Overview

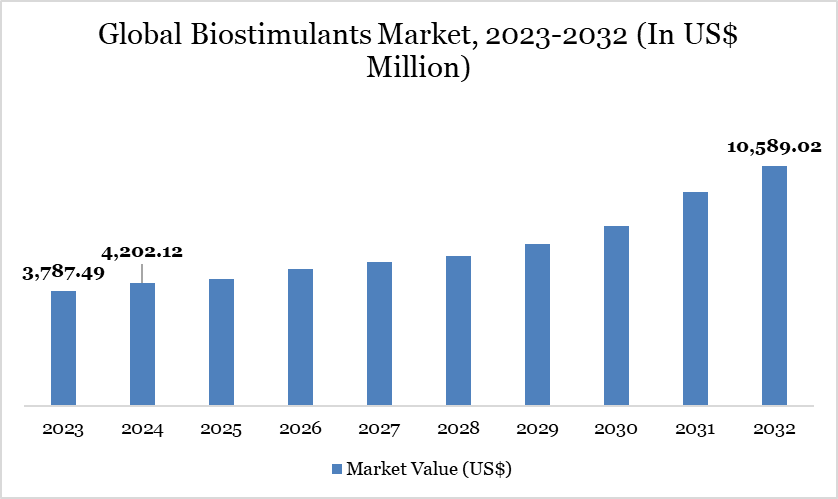

The global market for biostimulants reached US$4,202.12 million in 2024 and is expected to reach US$10,589.02 million by 2032, growing at a CAGR of 12.4% during the forecast period 2025-2032.

The global biostimulants market is experiencing significant growth, driven by the increasing demand for sustainable agricultural practices, improved crop productivity, and environmental protection. The market is expanding rapidly, with technological advancements, regulatory support, and increasing awareness among farmers contributing to its growth.

Extreme weather conditions such as droughts, floods, and heat stress are negatively impacting crop yields. Biostimulants, particularly seaweed extracts, betaine, and silicon-based products, help plants develop resistance to abiotic stress by strengthening their natural defense mechanisms. For instance, environmental stresses such as drought, salinity, and extreme temperatures can severely reduce plant growth and crop yields. Biostimulants make plants more resilient to these stresses by activating their defense mechanisms. For example, they can induce the production of stress-related proteins and antioxidants that protect cells from damage.

Additionally, the rapid growth of organic farming and residue-free agriculture is fueling the demand for biostimulants. Regulatory bodies such as the European Union, USDA, and the Indian Council of Agricultural Research (ICAR) are actively encouraging the use of biostimulants as sustainable inputs. With organic food consumption on the rise, farmers are shifting toward biostimulants as an alternative to synthetic fertilizers and pesticides.

Biostimulants Market Trend

The biostimulants market is increasingly driven by the growing adoption of microbial and biological formulations, with a strong focus on sustainability and soil regeneration. For instance, in 2024, Rovensa Next launched Wiibio, a microbial biofertilizer based on Bacillus subtilis F1, designed to improve soil biodiversity and plant vitality, particularly relevant in Europe, where over 60% of soils are considered degraded.

Similarly, Bionema Group Ltd introduced seven new microbial biostimulant products in 2023, following over ten years of R&D. These innovations demonstrated the potential to reduce fertilizer use by up to 50% without negatively impacting yield.

Regulatory support is also reinforcing this trend, as seen with the European Union’s 2019/1009 regulation, which formally categorized biostimulants and encouraged the use of plant growth-promoting microorganisms (PGPMs). With a growing shift toward low-input, regenerative agriculture, microbial biostimulants are expected to gain broader adoption across global markets, offering long-term agronomic and environmental benefits.

Market Scope

Metrics | Details |

By Ingredient | Acids, Microbial, Seaweed Extracts and Others |

By Form | Liquid and Solid |

By Crop Type | Cereals and Grains, Fruits and Vegetables, Oil Seeds, Turf and Ornamental and Others |

By Application | Foliar, Soil and Seed |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Organic Farming

The growing demand for organic food has led farmers to adopt organic farming practices, reducing reliance on synthetic fertilizers and pesticides. Biostimulants, which enhance nutrient uptake and plant growth naturally, align perfectly with organic farming principles.

For instance, in Europe, plant biostimulants are regulated under the EU Fertilizing Products Regulation (FPR), Regulation (EU) 2019/1009, which came into effect on July 16, 2022, defining them as products that stimulate plant nutrition processes, aiming to improve nutrient use efficiency and other plant traits.

Additionally, according to the European Biostimulants Industry Council (EBIC), it actively engages with policymakers and regulatory bodies to address challenges and facilitate smoother market entry for biostimulants. This includes working on issues related to animal by-products, microbials, and industrial by-products. Regular workshops and discussions with European Commission representatives and notified bodies ensure that the biostimulant industry’s concerns are heard and addressed. With climate change and soil degradation posing a very real threat to food security and farmer livelihoods, EBIC’s 2024 manifesto puts forward a vision that leverages the power of plant biostimulants to address these issues head-on.

Additionally, the global shift toward organic food consumption is a major factor driving the biostimulants market. Consumers are increasingly choosing chemical-free and sustainably grown produce, prompting farmers to adopt organic farming practices. Since synthetic fertilizers and pesticides are restricted in organic farming, biostimulants serve as a natural alternative to enhance crop growth, soil fertility, and stress tolerance.

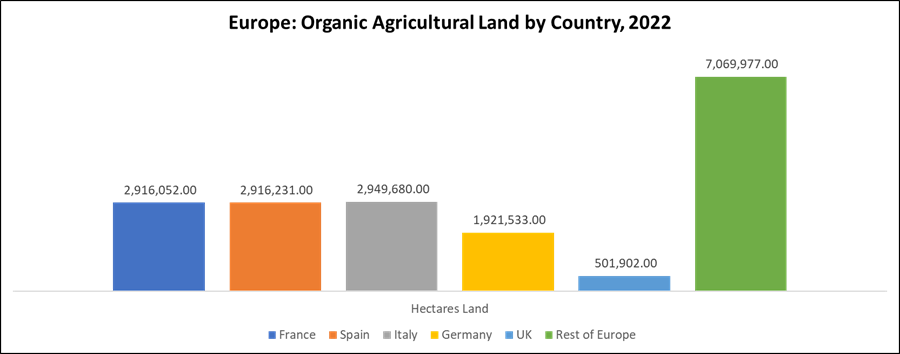

For instance, Europe is a global leader in organic farming, with significant variations in organic agricultural land across its countries. According to the FiBL-AMI Survey 2024, Italy leads with 2.95 million hectares of organic farmland, closely followed by Spain (2.92 million ha) and France (2.92 million ha). Germany ranks fourth with 1.92 million hectares, while the UK has 501,902 hectares under organic cultivation.

The remaining European nations collectively contribute 7.07 million hectares, highlighting the widespread adoption of organic practices across the continent. This growth in organic farming is a key driver for the biostimulants market, as farmers increasingly rely on natural solutions to enhance soil health and crop productivity in alignment with EU sustainability goals.

The rise of organic farming in developing nations is further fueling the biostimulants market. Countries like China, Brazil, and India are experiencing rapid growth in organic farming acreage, driving demand for biostimulants to improve productivity without synthetic inputs.

As organic farming continues to expand, biostimulants are becoming essential tools for improving crop yields, nutrient efficiency, and stress resistance without synthetic agrochemicals. With consumer demand, regulatory support, and increased organic acreage fueling this trend, the biostimulants market is set to experience significant growth in the coming years.

Favorable Government Policies and Regulations

Governments worldwide are implementing supportive policies and regulatory frameworks to promote sustainable agriculture, significantly boosting the biostimulants market. Policies such as subsidies, tax incentives, and organic certification programs encourage farmers to adopt biostimulants as eco-friendly alternatives to synthetic inputs.

For instance, in 2024, the Government of India, through the Department of Fisheries, Ministry of Fisheries, Animal Husbandry & Dairying, is promoting seaweed cultivation in the country. A set of projects worth total cost of Rs.193.56 crore ($22.60 Mn USD) with central share of Rs. 98.75 crore ($11.52 Mn USD) have been approved Under Pradhan Mantri Matsya Sampada Yojana (PMMSY) and funds are released to coastal States/ UTs and R&D Institutions for development of Seaweed cultivation in the Country.

Additionally, the US Farm Bill allocates funding for organic farming research, indirectly encouraging biostimulant adoption, while India's National Mission on Natural Farming subsidizes microbial biostimulants to reduce chemical inputs. In Brazil, the National Bioinputs Program offers tax incentives for biostimulant producers, driving a 25% increase in domestic production since 2022.

Moreover, the USA Government, Plant Biostimulant Act of 2023, this bill excludes plant biostimulants (i.e., a substance, microorganism, or mixture thereof that supports a plant's natural processes independently of the biostimulant's nutrient content) from regulation under the Federal Insecticide, Fungicide, and Rodenticide Act.

The bill also requires the Department of Agriculture to study the types of plant biostimulants and practices of plant biostimulant use that best achieve certain results, such as increasing organic matter content.

Moreover, Government policies and regulations are pivotal in accelerating the global biostimulants market, with China emerging as a key growth engine. The country's "Zero Growth Policy for Chemical Fertilizers by 2030" mandates sustainable alternatives, propelling biostimulant adoption.

In 2022, China’s Ministry of Agriculture allocated $200 million to subsidize organic inputs, including seaweed- and humic acid-based biostimulants, leading to a 30% year-on-year market expansion. Additionally, the "Green Agriculture" initiative under China’s 14th FiveYear Plan prioritizes soil health, further integrating biostimulants into mainstream farming.

The biostimulants market is no longer niche but a strategic pillar of sustainable agriculture, fueled by stringent environmental policies and financial incentives.

China’s aggressive decarbonization targets and Europe’s regulatory clarity exemplify this shift, while emerging economies leverage biostimulants to balance productivity and ecological resilience. The future hinges on continued policy support, R&D investments, and farmer education to scale biostimulants from complementary inputs to agricultural essentials

Segmentation Analysis

The global biostimulants market is segmented based on ingredient, form, crop type, application and region.

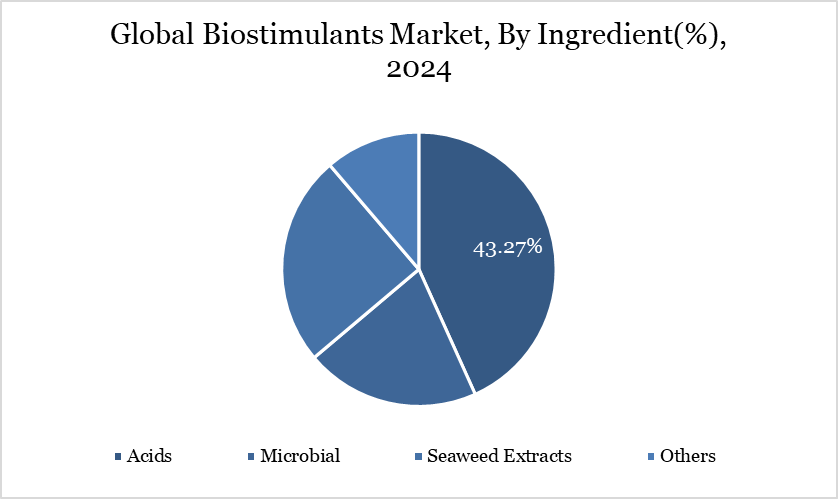

Acid-Based Biostimulants Gaining Ground as Key Drivers of Sustainable Crop Productivity

The global biostimulants market for acids was US$ 1,818.21 million in 2024 and is expected to reach US$ 4,311.59 million by 2032, growing with a CAGR of 11.5% between 2025 and 2032.

The acids segment plays a crucial role in driving the growth of the global biostimulants market, as humic acids, fulvic acids, and amino acids are widely recognized for their ability to enhance plant health, nutrient absorption, and stress tolerance. Humic and fulvic acids improve soil structure, increase microbial activity, and enhance root growth, making them essential in regions with poor soil fertility, such as parts of Africa and India.

In Spain, vineyards and olive farms increasingly use humic acid-based biostimulants to improve drought resistance and boost yields. Similarly, in the U.S., large-scale soybean and corn farmers integrate fulvic acid biostimulants to enhance nutrient uptake and reduce dependency on chemical fertilizers. Amino acids, another key sub-segment, are extensively used in horticulture, especially in China and Japan, to improve flowering, fruit set, and crop resilience.

Major agrochemical companies like Valagro and UPL are investing in acid-based biostimulants, launching innovative products that cater to both organic and conventional farming. With the increasing shift towards sustainable agriculture and the need for higher crop productivity, the acids segment continues to drive the biostimulants market's expansion globally.

Humic and fulvic acids are essential components in agriculture, significantly enhancing soil structure, nutrient availability, and plant resilience. Humic acids, being larger molecules, improve soil aggregation, porosity, and water retention, making them crucial in drought-prone regions like parts of Africa and India, where farmers use humic-based soil conditioners to reduce irrigation needs.

Additionally, their chelating properties bind essential micronutrients like iron and zinc, ensuring better plant uptake, a practice widely adopted in vineyards across Spain to enhance grape quality. Fulvic acids, with their superior solubility, act as efficient carriers of trace elements, promoting root development and stress tolerance.

In the U.S., soybean and corn farmers use fulvic acid-based treatments to improve nutrient transport, leading to higher yields and better crop quality. These acids also aid in seed germination, as seen in organic wheat farming in Europe, where pre-sowing seed treatments improve sprouting rates.

Soil remediation is another key benefit, with humic acids applied in polluted farmlands to detoxify heavy metals and restore fertility, a method used in industrially affected zones in China. Their role in stress tolerance is evident in salinity-affected coastal farmlands in the Middle East, where growers use fulvic acid biostimulants to combat soil salinity and improve plant survival.

By incorporating humic and fulvic acids into biostimulant formulations, modern agriculture maximizes plant growth, stress resistance, and overall productivity, making them vital for sustainable farming worldwide.

Amino acids are a major driver of the global biostimulants market, as they play a crucial role in improving plant metabolism, stress tolerance, and overall crop productivity. These organic compounds serve as building blocks for proteins and enzymes, helping plants recover from abiotic stressors like drought, salinity, and extreme temperatures.

Product launches in the amino acid-based biostimulant segment drive market growth by enhancing plant metabolism, nutrient absorption, and stress resilience.

In 2022, Bayer introduced "Ambition" in China, boosting crop growth, stress resistance, and yield while ensuring soil protection and consumer safety. With ongoing R&D investments and new formulations, amino acid biostimulants continue to support sustainable agriculture and global market

expansion

Geographical Penetration

Biostimulant Growth in Europe Fueled by Innovation and Sustainability

Europe’s biostimulants market was valued at US$1,564.87 million in 2024 and is estimated to reach US$3,635.28 million by 2032, growing at a CAGR of 11.2% during the forecast period from 2025-2032.

The demand for biostimulants in the European market is growing due to sustainable farming practices, environmental regulations, government policies, technological innovation and product launches. For instance, in February 2025, Bioiberica, a global life sciences company, has launched Terra-Sorb granum, an innovative solution for optimizing the nutrition of field crops like cereals, legumes, and oilseeds. The product maximizes nitrogen and sulfur absorption, boosting productivity, especially under stress conditions. The new biostimulant's unique formula combines L-α-amino acids with sulfur, boron, zinc, and molybdenum, offering a unique solution for modern agriculture.

Moreover, in March 2024, UPM Biochemicals has launched UPM SolargoTM, a range of bio-based plant stimulants, offering a sustainable alternative to fossil raw materials-based products. These biostimulants are scientifically proven to benefit a wide range of crops in fields and greenhouses, with a significantly optimized environmental footprint.

Similarly, in February 2024, Bioiberica, a global life sciences company, has introduced Terra-Sorb SymBiotic, the first biostimulant probiotic that enhances the unique symbiosis between biostimulation and biofertilization through its exclusive Priming Tech™ technology.

Furthermore, the significant partnerships and collaborations, expansion, growing awareness of soil health and sustainable agriculture practices encourage farmers to use and adapt to the bio-based products. For instance, Syngenta and TraitSeq are partnered to develop high-performance biostimulants using AI. Syngenta, a leader in crop biology, will use TraitSeq's AI methods to identify biomarkers that indicate a plant's cellular state.

Competitive Landscape

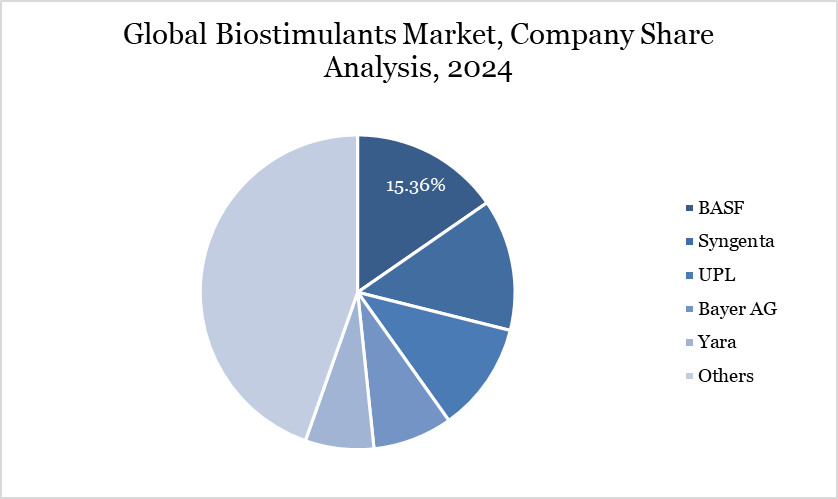

The major global players in the market include Sumitomo Chemical Co., Ltd., BASF SE, Syngenta Crop Protection AG, UPL Ltd, Yara, Corteva, Nufarm, PI Industries, Haifa Group and Bayer AG.

Key Developments

In 2022, Bayer introduced "Ambition" in China, boosting crop growth, stress resistance, and yield while ensuring soil protection and consumer safety. With ongoing R&D investments and new formulations, amino acid biostimulants continue to support sustainable agriculture and global market expansion.

For instance, in 2023, Bionema Group Ltd, a leading biocontrol technology developer and manufacturer, has announced the launch of a new range of biostimulant products in the UK for use in agriculture, horticulture, forestry, and turf and amenities. Having completed its ten years of R&D research on a range of biostimulants, Bionema Group is launching seven products, including seaweed extracts, and other natural nutrients that cover all stages of plant growth, with foliar and root applications in agriculture, horticulture, forestry, and turf and amenities.

In April 2025, the government of Mexico announced a substantial investment of US$ 2.6 billion to modernize irrigation systems. This initiative aims to reduce agricultural water consumption, which currently accounts for about 76% of the country's total water use, by up to 50% through advanced irrigation technologies. This type of large public investment not only boosts domestic market growth but also sets a precedent for other water-stressed nations, reinforcing global momentum toward microirrigation adoption.

For instance, in December 2023, Yara launched its first biostimulant product, YaraAmplix, in China, which aims to maximize crop yield and quality via improvement of crop resilience. YaraAmplix is a highly concentrated liquid biostimulant containing the yellow tang extract. The product has a high content of bioactive ingredients, which activates the natural mechanism of plants, improves nutrient utilization efficiency, effectively promotes crop growth and improves plant tolerance to abiotic stresses such as drought or extreme temperature. It makes crops more resilient and also helps mitigate the negative effects of climate change.

DMI Insights

The global biostimulants market, while experiencing robust growth, faces limited adoption due to factors such as high product costs, lack of awareness, regulatory inconsistencies, and limited technical expertise among farmers. Smallholder farmers, particularly in developing regions, often lack access to training, financing, and infrastructure, which restricts their ability to shift from conventional agrochemicals to bio-based inputs. Despite proven benefits in enhancing crop resilience, soil health, and nutrient efficiency, many growers remain hesitant due to a lack of demonstrated field results and confidence in product efficacy.

To overcome these barriers, expanding government support through input subsidies, inclusion in organic farming schemes, and clear regulatory frameworks—similar to the EU's Regulation (EU) 2019/1009—is critical. Parallelly, increasing investment in farmer education, field demonstrations, and region-specific product development can drive adoption. Companies should focus on affordable, performance-driven solutions tailored to local soil and climate conditions, while partnerships between agri-tech firms and research organizations can accelerate innovation and trust. Strengthening distribution networks and digital advisory services will further improve access and awareness, positioning biostimulants as a core component of sustainable agriculture worldwide.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report