The global chlor-alkali market Overview

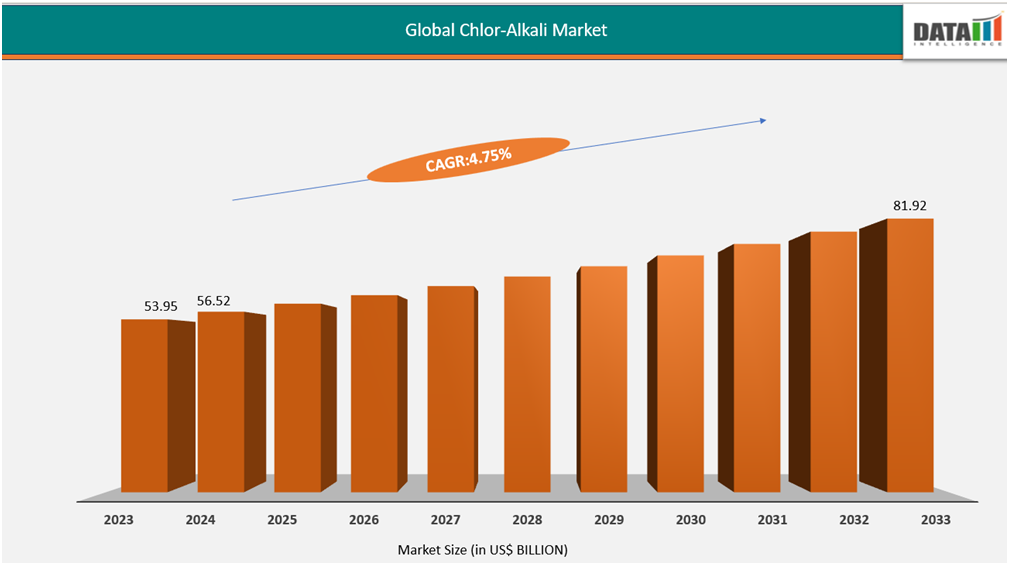

The global chlor-alkali market reachedUS$56.52Billionin 2024 and is expected to reach US$81.92Billion by 2032, growing at a CAGR of 4.75% during the forecast period 2025-2032.

The chlor-alkali market is gaining the market is witnessing robust growth driven by rising demand across key industries such as textiles, chemicals, and water treatment. Additionally, the surge in construction and infrastructure projects is significantly boosting caustic soda consumption, while the increasing need for polyvinyl chloride (PVC) continues to strengthen chlorine demand.

Moreover, favorable government initiatives aimed at promoting industrial expansion, coupled with rapid urbanization and technological advancements in energy-efficient production methods, are further accelerating market development. These combined factors are creating a dynamic and resilient growth environment for the sector.

Chlor-Alkali Industry Trends and Strategic Insights

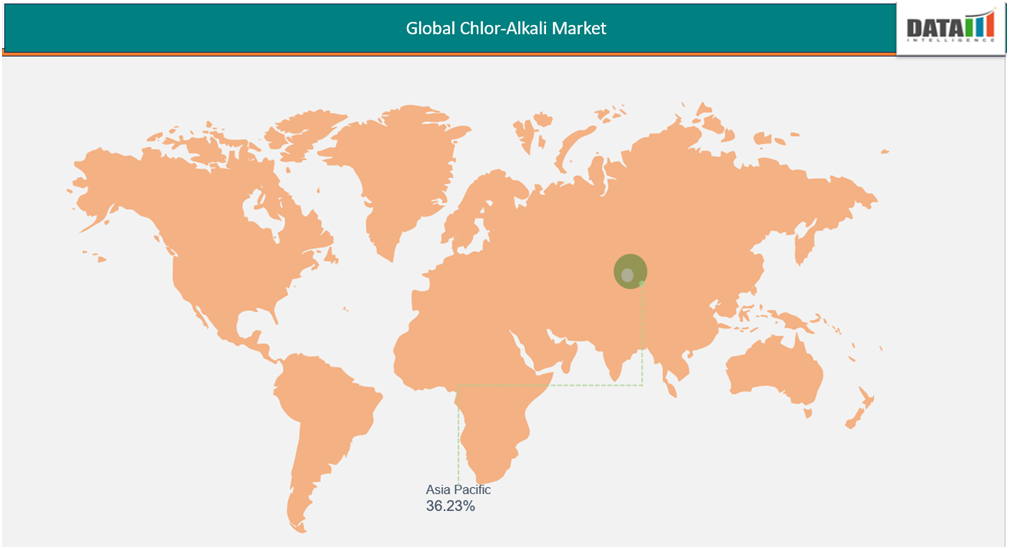

The Asia pacific dominates the global chlor-alkali in the market, capturing the largest revenue share of 36.23% in 2024.

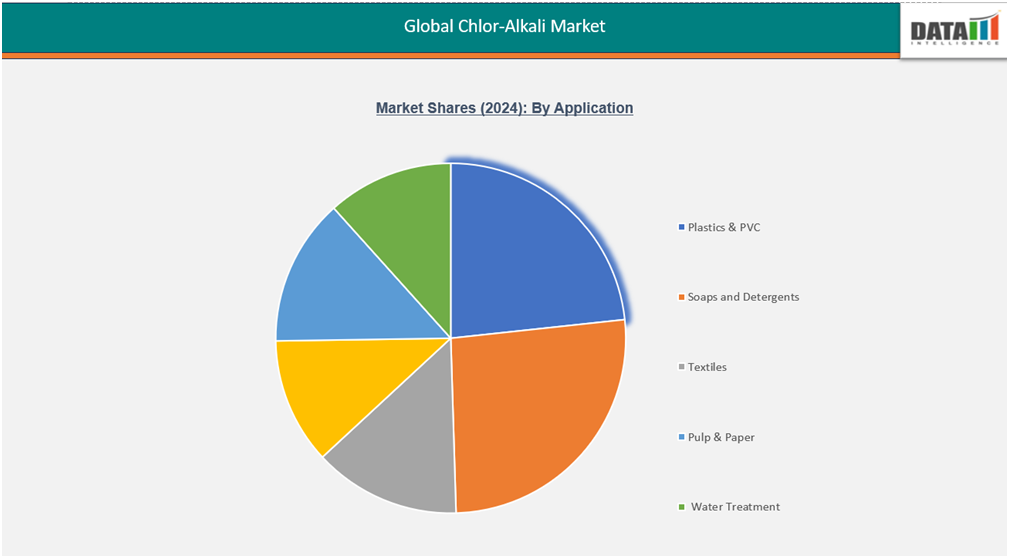

By Application, the Plastic and Pvc Market is projected to experience the largest market, registering a significant growth in Chlor-Alkali market

Market Size and Future Outlook

2024 Market Size: US$ 56.52Billion

2032 Projected Market Size: US$ 81.92 Billion

CAGR (2025-2032):4.75

Largest Market: Asia pacific

Fastest Market: North America

Market Scope

Metrics | Details |

By Product | Caustic Soda, Packed chlorine, Sodium hydroxide, potassium hydroxide, Hydrogen chloride, Others |

By Production Process | Membrane cell process, Diaphragm process Mercury cell process |

By Application | Water Treatment, Soaps and Detergents , Textile, Pulp &Paper, Plastics& PVC, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Industrial Expansion Elevates Strategic Importance of Chlor-Alkali Inputs

The expansion of chemical manufacturing across emerging Asia-Pacific economies is rapidly transforming the global industrial landscape, with direct implications for the chlor-alkali market. Countries such as China, India, Indonesia, and Vietnam are scaling up production capacity through strategic investments in petrochemical hubs, industrial corridors, and export-oriented chemical clusters. This surge is not only driven by cost competitiveness and rising domestic demand, but also by government-backed initiatives that offer tax incentives, streamlined approvals, and infrastructure support.

In 2025, Chandra Asri launched a joint venture in Indonesia to build a world-scale caustic soda and EDC plant. Backed by sovereign wealth funds, the project aims to reduce import reliance and support key sectors like textiles, water treatment, and nickel processing. Completion is expected by 2027.

High energy consumption limits competitiveness in cost-sensitive regions.

High energy consumption remains a critical challenge for chlor-alkali producers operating in cost-sensitive regions. The electrolysis process used to produce chlorine and caustic soda is highly electricity-intensive, often accounting for up to 90% of a plant’s total power usage. In markets where energy prices are volatile or comparatively high, this significantly erodes profit margins and limits competitiveness against producers in regions with subsidized or renewable energy access.

Segmentation Analysis

The global chlor-alkali market is segmented based on product, production process, application, end user and region.

PVC Drives Global Chlor-Alkali Market Growth

Plastics, particularly PVC, dominate the chlor-alkali market due to their intensive reliance on chlorine as a key feedstock. PVC production requires large volumes of chlorine for synthesizing vinyl chloride monomer, making it one of the most chlorine-intensive applications globally. This dominance is further reinforced by strong demand from construction, automotive, and packaging industries, especially in rapidly urbanizing regions like Asia-Pacific.

In 2023, Adani Group announced plans to build a 1 million tonne per annum PVC manufacturing facility at Mundra, Gujarat, marking its entry into India’s petrochemical sector. The project includes integrated units for PVC, chlor-alkali, calcium carbide, and acetylene, and aims to reduce the country’s reliance on imported PVC by expanding domestic production capacity. With India’s annual PVC demand approaching 4 million tonnes and local output significantly lagging, the facility is expected to play a key role in meeting industrial and infrastructure needs. Scheduled for commissioning by fiscal 2028.

Soaps and Detergents Propel Chlor-Alkali Market Expansion

The soaps and detergents segment is experiencing rapid growth in the chlor-alkali market due to its substantial reliance on caustic soda for saponification and cleaning formulations. This surge is largely driven by heightened hygiene awareness following the pandemic, particularly in emerging regions such as South Asia, Africa, and Latin America. Industrial demand is also expanding, with sectors like food processing, healthcare, and hospitality requiring large volumes of cleaning agents.

Major players like Tata Chemicals, Solvay, and Olin Corporation are investing in membrane cell technology to produce caustic soda more sustainably, aligning with the growing demand for eco-friendly detergent formulations.

Geographical Penetration

Driving Global Leadership: Asia-Pacific’s Chlor-Alkali Expansion Through Policy and Technology

Asia-Pacific leads the global chlor-alkali market, propelled by its expansive industrial infrastructure, efficient production capabilities, and supportive government policies. Nations such as China, India, and Indonesia have significantly increased their manufacturing output, fueled by growing local consumption and a strong focus on export-driven development.

Government programs such as India’s PCPIRs and Indonesia’s National Strategic Projects are actively expanding chemical infrastructure and attracting foreign investment across the region. At the same time, Asia-Pacific producers are adopting energy-efficient membrane cell technology, improving environmental performance and aligning with international standards. Together, such developments reinforce the region’s position as a global leader in chlor-alkali production and consumption.

China Chlor-alkali Market Outlook

China’s dominant position in the global chlor-alkali market stems from its substantial domestic demand and rapid industrial expansion across key sectors such as PVC, alumina, textiles, and water treatment. This growth is reinforced by government-led initiatives aimed at scaling chemical production capacity through focused infrastructure development and policy support.

In 2025, the China Chlor-Alkali Industry Association (CCAIA) played a pivotal role in advancing the sector through strategic engagement, policy collaboration, and technology promotion. The association actively participated in high-level industry events such as the China (Zhengzhou) International Futures Forum, where its leadership emphasized the importance of financial tools and risk management for commodity-linked industries like chlor-alkali.

India Chlor-alkali Market Trends

India’s chlor-alkali market continues to show steady growth, driven by rising demand from key sectors such as textiles, paper & pulp, pharmaceuticals, and water treatment. The industry is undergoing a notable shift toward energy-efficient membrane cell technology, with producers investing in modernization to meet environmental standards and reduce operational costs.

To further accelerate industry development, the Alkali Manufacturers Association of India (AMAI) has collaborated with government bodies to promote sustainability, safety, and global competitiveness. In 2025, AMAI launched new initiatives aligned with India’s green manufacturing goals, including technical workshops, ESG benchmarking programs, and policy dialogues focused on energy efficiency and circular economy practices.

North America Emerging as the Powerhouse of Chlor-alkali MarketGrowth

North America’s chlor-alkali market remains strategically strong due to its abundant raw materials, advanced production technologies, and consistent demand from downstream sectors like PVC, water treatment, and pharmaceuticals. The region benefits from shale gas availability, which ensures cost-effective feedstock for chlor-alkali production. Strong infrastructure and regulatory support further enhance operational efficiency and industry growth. These advantages collectively position North America as a key driver of global chlor-alkali market expansion.

For reference, in 2023, Blue Water Alliance joint venture formed between Olin Corporation and Mitsui & Co., which integrates Olin’s North American chlor-alkali production and global terminal assets with Mitsui’s logistics expertise and commercial relationships

U.S Chlor-alkali Market Growth

The U.S. chlor-alkali market is undergoing transformation, fueled by rising demand for chlorine and caustic soda across key sectors like water purification, chemical processing, and plastics manufacturing. In response to growing sustainability pressures, producers are increasingly adopting energy-efficient membrane cell technology, which helps lower power usage and minimize environmental impact.

In 2024, Chemours and PCC Group unveiled plans for a collaborative chlor-alkali project located at Chemours’ titanium dioxide (TiO₂) site in DeLisle, Mississippi. The partnership centers on constructing a modern facility designed to enhance energy efficiency and supply reliability, marking a strategic move to strengthen both companies’ positions in the U.S. chemical sector.

Canada Chlor-alkali Market Industry Growth

Canada’s chlor-alkali market is advancing steadily, driven by consistent demand from industries such as pulp & paper, water treatment, aluminum processing, and chemical manufacturing. The sector benefits from access to low-cost hydroelectric power, proximity to key feedstock sources, and a shift toward membrane cell technology, which enhances energy efficiency and product purity.

The Canadian industry falls under the chlor-alkali manufacturing sector, classified as NAICS 325181 – Alkalies and Chlorine Manufacturing. It produces key chemicals like caustic soda and chlorine, supporting various industrial applications and strengthening the chlor-alkali market.

Sustainability Analysis

chlor-alkali industry contributes to environmental protection by enabling the production of essential chemicals used in water purification, sanitation, and pollution control. Chlorine plays a critical role in disinfecting drinking water and treating wastewater, helping prevent waterborne diseases and supporting public health. Caustic soda is widely used in flue gas treatment and industrial cleaning, aiding in the reduction of harmful emissions.

Mexico’s 2025 initiative to eliminate mercury use in the chlor-alkali sector promotes sustainability by replacing outdated mercury-based processes with membrane technology, reducing toxic emissions and improving waste management in line with global environmental standards.

Competitive Landscape

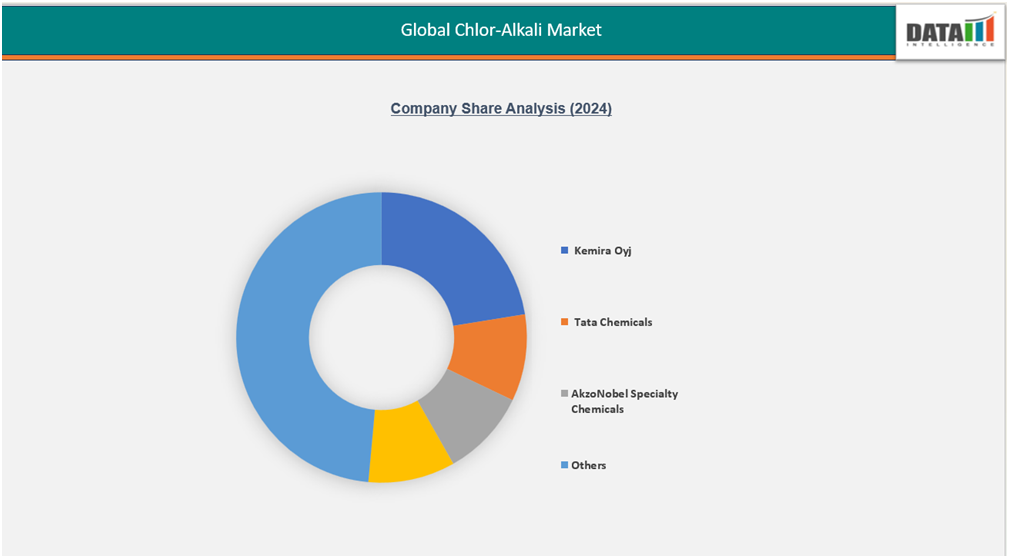

The Global Chlor-Alkali market is highly competitive, driven by a mix of global and regional players striving for technological efficiency and cost leadership.

Key players include, Kemira, Tata Chemicals, AkzoNobel Specialty Chemicals, Formosa Plastics Corporation, Occidental Petroleum (Oxy Chem), Olin Corporation, Shin-Etsu Chemical Co., Solvay S.A., Westlake Corporation, Xinjiang Zhongdu Chemical

Key Developments:

In 2025, a significant strategic development unfolded as Dow merged its European chlor-alkali assets with Olin Corporation in a deal valued at approximately $5 billion. This move was part of Dow’s broader initiative to streamline operations and enhance profitability across its European portfolio.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report