Industry Outlook

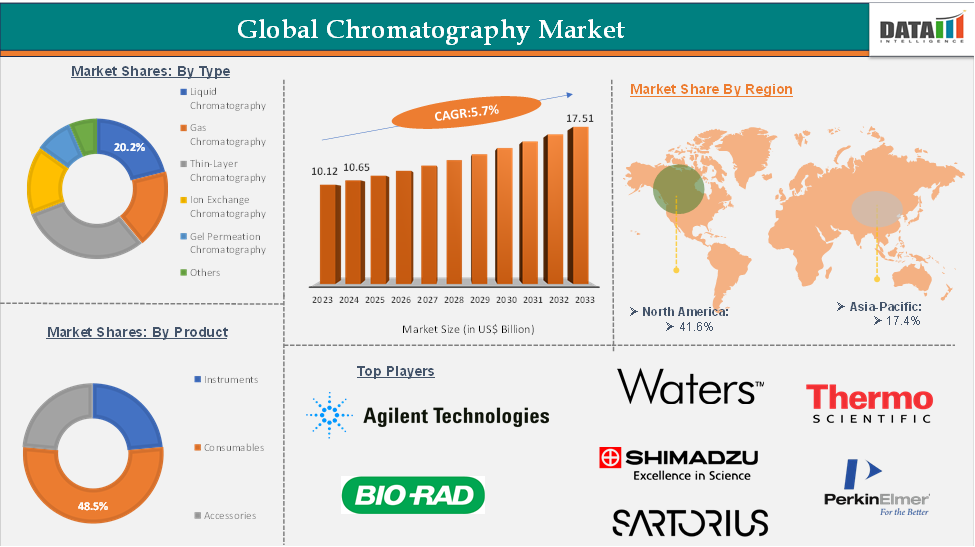

The global chromatography market reached US$ 10.12 billion in 2023, with a rise of US$ 10.65 billion in 2024, and is expected to reach US$ 17.51 billion by 2033, growing at a CAGR of 5.7%during the forecast period 2025-2033.

The chromatography market is undergoing a significant transformation, driven by advancements in analytical technologies, automation, and integration with digital platforms. Innovations such as high-performance liquid chromatography (HPLC), ultra-high-performance liquid chromatography (UHPLC), and mass spectrometry coupling are enhancing sensitivity, resolution, and speed of analysis.

The market is also trending toward miniaturized, portable chromatography systems, enabling real-time, on-site testing across industries like environmental monitoring, food safety, and clinical diagnostics. Additionally, AI and data analytics are being integrated to streamline data interpretation and improve accuracy. The push for green chromatography techniques, such as solvent-free or reduced-solvent methods, reflects a growing focus on sustainability.

As pharmaceutical R&D, biotechnology, and forensic testing continue to expand, chromatography is becoming increasingly central to quality control, compliance, and precision diagnostics, fueling market growth across global sectors.

Executive Summary

Market Dynamics: Drivers & Restraints

Driver: Increasing Demand for Pharmaceutical and Biopharmaceutical Analysis

The increasing demand for pharmaceutical and biopharmaceutical analysis is significantly driving the chromatography market. As the development of new drugs, biologics, and vaccines accelerates, there is a growing need for precise analytical techniques to ensure product quality, purity, and safety. Chromatography plays a critical role in every stage of the pharmaceutical lifecycle.

The rise of complex biologics and biosimilars, which require advanced purification and characterization, has further intensified reliance on high-performance liquid chromatography (HPLC), gas chromatography (GC), and other techniques.

Regulatory agencies such as the U.S. FDA and EMA mandate detailed analytical data, making chromatography indispensable for regulatory compliance. As pharmaceutical R&D spending increases globally and personalized medicine gains traction, the demand for robust, sensitive, and high-throughput chromatographic systems is expected to continue growing, significantly boosting the market.

Restraint: High Cost of Equipment and Maintenance

The high cost of chromatography equipment and its ongoing maintenance can significantly hinder the growth of the chromatography market, particularly in small laboratories and emerging economies. Advanced systems such as HPLC, UHPLC, and mass spectrometry-coupled instruments require substantial initial investment, often reaching tens or even hundreds of thousands of dollars.

Beyond the purchase price, routine calibration, servicing, replacement of columns, detectors, and software upgrades contribute to high operational expenses. These costs can be prohibitive for academic institutions, low-resource clinical settings, and small-scale testing facilities, limiting their ability to adopt or upgrade chromatography technologies.

For more details on this report, Request for Sample

Segmentation Analysis

The global chromatography market is segmented based on type, product, system type, end-user, and region.

Product:

The instruments segment is expected to have 24.8% of the chromatography market share.

The instruments segment is poised to hold a dominant share of the global chromatography market, especially in liquid chromatography (LC) systems, which accounted for over 55% of instrument revenue in 2023–2024. These systems are critical for high-precision applications in pharmaceuticals, environmental testing, food safety, and clinical diagnostics. For instance, Waters Corporation's Alliance iS HPLC system, introduced in March 2023, significantly enhanced operational intelligence and quality control workflows, reducing errors by up to 40% in QC settings.

Investment in next-generation chromatography hardware is further accelerating growth in the instruments sector. As such, this segment is expected to continue leading the market, supported by increasing demand across regulated industries and ongoing technological innovation.

Geographical Shares

The North America chromatography market was valued at 41.60% market share in 2024

North America remains the dominant region in the global chromatography market, driven by a strong pharmaceutical and biotechnology industry, advanced healthcare infrastructure, and strict regulatory standards that mandate precise analytical testing. The presence of major chromatography equipment manufacturers, such as Agilent Technologies, Waters Corporation, Danaher Corporation, and Thermo Fisher Scientific, further strengthens the region’s leadership. Ongoing investments in R&D, especially in drug development, personalized medicine, and biologics, continue to boost demand for high-performance chromatography systems.

Additionally, regulatory bodies like the U.S. FDA require rigorous quality control, encouraging widespread adoption of chromatography in pharmaceutical and environmental testing. With a well-established market and consistent technological innovation, North America is expected to maintain its leading position in the coming years.

Competitive Landscape and Key Players

The major players in the chromatography market include Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc., Waters Corporation, PerkinElmer, Sartorius AG, Danaher Corporation, Hitachi High-Tech Corporation, and Bruker, among others.

Key Developments

In October 2024, Shimadzu Corporation announced a strategic investment in Sepragen Corporation, a U.S.-based leader in bioprocess chromatography systems used for biopharmaceutical production. Alongside the investment, Shimadzu also entered into a strategic partnership with Sepragen, positioning itself to expand into the rapidly growing biopharmaceutical sector. Beginning in November, Shimadzu will hold exclusive rights to market and service Sepragen’s products across Japan, South Korea, and Southeast Asia, with a focus on supporting purification processes in vaccine and gene therapy drug manufacturing.

In September 2024, SCION Instruments announced a strategic partnership with Gulf Scientific Corporation (GSC), a leading lab solutions provider in the Middle East. Through this collaboration, GSC will represent SCION in Saudi Arabia, Kuwait, and Qatar, expanding access to SCION’s advanced gas chromatography, liquid chromatography, and mass spectrometry technologies. The partnership aims to deliver tailored analytical solutions across key industries, including petrochemical, environmental, food, and pharmaceuticals.

Global Chromatography Market: Scope

Metrics | Details | |

CAGR | 5.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Liquid Chromatography, Gas Chromatography, Thin-Layer Chromatography, Ion Exchange Chromatography, Gel Permeation Chromatography, Others |

Product | Instruments, Consumables, Accessories | |

| System Type | Single Use Systems, Multi-Use Systems |

| End-User | Pharmaceutical & Biotechnology Companies, Food & Beverage Companies, Research Institutes, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global chromatography market report delivers a detailed analysis with 56 key tables, more than 53 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more Laboratory Equipment-related reports, please click here