Circular Economy Market Size

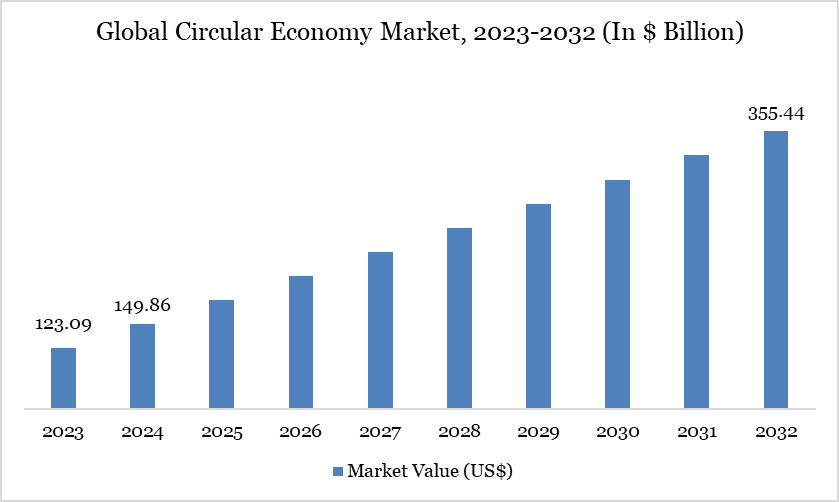

The Circular Economy Market Size valued at US$ 149.86 billion in 2024, is projected to reach US$ 355.44 billion by 2032, expanding at a robust CAGR of 11.40% from 2025 to 2032.

The circular economy market is entering a decisive growth phase, with governments and industries increasingly prioritizing material recovery and reuse to reduce resource dependence. In the European Union, the circular material use rate (CMUR) reached 11.8% in 2023, still short of the 2030 target of over 23%, indicating significant headroom for scaling. Economic activity tied to circular economy sectors is expanding, with investments, and sustaining over 4.3 million jobs across member states. Sectoral analysis shows strong recycling of metal ores (25%), but fossil-based materials remain poorly circularized, with recovery rates hovering near 3%, creating uneven progress across industries.

Industry Trend

A critical trend shaping the market is the persistent stagnation in material circularity. Out of the 106 billion tonnes of materials consumed annually worldwide, only 6.9% are cycled back into productive use, leaving over 90% flowing through linear consumption chains. This declining recycling rate marks the eighth consecutive year of contraction, underscoring structural inefficiencies in scaling recycling infrastructure, policy harmonization, and cross-border material flows. The inability to reverse this trend highlights both the urgency and the opportunity for large-scale innovation in advanced recycling technologies and international cooperation on material standards.

Circular Economy Market Scope

Metrics | Details |

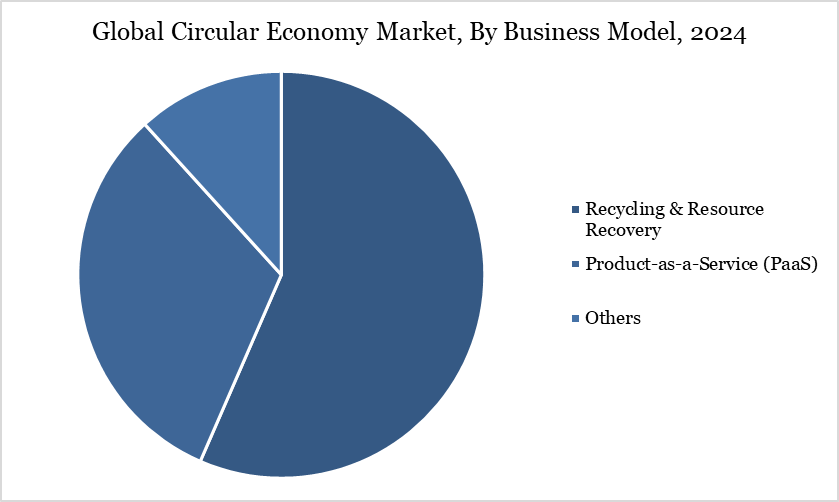

By Business Model | Recycling & Resource Recovery, Product-as-a-Service (PaaS), Others |

By Technology | Advanced Recycling, AI & Data Analytics, Others |

By End-User | Consumer Goods & Retail, Automotive & Mobility, Construction & Real Estate, Electronics & ICT, Agriculture & Food, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing Government-Led Circular Economy Action Plans and Regulatory Mandates

Governments are accelerating the shift toward a circular economy by embedding circular principles into law and policy. In 2023, the EU’s circular material use rate, the percentage of recycled inputs in total material consumption, reached 11.8%, inching upward from 11.5% and directed by the EU’s Circular Economy Action Plan and Ecodesign mandates.

In India, the Swachh Bharat Mission and EPR frameworks across plastics, batteries, tyres, and e-waste now ensure over 80% of solid waste is being processed, with e-waste collection and recycling exceeding 580,000 and 518,000 tonnes, respectively, in FY 2024-25. China’s 14th Five-Year Plan (2021–2025) sets bold targets, including a 60% utilization rate for construction waste and annual processing of 320 million tonnes of scrap steel. This confluence of regulatory frameworks and measurable targets is rapidly propelling the global circular economy forward.

Limited Standardization in Recycling Technologies and Material Recovery

Global recycling systems are held back by inconsistent technology standards and processes. For example, only 6–9% of plastic waste worldwide is actually recycled, with the remainder ending up in landfills or the environment. Additionally, regional disparities are vast, Australia recovers only 12.5% of its plastic waste, while in Brazil, overall recycling rates drop to a mere 4%. This fragmented infrastructure and lack of unified methods significantly restrict the effectiveness and scalability of circular economy practices.

Segment Analysis

The global circular economy market is segmented based on business model, technology, end-user and region.

Recycling & Resource Recovery Segment Driving Circular Economy Market

The advanced recycling segment, which includes chemical recycling methods like depolymerization, pyrolysis, and gasification, is rapidly scaling, with over 340 plants planned, installed, or operational globally, providing a collective input capacity of approximately 1,477 kilotons per annum. Europe is leading with more than 60 operational facilities, representing nearly a quarter of the global capacity, while projections suggest that global advanced recycling capacity is set to double by 2027, driven by policy incentives and technological progress. Meanwhile, the United States is increasingly recognizing advanced recycling as a valid waste recovery route. Policies now allow chemical recycling to be treated as legitimate recycling rather than waste disposal, laying the groundwork for market legitimacy and growth

Geographical Penetration

North America Drives the Global Market

The demand for circular economy solutions in North America is growing as resource inefficiencies highlight major opportunities for transformation. In the US, recycling rates remain uneven with paper at 64.7%, steel at 33%, glass at 26%, aluminum at 19.8%, and plastics trailing at 9.5%, while an estimated US$ 4 billion in economic value is lost annually from landfilled cardboard and paper. Canada faces similar challenges, discarding nearly 5 million tonnes of plastic in 2021, with only 365,000 tonnes processed into recycled resin despite a 99.2% collection rate.

Progress is visible as Canada’s plastic packaging recycling rate improved from 12% in 2019 to 20% in 2022, supported by municipal programs such as Winnipeg’s, which achieved an 85% participation rate and diverted 48,000 tonnes of recyclables from landfill. Together, these patterns reflect rising demand for circular practices while emphasizing critical gaps in processing infrastructure and recycling system efficiency across the region.

Sustainability Analysis

The effectiveness of sustainability analysis in the circular economy is increasingly measurable through key government-backed indicators. In the European Union, the circular material use rate (CMUR), reflecting the share of recycled inputs in total material usage, climbed modestly from 11.7% in 2021 to 11.8% in 2023, indicating some progress yet still well below the EU’s 2030 target of over 23%.

Meanwhile, municipal and packaging waste recycling rates show incremental improvements: overall waste recycling in Europe reached 44% in 2022, with packaging recycling at 65%, municipal at 49%, and e-waste at 32%. In India, circular economy initiatives are gaining traction, with approximately 62 million tonnes of solid waste generated annually, of which 75% is collected but only 20% processed through recycling or composting, prompting increased policy focus on waste segregation, extended producer responsibility frameworks, and single-use plastic bans.

Competitive Landscape

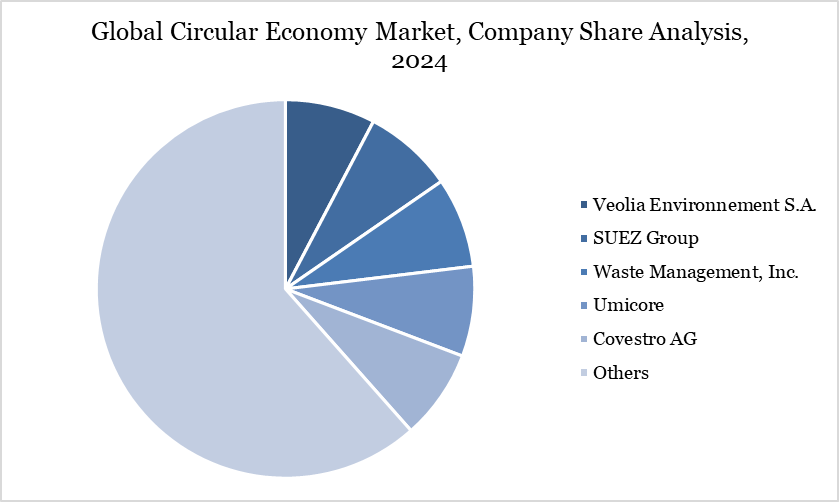

The major global players in the market include Veolia Environnement S.A., SUEZ Group, Waste Management, Inc., Umicore, Covestro AG, Paprec Group, Stora Enso Oyj, Renewi plc, TerraCycle Inc., and Loop Industries, Inc.

Key Developments

In July 2025, the United Nations Development Programme, in collaboration with the African Union Commission, the European Union, and key partners, launched the Continental Circular Economy Action Plan (CEAP) for Africa 2024–2034. The plan is designed to accelerate Africa’s transition to a circular economy, promoting green growth, efficient resource use, and inclusive development.

On March 19, 2025, Tamil Nadu advanced its sustainable plastic waste management and circular economy goals with the launch of the EU-India Resource Efficiency and Circular Economy Initiative (EU-I RECEI) in Chennai. The project will target plastics and textiles, driving recycled content adoption, reuse models, and plastic alternatives. It also aims to foster collaboration between European and Indian SMEs for sustainable solutions. Backed by the EU and BMUV, the initiative will be implemented by GIZ India with strong support from MoEFCC and Tamil Nadu government bodies.