images of almost any structure or organ in the body.

MRI produces images on a computer using magnets and radio waves. The images produced by an MRI scan can include organs, bones, muscles, and blood arteries. Hospitals and diagnostic centers often prefer advanced, emerging, and innovative MRI solutions to diagnose diseases in the body, which is creating a demand for MRI systems.Top of FormBottom of Form

MRI systems play a crucial role in disease detection, diagnosis, and treatment monitoring, particularly in identifying early changes in tissue and organ structures. This capability enables the earlier detection of conditions such as cancer, neurological disorders, and musculoskeletal diseases. As the prevalence of diseases affecting the brain, spinal cord, nerves, muscles, ligaments, and tendons continues to rise, there is an increasing demand for MRI technology to accurately detect, diagnose, and manage these conditions.

For instance, a 2024 report by the National Cancer Institute reveals that in the United States, over 110 million adolescents and young adults (AYAs) between the ages of 15 and 39 are living, with approximately 208,620 of them diagnosed with primary brain or spinal cord tumors. With the incidence of brain cancer expected to grow, the demand for MRI systems is anticipated to increase accordingly.

In addition, advancements in MRI technology by medical device manufacturers are expected to further propel market growth. For instance, in October 2024, FUJIFILM Healthcare Americas Corporation launched the Version 10 (v10) suite of upgrades for its ECHELON Synergy 1.5T MRI system. The v10 model integrates cutting-edge technologies, including Synergy DLR Clear, Synergy Vision with StillShot, and enhanced automated scanning capabilities, offering improved imaging precision and faster diagnostics.

With the rising number of neurological and musculoskeletal conditions, along with the ongoing innovation in MRI systems, the demand for advanced MRI solutions is poised to grow, driving the expansion of this market segment.

Geographical Analysis

North America is expected to dominate the diagnostic imaging market

The diagnostic imaging market in North America is driven by the increasing incidence of chronic diseases, the innovation of advanced systems, and also due to the presence of a large number of market players. The increasing applications of diagnostic imaging for various purposes and the presence of reimbursements in the region are expected to contribute to the region’s market growth.

Moreover, North America adopts advanced technologies and systems in the healthcare industry, which could create a lucrative opportunity for the region’s diagnostic imaging market growth. Cancer, cardiovascular disease, and osteoarthritis are rising among elderly individuals, raising the need and utilization of different diagnostics such as X-rays, MRIs, and CT scans. For instance, according to a report published by the Centers for Disease Control and Prevention in 2024, Heart abnormalities impact around 40,000 babies annually in the United States.

Similarly, according to the CDC revised report in 2024, approximately 53.2 million persons in the US suffer from arthritis. There are over 100 forms of arthritis, but osteoarthritis is the most common, affecting 32.5 million US people. With the rising abnormalities, the demand for diagnostic imaging rises. This transition has increased market demand for diagnostic imaging services. Healthcare providers are constantly investing in improved imaging technology to cater to this growing generation, fueling market development.

Market players in the region are increasingly innovating advanced diagnostic imaging solutions, which are expected to contribute to the region’s market share. Several organizations, hospitals, and healthcare institutes are conducting mobile health services in the region, which is expected to increase the adoption of advanced diagnostic imaging systems, which could contribute to the market growth.

For instance, in August 2024, DocGo Inc. launched an innovative mobile X-ray program in partnership with MinXray. The program launched in New York City to provide rapid and accessible chest X-rays for vulnerable populations and help identify active Tuberculosis (“TB”) cases. These programs increase the usage of the systems. Thus, the above factors are expected to hold the region in a significant position in the market share.

Competitive Landscape

The global market players in the diagnostic imaging market are GE HealthCare, Siemens Healthineers AG, Carestream Health, Hitachi Medical Corporation, Canon Medical Systems Corporation, Hologic, Inc., Koninklijke Philips N.V., Fujifilm Holdings Corporation, Shimadzu Corporation, and Mindray, among others.

Scope

| Metrics | Details | |

| CAGR | 4.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | X-Ray, Nuclear Medicine, Ultrasound, Tomography, Tactile Imaging, Functional Near Infrared Spectroscopy |

| Application | Orthopedic, Neurology, Oncology, Others, Radiofrequency Assisted Liposuction Devices, Others | |

| End User | Diagnostic Imaging Centers, Hospitals, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials and product pipelines and forecasts upcoming pharmaceutical advancements.

- Type Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient Type delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global diagnostic imaging market report would provide approximately 45 tables, 46 figures, and 180 pages.

Target Audience 2024

- Manufacturers: Pharmaceutical, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.