Data Center Cooling Market Size

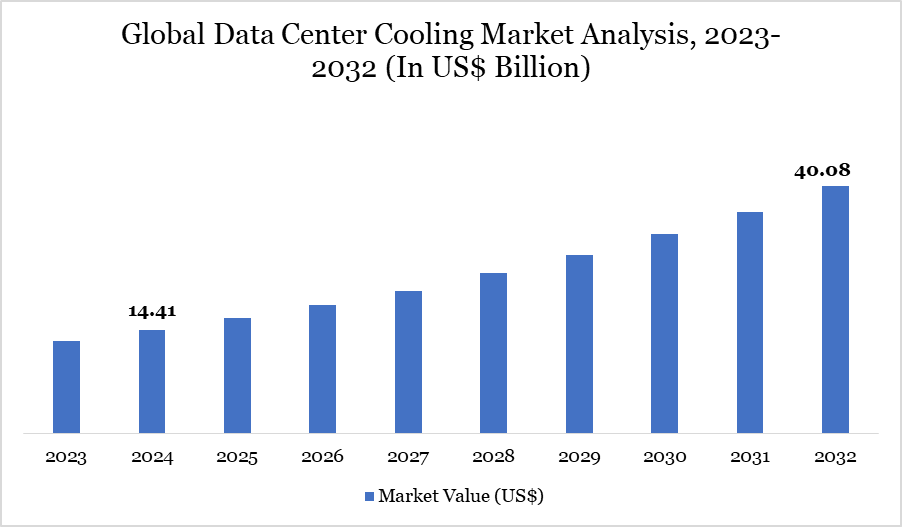

Data Center Cooling Market size reached US$ 14.41 billion in 2024 and is expected to reach US$ 40.08 billion by 2032, growing with a CAGR of 13.64% during the forecast period 2025-2032.

The global surge in data center construction is a major driver for the data center cooling market, as each new facility requires sophisticated thermal management to maintain operational efficiency and equipment longevity. The rapid expansion of cloud service providers along with the growing need for colocation centers by enterprises, has led to a sharp increase in hyperscale and edge data centers worldwide.

For instance, in 2024, Carrier Global Corporation announced that its venture arm, Carrier Ventures, is leading an investment and tech partnership with Strategic Thermal Labs (STL) to advance liquid cooling solutions for data centers. As AI-driven data centers with higher rack power densities emerge, the liquid cooling market is projected to grow to US$3–5 billion by 2028, up from just 2% of current adoption to nearly 30%. This construction boom directly fuels the demand for both traditional and innovative cooling solutions, positioning cooling as a critical component in modern data center infrastructure.

Data Center Cooling Market Trend

The current industry trend is utilizing external air as a solution for cooling systems in server rooms. Nonetheless, the external air can be utilized directly within the server rooms. Free air-cooling can be achieved by employing distinct airflow switching temperatures within the heat exchanger. Free air-cooling methods require the surrounding air to meet specified standards, thus this method is applicable only in certain places.

Certain vendors guarantee the ongoing utilization of free air conditioning when the external temperature remains below 20 ℃. This free air-cooling solution can be utilized for fifty percent of the operational duration. Free air-cooling serves as a cost-effective alternative to traditional data center cooling methods. Nonetheless, free air-cooling cannot entirely supplant traditional cooling systems; it is among the most effective alternatives for realizing financial savings and reducing environmental impact, hence eliminating the necessity for cooling towers and chillers in data center conditioning.

The air-cooling system's solution has significantly strengthened with the endorsement of the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE). It has established particular operational temperature and humidity parameters for employing the available air-cooling technologies. The free air-cooling method is a cost-effective approach for cooling data centers, and numerous operators implement this system.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Cooling Infrastructure | CRAC Units (Computer Room Air Conditioning), CRAH Units (Computer Room Air Handlers), In-Row Cooling Systems, Cooling Towers, Others |

| By Solution Type | Air-Based Cooling, Liquid-Based Cooling |

| By Tier Classification | Tier I & II, Tier III, Tier IV |

| By Deployment Scale | Hyperscale Data Centers, Colocation Data Centers, Enterprise Data Centers, Edge Data Centers |

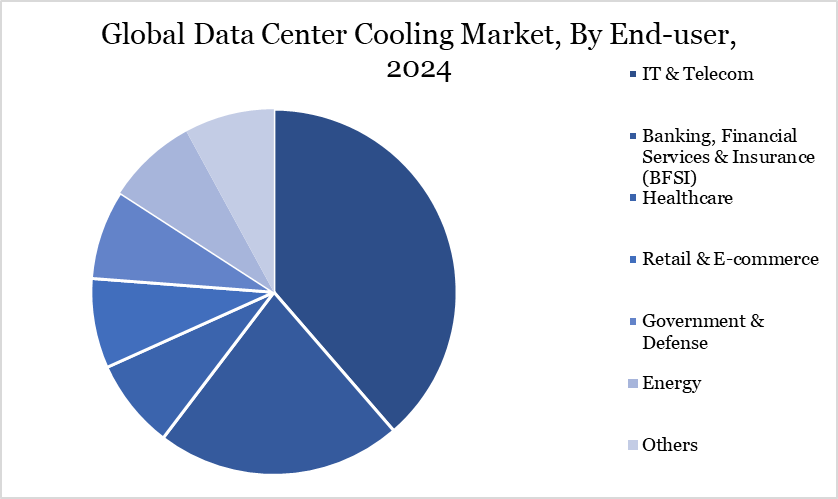

| By End-user | IT & Telecom, Banking, Financial Services & Insurance (BFSI), Healthcare, Retail & E-commerce, Government & Defense, Energy, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Data Center Cooling Market Dynamics

Rising Data Center Deployments

The swift global growth of data center infrastructure is a major factor driving the data center cooling market, as every new facility demands efficient thermal management to ensure optimal performance and avoid overheating. The surge in cloud computing, artificial intelligence, and digital services has prompted leading tech companies such as Amazon Web Services, Microsoft, and Google to consistently develop hyperscale data centers throughout North America, Europe, and Asia.

For instance, in 2025, Neon Cloud has entered the Indian market with the launch of a data center in Gurgaon, located just southwest of New Delhi. The platform provides a range of cloud services, including virtual machines and Kubernetes, with GPU access coming soon. It also offers block storage, object storage, secure backups, virtual private cloud, cloud firewall, and load balancing solutions.

In 2025, Axiom Space, a pioneer in commercial space infrastructure, has announced plans to launch its first two Orbital Data Center (ODC) nodes into low-Earth orbit (LEO) by the end of this year. These nodes will form the foundation for space-based cloud computing, aiming to meet the rising global demand for advanced data services.

High Initial Investment Costs

High initial investment costs significantly restrain the growth of the liquid cooling segment in India's data center cooling market. Liquid cooling systems, especially technologies like immersion cooling and direct-to-chip cooling, require substantial capital for specialized infrastructure, including custom server racks, dielectric fluids, advanced piping systems, pumps, heat exchangers, and monitoring tools.

Unlike traditional air-cooling, which uses standardized and widely available components, liquid cooling demands purpose-built solutions that are often imported, increasing both procurement and installation costs. This becomes a critical concern in a cost-sensitive market like India, where many operators, particularly colocation and edge data centers, operate on tight budgets and prefer incremental upgrades over large upfront overhauls.

For example, while large players like Yotta Infrastructure or AdaniConneX may absorb the capital costs for building high-performance liquid-cooled data centers, smaller players often delay adoption due to limited ROI visibility. Moreover, the retrofit complexity for existing facilities requiring downtime, redesign of airflow paths, and adaptation of server hardware further raises the entry barrier.

Data Center Cooling Market Segment Analysis

The global data center cooling market is segmented based on cooling infrastructure, solution type, tier classification, deployment scale, end-user and region.

BFSI Sector Leads Surge in High-Availability Data Center Cooling Solutions

The BFSI (Banking, Financial Services, and Insurance) segment dominates the global data center equipment and cooling market due to its critical need for high availability, data security, and real-time transaction processing. Financial institutions operate mission-critical applications that demand continuous uptime, which in turn drives investments in high-redundancy UPS systems, precision cooling infrastructure, and environmental monitoring tools. These institutions often adopt Tier III and Tier IV data center designs, requiring N+1 or 2N equipment redundancy for both power and cooling.

For example, JPMorgan Chase operates several in-house data centers and is expanding its global infrastructure to support AI-based financial services, leading to increased demand for high-capacity UPS systems and liquid cooling for dense compute environments. Similarly, ICICI Bank and HDFC Bank in India have invested in their own green and high-efficiency data centers to comply with RBI regulations and ensure uninterrupted digital banking services.

In Europe, Deutsche Bank has partnered with Google Cloud but still maintains hybrid data centers that rely on highly resilient physical infrastructure for core banking operations. Additionally, insurance giants like AXA and Allianz continue to rely on dedicated colocation facilities with strict power and cooling SLAs to protect sensitive customer and claims data.

Data Center Cooling Market Geographical Share

Scaling Heat and Power Walls in Asia-Pacific’s AI and Cloud Data Center Boom

The Asia-Pacific (APAC) region is emerging as a dominant force in the global data center equipment and cooling market, driven by rapid digitalization, the expansion of cloud providers, and government-led digital infrastructure initiatives. Countries like China, India, Japan, Singapore, and Hong Kong are experiencing a surge in data traffic, AI workloads, and fintech adoption, all of which require scalable, high-density data centers equipped with advanced UPS systems, precision cooling, and redundant power architectures.

For instance, in 2025, BDx Data Centers secured project financing from Clifford Capital, Singapore’s United Overseas Bank, and Japan’s Sumitomo Mitsui Banking Corporation to develop its first hyperscale data center in Kwai Chung, Hong Kong. The funding not only supports construction but also operating costs, emphasizing the increasing commitment toward infrastructure reliability and efficiency in APAC.

Similarly, EdgeConneX entered the Japanese market in 2025 by securing land in the greater Osaka-Kyoto area in collaboration with Kagoya Asset Management, to build a sustainable, AI-ready data center highlighting Japan’s push to support robust digital and AI infrastructure.

In addition, Singapore continues to lead as a regional data hub, with companies like Equinix and Digital Realty expanding facilities and investing in liquid cooling and modular UPS systems to meet green data center guidelines. These instances underscore how APAC's strong capital investment, regulatory support, and growing digital economy are positioning the region as a global hotspot for data center infrastructure growth, thereby fueling demand for power and cooling equipment.

Data Center Cooling Market Major Players

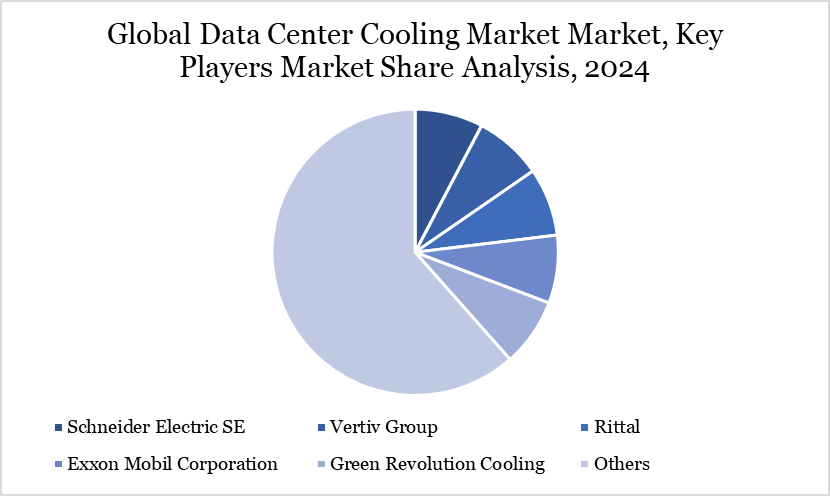

The major global players in the market include Schneider Electric SE, Vertiv Group, Rittal, Exxon Mobil Corporation, Green Revolution Cooling, Air Enterprises, Asetek, Inc., Climaveneta Climate Technologies PVT. LTD., Coolcentric, Mitsubishi Electric Corporation.

Technological Analysis

The escalating demands of technology, internet traffic, and intensive workloads necessitate expanded data center capacity, projected to grow at a 25%-30% CAGR to nearly US$650 billion by 2028. This surge presents critical challenges, particularly in balancing high-density computational workloads, such as AI and high-performance computing (HPC) with sustainability goals. Central to addressing these challenges is the advancement of energy-efficient cooling technologies tailored to diverse operational needs.

Traditional air-cooling remains prevalent for lower-density environments, whereas liquid cooling both direct and immersion has emerged as a superior solution for managing the thermal load of power-intensive applications. Innovative hybrid cooling systems combine air and liquid techniques to optimize energy use dynamically. Furthermore, approaches such as evaporative and free cooling leverage environmental conditions to reduce reliance on mechanical systems, thereby minimizing carbon footprints.

Optimal cooling design integrates hot/cold aisle containment, airflow management, and adherence to industry standards (e.g., ASHRAE), ensuring reliability, efficiency, and scalability. Ultimately, sophisticated cooling strategies not only maintain data center performance but also drive sustainable growth in this rapidly evolving sector.

Key Developments

In March 2025, Vertiv Group Corp. formed a partnership with Tecogen Inc., a U.S.-based sustainable energy firm that specializes in ultra-efficient, clean on-site power, heating, and cooling solutions. This partnership enables Vertiv to integrate Tecogen's sophisticated natural gas-powered chiller technology into its worldwide data center solutions. The novel solution seeks to mitigate power constraints and facilitate the extensive implementation of AI technologies. This enhancement augments Vertiv’s already formidable line of industry-leading cooling solutions.

In December 2024, Schneider Electric launched new AI-ready data center solutions to address the energy and sustainability requirements of AI systems. In partnership with NVIDIA, Schneider Electric introduced a standard design for liquid-cooled AI clusters capable of sustaining up to 132 kW per rack. The compact Galaxy VXL uninterruptible power supply (UPS) provides 52% space savings and high power density, specifically engineered for AI and data centers, ensuring effective power delivery in a reduced footprint.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies