Big Data and Analytics Healthcare Market Size

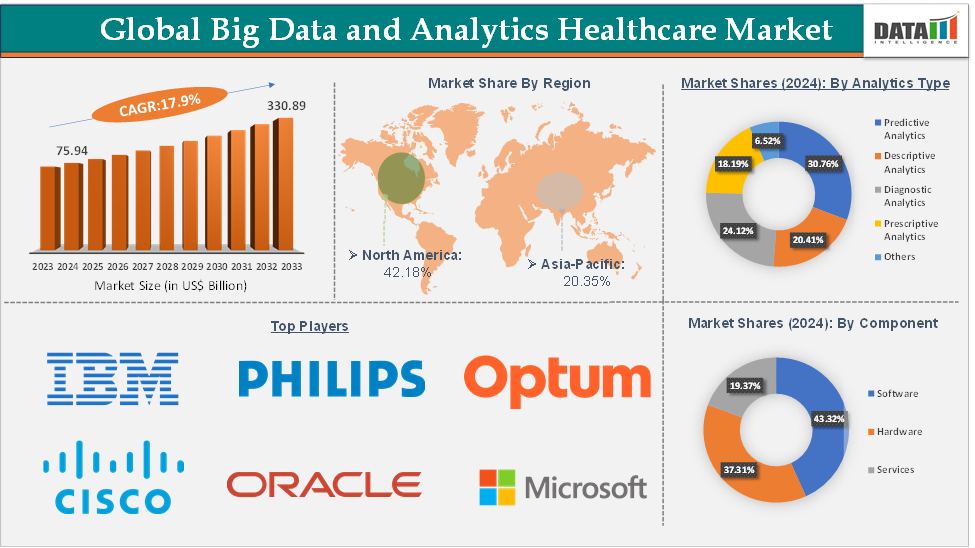

The global big data and analytics healthcare market size reached US$ 75.94 Billion in 2024 and is expected to reach US$ 330.89 Billion by 2033, growing at a CAGR of 17.9% during the forecast period 2025-2033.

Big Data and Analytics Healthcare Market Overview

The big data and analytics healthcare market is experiencing rapid growth, driven by the increasing need for data-driven decision-making, personalized medicine, operational efficiency, and regulatory compliance across the healthcare ecosystem. As healthcare providers, payers, and life sciences companies grapple with vast volumes of data from electronic health records (EHRs), genomic sequencing, clinical trials, and IoT-enabled devices, advanced analytics has become a strategic imperative. Growth is being fueled by increasing adoption of AI/ML algorithms, the integration of cloud-based platforms, the expansion of value-based care models, and rising investments in health informatics and digital health infrastructure.

Big Data and Analytics Healthcare Market Executive Summary

Big Data and Analytics Healthcare Market Dynamics

Drivers:

The rising volume of healthcare data is significantly driving the big data and analytics healthcare market growth

The healthcare sector generates massive amounts of data daily, with volumes expected to reach 2,314 exabytes by 2025, a staggering increase fueled by multiple data sources. This data explosion is a critical catalyst for the growth of the big data and analytics market in healthcare. Additionally, as healthcare systems digitize and adopt more advanced technologies, the amount of data generated across various platforms has surged. This growing volume of data creates a significant demand for sophisticated analytics tools capable of extracting valuable insights to improve patient care, optimize operations, and reduce costs.

The exponential growth in healthcare data volume driven by digitalization, wearable tech, genomics, and remote monitoring is compelling healthcare stakeholders to invest heavily in big data analytics solutions. These technologies enable unlocking actionable insights from complex data, driving clinical excellence, operational efficiency, and better patient outcomes, thereby fueling significant market expansion.

Integration of IoT and wearable health devices is also driving the big data and analytics healthcare market growth

The proliferation of Internet of Things (IoT) devices and wearable health technologies is revolutionizing healthcare data generation, creating continuous streams of real-time, patient-centric data. This surge in data volume and velocity is a major growth driver for the big data and analytics healthcare market. IoT-enabled wearables like smartwatches, fitness trackers, glucose monitors, and ECG patches collect vital signs and activity data 24/7. For instance, 44% of Americans own wearable health tracking devices such as smartwatches or smart rings, tracking health metrics from sleep to heartbeat patterns.

The integration of IoT and wearable health devices fuels the big data and analytics healthcare market by generating vast amounts of continuous, real-time patient data. Advanced analytics platforms are essential to process and interpret this data, enabling proactive care management, cost savings, and improved patient outcomes, driving accelerated adoption and market expansion.

Restraints:

The complexity of data management is hampering the growth of the big data and analytics healthcare market

The complexity of data management significantly hampers the growth of the big data & analytics healthcare market due to challenges in handling, integrating, and analyzing vast, diverse datasets from multiple sources. This complexity leads to inefficiencies, data silos and increased costs, slowing market adoption.

Healthcare data is generated from EHRs, wearables, medical imaging, and IoT devices, but integrating structured and unstructured data remains a significant challenge. For instance, according to the National Institute of Health (NIH), over 80% of digital data in healthcare is available as unstructured data, requiring new forms of data processing and standardization that prove challenging to health researchers. This limits actionable insights and delays decision-making.

Healthcare organizations prioritize patient data security due to regulations like HIPAA in the U.S. and GDPR in Europe, making data sharing and management more complex. Breaches further erode trust, discouraging organizations from fully adopting analytics tools. For instance, according to the HIPAA Journal, in 2024, the protected health information of 276,775,457 individuals was exposed or stolen. On average, that is 758,288 records per day. In March 2025, 1,754,097 individuals had their protected health information exposed, stolen, or impermissibly disclosed in a healthcare data breach.

Opportunities:

Interoperable health data platforms create a market opportunity for the big data and analytics healthcare market

Interoperability, the ability of different health information systems and devices to access, exchange, integrate, and cooperatively use data, presents a transformational opportunity for the big data and analytics market in healthcare. By breaking down data silos, interoperable platforms enable unified insights, which are essential for effective analytics.

Interoperable health data platforms unlock a critical market opportunity by enabling clean, connected, and comprehensive datasets essential for advanced analytics in healthcare. As regulations, value-based care, and AI adoption accelerate, organizations that can offer interoperable analytics platforms stand to lead in this rapidly growing market.

For more details on this report – Request for Sample

Big Data and Analytics Healthcare Market, Segment Analysis

The global big data and analytics healthcare market is segmented based on component, analytics type, deployment mode, application, end-user, and region.

Predictive analytics segment from the analytics type is expected to hold 30.76% of the market share in 2024 in the big data and analytics healthcare market

Predictive analytics uses historical and real-time data, along with statistical algorithms and machine learning techniques, to forecast future outcomes. In healthcare, this capability is crucial for anticipating patient risks, optimizing resource allocation, and improving clinical decision-making, making it the most dominant and fastest-growing segment in the market. Many market players are focusing on predictive analytics, which is further boosting the segment growth.

For instance, in October 2024, Clarify Health launched the industry’s first AI-powered predictive analytics, Clarify Performance IQ Suite, that spans cost, quality, and utilization assessment to deliver opportunity analytics. Leveraging advanced machine learning and natural language processing, the Performance IQ Suite empowers health plans and others with unparalleled insights to contain costs, improve care quality, and gain a competitive edge.

Predicting readmissions is one of the most common applications. Hospitals use predictive models to assess the likelihood of a patient being readmitted within 30 days of discharge. These models use factors like age, medical history, and current health status to predict readmission risks. For instance, Corewell Health care coordinators shared that a recent initiative, which uses predictive analytics to forecast risk and reduce readmissions, has kept 200 patients from being readmitted and resulted in a $5 million cost savings.

Big Data and Analytics Healthcare Market, Geographical Analysis

North America is expected to dominate the global big data and analytics healthcare market with a 42.18% share in 2024

North America, especially the United States, has one of the most sophisticated healthcare systems in the world, with widespread adoption of Electronic Health Records (EHRs), telemedicine, and health data management systems. For instance, according to the study conducted by the National Institute of Health found that basic EHR adoption surged from 6.6% to 81.2%, while comprehensive systems increased from 3.6% to 63.2%, creating a vast pool of structured and unstructured healthcare data that drives demand for analytics tools.

North America is home to many of the world’s leading technology companies offering big data & analytics solutions in healthcare. Regional key players and other local key players in the United States have been at the forefront of developing analytics tools for healthcare. For instance, in February 2025, CitiusTech introduced a new platform, HealthSPARX. HealthSPARX aims to improve data management and analytics for clinical research, medical studies, and commercial operations. It supports advanced analytics, including the development of Software as a Medical Device (SaMD), helping organizations use data more effectively.

Asia-Pacific is growing at the fastest pace in the big data and analytics healthcare market, holding 20.35% of the market share

Asia Pacific countries such as Japan, China, and India are undergoing a digital transformation in healthcare, with governments pushing for the digitization of healthcare records, telemedicine adoption, and smart health initiatives by implementing national strategies to boost healthcare IT infrastructure and integrate advanced technologies, including big data analytics. For instance, in China, the government’s Healthy China 2030 initiative is driving the use of health data analytics, including the integration of electronic health records (EHRs) and wearable devices across hospitals.

The APAC region is seeing an expansion in healthcare IT infrastructure, including the adoption of cloud computing, AI, machine learning, and IoT devices. These technologies generate large volumes of data that can be analyzed to improve healthcare services. The regional market players are also developing various platforms, which are accelerating the market growth in the region.

For instance, in January 2024, GenepoweRx launched an AI platform GeneConnectRx, for big data analytics and drug discovery. This revolutionary step in personalized medicine marks a paradigm shift, empowering healthcare providers to customize treatments based on individual genetic makeup. GeneConnectRx integrates internal data, global resources, and cutting-edge models to forecast potential molecules for revolutionary drug discovery.

Big Data and Analytics Healthcare Market Competitive Landscape

Top companies in the big data and analytics healthcare market include IBM, Koninklijke Philips N.V., Optum, Inc., FLATIRON HEALTH, Health Catalyst, Microsoft, Oracle, Google, Wipro, and Cisco Systems, Inc., among others.

Big Data and Analytics Healthcare Market Scope

Metrics | Details | |

CAGR | 17.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Component | Software, Hardware, and Services |

Analytics Type | Predictive Analytics, Descriptive Analytics, Diagnostic Analytics, Prescriptive Analytics, and Others | |

Deployment Mode | On-Premises and Cloud-Based | |

Application | Clinical Analytics, Financial Analytics, Operational Analytics, Fraud Detection and Risk Management, and Others | |

End-User | Pharmaceutical and Biotechnology Companies, Hospitals and Clinics, Finance and Insurance Agencies, and Research Organizations | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global big data and analytics healthcare market report delivers a detailed analysis with 78 key tables, more than 76 visually impactful figures, and 166 pages of expert insights, providing a complete view of the market landscape.