Banana Flour Market Size

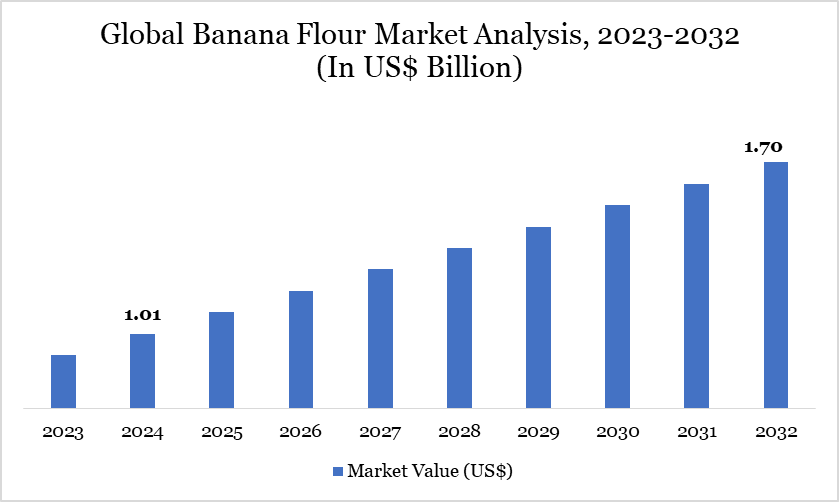

Banana Flour Market Size reached US$ 1.01 billion in 2024 and is expected to reach US$ 1.70 billion by 2032, growing with a CAGR of 6.73% during the forecast period 2025-2032.

Celiac disease affects approximately 1% of the global population, with regional prevalence varying: 0.4% in South America, 0.5% in Africa and North America, 0.6% in Asia, and 0.8% in Europe and Oceania. This underscores the growing demand for gluten-free alternatives. Banana flour has emerged as a nutritious option, rich in resistant starch, vitamins, and minerals, appealing to health-conscious consumers. Its versatility in baking, thickening sauces, and creating snacks enhances its market appeal.

In January 2024, Kenyan farmers in Embu launched nutrient-rich green banana flour to enhance market opportunities. Led by Stephen Mutuanga of the Healthy Life Juices group, this gluten-free product addresses post-harvest losses and is rich in essential nutrients like calcium, phosphorus and magnesium.

Moreover, banana flour promotes sustainability by repurposing banana by-products and reducing agricultural waste, resonating with environmentally conscious consumers. As health and sustainability trends continue to influence consumer choices, banana flour is well-positioned to meet the increasing demand for nutritious, gluten-free, and eco-friendly food options.

Banana Flour Market Trend

The banana flour market is experiencing a notable uptrend in 2024, driven by increasing consumer demand for gluten-free and health-conscious products. Banana flour, derived from green bananas, is rich in resistant starch, dietary fiber, and essential nutrients, making it an attractive alternative to traditional flours.

Its versatility in culinary applications, from baking to thickening agents, further enhances its appeal among health-conscious consumers. Additionally, the sustainable production process of banana flour, which utilizes unripe bananas that might otherwise go to waste, aligns with growing environmental awareness and sustainability goals.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Processing | Freeze Dried, Spray/Drum dried, Sun Dried, Others |

| By Nature | Organic, Conventional |

| By Distribution Channel | Supermarkets, Specialty Stores, E-Commerce, Others |

| By Application | Food, Beverages, Pet Food, Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Banana Flour Market Dynamics

Rising Adoption of Gluten-Free Diet

The rise in gluten-free diets has become a significant trend, particularly driven by health concerns related to gluten intolerance and celiac disease. According to a recent online survey, 18% of respondents reported being gluten-free for less than a year, indicating a growing interest in this dietary choice. Notably, 48% of those adopting a gluten-free lifestyle do so due to celiac disease, while 31% identify gluten intolerance as their primary reason.

Additionally, over 8% have made this dietary change due to other autoimmune diseases. The increasing awareness and diagnosis of gluten-related health issues highlight a broader shift toward gluten-free eating. This trend is positively impacting the global banana flour market, as consumers seek alternative gluten-free options. Banana flour, made from green bananas, serves as a versatile and nutritious substitute for traditional flour, making it a popular choice among those avoiding gluten.

High Cost of Banana Flour Compared to Other Flours

The global banana flour market faces a significant restraint due to its higher price compared to more commonly used flour like wheat and rice flour. This price discrepancy can deter price-sensitive consumers who prioritize cost when selecting food products. As a result, many potential buyers may choose to stick with traditional flours, limiting the market's reach and growth potential.

Furthermore, the perception of banana flour as a specialty product may contribute to its premium pricing, making it less accessible to a broader audience. In regions where budget constraints are prevalent, the preference for more affordable alternatives could hinder the adoption of banana flour, as there are flours available around half the price of the banana flour, impacting its overall market penetration and expansion efforts.

Banana Flour Market Segment Analysis

The global banana flour market is segmented based on processing, nature, distribution channel, application and region.

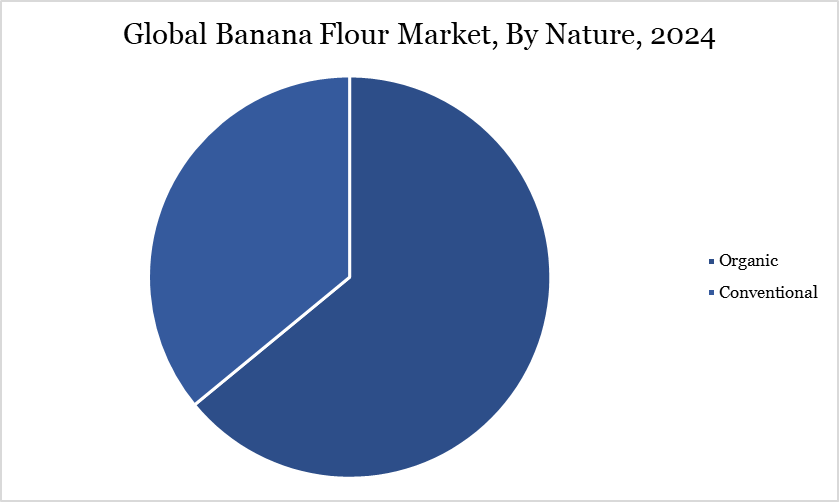

Organic Segment Driving Banana Flour Market

In 2025, organic banana flour continues to lead the global market, commanding a dominant share over 60%, driven by increasing consumer demand for gluten-free and nutrient-rich alternatives. The US organic food sector reflects this trend, with sales reaching US$ 65.4 billion in 2024, marking a 5.2% growth over the previous year. Notably, organic banana sales surged by 15.5%, highlighting a significant shift towards organic produce.

The appeal of organic banana flour lies in its clean-label attributes and versatility, catering to health-conscious consumers and those following gluten-free diets. Furthermore, sustainable farming practices associated with organic production enhance its attractiveness, aligning with the growing consumer emphasis on environmental responsibility. These factors collectively position organic banana flour as a pivotal component in the evolving global flour market.

Banana Flour Market Geographical Share

Demand for Banana Flour in Asia-Pacific

In 2024, the Asia-Pacific region dominated the global banana flour market, underpinned by its substantial banana production. India, as the world's leading banana producer, achieved a production volume of approximately 37.47 million metric tonnes, accounting for 19.37% of global output. This abundant supply of raw bananas facilitates large-scale banana flour production, reducing production costs and encouraging the establishment of processing facilities across the region.

The robust supply chain positions Asia-Pacific as a pivotal player in the global banana flour market. Furthermore, the rising health consciousness among consumers has led to increased demand for gluten-free and nutrient-rich alternatives, making banana flour an appealing choice due to its versatility and nutritional benefits. Coupled with ongoing innovations in processing techniques and strong export potential, the region is well-equipped to meet the growing international demand, solidifying its pivotal role in the banana flour supply chain.

Sustainability Analysis

The banana flour market is emerging as a sustainable solution to food waste and environmental concerns. By utilizing surplus or cosmetically imperfect bananas, producers reduce food waste and offer a valuable product. This approach not only minimizes waste but also requires less water and energy compared to traditional flour production, enhancing its environmental appeal. The growing consumer demand for eco-friendly and health-conscious products is driving the market's expansion. As awareness of the environmental impact of food systems grows, banana flour's sustainability credentials position it as a favorable alternative in the global market.

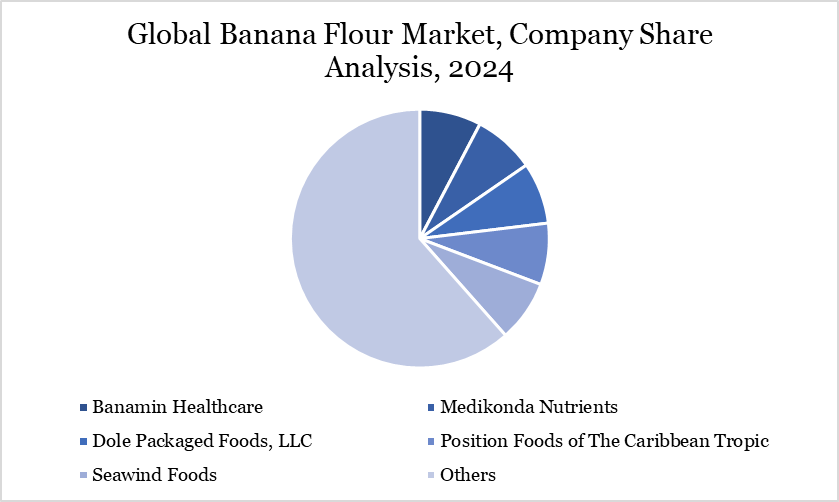

Banana Flour Market Major Players

The major global players in the market include Banamin Healthcare, Medikonda Nutrients, Dole Packaged Foods, LLC, Position Foods Of The Caribbean Tropic, Seawind Foods, Phalada Pure & Sure, Sattvic Foods, Nutrica Agro & Food Processors Pvt Ltd, Jayashree Foods and Anvi'S Food Products.

Key Developments

In July 2024, Start-up ingredient technology company, International Agriculture Group (IAG), launched a new ingredient that features a high level of the prebiotic dietary fiber resistant starch. NuBana N200 Green Banana Flour contains a minimum of 65% RS2 resistant starch, which has been shown to provide a broad range of health benefits dependent upon the amount consumed daily. Moderate levels (10-15 grams) of resistant starch consumption improves regularity, satiety and fat burning. A high level of consumption (20-35 grams) adds improved digestive health, insulin sensitivity and other metabolism benefits to these.

In October 2024, Rob and Krista Watkins of Natural Evolution launched a world-first skincare line infused with lady finger banana extract.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies