Charcot-Marie-Tooth (CMT) Disease Market Size & Industry Outlook

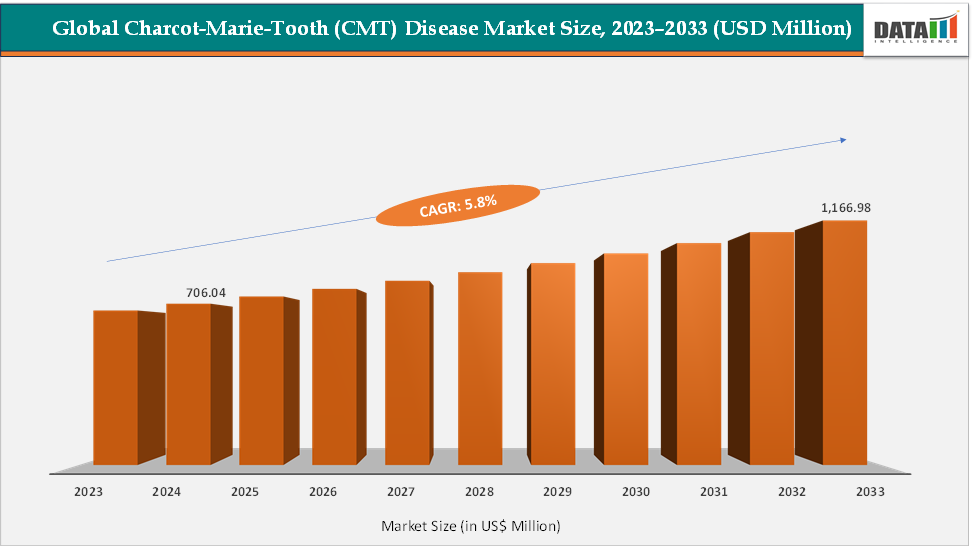

The global Charcot-Marie-Tooth (CMT) disease market size reached US$ 706.04 Million in 2024 from US$ 670.21 Million in 2023 and is expected to reach US$ 1,166.98 Million by 2033, growing at a CAGR of 5.8% during the forecast period 2025-2033. The market growth is driven by rising awareness and a robust therapeutic pipeline moving beyond symptomatic care. Key pipeline candidates include IFB-088 (InFlectis BioScience), EN001 (ENCell), and others. Leading players shaping the market landscape include ENCell, InFlectis, Addex Therapeutics, Augustine Therapeutics, and HELIXMITH, each pursuing novel gene, RNA, and small-molecule therapies targeting CMT subtypes.

Key Market Highlights

- North America dominates the Charcot-Marie-Tooth (CMT) disease market with the largest revenue share of 44.37% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 6.1% over the forecast period.

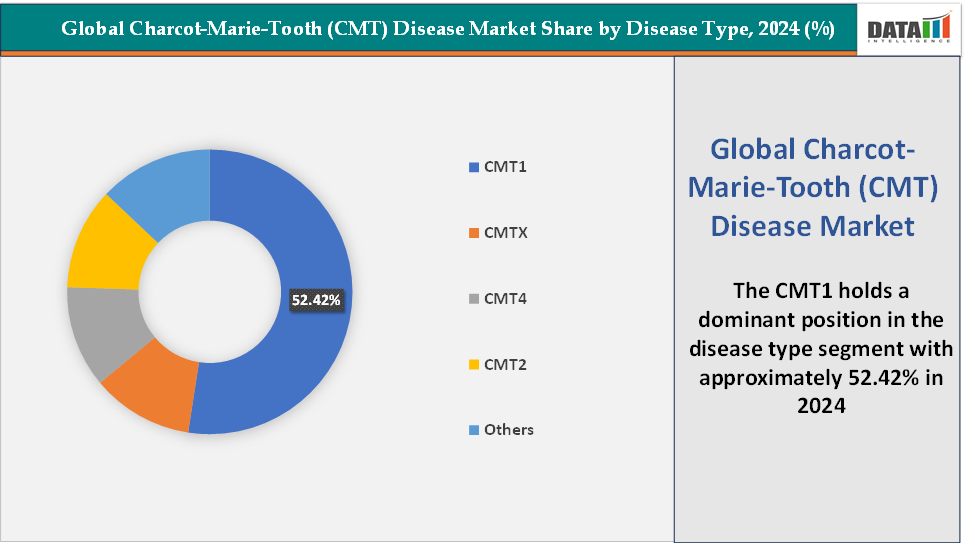

- Based on disease type, the CMT1 segment led the market with the largest revenue share of 52.42% in 2024.

- The major pipeline companies in the Charcot-Marie-Tooth (CMT) disease market are NMD PHARMA A/S, ActioBio, InFlectis BioScience, HELIXMITH Co., Ltd., ENCell Corp., Addex Therapeutics, and Augustine Therapeutics, among others

Market Dynamics

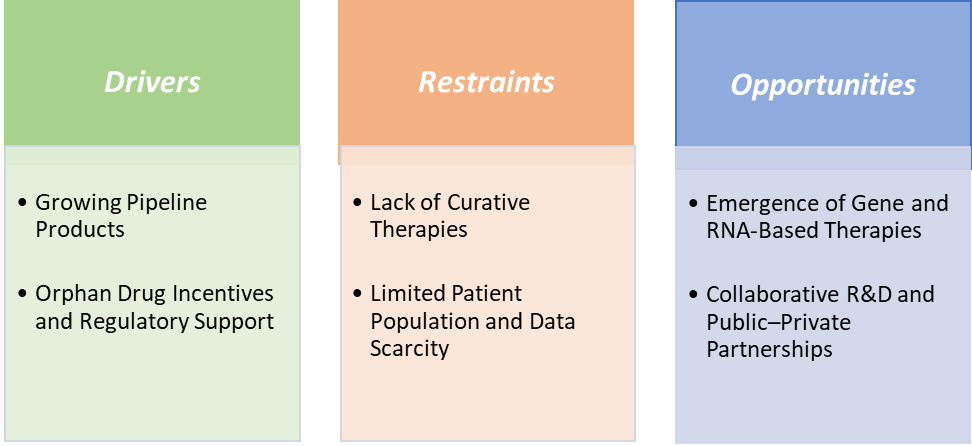

Drivers: Growing pipeline products are significantly driving the Charcot-Marie-Tooth (CMT) disease market growth

The growing pipeline of therapeutic candidates is one of the most significant drivers accelerating the Charcot–Marie–Tooth (CMT) disease market growth. Historically managed only with supportive care, CMT is now witnessing a surge in disease-modifying drug development, transforming its treatment landscape. Over 25 active programs are in various clinical and preclinical stages, targeting the genetic roots of the disease through gene therapy, antisense oligonucleotides (ASOs), RNA-based drugs, and small-molecule modulators.

Novel pipeline products are further accelerating the growth of the market. For instance, in May 2025, Augustine Therapeutics NV, a biotechnology company focused on developing new therapies for neuromuscular, neurodegenerative and cardio-metabolic diseases through the inhibition of the cytosolic Histone DeACetylase 6 (HDAC6) enzyme, announced it has dosed the first patient in its Phase I clinical trial evaluating lead candidate AGT-100216, the first peripherally-restricted, selective HDAC6 inhibitor (HDAC6i) for the treatment of Charcot-Marie-Tooth disease (CMT).

Similarly, in January 2025, NMD Pharma A/S, a clinical-stage biotech company dedicated to developing novel and improved treatments for patients living with neuromuscular diseases, announced that the U.S. Food and Drug Administration (FDA) has granted orphan drug designation (ODD) for NMD670, a novel, oral, small molecule inhibitor of the skeletal muscle-specific chloride ion channel ClC-1, for the treatment of Charcot-Marie-Tooth disease (CMT).

Furthermore, these orphan drug incentives, fast-track designations, and growing patient registries are enhancing trial efficiency and commercialization prospects. This expanding and diversified pipeline not only reflects technological progress but also signals a paradigm shift from symptomatic management to curative approaches, driving sustained growth and optimism within the global CMT therapeutics market.

Restraints: Lack of curative therapies is hampering the growth of the market

The lack of curative therapies remains one of the most critical restraints hindering the growth of the Charcot–Marie–Tooth (CMT) disease market. Despite decades of research, there are no FDA- or EMA-approved disease-modifying treatments, and current management primarily relies on physical therapy, orthopedic devices, and pain management, which only address symptoms rather than the underlying genetic cause. This therapeutic gap limits patient outcomes and reduces long-term treatment adoption rates, directly constraining market expansion.

For instance, leading candidates like InFlectis BioScience’s IFB-088 are still in clinical stages and yet to demonstrate definitive curative potential. Moreover, the genetic heterogeneity of CMT involving over 100 gene mutations makes it challenging to design a one-size-fits-all therapy, further complicating drug development and regulatory approval. As a result, both patients and clinicians face limited therapeutic options, discouraging investment in specialized care facilities and slowing healthcare system integration. Until a truly curative or disease-halting therapy reaches the market, this unmet need will continue to restrain the full commercial and clinical potential of the CMT treatment landscape.

For more details on this report – Request for Sample

Segment Analysis

The global Charcot-Marie-Tooth (CMT) disease market is segmented based on disease type, treatment type, end-user, and region.

Disease Type: The CMT1 segment is dominating the Charcot-Marie-Tooth (CMT) disease market with a 52.42% share in 2024

According to the National Institutes of Health (NIH), CMT1 accounts for 50% of cases and is characterized by demyelinating pathology, an autosomal dominant mode of inheritance, early onset, distal motor weakness, and moderate slowing of NCVs (>15 to ≤35 m/s). The most common subtype, CMT1A, results from a mutation in the PMP22 gene, while CMT1B is caused by mutations in MPZ.

This high incidence has made CMT1 the primary focus of clinical research and commercial investment. The dominance of this segment is reinforced by the presence of multiple late-stage pipeline products targeting CMT1A, InFlectis BioScience’s IFB-088 (NMD670), which aims to restore proteostasis in Schwann cells. Additionally, ENCell’s EN001 (a stem cell-based therapy) are also being evaluated for CMT1A, further expanding therapeutic potential.

Geographical Analysis

North America is dominating the global Charcot-Marie-Tooth (CMT) disease market with a 44.37% in 2024

North America is expected to dominate the global Charcot–Marie–Tooth (CMT) disease market throughout the forecast period, driven by its strong research ecosystem with major companies performing clinical trials, and early adoption of novel therapies. This dominance is also due to the high prevalence.

US Charcot-Marie-Tooth (CMT) Disease Market Trends

The US has a high prevalence of diagnosed cases, with an estimated 125,000–150,000 individuals living with CMT, supported by widespread availability of genetic testing and specialized neuromuscular centers. The US also benefits from strong regulatory support through the FDA’s Orphan Drug and Fast Track programs, which have accelerated approvals and provided incentives for companies developing rare disease treatments.

For instance, in January 2025, NMD Pharma A/S, a clinical-stage biotech company dedicated to developing novel and improved treatments for patients living with neuromuscular diseases, announced that the U.S. Food and Drug Administration (FDA) has granted orphan drug designation (ODD) for NMD670, a novel, oral, small molecule inhibitor of the skeletal muscle-specific chloride ion channel ClC-1, for the treatment of Charcot-Marie-Tooth disease (CMT).

Major industry players such as InFlectis BioScience, Actio Biosciences, and ENCell have a significant operational or collaborative presence in the region, further fueling innovation and clinical trial activity. For instance, in March 2025, Actio Biosciences, a clinical-stage biotechnology company leveraging its one to many paradigm to genetics and precision medicine to develop new therapeutics that target shared underlying biology in both rare and common diseases, announced that the first participant has been dosed in the Phase 1 healthy volunteer clinical trial of its lead program, ABS-0871, a TRPV4 inhibitor, for the treatment of TRPV4-positive Charcot Marie Tooth Disease subtype 2C (CMT2C), a severe peripheral nerve disorder.

The Asia Pacific region is the fastest-growing region in the global with a CAGR of 6.1% in 2024

The Asia-Pacific (APAC) region is emerging as the fastest-growing market for Charcot–Marie–Tooth (CMT) disease, driven by a combination of rising healthcare investment and growing research infrastructure. The growth is fueled by increasing awareness of rare diseases, the establishment of genetic testing and neurodiagnostic centers, and greater clinician expertise in identifying CMT subtypes, leading to a higher diagnosed patient base. Countries like China, Japan, and India are investing heavily in rare disease frameworks, regulatory modernization, and patient registries, which collectively facilitate clinical trial enrollment and early adoption of novel therapies.

Although no CMT-specific therapies have been launched exclusively in APAC yet, the region is playing a crucial role in clinical trials and bridging studies for global candidates, with manufacturers expected to include APAC in future launch plans. The growth is further supported by advancing cell and gene therapy infrastructure, exemplified by new manufacturing and collaboration centers, as well as favorable regulatory pathways for orphan and fast-track drugs in countries like China, India, and Japan. Collectively, these factors position the Asia-Pacific region as a high-potential, rapidly expanding market, likely to witness accelerated adoption of disease-modifying therapies for CMT once global approvals are achieved.

Europe Charcot-Marie-Tooth (CMT) Disease Market Trends

The Charcot–Marie–Tooth (CMT) disease market in Europe is witnessing robust growth, driven by increasing disease awareness, advancements in genetic diagnostics, and a supportive regulatory environment. Enhanced access to genetic testing and early diagnosis allows precise identification of CMT subtypes, facilitating timely interventions. The European Medicines Agency (EMA) supports orphan drug designations and accelerated approval pathways, encouraging investment in disease-modifying therapies.

Additionally, the adoption of multidisciplinary care, including physical and occupational therapy, along with supportive solutions such as orthotic devices, is improving patient outcomes and quality of life. These factors, combined with growing clinical trial activity and collaborations between biotech and pharma companies, are positioning Europe as a key growth hub for CMT therapeutics in the coming decade.

Competitive Landscape

Top companies in the Charcot-Marie-Tooth (CMT) disease market include NMD PHARMA A/S, ActioBio, InFlectis BioScience, HELIXMITH Co., Ltd., ENCell Corp., Addex Therapeutics, and Augustine Therapeutics, among others.

Market Scope

| Metrics | Details | |

| CAGR | 5.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Disease Type | CMT1, CMTX, CMT4, CMT2, and Others |

| Treatment Type | Physical Therapy, Occupational Therapy, Orthopedic Devices, and Others | |

| End-User | Hospitals, Specialty Clinics, Home Care Settings, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Charcot-Marie-Tooth (CMT) disease market report delivers a detailed analysis with 53 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

For more pharmaceuticals-related reports, please click here