Overview

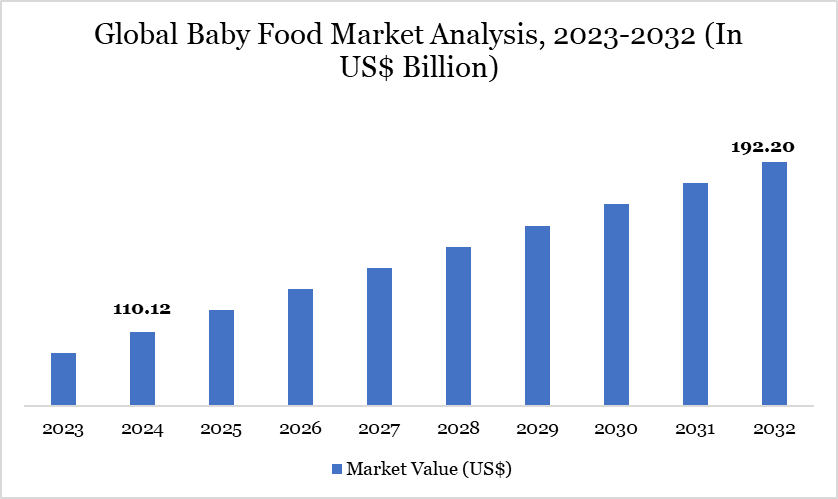

Global baby food market size reached US$110.12 billion in 2024 and is expected to reach US$192.20 billion by 2032, growing with a CAGR of 7.21% during the forecast period 2025-2032, according to DataM intelligence report.

The baby food market is undergoing a significant transformation, driven by heightened regulatory scrutiny and evolving consumer preferences. In the US, the Baby Food Safety Act of 2024 mandates the Food and Drug Administration (FDA) to establish limits for contaminants such as lead and arsenic in infant foods, aiming to enhance product safety.

The legislative move responds to concerns about the nutritional quality of baby foods, as highlighted by studies indicating that a substantial portion of products may not meet optimal health standards. In the UK, the Competition and Markets Authority (CMA) has proposed reforms to address high prices and limited choices in the baby formula market, including standardizing packaging and ensuring nutritional equality among brands. These initiatives reflect a broader industry shift towards more transparent and health-conscious baby food offerings.

Baby Food Market Trend

A notable trend in the baby food market is the increasing demand for organic and fortified products, driven by health-conscious parents and government initiatives. In India, programs like POSHAN Abhiyaan and regulations from FSSAI are ensuring the inclusion of essential micronutrients in infant diets. Such trends reflect a global shift towards healthier, more transparent baby food options.

Market Scope

Metrics | Details |

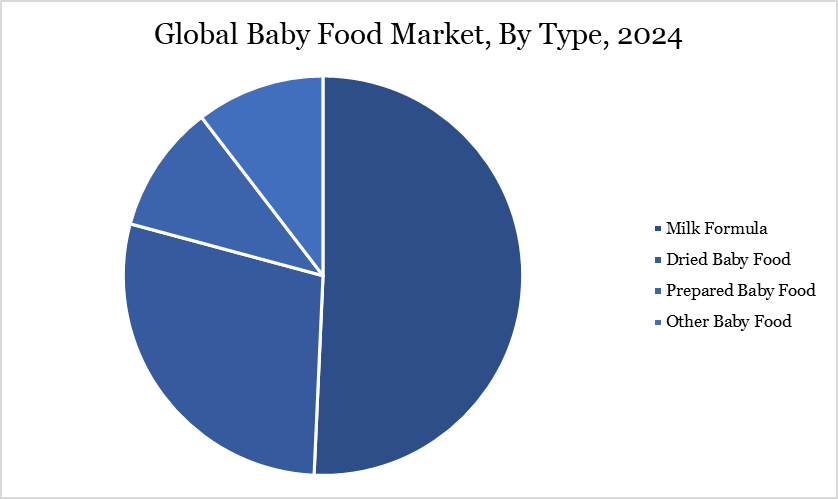

By Type | Milk Formula, Dried baby food, Prepared Baby food, others. |

By Age Group | Newborn (0-6months), Infants (6-12 months), Toddlers (1-3 years) |

By Category | Organic, Conventional |

By Packaging | Jars, Pouches, Boxes, Cans, Others. |

By Distribution Channel | Supermarkets/Hypermarket, Pharmacies, Online Retail, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Rising Birth Rates

Increased birth rates in various regions drive the global baby food market. According to the United Nations' World Population Prospects, the birth rate in 2023 was 17.464 births per 1,000 people, with approximately 132.11 million births recorded in 2022. This figure is projected to rise to around 133.26 million by 2030. As the number of infants increases, the demand for baby food products increases, fueling market growth as parents seek nutritious options for their children.

The rise in births not only expands the population of new parents but also leads to greater consumer spending on quality nutrition, including organic and premium products. New parents are often willing to invest in quality nutrition for their children, leading to higher spending on baby food, including organic and premium options. Rising birth rates foster sustained demand for baby food, driving growth in the market.

Health Concerns Related to Baby Food Products

Growing awareness of additives and preservatives in processed baby food is leading some parents to avoid commercial options in favor of organic or homemade alternatives. Additionally, research shows that heavy metals like arsenic, lead, mercury, and cadmium routinely taint baby food. At high levels, these neurotoxins can delay and impair brain development in young children, raising significant alarm among parents.

The concern poses a substantial restraint on the global baby food market, as consumers increasingly seek safer, healthier products for their infants. Furthermore, the rise of personalized feeding approaches, such as baby-led weaning, impacts traditional baby food sales, as parents look for more tailored solutions to meet their children's nutritional needs.

Segment Analysis

The global baby food market is segmented based on type, age group, category, packaging, distribution channel and region.

Milk Formula Segment Driving Baby Food Market

Milk formula dominates the global baby food market in the type segment, largely due to the challenges many mothers face with breastfeeding. In April 2024, Aldi Ireland announced the launch of Ireland’s first private-label baby formula, Mamia First Infant Milk, available in store for US$10.18 (for 800 g). Suitable to combine with breastfeeding, or for bottle-fed babies, it is available in Aldi stores. Manufactured exclusively by Aldi, it is the only private-label infant formula available to Irish shoppers.

The widespread concern drives many parents to seek alternatives like milk formula, which provides essential nutrition for infants who cannot be exclusively breastfed. The convenience of milk formula makes it an attractive option for busy families, offering a ready-to-use solution that saves time compared to preparing homemade food. Furthermore, the availability of specialized formulas for infants with specific dietary needs enhances consumer preference.

Geographical Penetration

Demand for Baby Food in Asia-Pacific

The Asia-Pacific baby food market is experiencing significant growth, driven by demographic shifts and evolving consumer behaviors. A key factor is the increasing participation of women in the workforce; for instance, South Korea's female labor force participation rose from 42.1% in 2018 to 43.5% in 2023, and Japan's increased from 44.1% to 45.1% during the same period. This trend, coupled with rising per capita incomes, has led to a higher demand for convenient baby food options such as formula milk and ready-to-eat products, particularly in urban areas where busy lifestyles prevail.

In April 2024, Else Nutrition, which specialises in plant-based but soy-free infant and toddler formulas, launched in Asia-Pacific with Australia as its first stop. Moreover, there is a growing preference for organic and natural baby food products, as parents become more health-conscious and seek safer, chemical-free options for their children.

Sustainability Analysis

The sustainability landscape of the baby food market is undergoing a significant transformation, with companies and regulatory bodies emphasizing health and environmental considerations. Nestlé India, for instance, has reduced added sugars in its baby food products by up to 30% over the past five years, aligning with global health guidelines and responding to consumer demand for healthier options.

In response to concerns about sugar content in infant foods, the Food Safety and Standards Authority of India (FSSAI) is actively examining the nutritional profiles of such products to ensure compliance with safety standards. These initiatives reflect a broader industry shift towards more sustainable and health-conscious baby food offerings.

Competitive Landscape

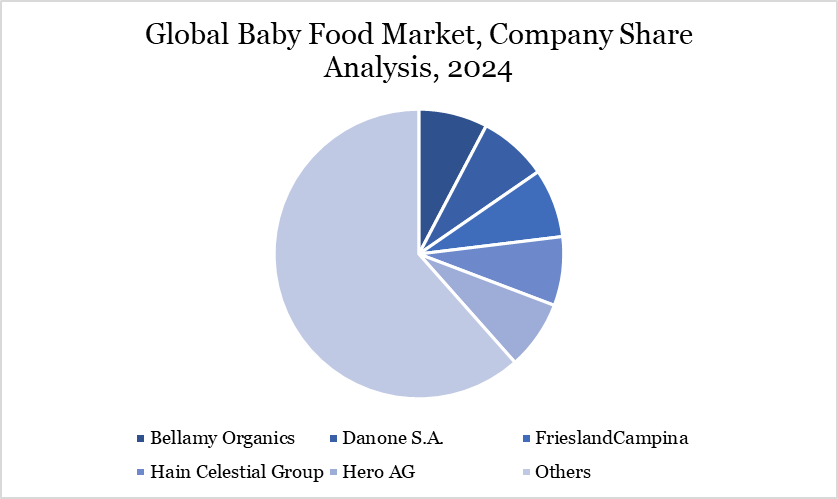

The major global players in the market include Abbott Laboratories, Bellamy Organics, Danone S.A., FrieslandCampina, Hain Celestial Group, Hero AG, Mead Johnson & Company, LLC, Nestle S.A., Perrigo Company Plc. and DANA DAIRY GROUP.

Key Developments

In October 2024, Brainiac Foods, the leading brain health and wellness company, is thrilled to announce the launch of their new Neuro+ line, now available at Target stores nationwide. Neuro+ offers the most advanced brain nutrition in the baby food category with the addition of Milk Fat Globule Membrane (MFGM), a nutrient found in breast milk and proven to support baby’s brain development and immune system.

In February 2024, Baby formula brand Bobbie expanded into pediatric nutrition with the launch of two new supplements: a vitamin D supplement and a probiotic supplement, both in drop form for mixing into the formula. This is Bobbie's first foray beyond infant formula.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies