Overview

The global construction aluminum market reached US$75,345.01 million in 2024 and is expected to reach US$1,20,653.41 million by 2032, growing at a CAGR of 6.17% during the forecast period 2025-2032.

The construction aluminum market is witnessing strong growth, driven by rising urbanization, infrastructure expansion, and the increasing demand for lightweight, durable, and energy-efficient materials. Aluminum’s recyclability and corrosion resistance make it a preferred choice for modern buildings, particularly in facades, doors, and roofing systems. According to National Action Plans on Business and Human Rights, the global construction market is expected to grow by US$4.5 trillion to US$15.2 trillion within the next decade, with China, India, the US, and Indonesia accounting for nearly 60% of this growth, creating massive opportunities for aluminum consumption.

This momentum is further supported by sustainable building initiatives, where aluminum plays a crucial role due to its eco-friendly properties and alignment with green certification standards. Rapid infrastructure projects in emerging economies, coupled with smart city developments, are fueling demand for advanced aluminum alloys and solutions. With governments emphasizing sustainable growth and global players investing in innovative construction materials, the construction aluminum market is set to expand at a robust pace in the coming years.

Construction Aluminum Market Trend

The construction aluminum market trend is shifting toward sustainability, innovation, and energy efficiency. Increasing adoption of aluminum in green buildings, smart city projects, and modern infrastructure is driving demand for lightweight and recyclable materials. Advanced aluminum alloys are gaining popularity for their strength, design flexibility, and corrosion resistance, making them ideal for facades, windows, and roofing. With rapid urbanization in Asia-Pacific and rising government focus on eco-friendly construction, the market is expected to grow steadily, supported by continuous technological advancements and large-scale infrastructure investments worldwide.

Market Scope

Metrics | Details |

By Product Type | Extrusions, Sheet and Plates, Castings, Others |

By Alloy Type | Wrought Alloys, Cast Alloys |

By Application | Roofing & Cladding, Windows & Doors, Structural Components, Balustrades and Handrails, Others |

By End-User | Residential, Commercial, Infrastructure, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For more details on this report, Request for Free sample

Market Dynamics

Rapid Urbanization & Infrastructure Growth

Rapid urbanization and infrastructure growth are key forces driving the global construction aluminum market, as cities expand and demand for modern housing, commercial spaces, and transport systems rises. Aluminum’s lightweight, durable, and recyclable nature makes it indispensable for large-scale projects like metro stations, airports, and high-rise buildings, where both strength and sustainability are required. Governments worldwide are prioritizing infrastructure upgrades to support urban growth, further boosting the adoption of aluminum in roofing, cladding, and structural applications.

In April 2025, the UK government strengthened this momentum by launching the National Infrastructure and Service Authority (NISTA), merging the NIC and IPA to accelerate major projects such as roads, railways, and hospitals. Supported by the Teal Book and a new 10-year strategy, this initiative aims to cut delays, improve efficiency, and restore investor confidence, reflecting how infrastructure reforms directly enhance demand for aluminum. With similar initiatives taking shape globally, rapid urbanization combined with proactive government strategies is ensuring sustained growth in the construction aluminum market.

High Energy Consumption and Environmental Concerns

High energy consumption in aluminum smelting significantly increases production costs, making construction aluminum less competitive against alternative materials. Moreover, primary aluminum production is associated with high carbon emissions, raising environmental concerns and attracting stricter government regulations. These factors are pushing construction companies to seek cost-effective and eco-friendly substitutes, thereby restraining the overall growth of the construction aluminum market.

Segment Analysis

The global construction aluminum market is segmented based on product type, alloy type, application, end-user and region

Extrusions Dominate the Construction Aluminum Market Due to Versatility, Strength, and Sustainable Design Applications

Extrusions hold a significant share in the construction aluminum market because of their lightweight, durable, and highly versatile properties, making them essential for applications such as windows, doors, curtain walls, and roofing systems. Their ability to be shaped into complex designs while maintaining strength and corrosion resistance makes them vital for modern infrastructure, where performance and aesthetics go hand in hand. Additionally, their recyclability and energy efficiency align with the growing global shift toward sustainable construction practices.

In line with this, Hindalco Industries announced on September 12, 2023, a strategic partnership with Italy’s Metra SpA to introduce advanced aluminium extrusion technology in India. The collaboration focuses on producing large-scale, high-precision extrusions for high-speed rail coaches, a technology so far limited to Europe, China, and Japan. While primarily aimed at modernizing Indian Railways, this move is expected to have a positive impact on the broader construction sector by bringing world-class extrusion capabilities to the domestic market, further strengthening its role as a cornerstone of sustainable and future-ready infrastructure.

Geographical Penetration

Asia-Pacific Leads the Construction Aluminum Market Driven by Rapid Urbanization and Infrastructure Growth

Asia-Pacific commands a significant share in the construction aluminum market, driven by rapid urbanization, expanding real estate, and large-scale infrastructure development in countries like China, India, and Southeast Asia. Aluminum’s versatility in applications such as facades, windows, roofing, and structural components makes it the preferred material for modern, energy-efficient buildings. According to IBEF, India’s infrastructure investment is set to rise from 5.3% of GDP in FY24 to 6.5% by FY29, highlighting the region’s growing emphasis on sustainable and advanced construction practices.

Supporting this momentum, the Indian government recently approved 56 new Watershed Development Projects across 10 states with a budget of ₹700 crore (US$80.9 million), reinforcing its focus on rural development and sustainable infrastructure. Such initiatives, combined with the region’s strong manufacturing base and availability of raw materials, are boosting aluminum adoption in construction. As Asia-Pacific continues to prioritize eco-friendly and long-lasting building solutions, aluminum extrusions, sheets, and castings are witnessing robust demand, solidifying the region’s dominance in the global construction aluminum market.

Tariff and Regulatory Analysis

The construction aluminum market is expanding steadily, driven by rising infrastructure projects, smart city developments, and the push for sustainable building solutions. Aluminum’s recyclability, durability, and lightweight nature make it a preferred choice for modern designs, while government policies promoting green construction further boost demand. However, trade regulations and tariffs play a major role in shaping market dynamics, influencing both supply chains and pricing trends.

On August 18, 2025, the US expanded steel and aluminum tariffs to include hundreds of finished products, such as aluminum wire, imposing a 50% duty, which benefits domestic producers but risks delaying infrastructure and transformer-heavy sectors. These regulatory shifts highlight how tariffs can create short-term disruptions even as they encourage local production. Despite such challenges, growing global construction investments and the increasing use of eco-friendly materials continue to drive the long-term growth trajectory of the construction aluminum market.

Competitive Landscape

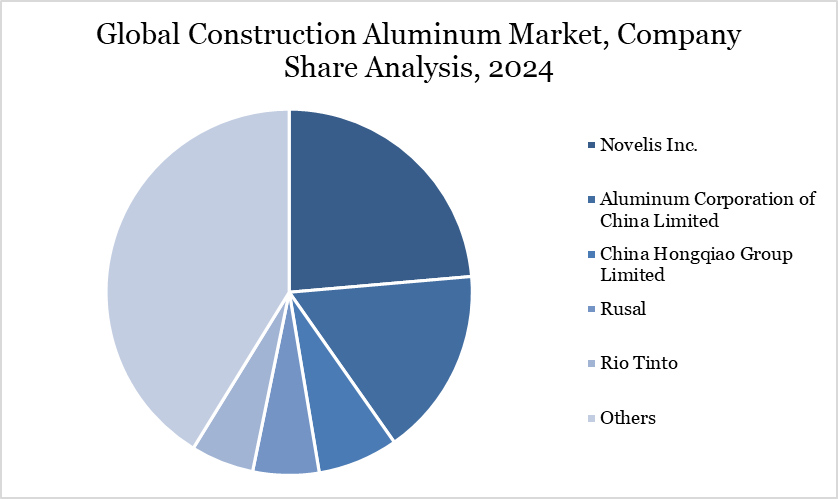

The major global players in the market include Novelis Inc., Aluminum Corporation of China Limited, China Hongqiao Group Limited, Rusal, Rio Tinto, Emirates Global Aluminum (EGA), Norsk Hydro, Constellium, EFCO Aluminium Formwork, Alcoa Corporation

Key Developments

In January 2025, Viva, Asia’s largest manufacturer of aluminium composite panels, launched SOLID X, India’s first pre-coated ready-to-install solid aluminium panels, at the BAU Expo in Germany. The panels combine strength, versatility, and sustainability, featuring a fire rating of A1, weather-resistant PVDF coating, and superior load-bearing capacity. Designed for easy installation and customizable aesthetics, SOLID X also incorporates eco-friendly manufacturing practices, scratch resistance, antimicrobial coating, and a 15-year warranty, setting a new benchmark for modern facades and interiors.

In January 2024, Jindal Aluminium, India’s aluminium extrusion company, announced the launch of a new fabrication division to manufacture engineered aluminium products for the building and construction sector, including windows, frameworks, roofing, and furniture. The unit is equipped with advanced machinery like automated sawing systems, punching machines, and four-axis cutters to deliver precision and efficiency.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies