Global Deep Venous Disease Treatment Devices Market is Segmented By Device Type (Ablation Devices, Venous Stents, Venous Closure Products, Sclerotherapy Injection, Vena Cava Filter, Others), By End-User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Deep Venous Disease Treatment Devices Market Overview

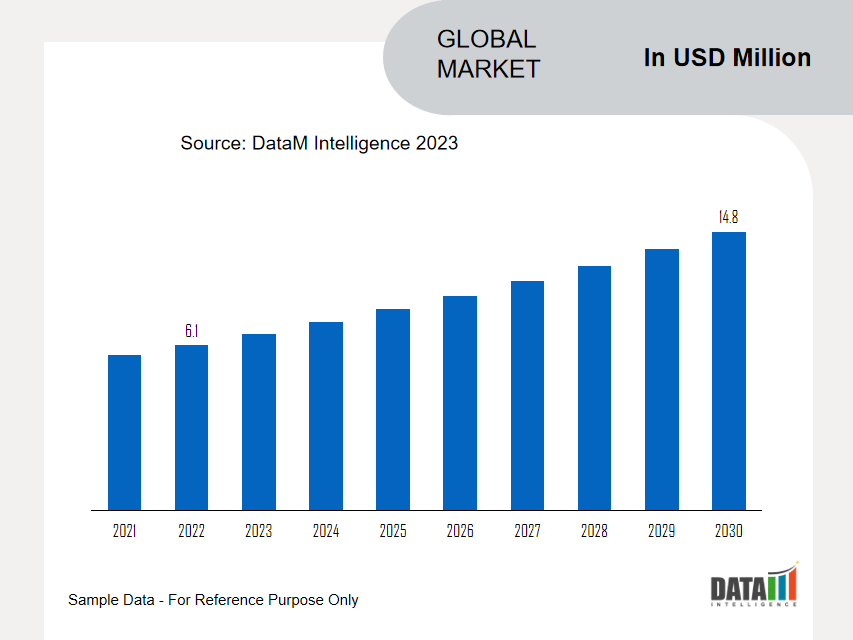

Global Deep Venous Disease Treatment Devices Market reached US$ YY million in 2022 and is expected to reach US$ YY million by 2030, growing at a CAGR of YY% during the forecast period 2023-2030.

A deep-vein thrombosis (DVT) is a blood clot that forms within the deep veins, usually of the leg, but can occur in the arms and the mesenteric and cerebral veins. Venous insufficiency and other vein conditions can be acute, or they can last for months or years as a chronic condition.

Deep vein disease treatment devices have been introduced to treat the conditions and clots associated with the veins. These devices include venous stents, catheters, filters, compression stockings, and others. These devices play a major role in preventing and managing deep venous diseases.

Deep Venous Disease Treatment Devices Market Scope

| Metrics | Details |

| CAGR | YY% |

| Market Size | 2021-2030 |

| Market Estimation Forecast Period | 2023-2030 |

| Revenue Units | Value (US$ Mn) |

| Segments Covered | Device Type, End-User |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Increase in the prevalence of the disease

An increase in the elderly population is expected to drive the market growth. Increasing age will increase the complications. Deep venous thrombosis occurs at any age but is most common in aged population over the age of 60. Deep vein thrombosis (DVT) is a condition in which a blood clot develops in the deep veins, usually in the lower extremities.

Pulmonary embolism (PE) occurs when a part of the DVT clot breaks off and travels to the lungs, which can be life-threatening. A PE occurs when a clot breaks loose and travels through the bloodstream to the lungs.

It is estimated that 300,000 to 600,000 Americans are affected each year by venous thromboembolism, making it the third leading vascular diagnosis behind heart attack and stroke, and the leading cause of death due to major orthopedic surgery.

Venous thromboembolism (VTE), which includes deep vein thrombosis (DVT) and pulmonary embolism (PE), occurs in about 1 in 1,000 persons each year. Incidence rises with age to at least 5 in 1,000 persons in those aged greater than 80. Thus, the above factors are expected to drive the market growth.

Increase in the preferences for drug-based treatment

Drug-based treatment provides several alternatives when compared to invasive procedures thus reducing the demand for devices. Based on the severity of the condition individuals suffering from deep venous disease will often choose drugs to recover fast when compared to the expensive procedures.

Deep Venous Disease Treatment Devices Market Segmentation

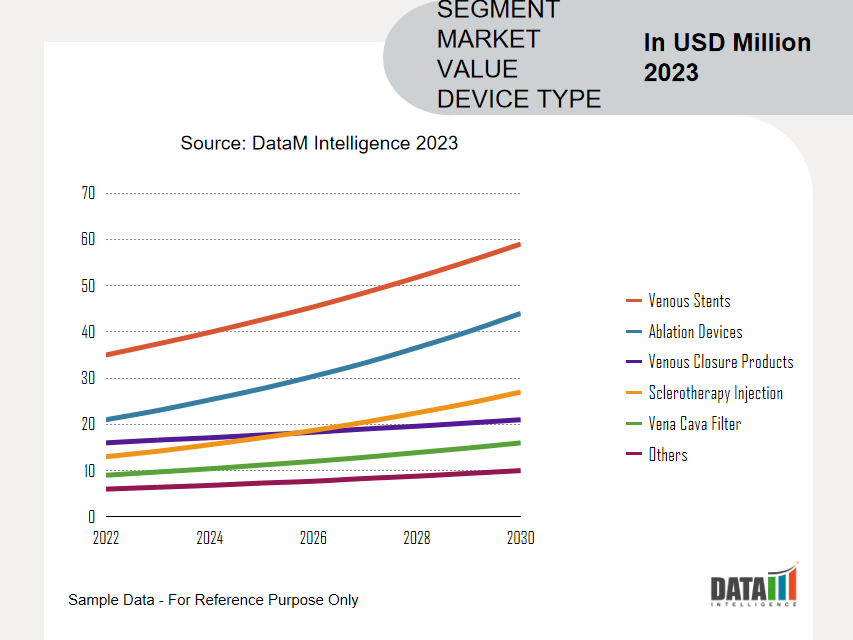

The global deep venous disease treatment devices market is segmented based on device type, end-user, and region.

Venous Stents segment accounted for 38.4% of the market share

The increase in the technological advancements in the devices and the increase in the approvals of the devices are expected to hold the segment in the dominant position. For instance, in January 2023, Penumbra, Inc. announced the U.S. Food and Drug Administration (FDA) clearance and launch of Lightning Flash, the most advanced and powerful mechanical thrombectomy system on the market. Lightning Flash features Penumbra's novel Lightning Intelligent Aspiration technology, now with dual clot detection algorithms.

In October 2020, Medtronic plc announced it had received U.S. Food and Drug Administration (FDA) approval for the Abre venous self-expanding stent system. This device is indicated for use in the iliofemoral veins in patients with symptomatic iliofemoral venous outflow obstruction, also known as deep venous obstruction. Thus, the above factors are expected to drive the market growth.

Global Deep Venous Disease Treatment Devices Market Geographical Share

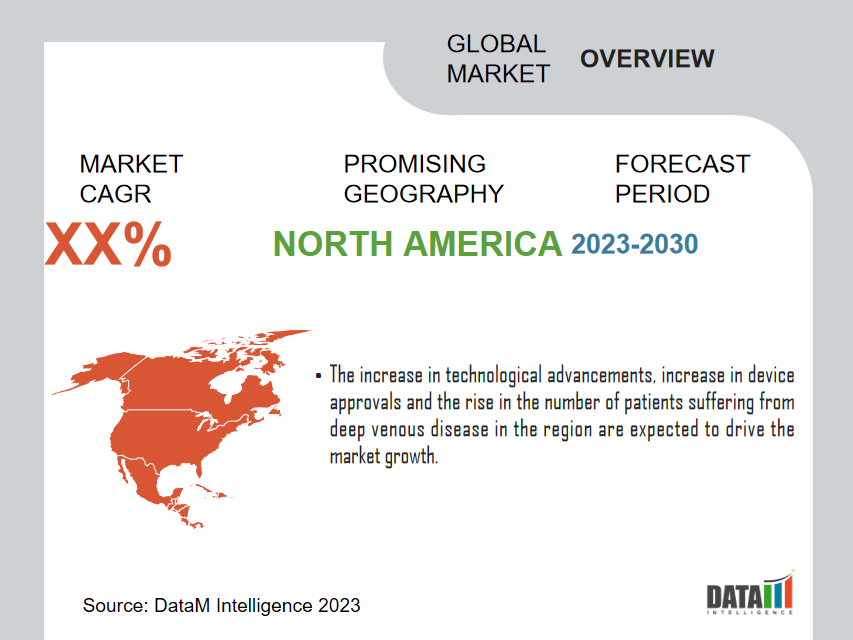

North America is expected to hold a significant position in the global deep venous disease treatment devices market share

The increase in technological advancements, increase in device approvals and the rise in the number of patients suffering from deep venous disease in the region are expected to drive the market growth.

Deep-vein thrombosis and pulmonary emboli are common conditions. According to the report by NIH in 2023, the incidence and prevalence of DVT are estimated to be 80 cases per 100,000, with a prevalence of lower limb DVT of 1 case per 1000 population in the United States

Annually in the United States, more than 200,000 people develop venous thrombosis, of those, 50,000 cases are complicated by pulmonary embolism. Thus, the increase in the prevalence of the disease conditions is expected to drive the market growth in the region.

COVID-19 Impact Analysis

COVID-19 has had a moderate impact on the growth of the market. The device manufacturing companies have been closed due to the lockdown imposed by the government. The shift of the medical companies has shifted their focus to the manufacturing of COVID-19 medication. Thus, COVID-19 has impacted the market growth.

Competitive Landscape

The leading companies with a significant market share include Medtronic Plc, Vesper Medical Inc., enVVeno Medical Corporation, Inari Medical, Cook Medical and Boston Scientific Corporation among others.

Why Purchase the Report?

- To visualize the global deep venous disease treatment devices market segmentation based on device type, end-user, and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of deep venous disease treatment devices market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global deep venous disease treatment devices market report would provide approximately 47 tables, 48 figures, and 176 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies