Controlled Environment Agriculture Market Size

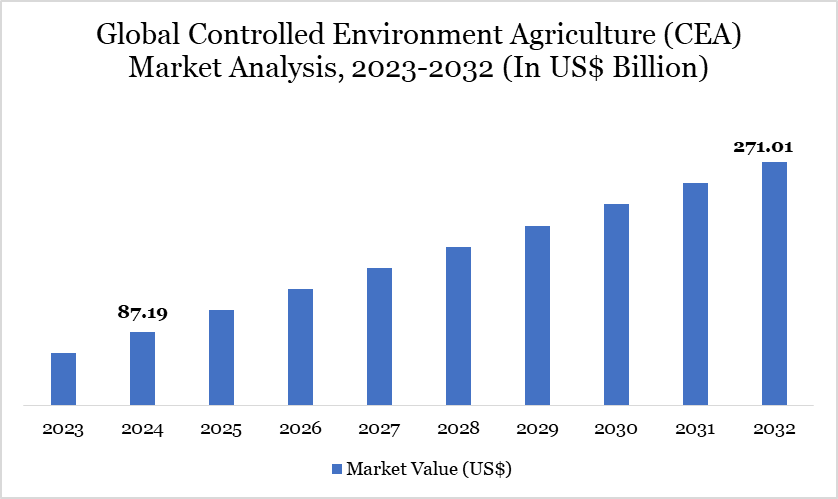

Global Controlled Environment Agriculture (CEA) Market size reached US$ 87.19 billion in 2024 and is expected to reach US$ 271.01 billion by 2032, growing with a CAGR of 15.23% during the forecast period 2025-2032.

Controlled Environment Agriculture (CEA) is an innovative approach to food production that utilizes technology to optimize growing conditions within enclosed structures such as greenhouses and vertical farms. This method enables year-round cultivation, efficient resource use, and reduced dependency on external climatic factors.

According to the US Department of Agriculture (USDA), nearly 3,000 fruit and vegetable operations in the US employed CEA techniques, accounting for 2–3% of total production. Furthermore, data from the USDA's Economic Research Service indicates that from 2009 to 2019, approximately 60–70% of crops grown in CEA systems were tomatoes, lettuce, and cucumbers, predominantly using hydroponic methods.

Controlled Environment Agriculture (CEA) Market Trend

A trend in the CEA market is the increasing adoption of advanced technologies to enhance efficiency and sustainability. Innovations such as automation, artificial intelligence (AI), and Internet of Things (IoT) devices are being integrated into CEA systems to monitor and control environmental conditions, optimize resource use, and improve crop yields.

Technological advancements are boosting productivity and making CEA more accessible and cost-effective for a broader range of agricultural producers. As urban populations grow and arable land becomes scarcer, the role of technology in CEA will be pivotal in meeting global food demands sustainably.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

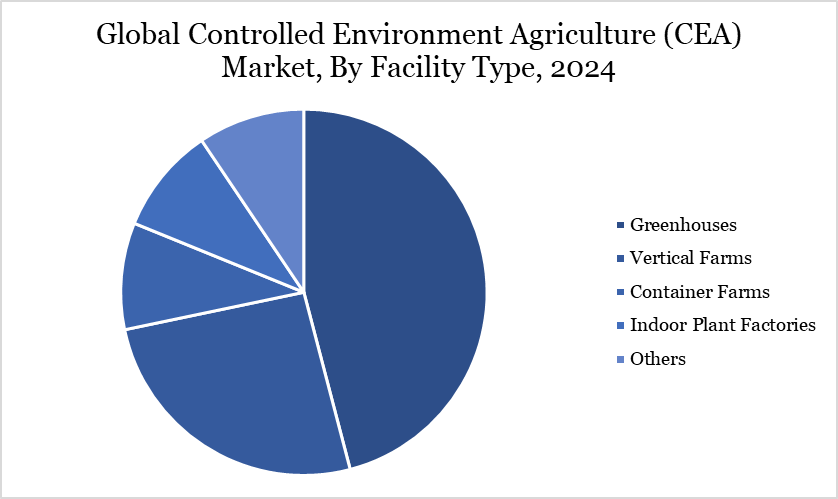

| By Facility Type | Greenhouses, Vertical Farms, Container Farms, Indoor Plant Factories, Others |

| By Crop | Leafy Greens, Herbs, Microgreens, Tomatoes and Berries, Mushrooms, Others |

| By Technique | Hydroponics, Aeroponics, Aquaponics, LED Lighting Systems, IoT and Automation, Others |

| By End-User | Commercial Agriculture, Urban Farming Community-Supported Agriculture (CSA), Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Controlled Environment Agriculture Market Dynamics

Increasing Urban Food Demand and Declining Arable Land Availability

The Controlled Environment Agriculture (CEA) market in the Asia-Pacific region is being propelled by escalating urban food demand coupled with diminishing arable land availability. According to the Food and Agriculture Organization (FAO), nearly 55% of Asia-Pacific's population is projected to reside in urban areas by 2030, intensifying challenges related to urban food security.

The rapid urbanization, alongside a shift in dietary preferences towards meat, dairy, fruits, and vegetables, is placing unprecedented pressure on food systems. Simultaneously, countries like China are grappling with limited arable land, possessing only 7% of the world's arable land to feed approximately 20% of the global population. These dynamics underscore the critical role of CEA technologies in ensuring sustainable food production in urban settings.

High Energy Consumption and Operational Costs in CEA Systems

High energy consumption and operational costs are significant restraints in the Controlled Environment Agriculture (CEA) market. Electricity expenses, particularly for lighting and climate control, can account for up to 28% of a facility's operational costs, with lighting systems alone consuming between 65% to 85% of total energy use.

The substantial energy demand has led to financial challenges for some CEA operations; for example, the vertical farming company Infarm announced major layoffs and downsizing due to rising electricity costs and profitability pressures. These high operational costs pose a barrier to the widespread adoption and scalability of CEA systems.

Controlled Environment Agriculture Market Segment Analysis

The global controlled environment agriculture (CEA) market is segmented based on facility type, crop, technique, end-user and region.

Greenhouses Segment Driving Controlled Environment Agriculture (CEA) Market

Greenhouse facilities are a pivotal segment propelling the advancement of Controlled Environment Agriculture (CEA) globally. In the UK, the proposed Rivenhall greenhouse in Essex exemplifies this trend. Spanning 40 hectares, it aims to supply 30,000 tonnes of tomatoes annually, accounting for approximately 7% of the UK's imports. This facility plans to utilize heat, electricity, and CO₂ from a neighboring incinerator, ensuring stable energy prices for a decade and enhancing food security by reducing reliance on imports.

Similarly, the Netherlands showcases the impact of greenhouse agriculture. With around 4,000 greenhouse enterprises operating over 9,000 hectares, the country produces US$ 8.11 billion worth of vegetables, fruits, plants, and flowers, with approximately 80% exported. Innovations like "closed greenhouses" have emerged, allowing complete control over the growing process while reducing energy usage.

Controlled Environment Agriculture Market Geographical Share

Demand for Controlled Environment Agriculture (CEA) in Asia-Pacific

The Asia-Pacific region is witnessing a significant surge in demand for Controlled Environment Agriculture (CEA), driven by government initiatives and technological advancements. In India, the government has provided subsidies for aeroponic farming techniques, promoting indoor farming to address food security concerns.

Singapore's "30 by 30" goal aims to produce 30% of the nation's nutritional needs locally by 2030, encouraging urban farming practices. South Korea has invested US$ 0.18 billion to promote smart farm technology, aiming to modernize agriculture and attract younger farmers. These concerted efforts across the region underscore the growing importance and adoption of CEA to ensure food security and sustainable agricultural practices.

Technological Analysis

The Controlled Environment Agriculture (CEA) market is witnessing significant technological advancements, particularly in automation, artificial intelligence (AI), and Internet of Things (IoT) applications. These innovations are enhancing efficiency and precision in agriculture by optimizing climate control, nutrient delivery, and crop monitoring. For instance, the Indian government's Krishi 24/7 initiative, launched in November 2023, utilizes AI to monitor and analyze agricultural data, supporting decision-making processes in farming practices.

Similarly, in the US, the Department of Agriculture (USDA) introduced a crop insurance program in October 2023 specifically designed for producers in controlled environments, including greenhouses and indoor farms, to mitigate financial risks and promote urban-based food production. These developments underscore the pivotal role of technology in advancing CEA systems and addressing challenges in modern agriculture.

Controlled Environment Agriculture Market Major Players

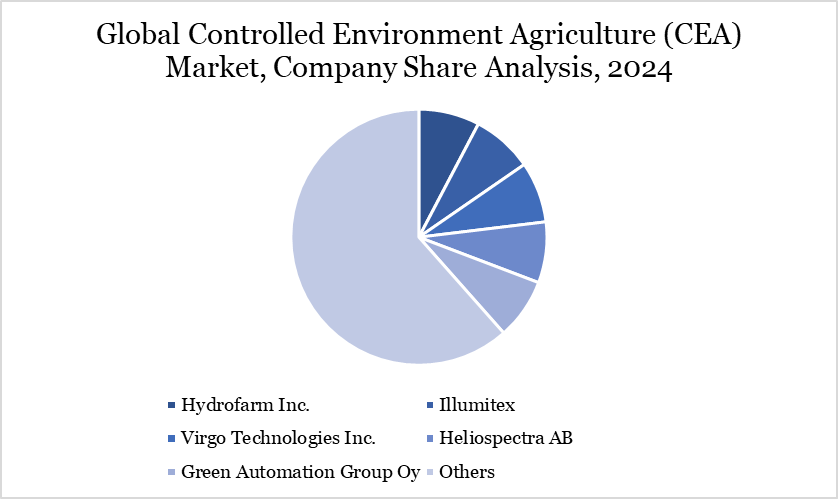

The major global players in the market include Hydrofarm Inc., Illumitex, Virgo Technologies Inc., Heliospectra AB, Green Automation Group Oy, Kryzen Biotech, Agroz Group, Cultiveat, Boom Grow Farms, and Gotham Greens.

Key Developments

- In July 2022, the CDA (Center for Desert Agriculture) launched several pilot projects within the CEA domain, in collaboration with Red Sea and external industry partners, exploring different aspects of CEA design and engineering that will increase the viability of CEA in the KSA and other hot, arid regions.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies