Overview

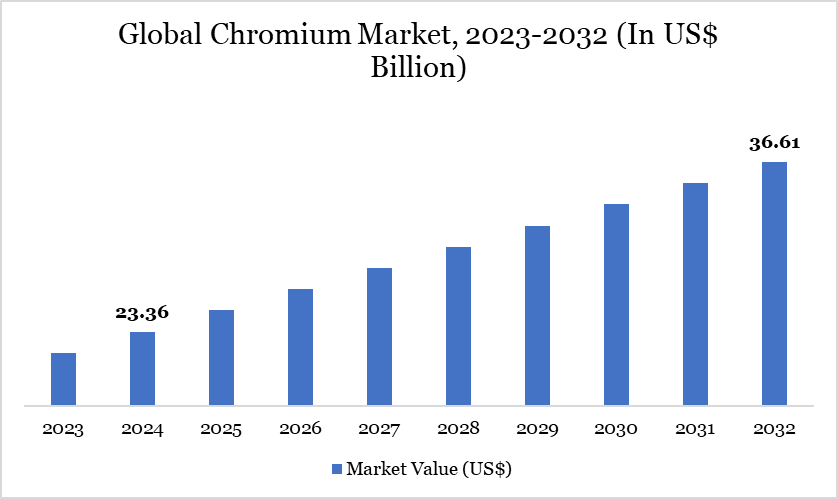

Global Chromium Market reached US$ 23.36 billion in 2024 and is expected to reach US$ 36.61 billion by 2032, growing with a CAGR of 5.78% during the forecast period 2025-2032.

Chromium is an important alloying element in the production of stainless steel and makes up around 18.0% of the total composition of stainless steel, driving growth of the global chromium market. Companies are entering into strategic collaborations to increase their market presence. For example, Glencore PLC stated in September 2023 that it had signed a new supply arrangement with a large Chinese steelmaker for chromite ore. The agreement is worth approximately US$ 1 billion over five years.

Chromium Market Trend

A prominent trend in the global chromium market is an increasing focus on protecting and diversifying chromium supply chains. This change is motivated by the metal's vital role in stainless steel manufacturing, as well as the desire to reduce the risks associated with supply concentration in a few areas. For example, global exports of chromium ores and concentrates increased dramatically to 24 million tons in 2024, up 9% from the previous year, demonstrating attempts to strengthen supply chain resilience.

Furthermore, firms are looking into alternate sources and investing in new mining projects to lessen their reliance on conventional suppliers. This strategic diversification aims to provide a steady and sustainable supply of chromium by addressing any geopolitical and logistical difficulties that may harm the market.

Market Scope

| Metrics | Details | |

| By Type | Trivalent Chromium, Hexavalent Chromium | |

| By Application | Metal Ceramics, Chrome Plating, Refractory Materials, Dyes and Paints, Alloys, Others | |

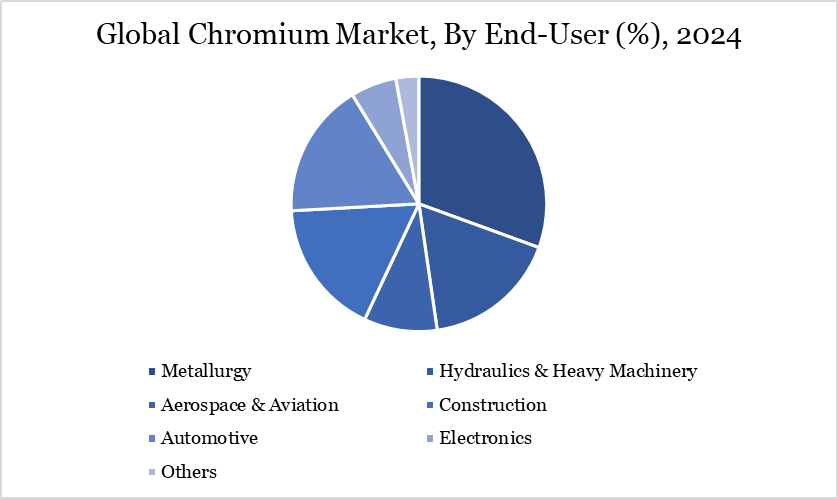

| By End-User | Metallurgy, Hydraulics & Heavy Machinery, Aerospace & Aviation, Construction, Automotive, Electronics, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamic

Rising Demand for Chromium in Electronics

Chromium's anticorrosive qualities make it suitable for electroplating electrical and electronic equipment, particularly electro-galvanized steel, zinc, copper and aluminum. In accordance to the Statistical Handbook of Japan 2021, production and shipments of electronic equipment totaled US$ 52.6 billion in the fourth quarter of 2020 and are predicted to rise in the following years.

Lenovo Group, an established company in consumer electronics and media, published its annual report for the fiscal year ending in March 2021, stating that the company's total revenue reached US$ 60,742 million in fiscal year 2020/21, a 20% increase over fiscal year 2019/20. According to recent Semiconductor Industry Association (SIA) data, US invested approximately US$ 142.2 billion in computer production and US$ 53 billion in consumer electronics such as cell phones, televisions and other related applications.

Environmental and Regulatory Challenges

Stringent environmental restrictions and accompanying compliance costs are a substantial restraint on the worldwide chromium industry. Chromium mining and processing, particularly of hexavalent chromium (Cr(VI)), offer significant environmental and health problems, such as soil and water contamination, air pollution and negative health consequences on local communities.

Regulatory authorities throughout the world, like US Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), have enacted stringent restrictions to offset these effects, demanding significant expenditures in cleaner technology and sustainable practices. These compliance requirements raise operational costs for chromium producers, thereby hurting profitability and slowing market growth.

Segment Analysis

The global chromium market is segmented based on type, application, end-user and region.

Metallurgy to Drive the Segment Growth

Chromium is used in metallurgical operations to improve its hardenability, impact strength, corrosion resistance, oxidation to other metals and a variety of other qualities for use in heavy machinery, construction and other industries. In accordance to US Geological Survey, approximately 41 million metric tons of chromium were generated from mines worldwide in 2023. South Africa provided for around 45% of total production (18 million metric tons).

It is a significant component of stainless steel production because, even when heated to extremely high temperatures, it retains its hardening and corrosion-resistant characteristics. Similarly, chromium is used to strengthen and harden aluminum, as well as to retain it in form when heated to high temperatures. As a result, increased demand in the steel manufacturing industry is predicted to fuel the market demand for chromium.

Geographical Penetration

Rising Manufacturing Sector in Asia-Pacific

Asia-Pacific is expected to be the dominant market in the global chromium market. As the major countries of the region have highly developed industrial sectors, the metallurgical industry is experiencing increased demand. The region uses more chromium to manufacture stainless steel, which is becoming increasingly significant in all manufacturing sectors around the world. In accordance with the World Steel Association, Asia generated 1,367.2 million tons of crude steel in 2023, up 0.7% from 2022.

Asia-Pacific production and sales are dominated by countries like as China, India and Japan, which have big car manufacturers and several production sites within their borders. As per the Japan Automobile Manufacturers Association (JAMA), motor vehicle manufacturing in the country in 2023 increased by 14.84% and was valued at 8,998,538 units.

Impact of US Tariff

The imposition of a 25% US tariff on Chinese chromium imports has significantly disrupted global trade patterns, especially as US is a key consumer of high-purity chromium for use in aerospace, stainless steel and specialty alloys. Chromium is often found in stainless and heat-resistant steels. China is the world's largest producer of ferrochromium and stainless steel.

In 2023, US imported 103,034t of chromium ores and concentrates, of which only 10t came from China. Nonetheless, the US imported 9,302t of unwrought chrome metal from China so far in 2024, accounting for 74% of total volumes and US reliance on China for the metal has intensified since sanctions drove Russian supplies off the table.

Competitive Landscape

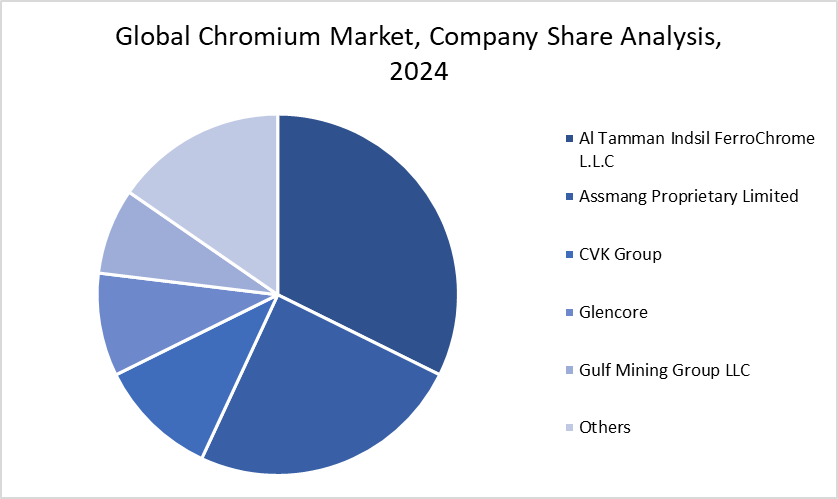

The major global players in the market include Al Tamman Indsil FerroChrome L.L.C, Assmang Proprietary Limited, CVK Group, Glencore, Gulf Mining Group LLC., Hernic Ferrochrome (Pty) Ltd., MVC Holdings LLC, Odisha Mining Corporation Ltd., Samancor Chrome and Kermas Group Ltd.

Key Developments

- In June 2023, The Indian government restricted the export of chromium ores and concentrates, which are key resources in a variety of sectors, including stainless steel manufacture. Exporters must get a license from the Directorate General of Foreign Trade (DGFT) in order to ship chromium products under the new laws.

- In May 2023, African Chrome Fields has announced plans to establish a pioneering aluminothermic smelting complex in Zimbabwe. The facility employs cutting-edge technology, eliminating the requirement for external power in the process of converting chrome ore into ferrochrome.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Suggestions for Related Report