Overview

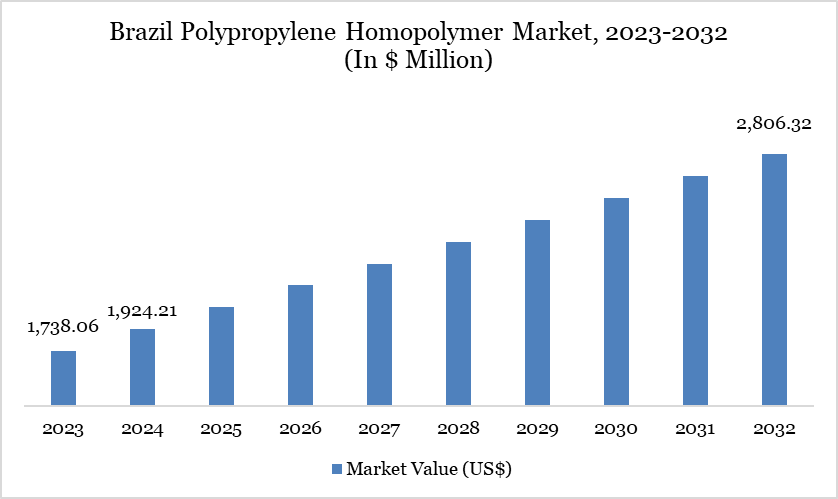

Brazil Polypropylene Homopolymer Market reached US$ 1,924.21 million in 2024 and is expected to reach US$ 2,806.32 million by 2032, growing with a CAGR of 4.83% during the forecast period 2025-2032.

Brazil produced approximately 7 million tonnes of plastics in 2023, with polypropylene accounting for nearly 20% of total resin consumption—a clear dominance of PP in the domestic plastics mix. Imports continued to play a vital role: import share of chemicals and polymers climbed to 43% of domestic demand in 2020, while consumption served by imports grew from 7% in 1990 to 30% by 2012, highlighting growing reliance on foreign resin amid persistent local production constraints.

Polypropylene Homopolymer Market Trend

Brazil’s PP homopolymer market exhibits a pronounced shift toward imported resin, driven by limited domestic production capacity and rising feedstock costs. While imports of chemical products surged 11.5% in 2024, resin imports rose as well, undermining local competitiveness despite import tariffs rising to 20% on PP and related polymers. Government tax incentives—such as Brazilian tax regime REIQ—are now supporting capacity expansions, including a R$614 million investment by Braskem to add roughly 139,000 tonnes/year output, signaling a strategic response to import dependency and market imbalance

Market Scope

Metrics | Details |

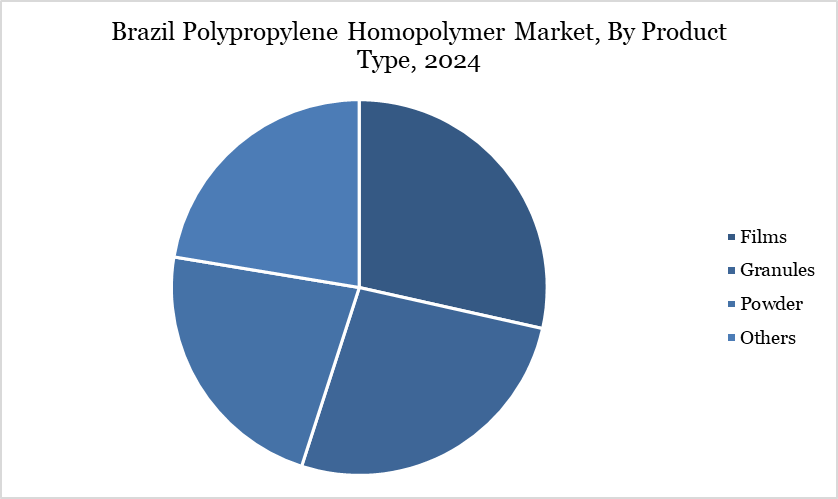

By Form | Films, Granules, Powder, Others |

By Processing Technology | Injection Molding, Extrusion, Blow Molding, Compression Molding and Others |

By Application | Automotive & Transportation, Electrical & Electronics, Medical & Healthcare, Construction, Packaging and Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Expansion of Brazil’s Flexible Packaging Sector Driven by E-commerce and Food Exports

Brazil produced 2.2 million tonnes of flexible plastic packaging in 2023, with the food industry consuming nearly 900,000 tonnes, accounting for approximately 41% of total flexible packaging output. Online retail sales surpassed 10% of all retail transactions, amplifying demand for high-quality, lightweight films. Polypropylene homopolymer is the dominant resin in flexible films, supporting this growth in packaging volume and performance needs across food and e‑commerce channels.

Volatility in Domestic Naphtha Supply Affecting Resin Production Stability

Brazil’s reliance on naphtha as a primary petrochemical feedstock has become a critical vulnerability, as volatile supply and high domestic pricing directly disrupt resin production capacity. Supply contracts with state-owned Petrobras set minimum utilization thresholds (e.g. 70%), yet utilization rates have declined to around 74% for polyethylene facilities, with polypropylene plants operating similarly below optimal levels. Braskem’s strategic shift toward ethane and propane highlights efforts to reduce dependence on naphtha amid global price fluctuations and limited feedstock reliability. Rising imports of chemical intermediates and resin—up 32% in 2024—further illustrate how unstable naphtha supply undermines domestic competitiveness and production stability.

Segment Analysis

The Brazil polypropylene homopolymer market is segmented based on form, processing technology, application and country.

Films Segment Driving Polypropylene Homopolymer Market

Brazil produced approximately 7 million tonnes of plastic products in 2023, with polypropylene accounting for nearly 20% of total resin consumption—making it the dominant polymer resin in the country. In 2023, the Brazilian food industry alone used around 900,000 tonnes of flexible plastic packaging, representing approximately 41% of total flexible packaging output in the country. This strong demand for food-grade packaging has significantly fueled the growth of polypropylene homopolymer usage in film applications across the packaging sector.

Sustainability Analysis

The mechanical recycling rate for post-consumer plastic in Brazil reached a record 25.6% in 2022, though this declined to 20.6% in 2023—the worst since 2018. Despite this drop, recycled polypropylene (rPP) accounted for 16–18% of all recycled resin in 2022, contributing to over 1.1 million tonnes of post-consumer resin output. Brazil processed through 2,385 kilotons of installed recycling capacity in 2023, up 3.5% year-over-year, indicating investment in infrastructure amid challenging economic conditions. Informal waste pickers (“catadores”) remain critical, collecting nearly 90% of recycled material nationwide. Recent national initiatives (Recircula Brasil platform and reverse logistics mandates) are expanding tracking and reuse of recycled polymers, offering strong support for domestic circular PP markets.

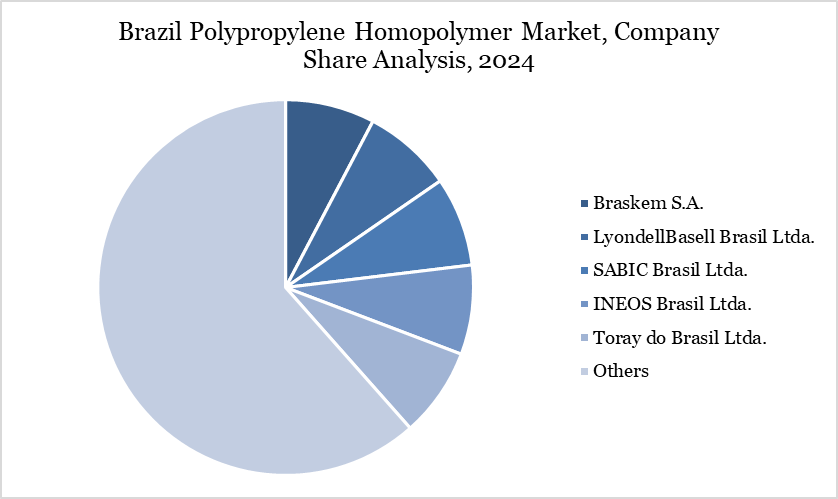

Competitive Landscape

The major Brazil players in the market include Braskem S.A., LyondellBasell Brasil Ltda., SABIC Brasil Ltda., INEOS Brasil Ltda., Toray do Brasil Ltda., ExxonMobil Brasil Ltda., TotalEnergies Petroquímica Brasil Ltda., Borealis Brasil Ltda., Prime Polymer Brasil Ltda., and Formosa Plastics Brasil Ltda.

Key Developments

In March 2025, LyondellBasell, a leading company in the global chemical industry, announced the launch of Pro-fax EP649U, a new polypropylene impact copolymer designed for the rigid packaging market. This innovative product is specifically formulated for thin-walled injection molding, making it ideal for food packaging applications.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies