Overview

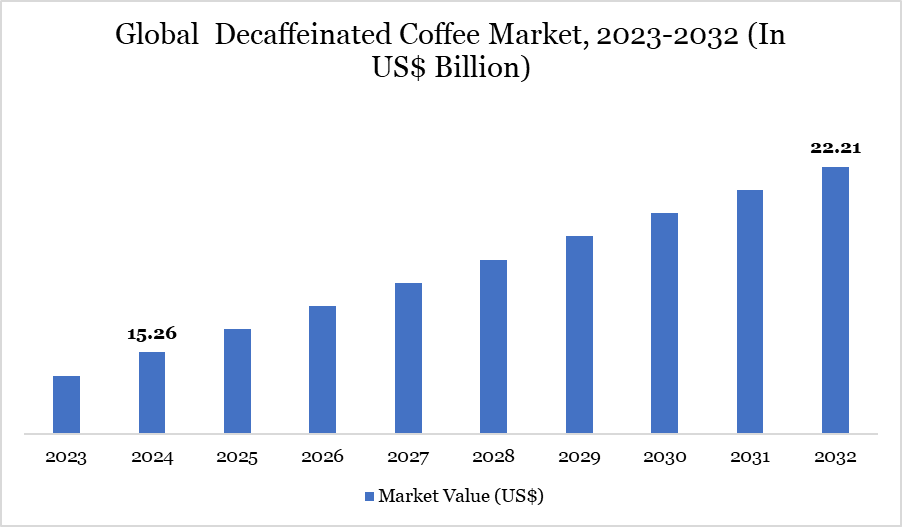

Global decaffeinated coffee market reached US$ 15.26 billion in 2024 and is expected to reach US$ 22.21 billion by 2032, growing with a CAGR of 4.81% during the forecast period 2025-2032.

The Global Decaffeinated Coffee Market showed resilience and upward growth in its early stages, moving from US$13.86 billion in 2022 to US$14.56 billion in 2023

The global decaffeinated coffee market is expanding steadily, driven by rising health consciousness and demand for low-caffeine alternatives. Growth is fueled by consumers prioritizing wellness, advancements in decaffeination technology, and increasing popularity in North America and Europe. Additionally, the market benefits from a shift toward premium, sustainable coffee products, with e-commerce and ready-to-drink offerings enhancing accessibility and sales.

Major brands are introducing ready-to-drink (RTD) decaf cold brew, expanding convenience options. For instance, in December 2024, STōK Cold Brew Coffee introduced the first ready-to-drink decaffeinated cold brew available nationwide in grocery stores in US, catering to consumers seeking convenient, low-caffeine options.

Market Scope

| Metrics | Details |

| By Product | Whole Bean Decaffeinated Coffee, Ground Decaffeinated Coffee, Ready-to-drink (RTD) Decaffeinated Coffee and Others |

| By Bean | Arabica, Robusta and Blended |

| By Nature | Organic and Conventional |

| By Roast | Light, Medium and Dark |

| By Flavor | Flavored and Unflavored |

| By End-User | Households and Food & Beverage Industry |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Health and Wellness Concerns

Health and wellness concerns are driving the decaffeinated coffee market as consumers seek healthier alternatives to regular coffee. Globally, around 2.25 billion cups of coffee are consumed daily, highlighting its massive demand. In the U.S., approximately 80% of people drink coffee. However, many people are reducing caffeine intake to manage issues like anxiety, insomnia, and high blood pressure, increasing demand for decaf options. For instance, the British Coffee Association reports that 20% of UK coffee consumers regularly choose decaffeinated options.

As wellness trends continue to evolve, coffee brands are innovating with high-quality, flavorful decaf options to meet consumer expectations. The rise of functional beverages and a growing preference for natural, clean-label products further boost the market. Additionally, pregnant women, older adults, and individuals with heart conditions are opting for decaf coffee as a safer choice.

Flavor and Aroma Loss

The decaffeination process removes not only caffeine but also essential oils and flavor compounds that give coffee its rich taste. Many coffee enthusiasts find decaf coffee to be weaker, flatter, or less aromatic compared to regular coffee, making it less appealing. This perception leads to lower consumer preference, especially among specialty coffee drinkers who prioritize taste and complexity.

Segment Analysis

The global decaffeinated coffee market is segmented based on product, bean, nature, roast, flavor, end-user and region.

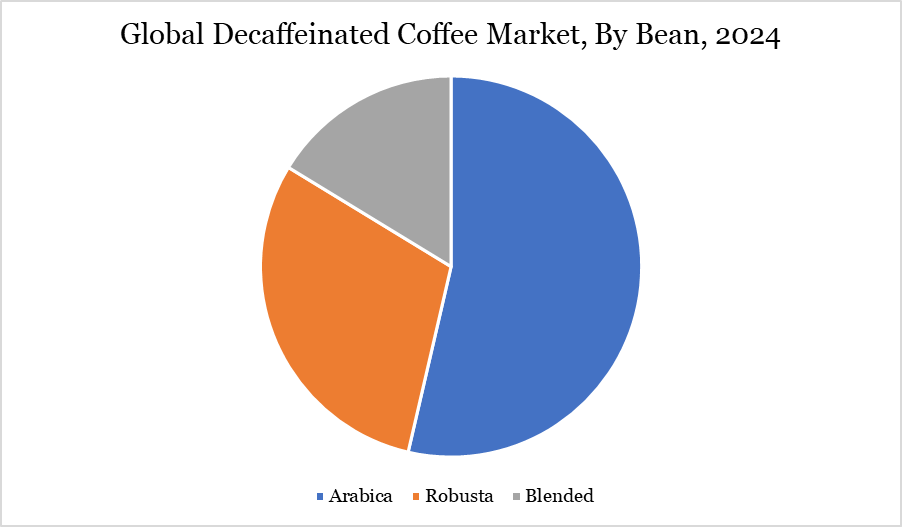

Arabica Dominates Global Decaffeinated Coffee Market Due to Superior Flavor and Consumer Preference

The Arabica segment grew from US$ 4.46 billion in 2022 to US$ 4.40 billion in 2023, owing to rising adoption in the global market.

Arabica holds a significant share in the global decaffeinated coffee market due to its superior flavor, offering a smooth and mild taste preferred by consumers. Its lower caffeine content compared to Robusta makes the decaffeination process easier while preserving quality. Arabica's widespread cultivation and dominance in specialty coffee contribute to its popularity in the decaf segment.

For instance, according to the International Coffee Organization, Arabica coffee exports reached 85.7 million bags in the 12 months ending January 2025, up from 76.33 million bags last year, marking strong growth in global demand. Advanced decaffeination techniques, such as the Swiss Water Process, help maintain Arabica’s rich aroma and taste. Rising health-conscious consumer trends drive demand for high-quality, low-caffeine options, further boosting Arabica’s share.

Geographical Penetration

North America's Consumer Demand for Healthier Caffeine Alternatives Drives Market Growth

North America led the Global Decaffeinated Coffee Market in 2022 with a market size of US$ 4.79 billion and reached further to US$ 4.89 billion in 2023.

North America holds a significant share of the global decaffeinated coffee market due to rising health consciousness and increasing consumer preference for healthier beverage options. The growing demand for premium and organic decaf coffee, driven by a well-established coffee culture, further boosts market growth. Major coffee chains and specialty coffee brands in the U.S. and Canada actively promote decaf options, expanding accessibility.

In December 2023, MATCHA DIRECT, a brand by Tsuji Riichi Honten Co., Ltd. in partnership with Kataoka & Co., Ltd., launched Decaf Matcha in the U.S. market. Using supercritical carbon dioxide decaffeination, it retains nearly 100% of matcha's catechins while reducing caffeine to the level of 8-ounce decaf coffee. This innovation aligns with North America's growing preference for premium, natural, and wellness-focused drinks, further expanding the market for decaf tea and coffee alternatives.

Sustainable Analysis

The sustainability of the decaffeinated coffee market depends on its environmental, social and economic impacts. Traditional decaffeination methods using chemical solvents like methylene chloride raise concerns about health and pollution, while water and CO₂ processes offer eco-friendly alternatives.

Swiss Water Process offers a 100% chemical-free decaffeination method, utilizing only water, temperature and time to remove caffeine while preserving the coffee's original characteristics. This eco-friendly process ensures no chemical solvents are used, aligning with sustainable practices. Consumer demand for sustainable and organic decaf is rising, influencing brands to adopt greener practices.

Competitive Landscape

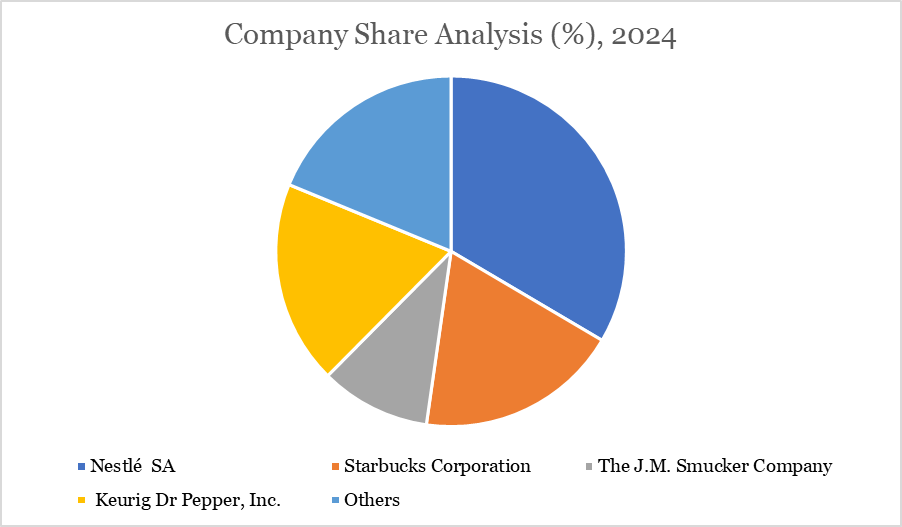

The Decaffeinated Coffee market is highly competitive, driven by advancements in AI-driven data management, automation and predictive analytics. The major players in the market include Nestlé SA, Starbucks Corporation, The J.M. Smucker Company, Keurig Dr Pepper, Inc., Kraft Heinz, Inc., Tata Consumer Products Limited, LAVAZZA SPA, PEET'S COFFEE, Swiss Water Decaffeinated Coffee Inc., Lifeboost Coffee LLC. and others.

Key Developments

- In January 2025, Explorer Cold Brew, a specialty coffee company expanded its offerings to include low-caffeine ready-to-drink cold brews. This line features a "half-caf" option with 65 milligrams of caffeine and a 99.9% caffeine-free cold brew, both using the Swiss Water Process for decaffeination.

- In April 2023, Japan's Moacal Co., Ltd, launched the CUNAE brand which offers high-quality decaffeinated coffee beans and drip packs. Collaborating with Higurashi Coffee, CUNAE developed three flavors: "Yurikago Sweet," "Floral Dance," and "Night Delight," aiming to change consumer perceptions of caffeine-free beverages by delivering rich and satisfying tastes.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Suggestions for Related Report