Obesity Therapeutics Market Size & Industry Outlook

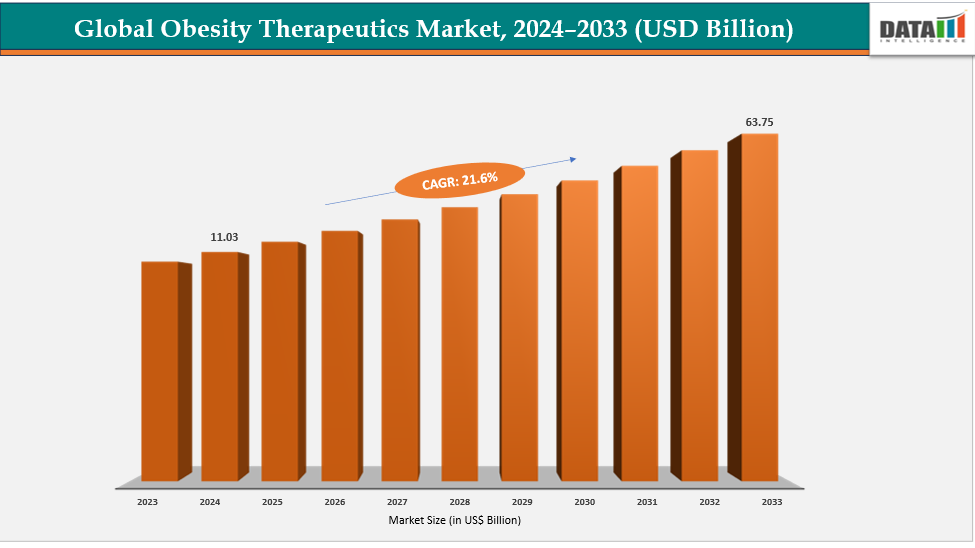

The global obesity therapeutics market size reached US$ 9.19 Billion in 2023 with a rise of US$ 11.03 Billion in 2024 and is expected to reach US$ 63.75 Billion by 2033, growing at a CAGR of 21.6% during the forecast period 2025-2033.

The obesity treatments market has grown considerably since the discovery of GLP-1 receptor agonists and dual-agonist medications. These medications showed previously unheard-of benefits for metabolism and weight loss, which led to widespread clinical adoption and patient demand. They were positioned as game-changing treatments for obesity and associated disorders due to their shown capacity to lower cardiovascular risks and enhance glycaemic glucose management. In order to provide next-generation incretin and non-incretin treatments with increased convenience, safety, and efficacy, big pharmaceutical corporations concurrently widened their R&D pipelines and established strategic alliances.

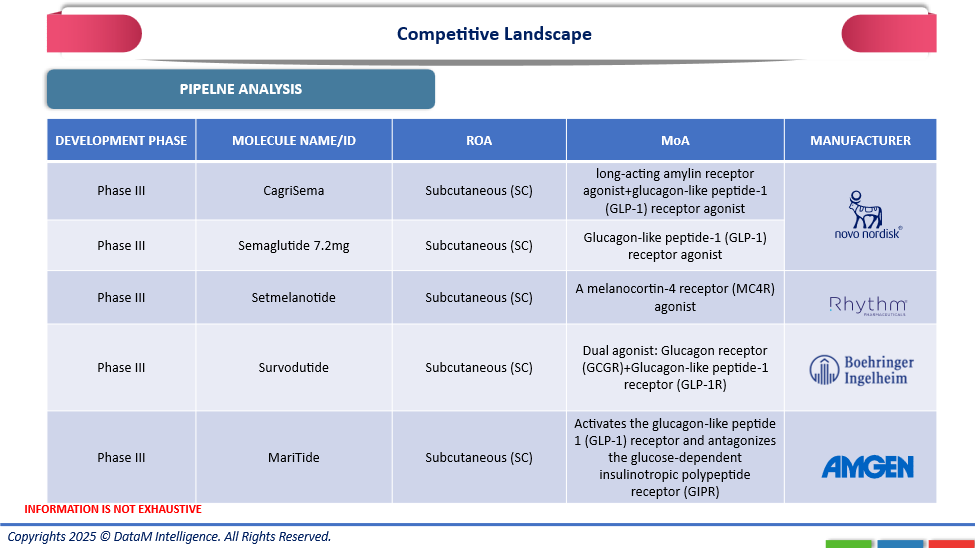

Competitive Landscape

The competitive environment of the global market for obesity treatments reflects a strong and rapidly expanding pipeline that is supported by leading pharmaceutical companies across the globe. Novo Nordisk dominates the market with subcutaneously administered CagriSema and Semaglutide 7.2 mg, both of which are in Phase III. These long-acting GLP-1 receptor agonists support Novo Nordisk's leadership in metabolic diseases by efficiently controlling hunger and glucose metabolism. Rhythm Pharmaceuticals continues to make progress with Setmelanotide, a melanocortin-4 receptor (MC4R) agonist, targeting rare genetic obesity syndromes. Amgen's MariTide, a GLP-1 receptor activator and GIPR antagonist, and Boehringer Ingelheim's Survodutide, a dual glucagon and GLP-1 receptor agonist, exhibit encouraging results in terms of weight and glycemic management.

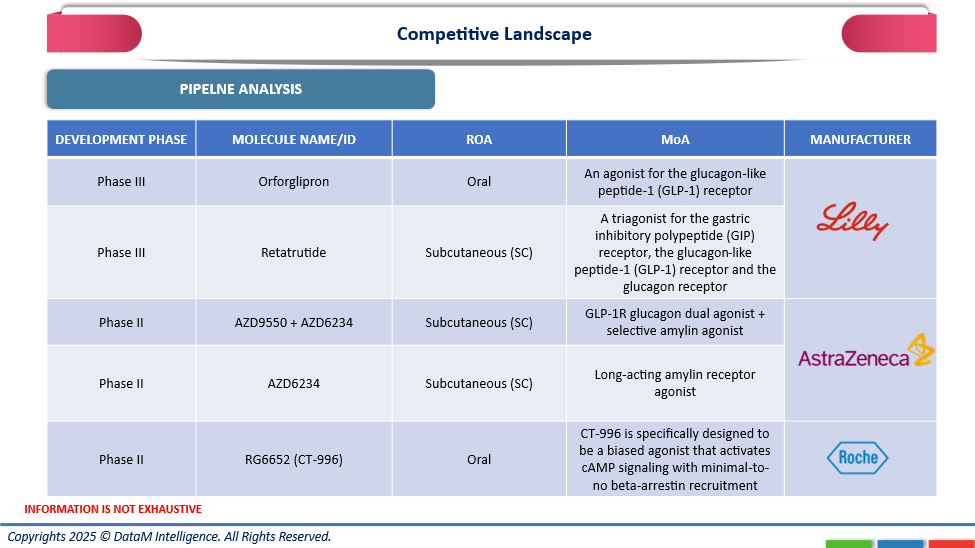

Eli Lilly, AstraZeneca, and Roche is parallel innovation shows how the industry is becoming more diversified. Lilly's leadership in next-generation metabolic medicines is demonstrated by its Orforglipron, an oral GLP-1 receptor agonist, and Retatrutide, a triple agonist that targets GIP, GLP-1, and glucagon receptors. Both medications are in Phase III. AstraZeneca develops Phase II dual and selective amylin receptor agonists, AZD9550 + AZD6234 and AZD6234, with the goal of improving durability and metabolic efficiency. Roche presents RG6652 (CT-996), an oral biased GLP-1 receptor agonist that may increase safety and acceptability by selectively activating cAMP signaling with little beta-arrestin recruitment. These biologics collectively show a sophisticated move toward precision-based, multi-receptor treatments that seek to reshape the future of managing metabolic diseases and obesity.

Key Highlights

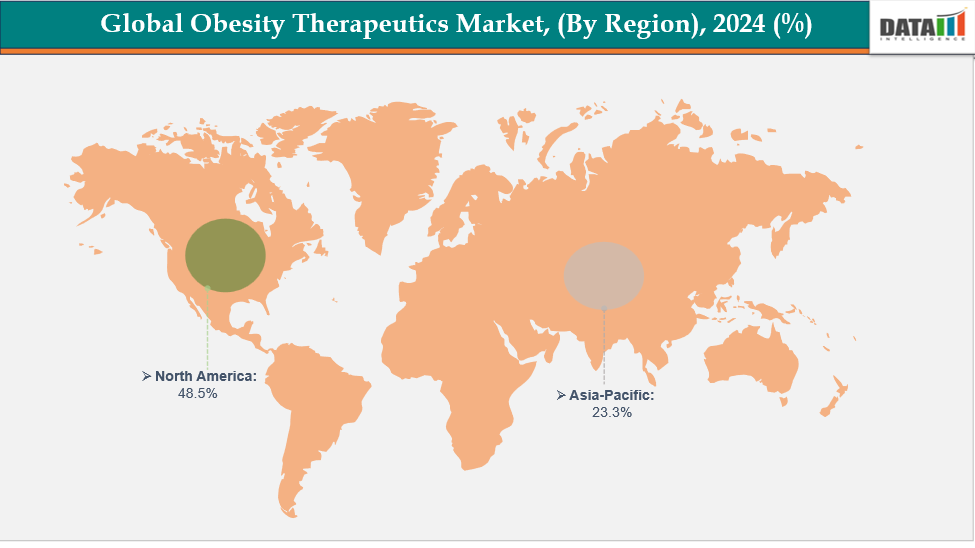

- North America is dominating the global obesity therapeutics market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global obesity therapeutics market, with a CAGR of 7.7% in 2024

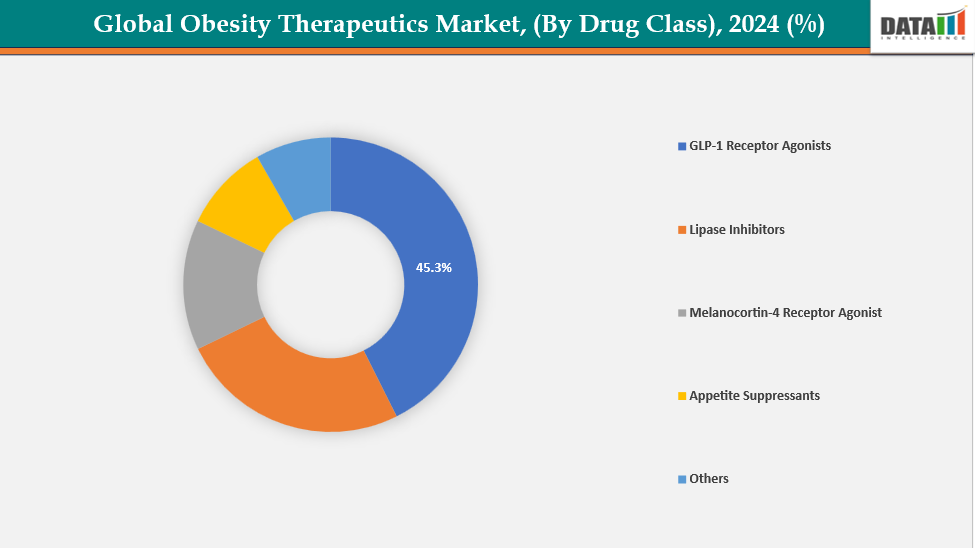

- The GLP-1 receptor agonists segment from drug class is dominating the obesity therapeutics market with a 45.3% share in 2024

- The oral segment route of administration is dominating the obesity therapeutics market with a 41.3% share in 2024

- Top companies in the obesity therapeutics market include Novo Nordisk, Eli Lilly, VIVUS LLC, Currax Pharmaceuticals LLC, GSK plc, Roche Laboratories Inc, AstraZeneca, Rhythm Pharmaceuticals, Inc, Takeda Pharmaceutical Company Limited, and KVK Tech, Inc, among others.

Competitive Landscape

Market Dynamics

Drivers: Rising prevalence of obesity worldwide are accelerating the growth of the obesity therapeutics market

The obesity treatments market is expanding at an accelerated rate due to the increased prevalence of obesity globally. The need for efficient weight-management programs is growing quickly as more people acquire weight-related illnesses like diabetes, high blood pressure, and heart disease. Pharmacological therapies are becoming more widely used as healthcare systems acknowledge obesity as a chronic, curable illness. Owing to the factors like worldwide prevalence, for instance, according to WHO data published in 2024, overweight and obesity were among the leading causes of disability and mortality in the European Region, affecting around 60% of adults, one-third of school-aged children, and 8% of children under five.

Additionally, patients are being encouraged to seek medical assistance due to increased awareness caused by public health campaigns and the media. Global need for long-term, safe treatment alternatives is driving robust market expansion as obesity rates continue to climb across all age groups and geographical areas.

Restraints: Regulatory withdrawals and rollout bottlenecks and off-label is hampering the growth of the obesity therapeutics market

The market expansion for obesity treatments is being hampered by regulatory withdrawals and deployment difficulties. New medicine launches across regions are delayed by stringent approval requirements and protracted evaluation durations. Market penetration is slowed by additional delays caused by manufacturing and distribution approvals.

Additionally, increased demand has resulted in the off-label or unsupervised use of anti-obesity drugs, which are frequently bought online without a doctor's supervision because of adverse impacts on people, the businesses are pulling their products off the market and stopping their development. For instance, in April 2025, Pfizer discontinued the development of its oral GLP-1 receptor agonist, danuglipron, which was under investigation for chronic weight management. The decision followed a comprehensive review of clinical data and regulatory feedback after a potential drug-induced liver injury was observed in one study participant.

Obesity Therapeutics Market, Segmentation Analysis

The global obesity therapeutics market is segmented based on drug class, route of administration, distribution channel and region

By Drug Class: The GLP-1 receptor agonists segment from drug class is dominating the obesity therapeutics market with a 45.3% share in 2024

The obesity treatments market is dominated by the GLP-1 receptor agonists segment because of its higher efficacy and established clinical results. These medications enhance glucose metabolism and cardiovascular health while promoting noticeable and long-lasting weight loss. They cause people to eat less because they mimic the natural gut hormones that control hunger and satiety. Long-term use is encouraged by their simple dosage schedules and good safety profile.

Furthermore, GLP-1 receptor agonists are becoming the most popular treatment choice for obesity due to their sophisticated formulations and delivery systems, which are being driven by ongoing research, new product launches, and growing regulatory approvals. For instance, in July 2024, the MHRA approved semaglutide (Wegovy) to reduce the risk of serious heart problems or strokes in overweight and obese adults. This GLP-1 receptor agonist was already approved for obesity and weight management, used alongside diet, physical activity, and behavioral support, marking a major milestone in preventive care.

By Route of Administration: The oral segment route of administration is dominating the obesity therapeutics market with a 41.3% share in 2024

The obesity treatments market is dominated by the oral route of administration since it is convenient, safe, and preferred by patients. Compared to injectables, oral medications are more convenient and non-invasive, which improves treatment adherence. They lessen reliance on medical personnel by enabling self-administration. This tendency has been reinforced by recent advancements, approvals, pharmaceutical launches, and exclusive licensing agreements in oral GLP-1 agonists and combination formulations. For instance, in November 2023, AstraZeneca entered into an exclusive licensing agreement with Eccogene for ECC5004, a next-generation oral GLP-1 receptor agonist, gaining global rights to develop and commercialize it for obesity, type 2 diabetes, and cardiometabolic conditions.

Additionally, cost-effective production and increased accessibility via physical and virtual pharmacies further increase use. Additionally, oral medications have easier logistics and a longer shelf life. To improve absorption and efficacy, pharmaceutical companies are concentrating on creating innovative oral formulations of incretin-based medications.

Geographical Analysis

North America is dominating the global obesity therapeutics market with a 48.5% in 2024

The obesity treatments market was dominated by North America due to high obesity rate, sophisticated healthcare system, and robust uptake of new anti-obesity medications. Growing awareness of the health problems associated with obesity, attractive reimbursement policies, and ongoing product innovation all contributed to regional expansion and market supremacy.

In the USA, obesity therapeutics market growth was driven by rising obesity prevalence, increasing patient awareness, and advancements in GLP-1 and combination therapies. Moreover, the recent launch of new companion combination products further supported effective and personalized weight management solutions. For instance, in November 2023, the U.S. FDA approved Eli Lilly’s Zepbound (tirzepatide) injection for chronic weight management in adults with obesity or overweight and at least one weight-related condition, as an adjunct to a reduced-calorie diet and increased physical activity.

Europe is the second region after North America which is expected to dominate the global obesity therapeutics market with a 34.5% in 2024

In Europe, the obesity therapeutics market has grown rapidly due to rising obesity prevalence, increasing health awareness, and expanding access to advanced GLP-1 therapies. Market growth was further supported by favorable regulatory frameworks, continuous product innovation and new product launches, and growing adoption of combination and personalized treatment approaches.

Owing to factors like new product launches, for instance, In June 2024, Rhythm Pharmaceuticals Netherlands B.V. received a positive opinion from the CHMP recommending changes to the marketing authorisation of Imcivree. The approval extended its use to children aged two years and above. Imcivree was indicated for the treatment of obesity and the control of hunger associated with genetic disorders.

The obesity treatment market in Germany was propelled by the country's robust healthcare system, rising obesity prevalence, and expanding knowledge of medical weight control. Market expansion and therapeutic adoption across patient demographics were further reinforced by the growing use of GLP-1 agonists, favorable reimbursement policies, and a focus on safe, clinically established medicines.

The Asia Pacific region is the fastest-growing region in the global obesity therapeutics market, with a CAGR of 7.7% in 2024

Asia-Pacific's obesity treatments market, which includes China, India, South Korea, and Japan, grew quickly as a result of rising obesity rates, rising healthcare costs, and increased awareness of weight-loss options. The expansion and adoption of the regional market were further hastened by improvements in drug development, increased accessibility to anti-obesity drugs, and encouraging government measures.

China’s obesity therapeutics market expanded rapidly, driven by rising obesity rates, higher disposable incomes, and increasing health awareness. Continuous innovation, expanding local players, and favorable NMPA approvals for advanced anti-obesity drugs supported strong market growth and accelerated adoption of effective therapeutic solutions nationwide. Owing to factors like NMPA approvals, for instance, in June 2025, Innovent Biologics, Inc. announced that China’s NMPA had approved Mazdutide, the world’s first dual GCG/GLP-1 receptor agonist, for chronic weight management in adults with overweight or obesity, marking a major milestone in advanced obesity treatment.

Obesity Therapeutics Market Competitive Landscape

Top companies in the obesity therapeutics market include Novo Nordisk, Eli Lilly, VIVUS LLC, Currax Pharmaceuticals LLC, GSK plc, Roche Laboratories Inc, AstraZeneca, Rhythm Pharmaceuticals, Inc, Takeda Pharmaceutical Company Limited, and KVK Tech, Inc, among others.

Novo Nordisk: Novo Nordisk is a global healthcare leader, specializing in diabetes and obesity care. The company has pioneered obesity therapeutics with innovative GLP-1 receptor agonists such as Saxenda (liraglutide) and Wegovy (semaglutide). Focused on addressing the global obesity epidemic, Novo Nordisk emphasizes sustainable weight management through evidence-based, safe, and effective treatments.

Key Developments:

- In September 2025, Pfizer acquired Metsera, a clinical-stage biopharmaceutical company developing next-generation therapies for obesity and cardiometabolic diseases. The acquisition strengthened Pfizer’s obesity portfolio with advanced oral, injectable, and combination incretin and non-incretin candidates, reflecting both companies shared commitment to pioneering innovative, effective, and safe treatments for metabolic health.

- In March 2025, AbbVie entered a license agreement with Gubra A/S to develop GUB014295, a potential best-in-class, long-acting amylin analog for obesity treatment. The collaboration combined AbbVie’s development expertise with Gubra’s innovation in peptide-based drug discovery to advance novel therapies for metabolic diseases.

Obesity Therapeutics Market Scope

| Metrics | Details | |

| CAGR | 21.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Drug Class | GLP-1 Receptor Agonists, Lipase Inhibitors, Melanocortin-4 Receptor Agonists, Appetite Suppressants and Others |

| By Route of Administration | Parenteral, Oral and Others | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global obesity therapeutics market report delivers a detailed analysis with 62 key tables, more than 56 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here