Cloud Gaming and Game-Streaming Market Overview

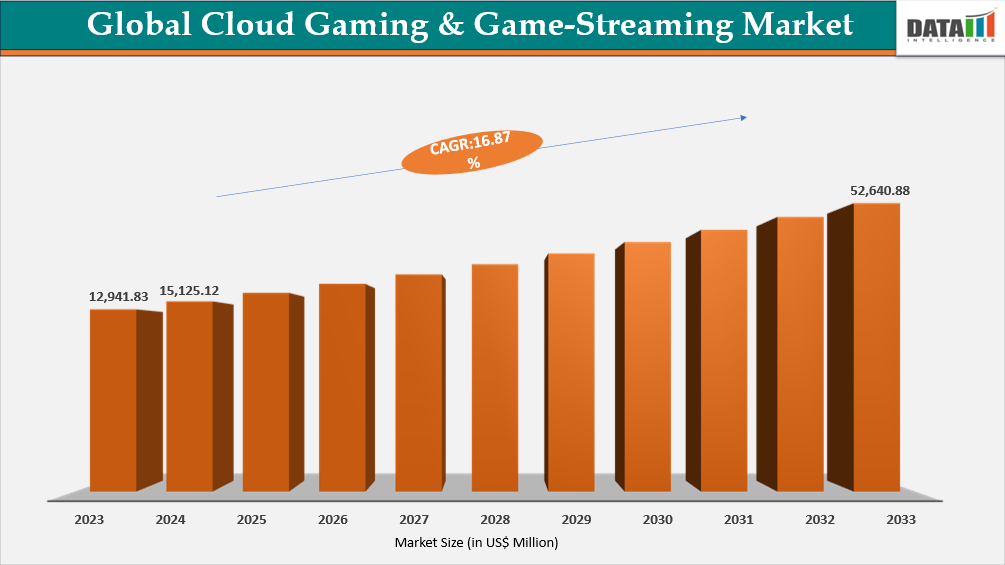

Global Cloud Gaming & Game-Streaming Market reached US$15,125.12 million in 2024 and is expected to reach US$52,640.88 million by 2032, growing with a CAGR of 16.87% during the forecast period 2025-2032.

Cloud gaming adoption is accelerating worldwide as mobile network capacity and GPU-virtualization infrastructure expand. According to the Ericsson Mobility data, 5G mobile subscriptions are projected to reach nearly 5.6 billion in 2029, representing around 60% of all global mobile subscriptions, creating an unprecedented backbone for high-bandwidth, low-latency game streaming. Meanwhile, global deployments of carrier-edge computing locations are accelerating, with telecom operators in the US, EU, Japan, and India expanding metro-edge capacity to support real-time compute workloads. These developments are enabling large-scale migration of rendering, storage, and processing from consoles and PCs directly into the cloud-edge continuum.

A structurally important trend shaping the market is the shift from centralized hyperscale streaming to distributed edge-rendered gaming, where frames are processed at regional edge nodes, not distant data centers. This architecture dramatically cuts latency and packet-loss impact, and is now being prioritized by leading telecom operators, cloud hyperscalers, and GPU providers.

Cloud gaming is transitioning into a globally scalable model as 5G coverage deepens, edge nodes proliferate, and GPU-sharing economics improve. With global 5G users expected to reach nearly 5.6 billion by 2029, cloud-rendered gameplay will become accessible to hundreds of millions of non-console households. Growing investments in network-edge infrastructure are enabling seamless high-fidelity streaming on smartphones, smart TVs, and basic PCs. This shift is redefining game delivery, monetization models, cross-device engagement, and overall gaming ecosystem structure worldwide.

Industry Trends and Strategic Insights

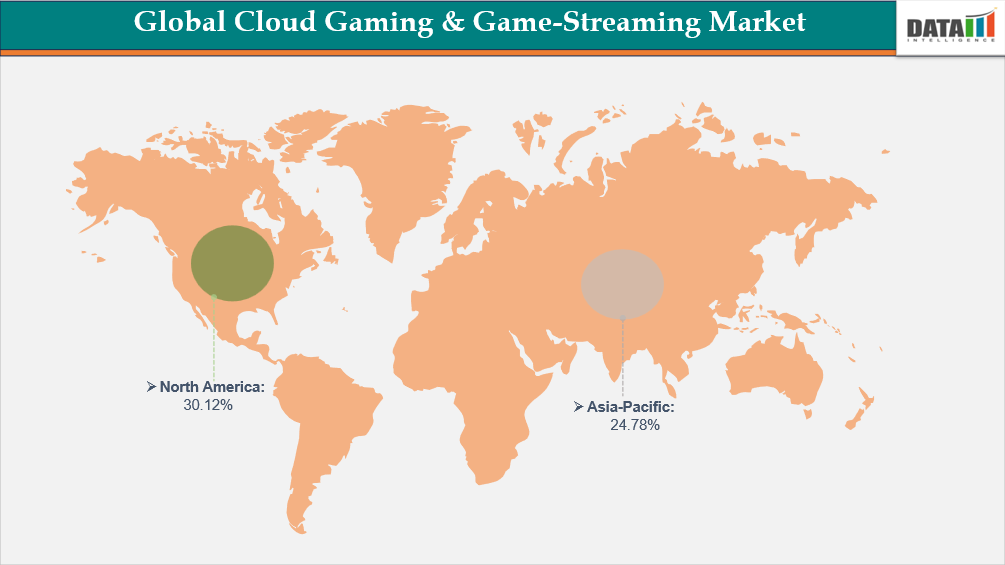

- North America dominates the cloud gaming & game-streaming market, capturing the largest revenue share of 30.12% in 2024.

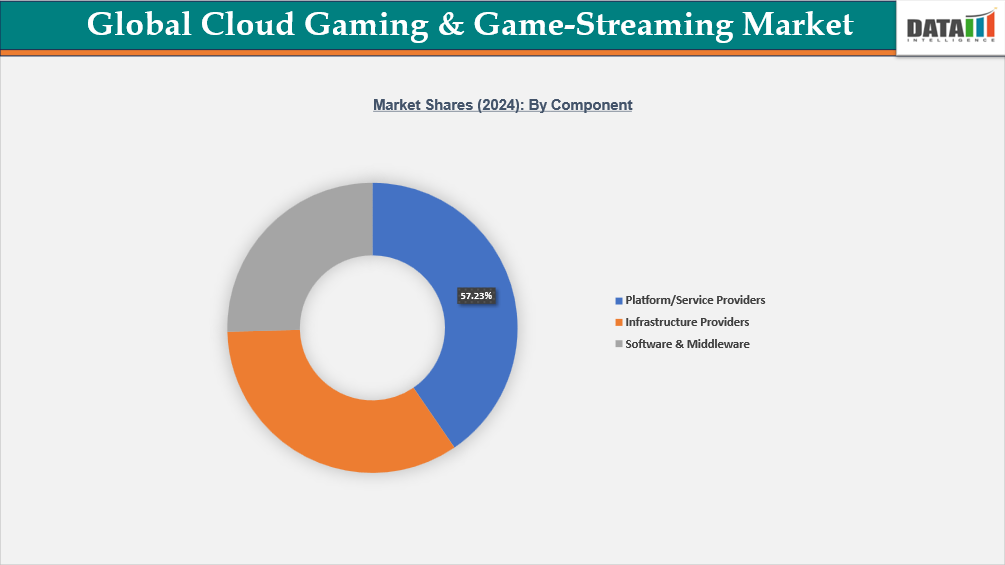

- By component, the Platform/Service Providers segment is projected to be the largest market, holding a significant share of 57.23% in 2024.

Global Cloud Gaming & Game-Streaming Market Size and Future Outlook

- 2024 Market Size: US$15,125.12 Million

- 2032 Projected Market Size: US$52,640.88 Million

- CAGR (2025-2032): 16.87%

- Largest Market: North America

- Fastest Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Component | Infrastructure Providers, Platform/Service Providers, Software & Middleware |

| By Deployment Model | Public cloud to edge, SaaS-based streaming, Enterprise/Developer-Focused Cloud Gaming, Others |

| By Device Type | Cloud-centralized processing, Consoles, Mobile / Tablet, Smart TVs, Others |

| By End-User | Casual Gamers, Hardcore / Enthusiast Gamers, Enterprises, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detail Information, Request for Sample

Market Dynamics

Rising Shift Toward Device-Agnostic, GPU-Independent Gaming

The shift toward device-agnostic, GPU-independent gaming is a powerful force driving global cloud gaming growth. In 2024, there were approximately 395.9 million cloud gaming users worldwide, a number that has surged as players seek to game on a wide variety of devices without needing to own expensive hardware. This flexibility removes the traditional barriers of console or PC ownership, broadening the market to casual users and mobile-first gamers. According to recent reporting, 47% of active cloud gamers now play exclusively in the cloud, indicating a strong preference for gaming on lower-cost or lower-power devices.

Cloud gaming platforms now often rely on GPU-accelerated cloud servers and rendering pipelines, allowing end users to game on laptops, tablets, and even budget smartphones with minimal latency requirements. On the infrastructure side, innovations like Capsule enable multiple players to share a single GPU in a data center, increasing utilization by up to 2.25× without impacting performance. As more service providers scale edge and data-center capacity, cloud-native game streaming becomes more reliable, making GPU-independent gaming not just possible, but high-quality and scalable.

Global Cloud Gaming & Game-Streaming Market, Segmentation Analysis

The global cloud gaming & game-streaming market is segmented based on component, deployment model, device type, end-user and region.

Demand for Platform/Service Providers in Cloud Gaming & Game-Streaming

Demand for service providers is surging as global cloud gaming users are projected to reach 395.9 million in 2024, underlining a massive user base for streaming platforms. Many gamers favor subscription-based models, more than 70% of cloud gamers reportedly prefer monthly access over game ownership. Service providers like Microsoft, NVIDIA, and Amazon are scaling libraries to thousands of titles, driving engagement across consoles, PCs, and mobile devices. As 5G and edge computing mature, platforms can deliver smoother, high-fidelity experiences without relying on high-end local hardware. For players, this removes the cost barrier of expensive GPUs or consoles. Moreover, publishers are forming direct partnerships with cloud services, enabling them to reach more players globally and better monetize their content.

Rise of Infrastructure Providers Components in the Market

Infrastructure providers are playing a critical role in cloud gaming’s growth by building edge-optimized data centers to reduce latency and improve quality of service. The global rollout of 5G, with over 2.3 billion 5G subscriptions as of the end of 2024, is making edge deployment more viable, enabling game-streaming platforms to place servers close to end users. Innovations such as multi-access edge computing (MEC) are increasingly used to route game-rendering workloads, minimizing network delays. Data center providers are also adopting GPU virtualization techniques; recent academic research shows that mechanisms like Capsule enable a single GPU to support over 2.25× more players without degrading experience. Advances in energy-efficient hardware, such as mobile SoC-based edge servers, further reduce the cost of scaling infrastructure, making the economics of cloud gaming more attractive.

Global Cloud Gaming & Game-Streaming Market, Geographical Penetration

FASTEST GROWING REGION

Rising Demand for Cloud Gaming & Game-Streaming in Asia-Pacific

In the Asia-Pacific region, widespread 5G deployment and strong smartphone penetration are fueling surge in cloud gaming consumption. According to national telecom regulators, 5G-NR coverage has reached over 580 million users across the region, with key markets like India and China leading infrastructure build-outs. Mobile gaming is extremely popular, especially in Southeast Asia, where a majority of gamers access games solely via their phones, making cloud-streaming ideal for lowering hardware costs. The rollout of local data centers by global cloud-gaming providers is accelerating, minimizing latency by keeping game compute closer to consumers. Governments are also supporting gaming and digital economy initiatives through favorable regulatory frameworks, contributing to rapid expansion.

India Cloud Gaming & Game-Streaming Market Outlook

India’s cloud gaming market is poised for rapid growth, driven by government digitalization initiatives and telecom investments. The Digital India program has helped increase mobile internet penetration to over 950 million users, boosting the potential addressable base for cloud gaming. With recent spectrum auctions, major telecom operators have committed to deploying 700 MHz and 3.5 GHz 5G bands, enabling ultra-low-latency services. Initiatives such as PM Gati-Shakti, which modernizes digital infrastructure, are attracting cloud providers to invest in local edge data centers. In addition, India’s Interactive Digital Media Scheme (IDMS) is encouraging gaming studios and cloud platforms to collaborate and expand content production.

China Cloud Gaming & Game-Streaming Market Trends

In China, cloud gaming adoption is being supercharged by government-led digital transformation and industrial policies. The Ministry of Industry and Information Technology (MIIT) has listed cloud gaming infrastructure as a strategic component in its “Next-Gen Information Infrastructure” plan, guiding multi-billion-yuan investments. China Telecom and China Mobile have launched MEC (Multi-Access Edge Computing) nodes in over 500 cities, reducing latency for cloud gaming services to regional users. Popular publishers are partnering with cloud platforms to offer lite versions of AAA titles, making high-end gaming accessible on mobile devices without expensive hardware. Furthermore, local regulation increasingly favors domestic cloud gaming platforms via content licensing policies, helping cloud-native games penetrate tier-2 and tier-3 cities more effectively.

LARGEST GROWING REGION

Rising Demand for Cloud Gaming & Game-Streaming in North America

Cloud gaming demand in North America is being significantly boosted by dense 5G network coverage. According to the FCC, 97% of the US population has access to 5G-NR mobile broadband at speeds of at least 7/1 Mbps, and 93% of the population can access 5G at 35/3 Mbps. This expanded coverage makes real-time game streaming technically viable for a broad audience. The widespread rollout of ultra-high data plans, where over 75% of US mobile subscribers now subscribe to plans offering 10 GB or more, is creating favorable conditions for high-bandwidth cloud game consumption. Meanwhile, major telecoms are monetizing edge and MEC infrastructure to serve gaming and XR content, aligning their network investments with gaming-as-a-service demand.

US Cloud Gaming & Game-Streaming Market Insights

In the US, cloud gaming is riding on strong infrastructure support: by late 2022, FCC data showed that approximately 93-94% of the US population was covered by at least one 5G provider at 35/3 Mbps, underpinning low-latency streaming. This network maturity, combined with growing gamer adoption and data plan usage trends, is enabling cloud gaming platforms to scale without requiring users to own expensive local hardware. At the same time, subscription-based models are seeing traction as consumers become more comfortable paying monthly for high-performance, device-agnostic gaming.

Canada Cloud Gaming & Game-Streaming Industry Growth

In Canada, 5G coverage has reached 93% of the population, according to the Canadian Radio-television and Telecommunications Commission (CRTC), enabling strong potential for cloud gaming. On major roads and highways, mobile coverage (LTE + 5G) now covers 87% of major routes, improving connectivity for users even on the move. Economically, 5G is expected to contribute substantially to Canada’s growth, with projections estimating 16% of Canada’s GDP growth by 2036 could be enabled by 5G and related technologies. These network and economic foundations make Canada a fertile market for cloud-streamed gaming, especially for mobile and in-vehicle use cases.

Technology Analysis

Cloud gaming technology is increasingly powered by edge computing and 5G networks, enabling ultra-low latency experiences crucial for smooth gameplay. By 2024, the cloud-gaming-over-5G market had already reached US$2.72 billion, as edge compute servers deployed near users reduce round-trip times dramatically. Edge-based AI inference in 5G environments can cut latency by up to 86% compared to traditional 4G cloud setups, which is key for real-time responsiveness.

Another core innovation is adaptive rendering systems: techniques like Adrenaline dynamically scale rendering quality based on both network conditions and server load, improving resource efficiency and enabling up to 24% more concurrent users per server.

Also, neural video-enhancement models are being used to boost visual quality mid-stream. For instance, newer frameworks can fine-tune super-resolution models on-the-fly to enhance image fidelity while maintaining low latency, improving quality by ~1.8 dB of PSNR in real-world trials.

Finally, ASIC-based video processing units (VPUs) are becoming more common in cloud gaming infrastructure, lowering decoding power consumption while maintaining high performance. This optimization helps cloud operators scale more efficiently while keeping energy and operational costs under control.

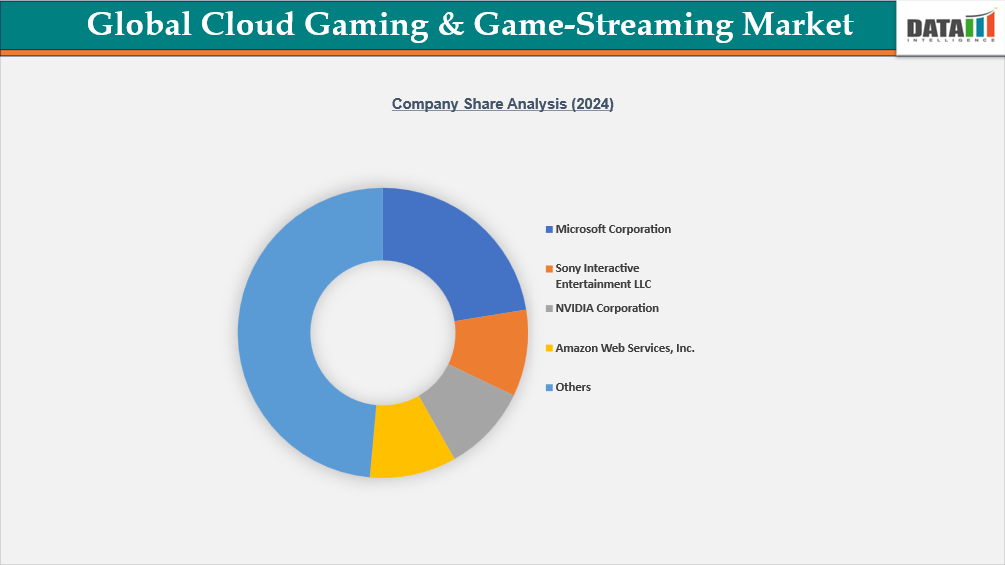

Competitive Landscape

The competitive landscape in the cloud gaming & game-streaming market is driven by infrastructure scale, exclusive content, and platform integration. Microsoft leads with Xbox Game Pass and strong ecosystem interoperability across PC, console, and smart devices. Sony focuses on PlayStation-led cloud streaming supported by premium exclusive titles and a highly loyal player base. NVIDIA differentiates through GeForce NOW with GPU-accelerated edge performance, appealing to high-fidelity PC gamers. Amazon Web Services (AWS) leverages its global cloud footprint to drive Amazon Luna and partnerships that target casual and bundled streaming adoption. Competition increasingly revolves around latency reduction, publisher licensing agreements, and subscription value propositions. Strategic alliances with telecom operators and device manufacturers are becoming critical enablers of regional expansion. Overall, competitive success hinges on balancing infrastructure, content depth, and flexible monetization models.

Key Developments

- In November 2025, Microsoft officially launched Xbox Cloud Gaming in India, allowing users to stream Xbox titles without owning a console. The service enables access to both exclusive and third-party games across PCs, smartphones, tablets, select smart TVs, Macs, and Amazon Fire TV Stick. Players can utilize Xbox Game Pass subscriptions to access the full cloud-playable library instantly. The rollout significantly expands Microsoft’s gaming footprint in the country and lowers hardware barriers for new gamers. This launch also positions India as a strategic growth market in the global cloud gaming ecosystem.

- In October 2025, Amazon introduced an upgraded version of its Luna cloud-gaming service, now offering a broader library and enhanced multiplayer functionality. The relaunch includes GameNight, a new catalogue of over 25 local multiplayer titles designed for living-room gaming and playable using a smartphone as a controller. Prime members can access the service at no additional cost, expanding Luna’s reach across casual and family-focused audiences. The update features exclusive Amazon Game Studios titles, alongside popular party games, to enhance social and interactive gaming experiences.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies