Bio-based Sustainable Aviation Fuel Market Size

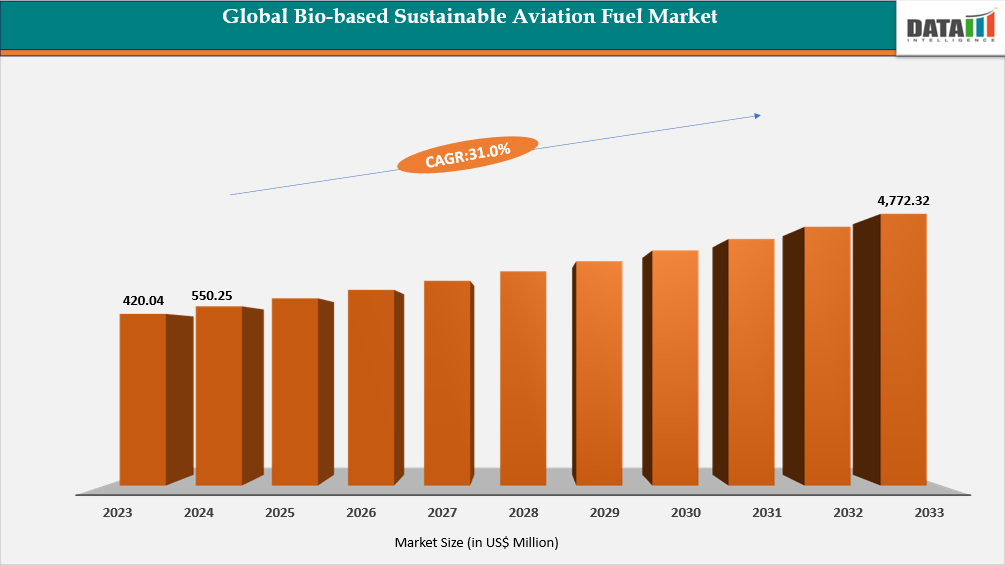

The global bio-based sustainable aviation fuel market reached US$ 420.04 million in 2024 and is expected to reach US$ 4772.329 by 2032, growing at a CAGR of 31.0% during the forecast period 2025-2032. The global bio-based Sustainable Aviation Fuel (SAF) market is growing rapidly market expansion is being driven by escalating environmental imperatives, increasingly stringent regulatory mandates aimed at decarbonizing the aviation sector and a pronounced shift in consumer behavior favoring sustainable travel alternatives.

The aviation sector is under mounting pressure to lower its carbon emissions, driving a surge in demand for Sustainable Aviation Fuel (SAF). According to the International Air Transport Association (IATA), the industry is targeting net-zero carbon emissions by 2050. Reaching this milestone will depend heavily on advancements in SAF—capable of cutting emissions by up to 80%—alongside innovations in flight path optimization, airport efficiency and environmental management strategies such as noise and waste reduction.

Bio-based Sustainable Aviation Fuel (SAF) Industry Trends and Strategic Insights

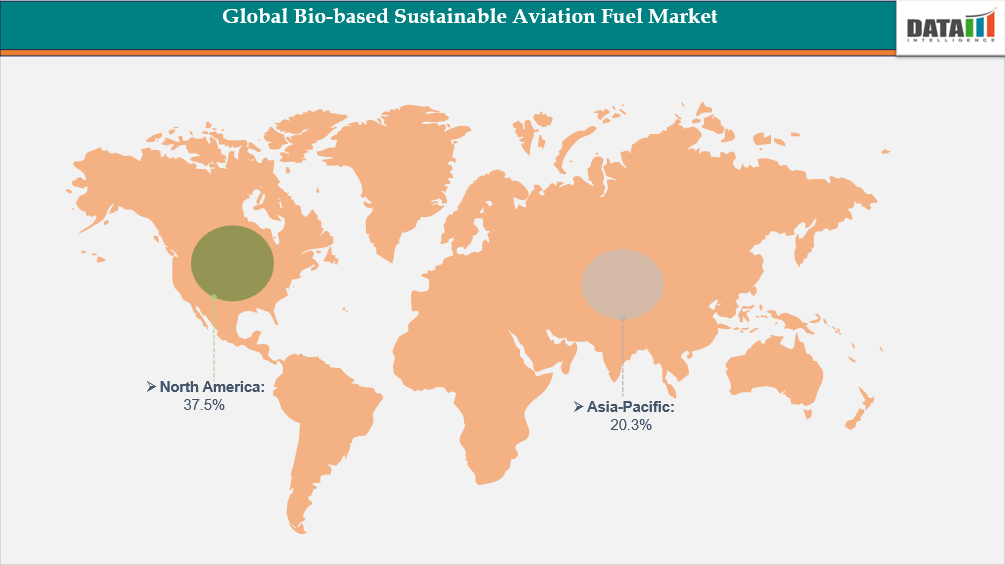

North America dominates the market in the market, capturing the largest revenue share of 37.5% in 2024.

By application, commercial aircrafts dominate the market holding 90% share of the bio-based sustainable aviation fuel market.

Market Size and Future Outlook

2024 Market Size: US$ 420.04 million

2032 Projected Market Size: US$ 4,772.329 million

CAGR (2025-2032): 31.0%

Largest Market: North America

Fastest Market: Asia Pacific

Market Scope

Metrics | Details |

By Type

| Hefa-Spk, Ft-Spk Atj-Spk, Co-processing, Others |

By Application | Commercial Aircrafts, Military, Private Jets, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Driver-Rising Demand for Bio-Based SAF in Commercial Aviation

As global regulatory pressures intensify and the aviation industry faces expectations to decarbonize, the demand for Sustainable Aviation Fuel (SAF) is experiencing accelerated growth. SAF, which is chemically compatible with conventional kerosene-based jet fuel, offers a significantly reduced carbon footprint. This reduction is achieved through advanced production pathways, including carbon capture technologies and the integration of biogenic carbon feedstocks such as biomass.

For rising the demand for the bio-based sustainable aviation fuel, DGCA is planning a road map plan for the sustainable aviation fuel demand. For example, on September 3, 2025, report, prepared by the Ministry of Civil Aviation in partnership with the International Civil Aviation Organization (ICAO) and supported by the European Union, outlines a strategic roadmap for SAF adoption across the country. This step promotes the commercial aviation industry to adopt bio-based Sustainable aviation fuel.

Segmentation Analysis

The global bio-based sustainable aviation fuel market is segmented based on type, application and region.

Commercial Aircraft Is Expected to Be the Dominant as Well As Fastest Growing Segment in The Global Market

Commercial aircraft continue to dominate demand in the bio-based sustainable aviation fuel (SAF) market, accounting for approximately 85–90% of its total share. This leadership is driven by the sector’s extensive operational scale and the strong commitment of airlines to reduce carbon emissions. Increasingly, commercial aviation is integrating SAF into flight operations through standardized blending protocols and voluntary sustainability initiatives. Notably, over 90% of airlines have set targets to ensure that by 2025, at least 2% of their fuel usage in commercial flights comes from SAF sources.

By witnessing strong demand of bio-based sustainable aviation fuel for commercial aircrafts, many airlines are planning to utilize SAF for their commercial aircraft. For reference, On November 10, 2023, during 67th Assembly of Presidents held in Singapore, the Association of Asia-Pacific Airlines (AAPA) announced its target for member airlines including newly inducted Air India to achieve 5% sustainable aviation fuel (SAF) usage by 2030.

Geographical Penetration

North America's Rise in Sustainable Aviation Fuel Market Driven by Strategic Partnerships and Policy Support

As the aviation sector accelerates its push toward decarbonization, sustainable aviation fuel (SAF) is pivotal. In North America, US is expanding its production capabilities, while Canada is laying the groundwork through strategic policy development and infrastructure planning. On December 5, 2024, Phillips 66 and United Airlines announced a strategic partnership with Phillips66 under which Phillips 66 will supply sustainable aviation fuel (SAF) to United Airlines at Chicago O’Hare International Airport (ORD) and Los Angeles International Airport (LAX). This agreement marks a significant step in advancing low-carbon aviation across key US hubs.

US Bio-based Sustainable Aviation Fuel (SAF) Market Insights

US has made significant advancements in building out its sustainable aviation fuel (SAF) infrastructure. According to the US Energy Information Administration (EIA), SAF production grew from 2,000 barrels per day in 2020 to 19,000 barrels per day in 2023, with projections reaching 51,000 barrels per day in 2025. This upward trend is largely fueled by co-processing at renewable diesel facilities an area where US maintains a leading global edge.

On September 3, 2025, Delta Air Lines, in collaboration with Shell and the Port of Portland, completed the first commercial-scale delivery of Sustainable Aviation Fuel (SAF) to Portland International Airport (PDX). This milestone marks a significant step in expanding SAF access across US airports. Over 400,000 gallons of blended SAF, derived from waste-based feedstock, were transported via barge, truck and pipeline to enter PDX’s fuel system.

Canada Bio-based Sustainable Aviation Fuel (SAF) Market Industry Growth

Canada currently lacks commercial SAF production. However, recent developments signal a strategic shift. In late 2024, Air Canada signed a deal with Neste for 77.6 million liters (20.5 million gallons) of SAF—the first time SAF has been imported for use in Canada. Deliveries commenced at the Port of Vancouver, utilizing a connected pipeline system to transport the fuel directly to Vancouver International Airport. Neste’s SAF purchase represents a meaningful contribution toward our objective of securing sustainable aviation fuel to cover one percent of the anticipated jet fuel demand in 2025.

Asia-Pacific Drives SAF Growth Through Government support and Industry Collaboration

Asia-Pacific is experiencing accelerated growth in the adoption of Sustainable Aviation Fuel (SAF), with countries such as China and India leading the charge. This momentum reflects a broader global shift toward environmentally responsible alternatives to conventional aviation fuels, driven by heightened awareness of climate change and the aviation sector’s ecological footprint. July 22, 2025, China Airlines signed an MOU with FPCC to purchase 10,000+ tonnes of SAF over three years, aiming to cut 26,000 tonnes of carbon emissions. The partnership drives Taiwan’s aviation energy transition toward net zero by 2050.

China’s Bio -based Sustainable Aviation Fuel Market Outlook

China, ranking as the second-largest aviation market globally, is intensifying its efforts to adopt Sustainable Aviation Fuel (SAF) as part of its broader environmental strategy. In Taiwan, China Airlines emerged as an early adopter, introducing SAF on ferry operations in 2017 and subsequently integrating it into regular passenger flights. In July 22, 2025, China Airlines signed an MOU with FPCC to purchase 10,000+ tonnes of SAF over three years, aiming to cut 26,000 tonnes of carbon emissions. The partnership drives Taiwan’s aviation energy transition toward net zero by 2050.

While talking about the partnerships and conferences , the SAF Technology Innovation and Industrial Development Exchange Conference held in Chengdu from August 19–21, 2025, marked the official launch of the China SAF Industry Alliance, aiming to unify stakeholders across the SAF value chain. Further strengthening global ties, the Sustainable Aviation Fuel Chengdu Forum on November 7, 2025, highlighted growing cooperation between Australia and China, with a focus on feedstock exports and joint SAF development initiatives.

India’s Bio - based Sustainable Aviation Fuel (SAF) Industry Growth

India’s sustainable aviation fuel (SAF) sector is set to transform the country’s aviation landscape by introducing environmentally friendly substitutes for conventional jet fuel. As global pressure mounts to cut carbon emissions, SAF innovation in India is gaining momentum as a key driver of cleaner air travel. As of September 2025, Indian Oil Corporation—India’s largest oil refiner—is set to commence production of Sustainable Aviation Fuel (SAF) in December. The upcoming plant, situated next to Indian Oil’s Panipat refinery in Haryana, is designed to produce up to 35,000 tonnes of sustainable aviation fuel annually. This volume is projected to fulfill the entire SAF blending requirement for international flights departing from India by 2027. In line with its climate strategy, India has introduced a phased SAF mandate, beginning with 1% blending by 2027 and increasing to 2% by 2028.

Sustainability Analysis

Sustainable Aviation Fuel (SAF) is a low-carbon alternative to conventional jet fuel that offers significant environmental benefits, particularly in terms of reducing greenhouse gas emissions. It can lower lifecycle CO₂ emissions by up to 80%, making it a key solution for decarbonizing the aviation sector. SAF is produced from renewable and waste-derived feedstocks such as used cooking oil, animal fats, municipal solid waste and non-food crops, none of which compete with food production or strain water resources.

On November 19, 2024, HSBC Hong Kong entered into a one-time agreement to purchase approximately 3,400 metric tonnes of Sustainable Aviation Fuel (SAF) from EcoCeres. This fuel will be used to power Cathay Pacific flights departing from Hong Kong International Airport. Produced entirely from waste-based biomass feedstock, primarily used cooking oil, EcoCeres’ SAF is certified by the International Sustainability and Carbon Certification (ISCC) and is expected to deliver up to a 90% reduction in greenhouse gas emissions compared to traditional jet fuel.

Competitive Landscape

Key Players:

The global sustainable aviation market is highly competitive, driven by a mix of global and regional players striving for technological efficiency and cost leadership.

The key players are Neste, World Energy, LLC, TotalEnergies, Honeywell International Inc., SkyNRG, LanzaJet, Swedish Biofuels AB, Eni, Gevo and Shell.

Key Developments

On August 19, 2025, MoU was signed between Indian Oil and Air India signalling a strategic move to ensure SAF supply for the airline, reinforcing India’s broader decarbonization goals in aviation.

On February 4, 2025, Singapore Airlines signed the Memorandum of Understanding with Aether Fuel. This marks a significant step toward more sustainable aviation, with the potential to reduce flight emissions by up to 75%.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies